In The “Everything Rally”, ‘Diversification’ Is The New Four-Letter-Word

Tyler Durden

Mon, 08/17/2020 – 05:30

“The price of just about every financial asset is heading up… and they are heading up in unison,” is the ominous warning that The FT’s Robert Armstrong begins the brief clip below as he

From stocks to bonds to commodities – everything is levitating on a bed of ultra-low (if not negative) rates and as more excess liquidity than the world has ever seen.

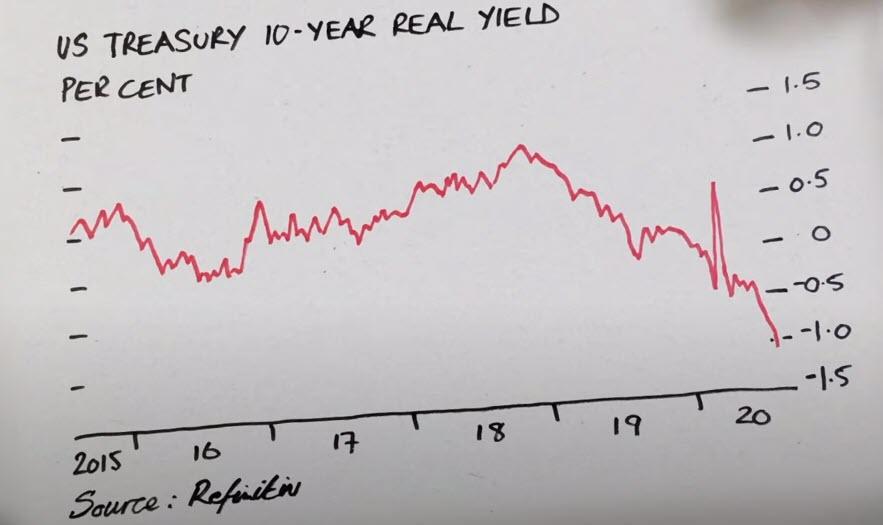

This “sychronized exuberance” is being driven by a collapse of real yields into negative territory for the first time…

Or, as Armstrong notes “money is free… and under those conditions, no asset price can be too high!” and this low or negative real rate environment is expected (by the market) to be around for a really, really long time.

But Armstrong’s ultimate warning comes as he point out that “what is especially worrisome now is that in a downturn, it used to be that investors’ best defense was diversification… which means that when the next downturn comes, there will be no place to hide!“

So the question is “Is it 2007 all over again?”

via ZeroHedge News https://ift.tt/2PZo5HI Tyler Durden