Warning Signs Flash For Stonks As Record Equity Issuance Surpasses Dot-Com

US firms and Wall Street understand that today’s market conditions of easy money, low bond yields, and euphoric Wall Street Bets traders buying anything under the sun is the perfect time to ramp up equity issuance. In fact, stock issuance has just surpassed Dot-Com levels to record-highs.

Country western star Kenny Rogers, famous for singing the “The Gambler,” one said:

You’ve got to know when to hold ’em

Know when to fold ’em

Know when to walk away

And know when to run

A new client note from Grantham Mayo Van Otterloo & Co. LLC (GMO) investment advisors outlines that US main equity indexes are screaming to new highs, and an inconvenient truth has just emerged for bulls:

“Stock issuance in 2021 is also setting a new record, blowing away the last high set in the run-up to the Tech Bubble. This is a dubious item to celebrate if history is any guide.”

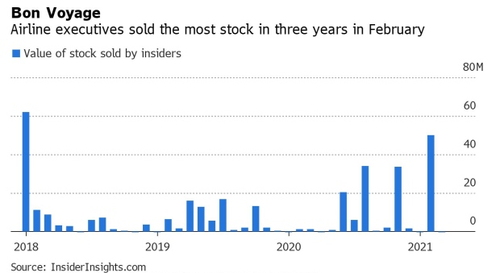

So back to Kenny Rogers’ song, and something retail should closely pay attention to, the flood of new issuance could result in excess supply that may drown out the market. Though we must add, buybacks have been accelerating as well, but alongside that, corporate insiders are dumping their own stock.

Some of the equity issuances came from SPAC (Special Purpose Acquisition Company) selling like hotcakes. More SPAC capital was raised in the first six months than in the past two decades. Talk about excess, right?

More on the SPAC space is Justin Wiggs, managing director in equity trading at Stifel Nicolaus, who said the issuance cycle of SPACs “peaked months ago,” possibly suggesting the SPAC party is over for now (we noted as early as April trouble was brewing for SPACs).

On the SPAC front, the issuance cycle seeming peaked months ago when we saw 92 US SPAC IPO’s in Feb to just eight de-SPACs and then in March where we had 101 new issues and just eight de-SPACs… the SPAC universe actually shrunk in July with 29 de-SPACs and just 28 IPOs… and we could potentially set up for a similar contraction in August with just 21 IPOs, 15 de-SPACs and another 17 set to vote this month.

But for some context, SPACs have raised something to the tune of $250Bln in proceeds ever (albeit nearly half of that has been in 2021), which is just about the market cap lost in Amazon in the last four weeks.

The Securities and Exchange Commission (SEC) has announced aggressive enforcement actions against SPACs as class-action lawsuits are mounting as some hyped-up deals become flops.

Billionaire investor Bill Ackman said Thursday he would return the $4 billion secured from investors for his SPAC if the SEC approves a new trading vehicle that will allow him to continue hunting deals.

“If you find yourself in a leaky boat, often times you are better off switching boats than patching leaks to complete the mission,” Ackman tweeted.

“In a de-SPAC merger transaction, time pressure on the sponsor is the enemy of a good deal for shareholders,” he said.

Ackman had multiple challenges finding a deal. He outlined a target that was expected before 1Q21 and then extended the timeframe. By June, he attempted to purchase a 10% stake in Universal Music Group from Vivendi SA, but the SEC shot down that idea.

GMO ended their note to clients by saying: “record-high stock issuance is an ominous sign” that should have Wall Street “on edge,” adding, “Wall Street knows an eager, price-insensitive buyer when it sees one. As the cynical expression goes, when the ducks are quacking, it’s time to feed ’em.”

Due to the explosion in offerings, the total pool of stocks has expanded for the first time in a decade.

When the Federal Reserve begins to taper, who will soak up all this supply?

Tyler Durden

Mon, 08/23/2021 – 05:45

via ZeroHedge News https://ift.tt/3jbiWMe Tyler Durden