Don’t Rely On Unbridled Optimism To Divine Profits’ Path

By Simon White, Bloomberg Markets Live Commentator and Reporter

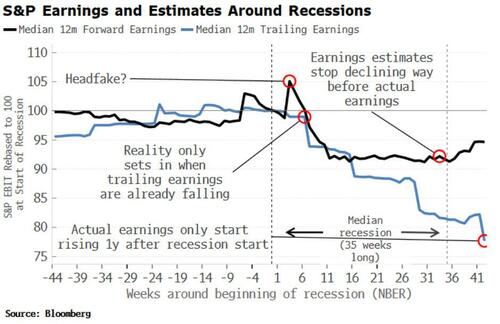

Earnings estimates start falling too late and stop falling too early in recessions. Macro-driven indicators are much more reliable indicators of the profit outlook, with the majority currently pointing to much weaker earnings through the rest of this year.

In a recent post, I showed that earnings estimates are most wrong in recessions. We can see what actually happens in the chart below. Typically earnings and their forward estimates track each other quite closely in the run up to a recession but, when one starts, things go a bit haywire. Earnings themselves don’t start to fall for several weeks, while forward earnings have one last burst of optimism, jumping higher, before reflecting reality and falling.

Earnings estimates cease falling long before the median recession ends, even while trailing earnings have much further to fall.

Stock analysts miss recessions as they are not really looking for them. They are experts in their field, and are generally able to intuit when and whether their sector is about to face a pervasive fall in earnings.

But recessions are different. A macro-focused strategist or even a housing expert may have been able to tell you the severity of the hurricane about to hit in 2007, but it is unlikely, say, a telcos analyst would have been in a position do do.

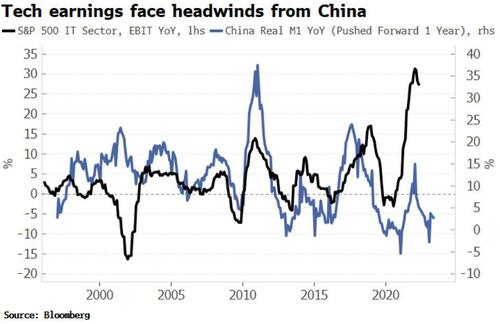

Today, the macro warnings for a recession are mounting, leaving earnings looking increasingly exposed. China is one clear example, but there are several others.

The country has yet to fully open up as it battles with Covid, while there is a continued reluctance to return to “flood-like” stimulus. As a result, liquidity in China is struggling, which has historically posed a significant headwind for US tech earnings (which despite their recent fall are still 43% of S&P 500 earnings).

Tyler Durden

Thu, 06/30/2022 – 08:22

via ZeroHedge News https://ift.tt/wnH8xUu Tyler Durden