Euro Surges On Report ECB Agrees No Need To Overreact To Euro Gains As Lagarde Says “Will Not Target Exchange Rate”

Tyler Durden

Thu, 09/10/2020 – 08:48

In what can only be described as the most coordinated trial balloon between ECB sources and Bloomberg, at the very moment that Lagarde started her press conference, Bloomberg reported the ECB would “adopt a weaker phrasing in President Christine Lagarde’s press conference about the euro’s recent appreciation than it did during previous bouts of currency gains” citing people familiar with the matter.

The report goes on to note that the Governing Council discussed the currency’s recent appreciation during its meeting on Thursday, “but the general view was that there is no reason to overreact to its recent rise.”

In January 2018, the ECB’s introductory statement contained a phrase that said: “the recent volatility in the exchange rate represents a source of uncertainty which requires monitoring with regard to its possible implications for the medium-term outlook for price stability.”

Then, moments ago, Lagarde appeared far less committal, instead saying that “The European Central Bank President has a close eye on the euro” adding that “in the current environment of elevated uncertainty the governing council will carefully assess incoming information including developments in the exchange rate.”

- *LAGARDE: ECB DISCUSSED APPRECIATION OF EURO

- *LAGARDE: ECB DOESN’T TARGET FX RATE

- *LAGARDE SAYS ECB DISCUSSED EURO, DOES NOT TARGET EXCHANGE RATE

“In the current environment of elevated uncertainty the governing council will carefully assess incoming information including developments in the exchange rate,” Lagarde says at press conference following moneary policy decision

This likely means that any expectations for an imminent currency war between the US and Europe can be put on hold.

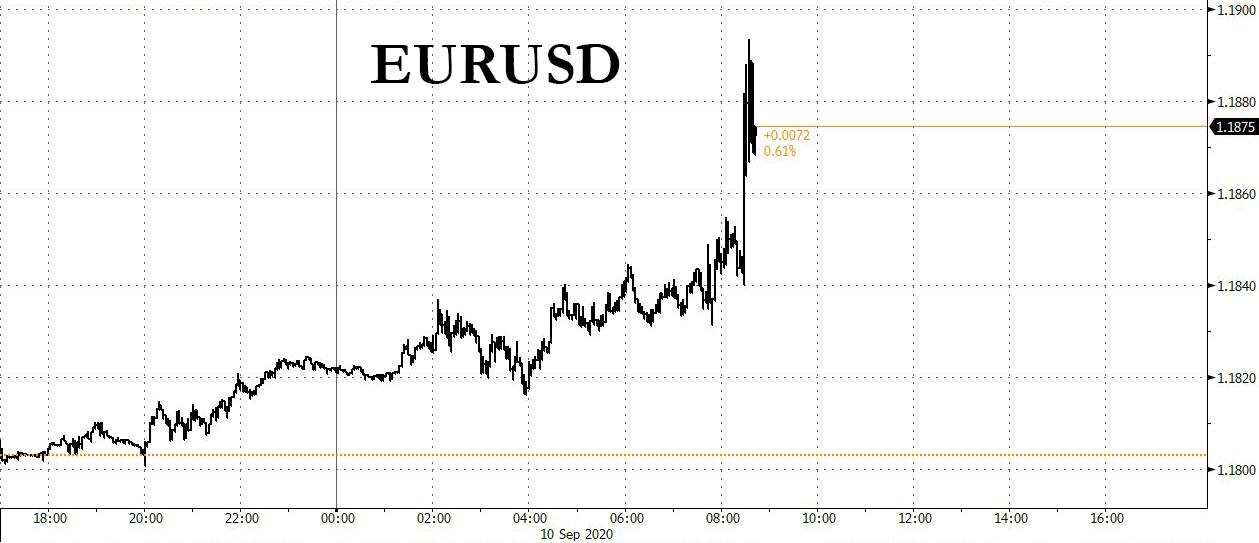

The euro rose to a fresh day high, hitting 1.894 before trimming some gains.

The spike in the Euro pushed European stocks lower, while Bunds extended declines, with the German 10-year yield climbing 3bps to -0.44%.

You can watch Lagarde’s presser here

via ZeroHedge News https://ift.tt/2ZrvKUp Tyler Durden