Poor Countries Borrowed Billions Using Their Oil As Collateral And Are Now Struggling To Pay

Tyler Durden

Sat, 05/23/2020 – 12:25

Smaller countries that have taken out billions of dollars in loans that they have promised to pay back in oil are starting to fall behind on their payments.

The deals are structured so that countries are advanced money from trading houses that will be paid back in future oil shipments. These types of loans have become popular with smaller African and Middle Eastern nations as the only way to raise money. But when oil prices tank – as they did over the last several weeks – the loans become difficult to repay.

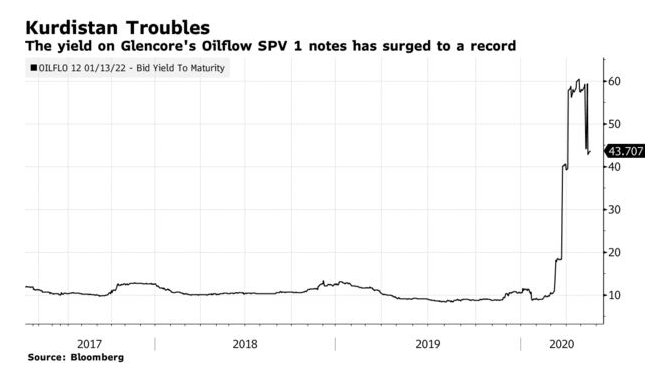

As the price of oil plunges, countries have to divert more oil to keep up with their payments. Now the Kurdistan region in Northern Iraq is having trouble repaying a $500 million loan from Glencore.

U.S. investors find themselves with exposure to $500 million in Kurdistan-based loans, as U.S. pension funds bought half a billion dollars worth of notes “known as Oilflow SPV 1 DAC linked to the loans”. Glencore has said it plans on formally restructuring the deal.

These notes have plunged in value due to the potential restructuring, falling to 80 cents on the dollar and a yield of more than 40% (the yield at par was 12%).

Glencore, along with Trafigura Group, are also together in talks to restructure a total of $1.5 billion in oil-for-cash loans from the Republic of Congo. It had been trying to restructure its loans for a year but the deal fell through when oil prices crashed in late 2019.

Additionally, Chad, one of the poorest countries in the world, is using a clause in its contract to reduce payments on the $1 billion it has borrowed, according to Bloomberg. It is allowed to reduce its payments when oil falls under $42 per barrel. Chad has already restructured the loans twice after they were first subscribed in 2013.

One non-governmental organization called Global Witness simply called the loans a “gamble on the future oil price” and warned countries they could become “an open ended liability for future government and generations”.

In many cases, commodity traders will syndicate the loans to banks and buy credit insurance, but they are still exposed to the plunge in commodity prices.

Oil’s plunge over the last couple months can be attributed to the deadly combination of the global economy shutting down due to the coronavirus and Saudi Arabia and Russia collectively flooding the market with supply.

via ZeroHedge News https://ift.tt/2M60S4R Tyler Durden