“Unlike Anything We Have Seen In History”: The Coronacrisis Will Wipe Out Over 4 Years Of GDP Growth

Tyler Durden

Thu, 05/21/2020 – 17:05

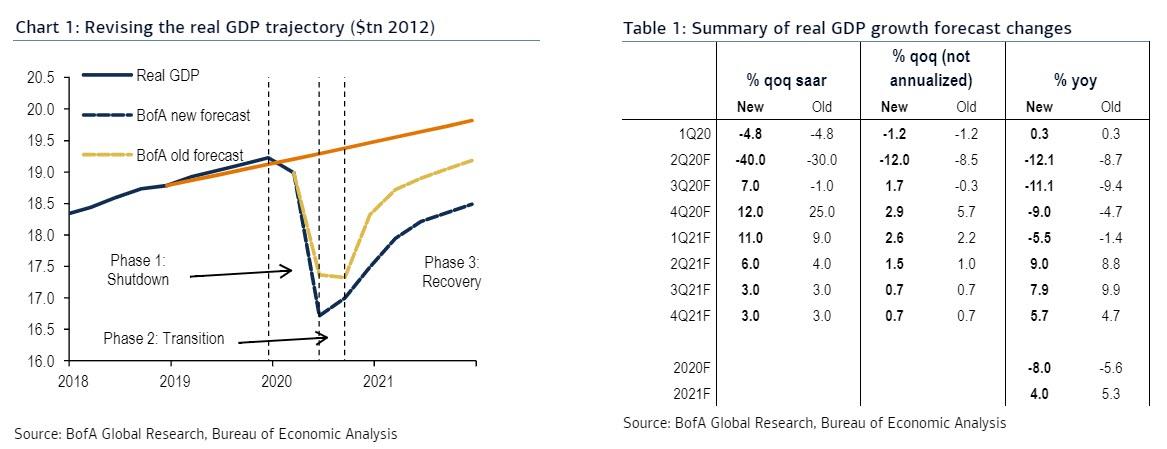

Now that banks have had a chance to evaluate the collapse in the economy in the post-covid world, a new round of GDP forecast revisions is coming, and it’s a doozy, with Bank of America spearheading the latest effort by slashing its Q2 GDP forecast from -30% to -40%.

Not without a trace of irony, BofA’s chief economist Michelle Meyer writes that “words cannot describe” the loss in economic output, which is “unlike anything we have seen in modern history. Back in early April when we introduced our forecasts, we penciled in a stunning 10% cumulative drop in output from the peak with the pain concentrated in 2Q with a 30% qoq saar decline.”

But it seems that it was not extreme enough, and according to data released since then, the drop will be more severe, with BofA now looking for a 40% Q/Q saar decline in 2Q, translating to a cumulative loss of 13%. To put this into perspective, in the Great Recession of ’08-09, the economy declined 4%. This recession would clearly be much deeper.

* * *

As BofA previously noted, ignore all the “letter”-descriptions of the current cycle, and instead think of it in phases, of where there are three: phase 1 is the shutdown, phase 2 is the transition and phase 3 is the recovery. The bank has tweaked its assumptions in each phase – bigger drop in phase 1, stronger bounce in phase 2 but weaker recovery in phase 3. Here are the three phases in detail:

Lockdown: a deeper contraction. We now believe that 2Q GDP growth will be down 40% qoq saar vs. our prior forecast of -30% qoq saar.

- Transition: a faster snapback. An earlier reopening means an earlier bounce in activity. We are revising up 3Q GDP growth to +7% qoq saar vs. -1% qoq saar previously. The gain is entirely driven by a snap higher in consumer spending; we still expect a meaningful decline in investment.

- Recovery: slower. An earlier reopening has prompted health experts to increase estimates for the number of COVID cases, which will slow the recovery. We have also become increasingly concerned about solvency issues and a sticky-high unemployment rate. We now think it will take until the end of 2022, or later, to return to the pre-COVID level of GDP.

- BofA’s new forecasts reflect the recent data and the early reopening, and leaves BofA’s annual GDP to plunge 8.0% this year with a 4.0% rebound next year. The peak-to-trough drop in GDP is 13%. This breaks the previously held post-war record of -4% in the Great Recession.

What is more troubling is that as shown in the chart below, the corona crisis will wipe out 4 years of GDP growth, with BofA now expecting real GDP at the end of 2021 to be where it was at the end of 2017!

Before it goes into more depth on its various findings, BofA issues a word of caution to all those who see a V-shaped recovery in recent data: “it is important to keep in mind that many indicators will show a significant bounce as the economy moves out of hibernation. But what initially looks like a V-shaped recovery is set to lose steam after the initial gain has subsided.“

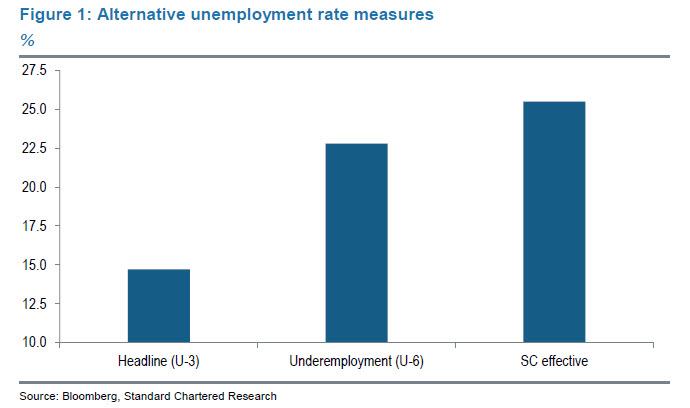

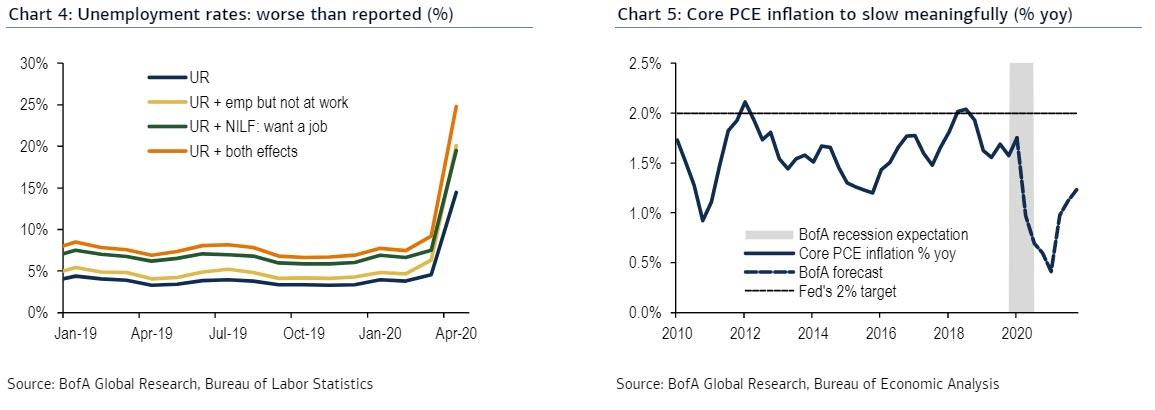

With that in mind, BofA moves on to the next key subject, the devastation in the labor market and upcoming disinflation. As Meyer writes, “although more than 20 million jobs have been lost over March and April, the jobless claims figures suggest we are likely to see more cuts in the May report”, something we discussed in our report spreading the real jobs report.

BofA now believes that the unemployment rate will reach a peak of 19% at the end of 2Q, while broader measures of unemployment suggest that the rates are already in excess of 20%. In the initial stages of the recovery, the unemployment rate will fall sharply upon reopening but will likely get stuck close to 10% for some time. This, as Meyer warns, is a recipe for disinflation and could prove catastrophic for banks that haven’t provisioned enough for loan losses. The bank forecasts core PCE inflation will reach 0.6% yoy by year-end, although the bank still believes that the US will avoid outright deflation in underlying inflation and that the focus will be on measures of expectations.

One silver lining is that we have not seen any damage to inflation expectations, at least not yet. In fact, the 5-10 year inflation expectations gauge in the University of Michigan consumer sentiment survey has actually crept upwards to 2.6% in May from 2.3% in March, heading to the top of its recent range which of course may merely be a reflection of the prices most Americans truly experience (which are surging) instead those that make up the BLS inflation basket. Indeed, in an economy under lockdown, demand for essentials has exploded higher resulting in a strong bid on prices. For example, food at home prices popped 2.6% mom in April. As a result, BofA says this could “misguide” consumers into believing the higher inflation story (we doubt consumers will be happy to know they are being “misguided” when they pay a record high price for steak ahead of the Labor Day holiday). However, this may prove to be only temporary as broader disinflationary forces take over, with a risk of falling below 0% and therefore entering deflation territory.

Looking ahead, Meyer writes that two of the most critical inputs into her medium-term forecast are i) the path of the virus and ii) the degree of stimulus.

While BofA is currently not forecasting a significant second wave that would prompt shelter-at-home policies to return, clearly this is a big downside risk. In terms of stimulus, BofA expects the Fed to continue with credit facilities and another fiscal stimulus package albeit smaller and focused on state and local governments. A bigger stimulus plan would present upside risk while lack of support would add to the downside. The path of virus and fiscal response are not mutually exclusive.

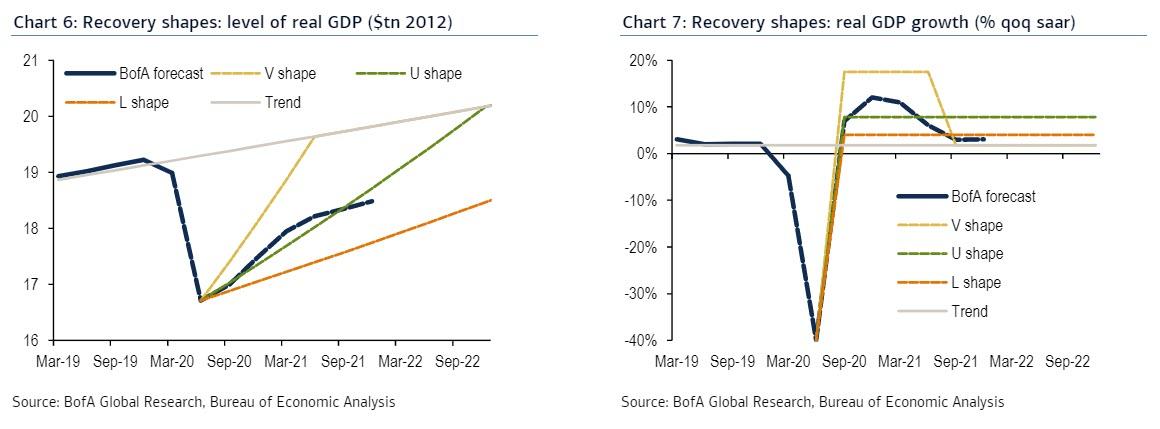

Finally, while urging clients to avoid letters to describe the cycle, BofA does just that and in the next chart it looks at four hypothetical types of recoveries: a “V” (upside) a “U” (close to the current), an “L” (downside) or a “W” (downside). In all cases, it assumes that output falls by 40% annualized in 2Q and trend growth of 1.8%.

- In the V-shaped recovery example, GDP gets back to potential in four quarters (by the end of 1H 2021) and then remains on trend. Therefore the recovery is twice as long as the downturn and lost output is not recovered. Still, this scenario would require nearly 18% growth over the next year, which we think is unrealistic.

- In the U-shaped recovery scenario, GDP takes longer to return to potential and more output is permanently lost. GDP gets back to trend at the end of 2022. Even this requires an average of 8% growth over the next ten quarters. Notice that BofA’s baseline forecast is closest to a “U” or “swoosh” scenario.

- An L-shaped recovery is the slowest, with the greatest permanent loss in output. It takes until the end of 2023 for GDP to return to its pre-COVID level. Growth averages 4% in that period.

- What about a “W”? The most likely scenario for a W-shaped (“double dip”) recovery is a second major virus outbreak in the fall/winter, which causes another round of shutdowns. There are many possibilities depending on the severity and duration of the shutdowns.

Finally, for all the charlatans who focus on Q/Q change instead of Y/Y or trendline, chart 7 illustrates the pitfalls of conflating levels and growth rates. In all scenarios, GDP growth would look quite robust initially. This is because when the economy re-opens, baseline economic activity will be so weak that growth will almost surpass its trend rate for a few quarters. This underscores the importance of considering the level of GDP.

Or, as BofA realistically concludes “we cannot simply snap our fingers and return the economy to the way it was prior to the shock from COVID-19.”

via ZeroHedge News https://ift.tt/3g96EjH Tyler Durden