Massive Auto Inventory Begins To Stockpile As Coronavirus Zaps An Already Anemic Chinese Car Market

Things couldn’t possibly be looking any worse for the Chinese auto industry.

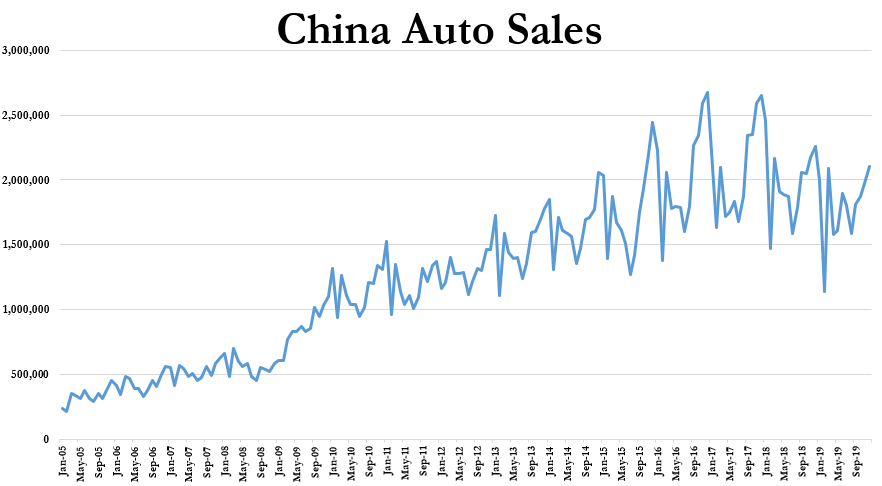

Even before the coronavirus scare, the industry had already been mired in a steep recession that we have been covering at length for nearly the last two years. To make matters worse, that recession was predicted to continue for a third straight year, through 2020, with sales forecasted to fall yet again. And this was before the coronavirus…

Now, with the entire country locked down due to the coronavirus, things look as though they could be much worse for China’s auto industry. And that, in turn, could very easily pull down the auto industry globally.

Last month, inventory of unsold cars in China rose by 6.5%, according to Bloomberg. Average inventory levels were at 62.7% for January, according to the China Automobile Dealer Association. These numbers are far above the standard 50% level that is considered normal in the industry.

And the forecast for the immediate future, let alone the rest of the year, looks pessimistic. Dealers are expecting sales in February to be less than half of those a year ago. In fact, Bloomberg notes that 70% of dealers polled by the CADA said they had seen “almost no customers” since the end of January.

This follows China’s Miao Wei, Minister of Industry and Information Technology, saying in mid-January (prior to the coronavirus outbreak becoming severe) that the industry still faces “big downward pressure”.

At the time, he predicted sales of just 25 million units for the year. We obviously think that this number could wind up being materially lower.

Recall, sales for 2019 totaled 25.769 million units. Sales of just 25 million units – an optimistic prediction in our eyes – would mark a third straight year of declines for the world’s largest auto market regardless.

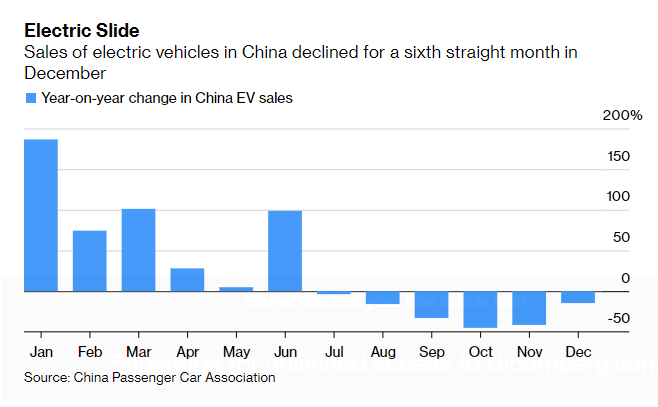

The MIIT also said at the time that it would further study and review its NEV vehicle subsidies. Recall, Beijing backing away from these subsidies caused NEV sales to taper off toward the end of 2019, sullying what was an otherwise consistent silver lining for the country, even amidst the overall recession in autos.

With no signs of the country recovering from its ongoing epidemic, there doesn’t seem to be any silver linings left.

We noted in December that NEV sales plunged 42% in November after Beijing backed away. The government is ostensibly dedicating all of its efforts to deal with the country’s ongoing outbreak, and so Beijing has not revisited its comments about EVs yet, and we are already halfway through Q1 2020.

China did say, however, it is going to “maintain support” for NEVs, without getting into too much detail. Miao also said he’s confident that the country will ensure “stable industrial production in 2020” while phasing out “zombie firms”.

There may have been some spooky foreshadowing in those words from mid-January, as almost every business in the locked down major cities of China now looks like a “zombie firm”.

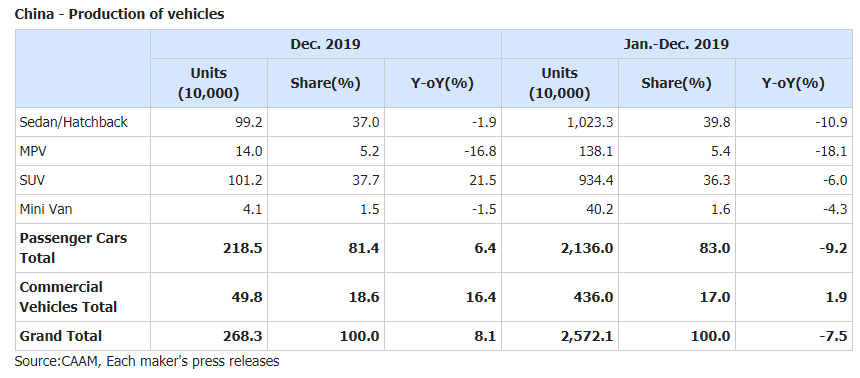

As we noted several weeks ago, passenger car vehicle sales in China fell to end 2019, plunging 3.6% to 2.17 million units, according to the China Passenger Car Association.

It marked the 18th drop in the past 19 months for the country. For the full year 2019, sales in China declined 7.5%, marking the country’s second straight annual decline.

Tyler Durden

Mon, 02/10/2020 – 23:05

via ZeroHedge News https://ift.tt/2tQ9GGq Tyler Durden