America Has An Epic Choice

Tyler Durden

Sat, 10/10/2020 – 17:00

Authored by MN Gordon via EconomicPrism.com,

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

– Ludwig von Mises, Human Action [1949]

Crisis Now or Total Catastrophe Later?

On Tuesday, while still hopped up on anti-coronavirus goofballs, President Trump had a moment of clarity. After 40 years of near uninterrupted credit expansion, it was finally time to cut it off. And he was just the guy to do the cutting.

Trump took to Twitter to make his first snips. He announced that stimulus bill negotiations were severed. Minutes after, the Dow Jones Industrial Average hit a 400 point air pocket. Several hours later, and perhaps following a little tutelage from Mnuchin and Kudlow, Trump reversed course.

We don’t know what Mnuchin and Kudlow said to Trump. But we suppose they informed him that, at this point, the immediate health of the American economy is contingent on delivering printing press money to citizens and non-citizens alike…who cares if the long-term consequences are catastrophic? Thus, Trump called on Congress to approve a second round of $1,200 stimulus checks.

This course of action eschews voluntary abandonment of further credit expansion. This, no doubt, is the path of least resistance for politicians. Unless Trump wants to lose the election, he can’t tell voters there’s no more free money.

The choice is real simple. Voluntary abandonment of further credit expansion and a crisis now. Or further credit expansion and the final and total catastrophe of the dollar system later.

For a politician this isn’t really a choice at all. If you recall, Nero clipped coins in 64 A.D. and fiddled as Rome burned. The decision every president makes is to avoid a crisis now and, with a little luck, leave total catastrophe for some other sucker.

We’ll have more on this in a moment. But first, some perspective…

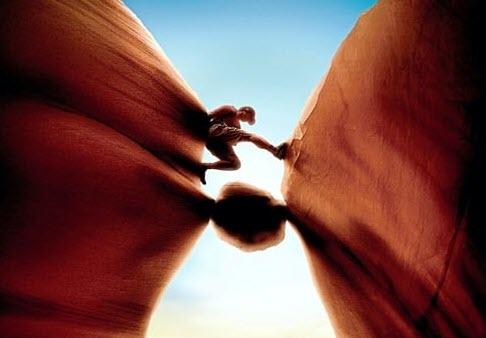

Between a Rock and a Hard Place

In the Spring of 2003, 27-year old Aron Ralston found himself between a rock and a hard place. While solo canyoneering within the rock fissures and tapered caverns of Bluejohn Canyon, in eastern Utah, something heinous happened.

While negotiating a 10 foot drop in a 3 foot wide canyon, Ralston dislodged a boulder he thought was stable. As he fell back, the boulder crashed down and crushed his right hand and lower arm. What’s worse, the 800 pound rock pinned him in the canyon. He was entombed.

Ralston was carrying a small rucksack with just one liter of water, two burritos and a few chunks of chocolate. He also had his rock climbing ropes and a small multi-purpose knife. He hadn’t bothered to tell anyone where he was going. He knew he was invincible.

Over the next 127 hours (more than 5 days), Ralston rationed his water and fruitlessly chipped away at the massive boulder with a dull multi-tool knife. He slowly slipped into a state of delirium. As Ralston weakened and his supplies faded, he was faced with a grim question: Your hand or your life?

Ralston concluded his only way out was to tourniquet his arm with his climbing ropes, and cut off his hand. But when he cut through the flesh with his dull knife he encountered another problem. His bones!

By the fifth day, as Ralston later recounted, he had found “peace” in “the knowledge that I am going to die here, this is my grave.” However, the following morning he had reservations. His peace was gone.

What happened next?

With death staring him in the face, Ralston went into a rage…resulting in another stark revelation. He could fling himself against the boulder to break his own bones.

The snap of his bones “like, pow!” was a horrifying sound “but to me it was euphoric,” recalled Ralston. “The detachment had already happened in my mind – it’s rubbish, it’s going to kill you, get rid of it.”

After snapping his bones and severing his hand (it took about an hour to hack through his flesh), Ralston somehow managed to scale a 65 foot cliff to escape the canyon. He then hiked out to his rescue – minus a hand.

America Has an Epic Choice

America has an epic choice. And it has nothing to do with who will be the next president of the United States. It has nothing to do with if the new stimulus bill is $1.6 trillion or $2.2 trillion.

To review, the choice is as follows: Voluntary abandonment of further credit expansion and a crisis now. Or further credit expansion and the final and total catastrophe of the dollar system later.

The President, Joe Biden, Congress, the Secretary of Treasury, the Federal Reserve, economic advisors, the political class, lobbyists, government contractors, Wall Street, pensioners, CalPERS, transfer payment recipients, social security and Medicare beneficiaries, and so on and so forth, including…

Jamie Dimon, the U.S. Forest Service, the Bureau of Land Management, Arlington Virginia, bureaucrats at the Department of HUD, Anthony Fauci, mortgage brokers, Edward Jones, Lockheed Martin, the staff at the IRS, public private partnerships, teachers unions, and much, much more.

The whole lot – and then some – are firmly on the side of further credit expansion and the final and total catastrophe of the dollar system later. Just this week, for example, Fed Chair Powell offered the following words of encouragement:

“The US federal budget is on an unsustainable path, [and] has been for some time. [But] this is not the time to give priority to those concerns.”

In other words, avoid a crisis now in exchange for total catastrophe later.

The choice, by all measures, is heinous. But sometimes, like Aron Ralston, one must cut off their hand if they want to live. By this, voluntary abandonment of further credit expansion is the way out of the current financial predicament. Stop the madness. Bring on the crisis.

via ZeroHedge News https://ift.tt/2GNLEST Tyler Durden