Fed Shifts Start Time Of Tomorrow’s Overnight Repo 15 Mintues Earlier As Dealer Usage Plummets

Shortly before the close on Monday, the New York Fed issued a surprise announcement according to which it pushed forward the start time of tomorrow’s month and quarter-end Overnight Reverse Repo operation to 12:30 PM ET from 12:45 PM ET, while keeping the end time of the operation at 1:15 PM ET, effectively increasing the operation time from 30 minutes to 45 minutes.

Why? The Fed explains:

This change has been made to ensure the Desk has sufficient time to obtain all bids from eligible counterparties on quarter end in light of remote working arrangements of eligible counterparties.

Yeah right, because those 15 minutes will “make or break” the quarter end repo.

The real reason? As we showed last week, in a “stunning development“, Dealers had either run out of securities to pledge to the Fed, or simply chose to hold on to their TSYs and MBS (and especially the latter in light of the ongoing MBS shortage which has sparked a visious margin call spiral among mortgage servicers), perhaps with the expectation of selling these securities to the Fed at much more economic conditions.

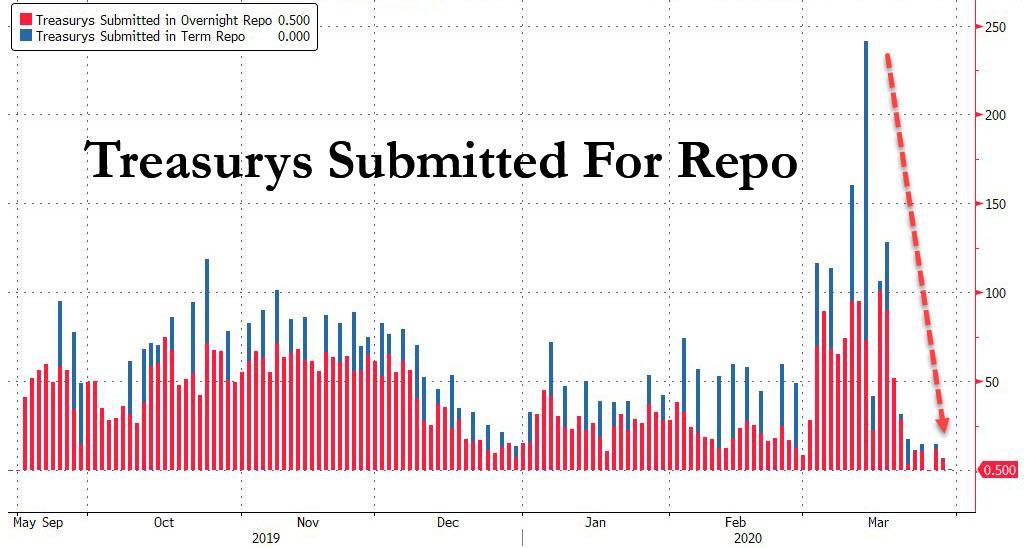

This can be seen in the chart below, which demonstrates the collapse in TSY submissions to the Fed’s repo operations ever since QE Unlimited was launched, which also meant that instead of parking their bonds at the Fed for up to 3 turbulent months, with an avalanche of new debt coming down the pipe, Dealers could just sell them to the Fed instead.

“Why on Earth you would tie something up for three months in repo with the Fed buying,” said Ian Burdette, managing director at Academy Securities, who followed up with a very apt observation:

“I think people are getting wise to the fact that an absolute tsunami of global sovereign debt issuance is on its way. Best to sell it all to the fed now probably.”

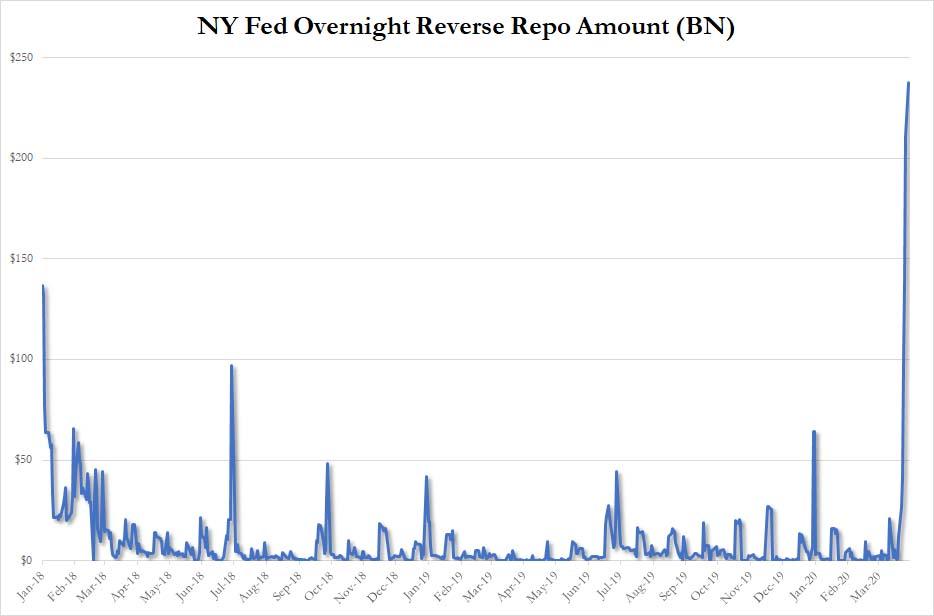

Meanwhile, instead of worrying about the repo – which thanks to Unlimited QE is now irrelevant – the Fed shoudl be much more focused on what is going on with uptake of its reverse repo operation, which likely due to quarter-end window dressing and various other strcutural reasons (especially when it comes to Bill yielding <0%), has seen a surge in usage to a record $237BN today, up from $210BN on Friday, in a bizarre reversal of liquidity dynamics which late on Friday we described - tongue in cheek - as a "treasury shortage."

Tyler Durden

Mon, 03/30/2020 – 15:36

via ZeroHedge News https://ift.tt/2UMmtmL Tyler Durden