“Devastating Impact”: One Bank Expects China’s PMI To Crater As Low As 30

To those who have been following our series of high-frequency, daily indicators of China’s economy, it will probably not come as a surprise that the world’s second biggest economy has ground to a halt, its GDP set to post the first negative print in modern history. To everyone else who is just now catching up, we have some news: it’s going to be bad.

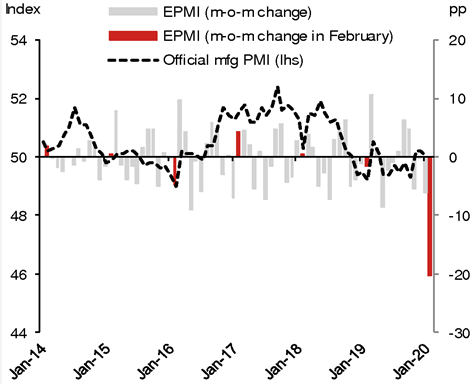

Ahead of official Chinese economic data which will soon start capturing the period when the coronavirus hit the nation, Nomura’s Chief China economist Ting Lu noted that China’s Emerging Industries PMI (EPMI), which gauges momentum in the country’s high-tech industries and is closely correlated with official manufacturing PMI, slumped to 29.9 in February (from 50.1 in January!), its lowest-print on record (introduced Jan ’14), which as Nomura’s Charlie McElligott writes “is pure reflection of the devastating impact of the COVID-19 outbreak.“

What does this mean for the closely followed China manufacturing PMI? As McElligott writes, “even adjusting for seasonality and expected progress in business resumption in the coming week, we estimate the official manufacturing PMI could drop to a range of 30-40 in Feb.”

And the punchline from Ting:

“We believe markets might underestimate the scale of the current growth slump. Due to a slower-than-expected rate of business resumption, we have cut our year-on-year Q1 real GDP growth forecast to 3.0% and expect Beijing to ramp up policy easing measures in coming months. That said, the likelihood of another round of massive stimulus appears low as policy space remains limited.”

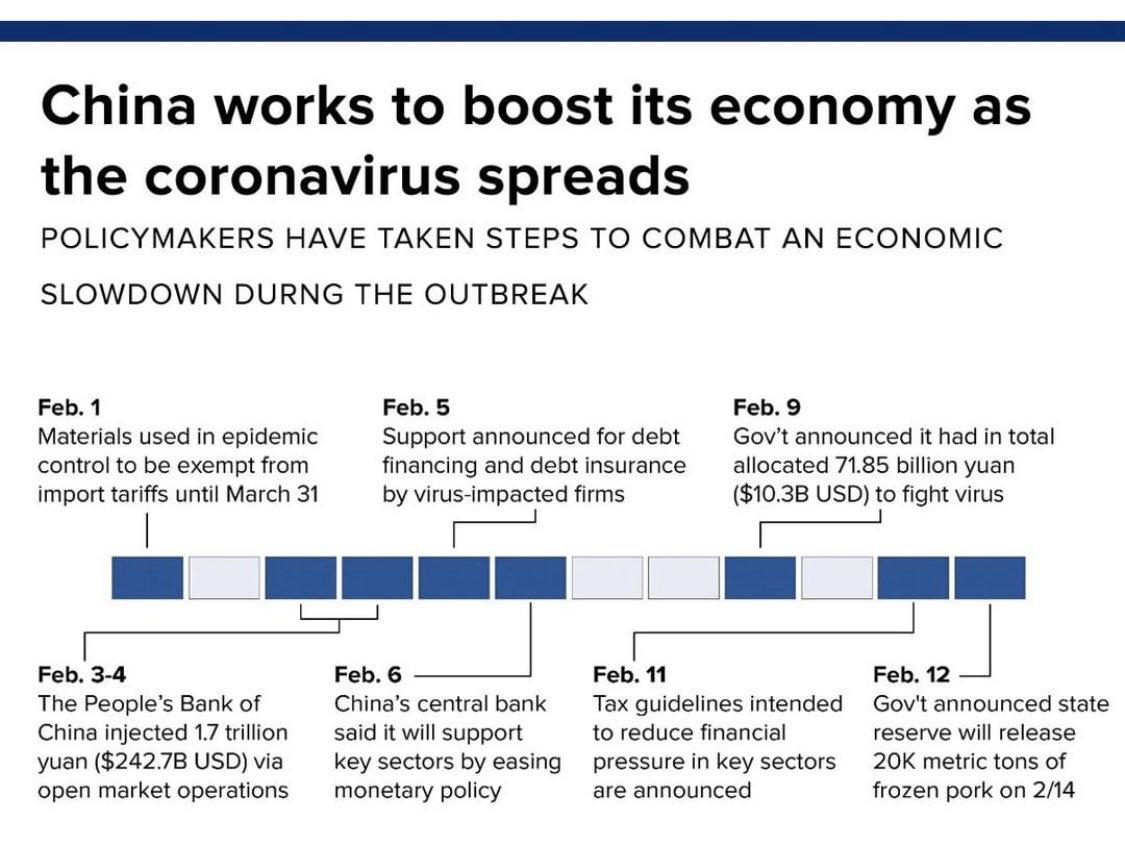

The last bolded sentence confirms what we said on Sunday, and even though China has already launched what has been a generous deployment of various stimuli

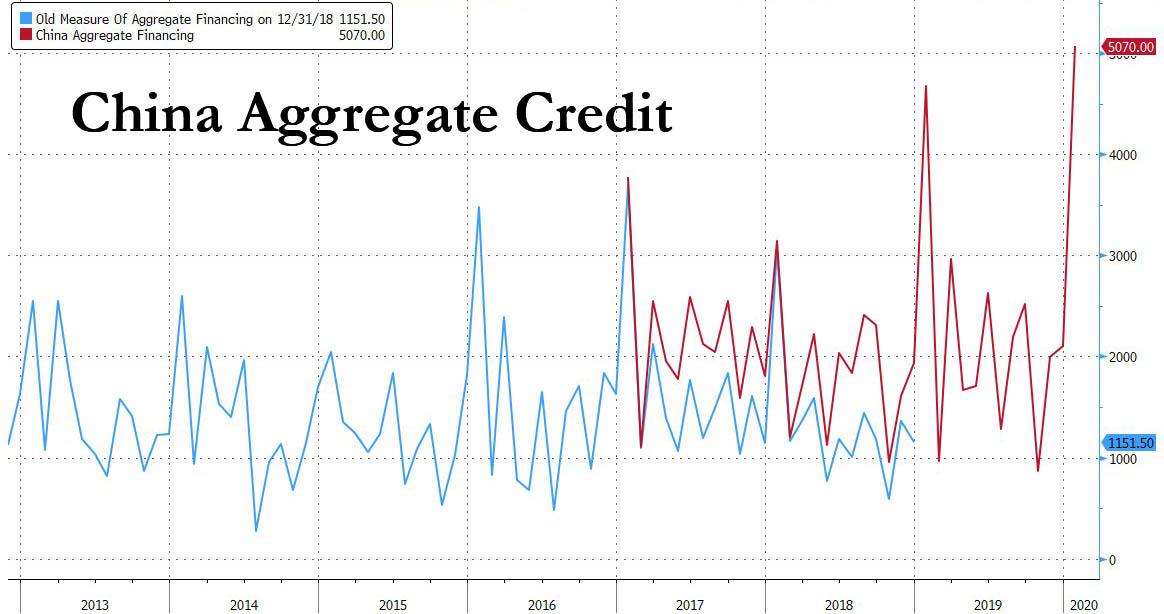

… it explains why some were disappointed after the PBOC only incrementally eased policy overnight, lowering the benchmark 1Y Loan Prime Rate to 4.05% (from 4.15%) and the 5Y rate to 4.75% (from 4.80%) – not pursuing a full-blown overnight rate cut as some had expected – while at the same time stating that it will work to promote consumption and investment to boost domestic demand; the PBOC did offset some of this disappointment with the biggest ever monthly injection in Total Social Financing credit as discussed earlier…

… but as McElligott concludes, “the negligible decline in the 5Y rate shows that authorities remain concerned about easing property policy and that, for now, they are attempting to maneuver within “conventional” policy.”

In other words, while the market remains convinced that Beijing with unleash even more stimulus to force the V-shaped rebound that has been priced in for Q2 and onward, also explaining the relentless bid for risk assets, this appears unlikely to happen any time soon, especially while China is still battling to contain the coronavirus, because as Jefferies strategist Sean Darby warned, “markets have taken a step back because the authorities won’t do any major stimulus until they are completely sure the virus has stopped, because there’s no point in doing it when people are sitting at home.”

Tyler Durden

Thu, 02/20/2020 – 22:45

via ZeroHedge News https://ift.tt/32cYpg1 Tyler Durden