Dow Soars To Best Quarter Since ’87 As Fed Balance Sheet Explodes

Tyler Durden

Tue, 06/30/2020 – 16:00

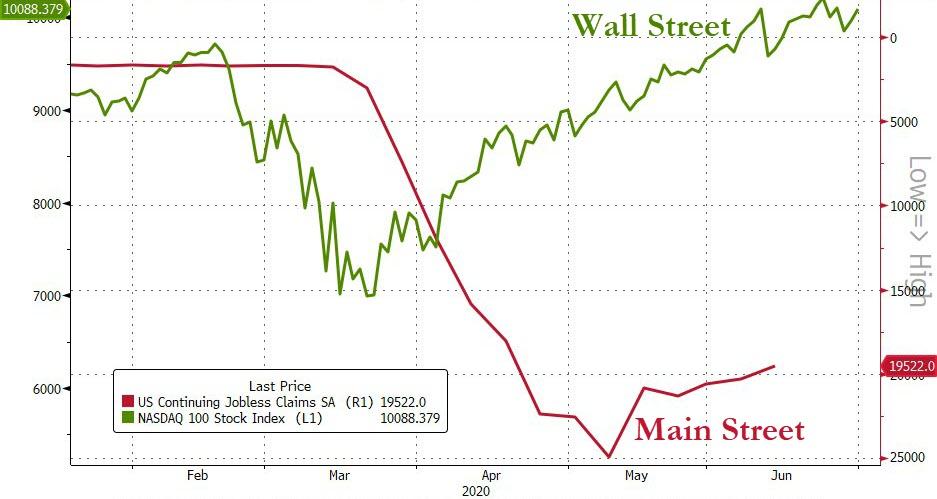

Well that was a quarter… Massive and unprecedented monetary and fiscal largesse “saved” the “economy”…

…for the 1%…

Source: Bloomberg

The Fed expanded its balance sheet at a stunningly unprecedented pace…

Source: Bloomberg

And if you think this correlation is not causation, we have a bankrupt car-rental business you can buy…

Source: Bloomberg

But does the flattening of the Fed balance sheet suggest the party’s over? One thing is for certain, the gusher of fiscal folly has sent the US Macro Surprise Index to levels it has never been close to before – suggesting this is as good as it gets relative to expectations…

Source: Bloomberg

And while much has been made of the recent surge in cases, the market remains confident (VIX relatively unmoved), clearly focused on the falling incremental death rate…

Source: Bloomberg

The Nasdaq soared 30% in Q2 and led the US majors, and The Dow lagged (though with a stunning 16% gain)…

Source: Bloomberg

Q2 was the biggest short-squeeze ever…

Source: Bloomberg

That was The Dow’s best quarter since Q1 1987…

Source: Bloomberg

Q2 2020 saw the S&P rally to its best quarter since 1998, Nasdaq’s best quarter since 2001…

Source: Bloomberg

… and “growth” saw its best quarter ever…

Source: Bloomberg

The S&P 500 is coiling at its 200DMA…

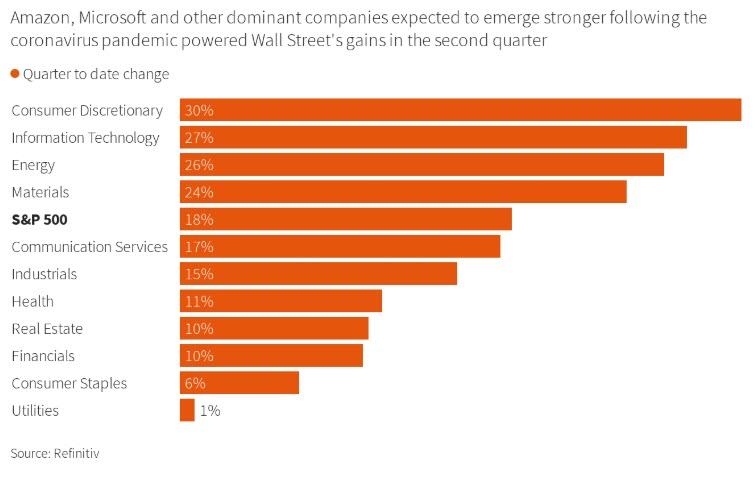

The quarter was dominated by big tech…

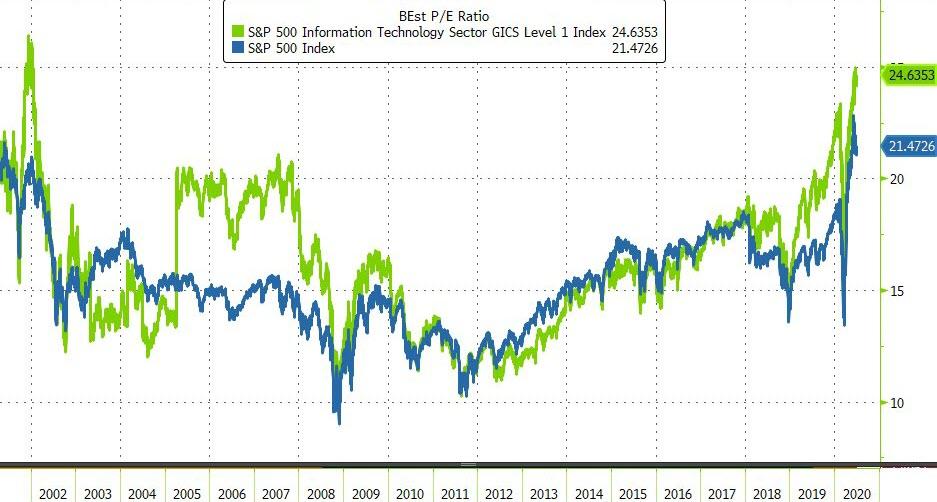

And valuations soared to near record highs…

Source: Bloomberg

Momentum bounced back from a deep-dive intra-quarter to end unch while value ended the quarter lower…

Source: Bloomberg

Banks mostly soared higher in Q2 (except Wells Fargo), although the last few weeks have seen weakness…

Source: Bloomberg

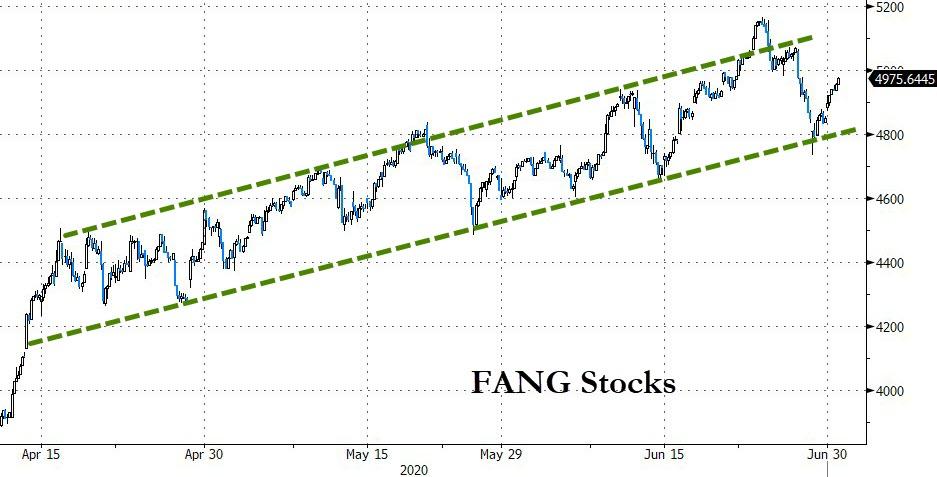

FANG Stocks saw BTFD’ers all quarter…

Source: Bloomberg

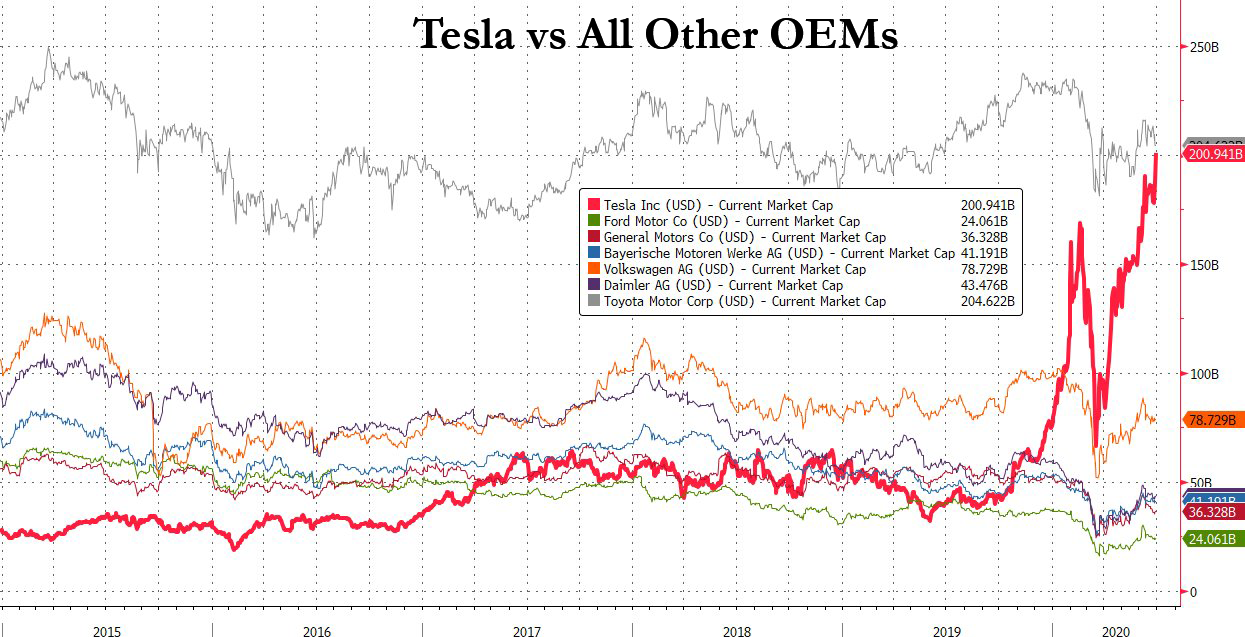

And TSLA topped $200bn market cap, within a few billion of the largest car-maker on the planet…

Source: Bloomberg

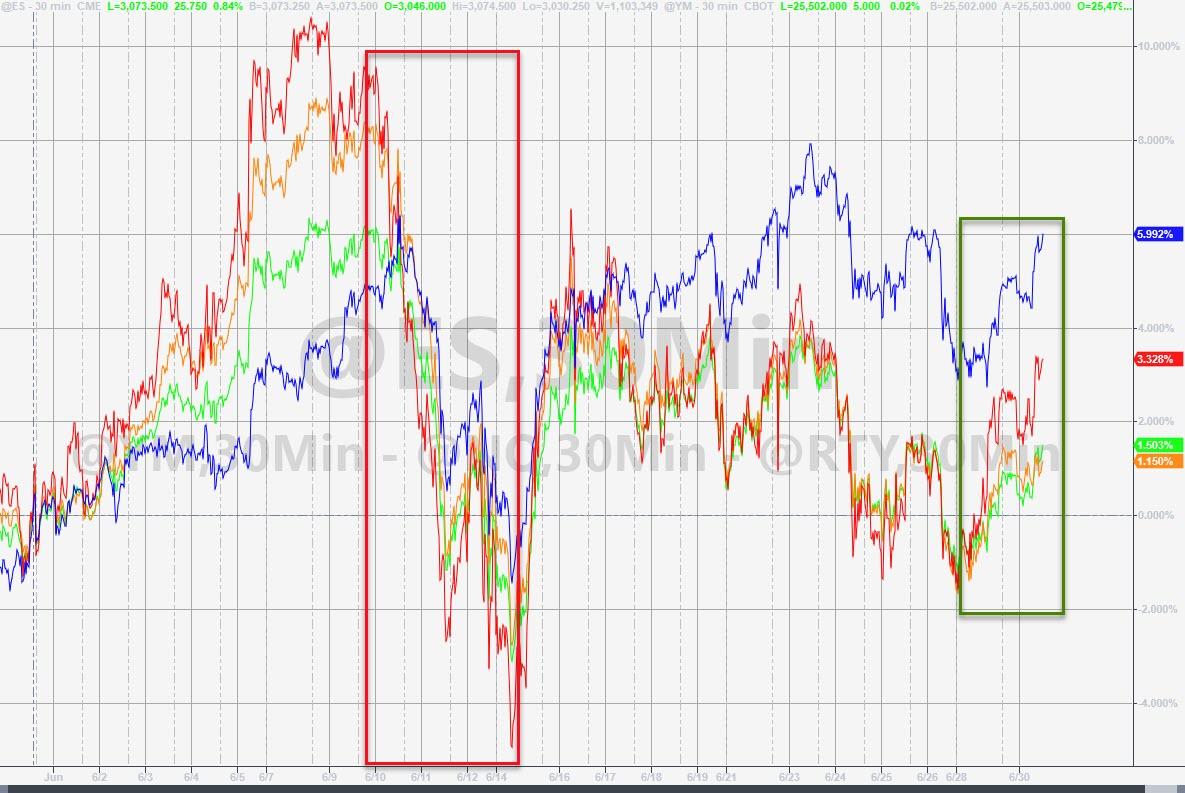

Nasdaq outperformed on the month and thanks to this week’s gains, Dow and S&P managed to get back into the green for the month after a mid-month scare over COVID second-wave (Small Caps outperformed Big Caps in June)…

In a copy of yesterday, stocks were bid at the cash open and into the cash close – small caps are up 5% this weeks…

But, stocks and Bonds remain massively decoupled over the quarter…

Source: Bloomberg

Treasury yields ended the quarter very mixed (after Q1’s biggest yield drop since Lehman) with the short-end dramatically outperforming the longer-end (but rates are way off their end-May highs)…

Source: Bloomberg

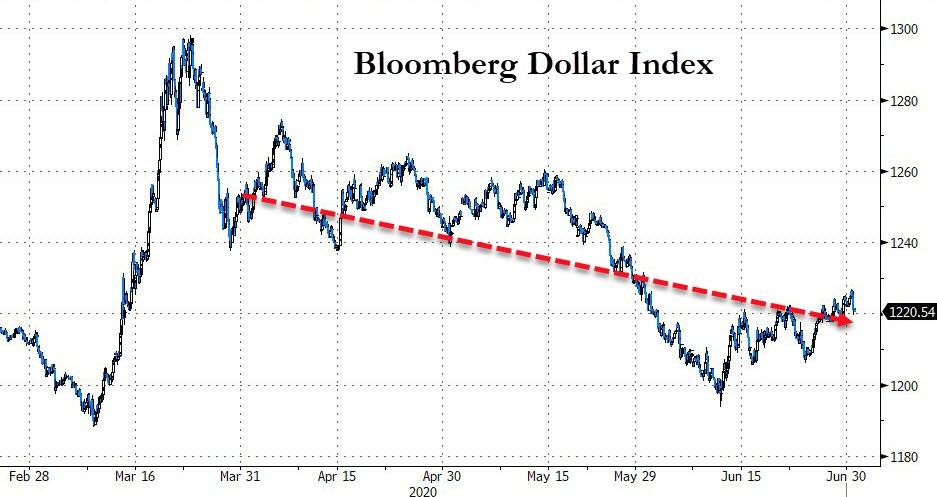

The USDollar fell 2% in Q2, its 2nd worst quarter since Q2 2018…

Source: Bloomberg

Ethereum and Bitcoin soared in Q2 with most of the smaller altcoins ended marginally higher…

Source: Bloomberg

All the major commodities were higher on the quarter with silver and crude doing best (after the latter’s historic collapse to a negative price)…

Source: Bloomberg

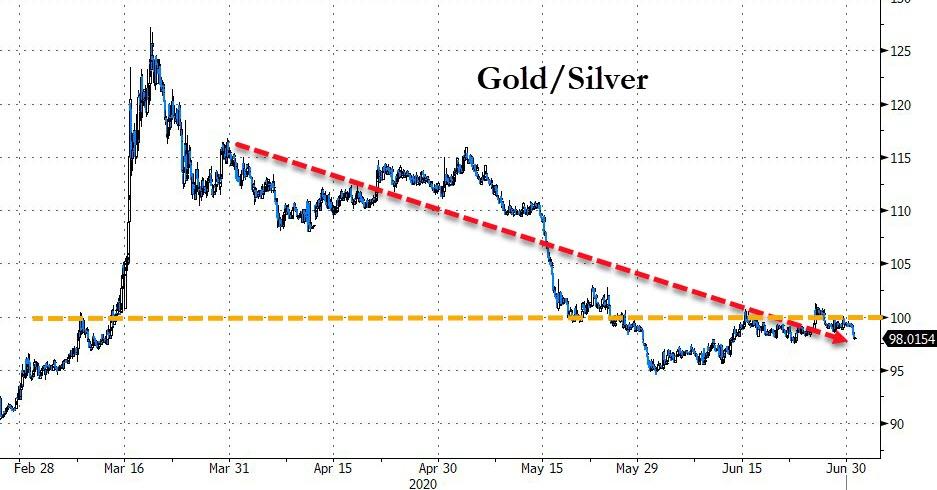

This was WTI’s best quarter since Sept 1990, Gold’s best Q since Q1 2016 (up 7 quarters in a row), and Silver’s best quarter since Q4 2010.

Gold futures topped $1800 to end the quarter…

… for the first time since 2011…

Source: Bloomberg

And the gold/silver ratio collapsed back below 100x…

Source: Bloomberg

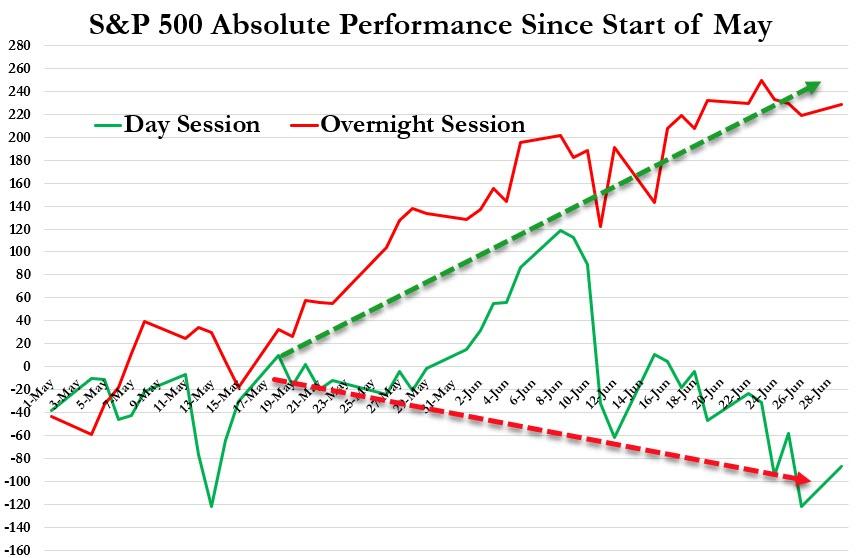

And finally, in case you wondered, “Sell in May and go away” is working… if you sell the day!

Since the start of May, the S&P 500 has lost 87 points during the day session and gained 228 pints during the overnight session.

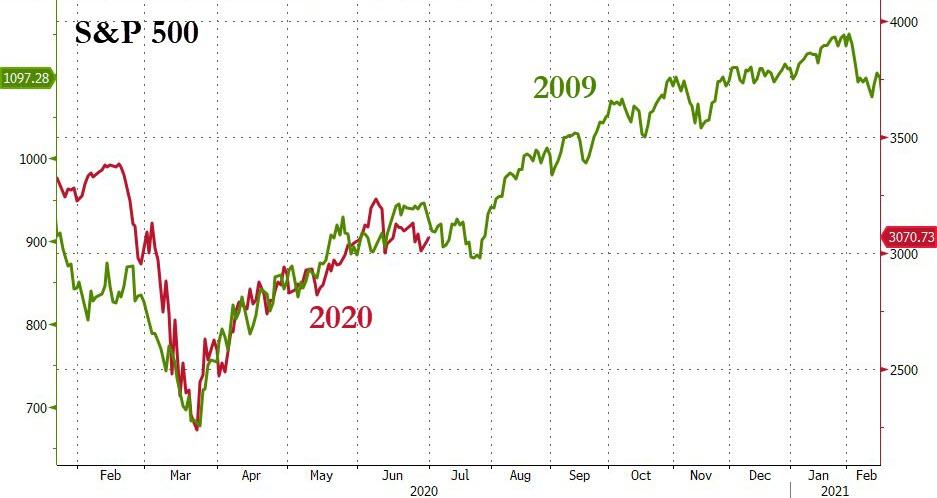

The question is – are we heading for 2009…

Source: Bloomberg

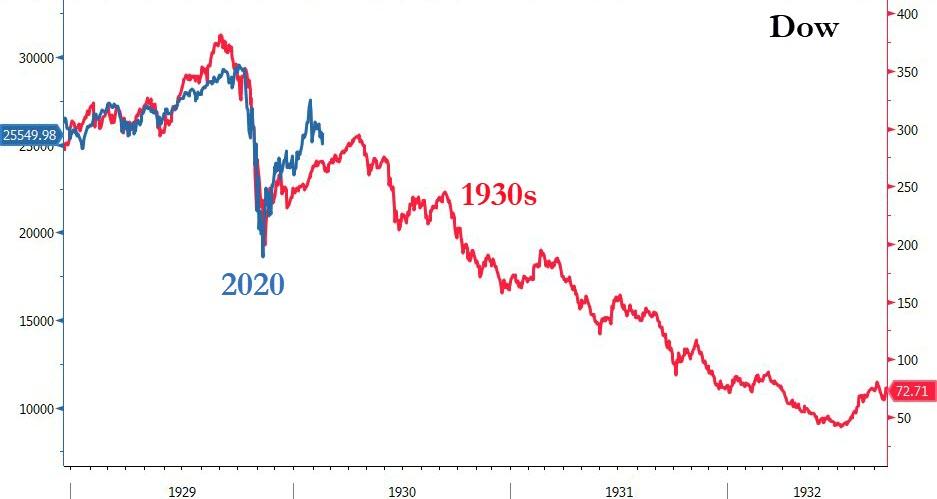

Or the ’30s…

Source: Bloomberg

via ZeroHedge News https://ift.tt/2BhgLnf Tyler Durden