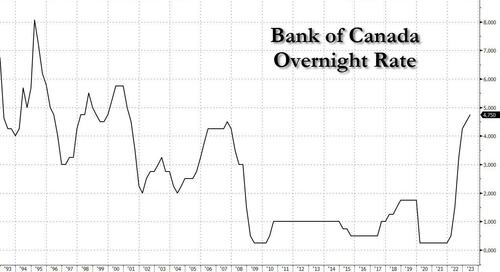

Bank of Canada Ends “Pause” With Unexpected Rate Hike To 4.75%, A 22-Year High

Two days ago Australia shocked the market when it unexpectedly hiked rates to 4.1%, an 11 year high, and warned of more hikes to come. Today, it was Canada’s turn.

Moments ago the BOC also hiked its overnight rate to 4.75% – the highest rate since 2001 – surprising median consensus which expected the central bank to extend its “pause” and remain unchanged from last month at 4.50%.

The hike was expected by only about one in five economists in a Bloomberg survey, and markets had put the odds at about a coin flip.

The Bank of Canada said that the “overall, excess demand in the economy looks to be more persistent than anticipated,” the bank said in its rate statement, which wasn’t accompanied by a new set of forecasts…. Governing Council decided to increase the policy interest rate, reflecting our view that monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target.” The bank also said that it “will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the inflation target” and added that it “remains resolute in its commitment to restoring price stability for Canadians.”

Some more details from the statement:

-

Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation. In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the inflation target.

-

Bank continues to expect CPI inflation to ease to around 3% in the summer as lower energy prices feed through and last year’s large price gains fall out of the yearly data.

-

However, with three-month measures of core inflation running in the 3!4-4% range for several months and excess demand persisting, concerns have increased that CPI inflation could get stuck materially above the 2% target.

-

The labour market remains tight: higher immigration and participation rates are expanding the supply of workers but new workers have been quickly hired, reflecting continued strong demand for labour. Overall, excess demand in the economy looks to be more persistent than anticipated

-

Demand for services continued to rebound. In addition, spending on interest-sensitive goods increased and. more recently, housing market activity has picked up.

Since declaring a conditional pause in January, policymakers have warned that further rate increases may be necessary. And while some Canadians are feeling the pinch of steeper borrowing costs, the bank’s move from the sidelines suggests officials are worried that economic momentum won’t slow enough without another hike.

“Monetary policy was not sufficiently restrictive to bring supply and demand into balance and return inflation sustainably to the 2% target,” the bank said, citing an “accumulation of evidence” that includes stronger-than-expected first quarter output growth, an uptick in inflation and a rebound in housing-market activity.

The move follows a surprise 25 basis-point boost Tuesday by the Reserve Bank of Australia.

As Bloomberg reminds us, the Bank of Canada was the first and only Group of Seven central bank to pause its hiking cycle. Now it’s changed its mind, conceding that higher borrowing costs are still required to bring inflation to heel in an economy that’s proving more resilient than anticipated.

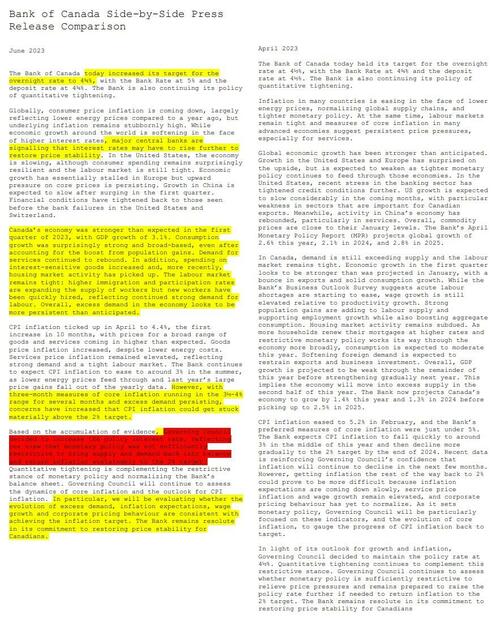

Understandably, the central bank also removed the April language about being prepared to raise rates further if needed. Here is a full redline comparison between the two most recent statements:

BoC chief Macklem and his officials pointed to elevated three-month moving measures of underlying price pressures as a key reason for their move. “Concerns have increased that CPI inflation could get stuck materially above the 2% target,” they said.

The statement was light on forward-looking commentary, suggesting policymakers aren’t yet sure whether the move will end up as a fine tuning or the start of another series of increases. Officials said they plan to examine how excess demand, inflation expectations, wage growth and corporate pricing behavior evolve.

In kneejerk response, the loonie rallied: the USDCAD fell from 1.3384 to 1.3320 before paring back to 1.3350…

… while Bonds dropped, pushing the Canada two-year yield to 4.473%, up about 10 basis points, the highest since August 2007.

Finally, we note that rate-hike odds for The Fed are on the rise, as investors reflect on Canada’s inflation/jobs data…

…and note how similar it looks to what The Fed is facing.

Tyler Durden

Wed, 06/07/2023 – 10:15

via ZeroHedge News https://ift.tt/IFoNj5i Tyler Durden