The 10 Cities In The Most Financial Distress

Tyler Durden

Sat, 10/31/2020 – 15:20

By Cailin Crowe of SmartCitiesDive,

Summary:

-

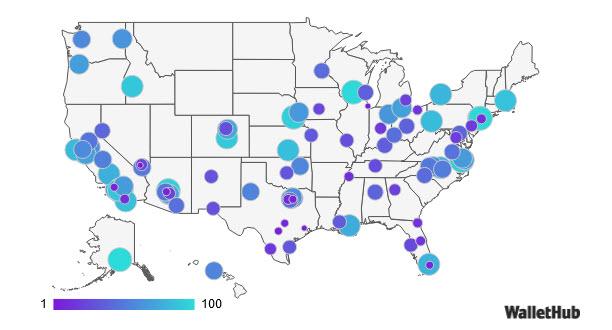

Las Vegas is the top U.S. city where people are experiencing “financial distress” during the coronavirus (COVID-19) pandemic, according to a WalletHub analysis of the country’s 100 largest cities.

-

The rankings were determined by a weighted average across six categories, including credit scores, average number of accounts in distress and changes in the numbers of bankruptcy filings in June 2020 versus June 2019. The 10 cities with the most people in financial distress include: Las Vegas; Chicago; Houston; San Antonio; Dallas; Phoenix; Los Angeles; Austin, Texas; Miami and Fort Worth, Texas.

-

The cities with the lowest rates of financial distress are Anchorage, Alaska; Madison, Wisconsin; Jersey City, New Jersey; Fremont, California; and Newark, New Jersey.

The national unemployment rate was 7.9% in September, according to the U.S. Bureau of Labor Statistics (BLS), compared to the 3.6% unemployment rate in January. The actual rate of unemployment, however, is likely closer to 26%, Axios reports.

Hawaii holds the highest rate of unemployment among states at 15.1%, followed by Nevada at 12.6%, according to Forbes, in part due to the pandemic’s heavy toll on tourism industries.

Las Vegas; Henderson, NV; Reno, NV; and North Las Vegas, NV were among the top five cities to see the highest change in the average number of accounts in distress this September compared to January, according to the WalletHub study.

Casinos and resorts are slowly starting to reopen, however. And employment in leisure and hospitality industries grew by 318,000 people in September, with 69,000 jobs added in amusement, gambling and recreation, according to BLS.

Orlando, FL, another tourist hub which WalletHub ranked among the top 15 cities for financial distress, has also seen some relief from the reopening of Walt Disney World Resort. The parks furloughed 70,000 workers at the onset of the pandemic, contributing to the leisure and hospitality sector’s staggering 40% unemployment rate in April.

To help alleviate financial stress, cities from Philadelphia to Los Angeles have used some of their federal coronavirus relief funds to help residents pay rent or utilities. Nonprofits like Accelerator for America have also stepped in by raising over $10 million to provide relief in the form of prepaid debit cards to local residents, particularly those who are unbanked and undocumented.

“Direct payments to individuals need to be a priority,” University of Cincinnati’s Economic Center Director Julie Heath said in a statement. “When the extra $600 per week was available to displaced workers, millions of jobs were supported (not eliminated) because these individuals and households still had money to spend in the economy.”

Low-income individuals and women have been hit the hardest by the pandemic-fueled recession, according to Heath. A recent survey by the U.S. Green Building Council (USGBC) found 89% of women reported feeling significant financial, professional and familial impacts from the pandemic.

The financial effects of the pandemic have also been disproportionately felt across communities of color, with 31% of Black residents unable to pay rent in July.

To address some of those financial strains, Rep. Maxine Waters, D-CA recently introduced the Emergency Housing Protections and Relief Act of 2020. The bill would allocate $100 billion for rental assistance and create a $75 billion fund for homeowners to prevent evictions, foreclosures and unsafe housing conditions. In June, the bill was passed in the House by a vote of 232 to 180, and received in the Senate where it is not expected to pass.

A second federal stimulus deal could also provide relief to residents, but a deal is unlikely to happen until after the election, The Washington Post reports.

via ZeroHedge News https://ift.tt/34P50Ap Tyler Durden