VIX, VVIX Explode Higher As “Folks Are Grabbing At Tails Again”

Tyler Durden

Wed, 10/28/2020 – 12:05

As the liquidation across asset-classes accelerates, equity protection costs are exploding.

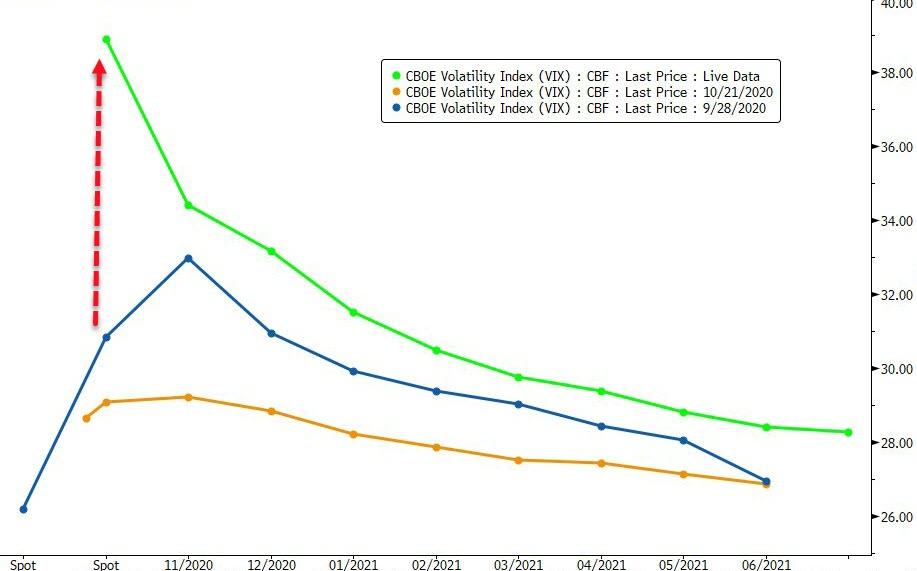

VIX topped 40 for the first time since June…

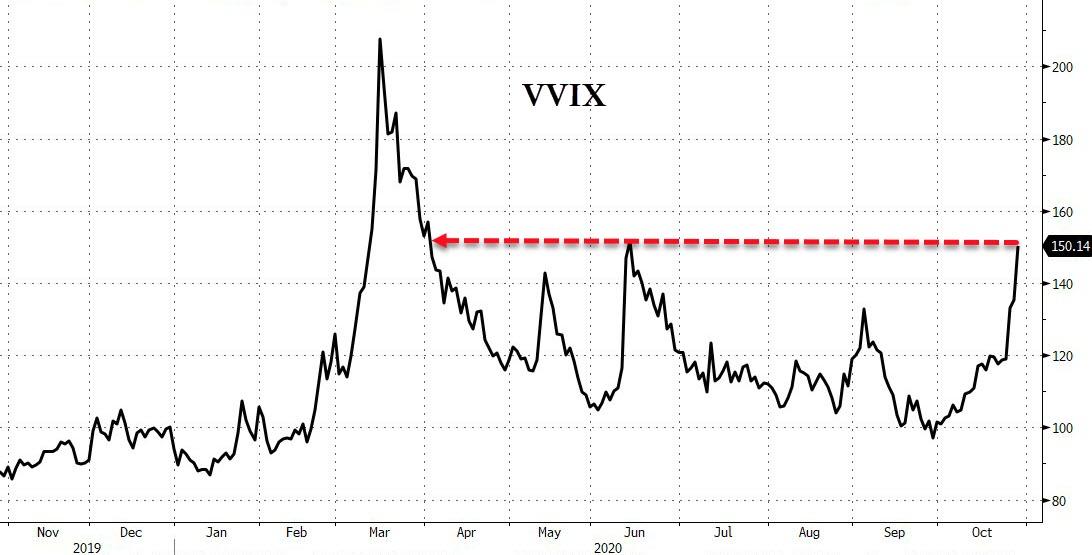

And, as Nomura’s Charlie McElligott notes, vol-of-vol (VVIX) is going absolutely BONKERS, as folks are grabbing at “tails” again into atrocious market illiquidity, election scenario freakouts (folks getting arms around tax implications of “Blue Sweep” yet again?! – or the massive downsizing of prior fiscal stimulus expectations with Republican Senate) and COVID shutting Europe back down as the “European Renaissance” trade again false-starts…

And in “flight to liquidity” fashion with a “short squeeze” positioning kicker, US Dollar is ripping higher, while SPX term structure btwn now and election is exploding higher as well in major cringe-fashion:

Additionally, as McElligott warns, making matters worse for the 60/40 and Risk Parity set is that USTs aren’t hedging on the risk-off move and actually SELLING-OFF…

…as the missing overseas “real money” buyers wait for event-risk to clear before backing up the truck into duration buying (esp with fx-adjusted yields at or near 5 year bests, and a Fed who won’t be able to risk tighter financial conditions into the super fragile pandemic recovery—just as Europe is re-entering “lockdown”—thus likely to “up” QE purchases amounts and / or extend the weighted avg maturity of the asset portfolio through duration purchases).

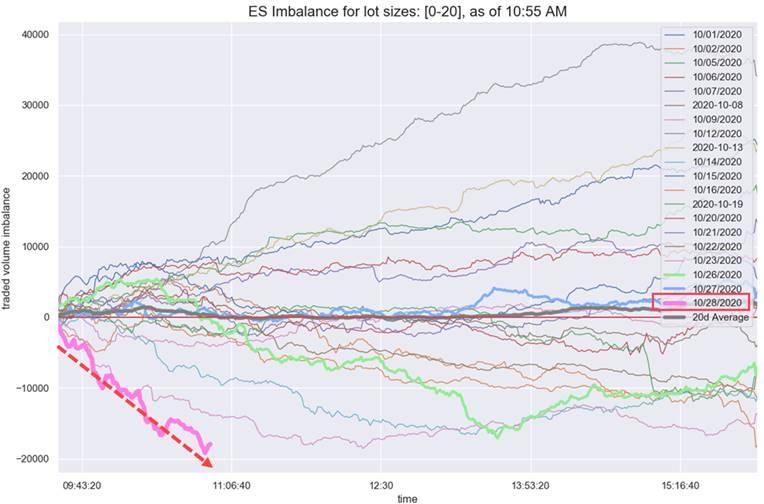

Perhaps most notably, the “Large Lot” sellers are back…

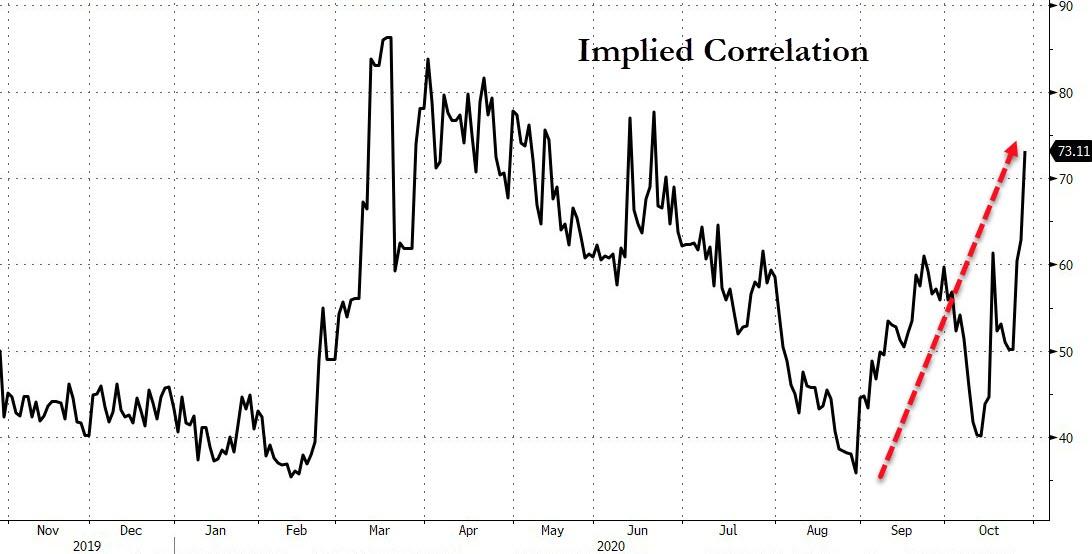

And professionals are starting to position for an imminent systemic risk event as implied correlation signals macro overlay buying is dominating any single-name protection buying…

Not pretty.

via ZeroHedge News https://ift.tt/34zV0dP Tyler Durden