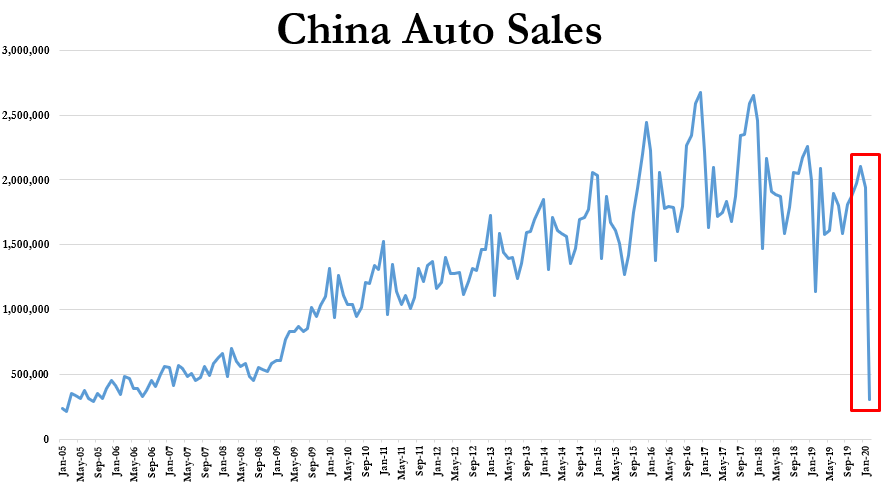

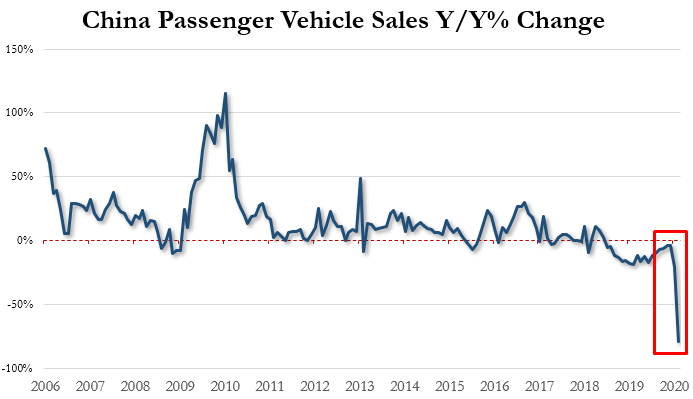

China Auto Sales Continue Collapse, Plunging 50% And 44% In First And Second Week Of March, Respectively

The coronavirus has certainly wreaked havoc on an already dilapidated global auto industry – and it’s no more evident than in China, where the virus originated and home to the largest auto market in the world.

Continuing February’s trends, auto sales in March have continued to collapse: lower by 50% during the first week of March and down 44% the second week of March.

And that’s if you want to believe the numbers that are coming out of China, where the optics of a recovery may mean more to the government than an actual recovery.

Cui Dongshu, secretary general of the China Passenger Car Association told Bloomberg that the “market is recovering” but that it is doing so at a “slower than expected pace”. He also called for the country to increase car purchase quota, lower purchasing taxes and continue to give subsidies to EV purchases, in an effort to create a tailwind for buyers.

The country is also reportedly considering the idea of relaxing emission curbs to help struggling automakers.

Recall, sales fell 79% in February, marking the biggest ever monthly plunge on record. We reported less than a week ago that automakers were asking the government for relief after the industry’s collapse, which occurred in the midst of an already-in-progress global recession for automakers. Specifically, they were asking at the time for cuts on the purchase tax for smaller vehicles and support for sales in rural markets, in addition to the easing of emission requirements.

It looks as though they may have gotten their wish.

Sales for February fell to just 310,000 vehicles from a year earlier, marking the 20th straight month of declines.

A twin shock has plagued the automobile industry in China, one where a supply shock has hit manufacturers, who can’t produce automobiles at full capacity because of labor shortages and lockdowns, along with a demand shock that has kept people away from dealerships. While supply woes could be resolved with near term factory restarts, demand woes are expected to linger through the first half of the year.

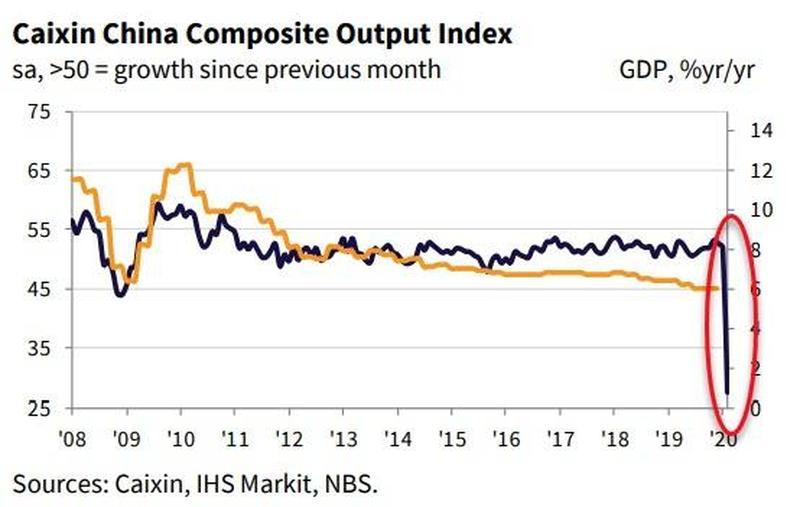

To illustrate the plunge in business activity, Caixin China Composite Output Index plunged to 27.5 in February from 51.9 in the previous month, one of the quickest drops on record. The virus outbreak has led to company closures and travel restrictions that have ground China’s economy to a halt.

Tyler Durden

Fri, 03/20/2020 – 23:45

via ZeroHedge News https://ift.tt/2J3Ci2L Tyler Durden