Authored by Kit Knightly via Off-Guardian.org,

Becoming a “Nation of Renters” is clearly a big part of the New Normal…

The incipient “Great Reset” is a multi-faceted beast. We talk a lot about vaccine passports and lockdowns and the Covid-realated aspects – and we should – but there’s more to it than that.

Remember, they want you to “own nothing and be happy”. And right at the top of the list of things you definitely shouldn’t own, is your own home.

The headlines about this have been steady for the last few years, but it has picked up pace in the wake of the “pandemic” (as has so much else). An agenda hidden on back pages, behind by Covid’s meaningless big red numbers, but perhaps no less sinister.

You can find articles all over the net talking up renting over owning.

Last month, for example, Bloomberg ran an article headlined:

America Should Become a Nation of Renters”

Which praises what they call “the liquefaction of the housing market” and gleefully expounds on the idea that “The very features that made home buying an affordable and stable investment are coming to an end.”

The Atlantic published “Why Its Better To Rent Than Own” in March.

Financial pages from Business Insider to Forbes to Yahoo and Bloomberg again are filled with lists titled “9 Ways Renting is Better Than Buying”, or similar.

Other publications go more personal with it, with anecdotal columns about ignoring financial advice and refusing to buy your home. Vox, never one to sell their agenda with any kind of subtlety, have a piece titled:

Homeownership can bring out the worst in you

Which literally argues that buying a house can make you a bad person:

It’s the biggest thing you might ever buy. And it could be turning you into a bad person.

So what exactly is the narrative here? What’s the story behind the story?

The short answer is fairly simple: It’s about greed, and it’s about control.

It almost always is, in the end.

The longer answer is rather more complicated. Major investment firms such as Vanguard and Blackrock, along with rental companies such as American Homes 4 Rent, are buying up single-family homes in record numbers – sometimes entire neighbourhoods at a time.

They pay well over market value, pricing families who want to own those homes out of the market, which forces the housing market up whilst the Lockdown-created recession is lowering wages and creating millions of newly unemployed.

Of course, this is motivating people to sell the houses they already own.

People all across America have been saddled with houses worth less than they bought them for since the 2008 economic crash, and are eager to take the cash from private investment firms paying 10-20% over market value. Combine an economic recession with a created housing boom and you have a huge population of motivated sellers.

Of course, many of these sellers don’t realise, until it’s too late, that even if they attempt to downsize or move to a cheaper area, they may be priced out of the market completely, and forced to rent.

As such, in the last year, the private investment share of single-family home purchases is estimated to have increased ten-fold, going from 2% in 2018 to over 20% this year.

As more and more people are forced to rent, of course, rental properties will be in higher and higher demand. This in turn will drive the cost of renting up.

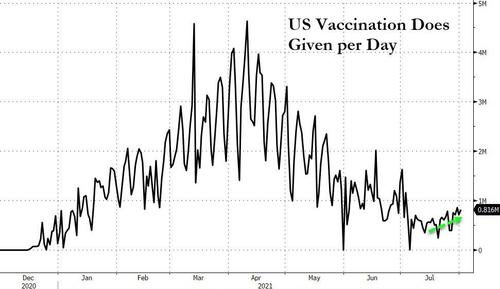

Market Watch has already reported that, in the last year, rent has increased over 3x faster than the government predicted.

This problem is likely to get worse in the near future.

Last night, Congress “accidentally failed” to extend the Covid-related eviction ban.

Which means, this weekend, while Senators adjourn to the summer homes they probably don’t rent, the ban will officially end and a lot of people are likely to have their houses foreclosed or their landlords kick them out.

The newly empty buildings will be a feeding frenzy for the massive corporate landlords. Who will descend on the banks like starving hyenas to snap up the foreclosed properties for pennies on the dollar. Just like they did in 2008.

None of this is any secret, it’s been covered in the mainstream. Tucker Carlson even did a segment on it in early June.

The Wall Street Journal headlined, back in April, “If You Sell a House These Days, the Buyer Might Be a Pension Fund”, and reported:

Yield-chasing investors are snapping up single-family homes, competing with ordinary Americans and driving up prices

However, since then, something has clearly changed. The propaganda machine has kicked into gear to defend Wall Street from any backlash.

No better example of this shift can be found than The Atlantic, which ran this story in 2019:

WHEN WALL STREET IS YOUR LANDLORD

With help from the federal government, institutional investors became major players in the rental market. They promised to return profits to their investors and convenience to their tenants. Investors are happy. Tenants are not.

…and this story last month:

BLACKROCK IS NOT RUINING THE US HOUSING MARKET

The real villain isn’t a faceless Wall Street Goliath; it’s your neighbors and local governments stopping the construction of new units.

Going back to the Vox well we have:

Wall Street isn’t to blame for the chaotic housing market

Which ran just a few days after the Atlantic article, and is practically identical.

Both these (oddly similar) articles argue that Wall Street and private equity firms can’t be blamed for buying up houses, and that the real problem is the lack of supply to meet demand.

You see, all the “selfish” people who already own homes (they did say it makes you a bad person) are blocking the construction of new houses, and thus driving up the cost of property through scarcity.

This has been a logically flawed argument around the housing market for decades.

That there aren’t enough houses for people to buy is patently absurd when the US census data says that there are over 15 million houses currently standing empty. That’s enough to house all of America’s roughly 500,000 homeless people 30x over.

There’s plenty of houses, there’s just not enough money to buy them.

The reason for that is the same reason the California has massive “homeless camps” in its major cities, and that so many people are having to become renters instead of owners: wage stagnation.

For decades now, wage increases have lagged behind increases in the cost of living. In the 1960s one full-time job could afford a decent standard of living for a family of four or more. These days both parents work, sometimes multiple jobs each.

It was huge amounts of financial de-regulation which created this situation. So, whether you believe Vox’s BlackRock apologia or not, one way or another Wall Street very definitely is to blame.

But this isn’t just about money. It never is. Just as the war on cash isn’t just about efficiency, and the environmental push isn’t just about climate change. Ditto veganism. It’s about control. Just like vaccines, lockdowns and masks.

It always comes down to control.

It’s an oft-used cliche, but no less true for that, that homeowning “gives people a stake in society”. A family-owned house is a source of security for the future and something to leave your children. It is also sovereignty and privacy. Your own space that no one else can control or take away.

In short: A homeowner is independent. A renter is not. A renter can be controlled. A homeowner can not.

It’s the same reasoning behind the way working people were encouraged to take out loans and become debt slaves. If you limit people’s options, if you make them rely on you for a roof over their heads, you have control over them.

There’s a great article about this situation called “Your New Feudal Overlords”.

Under Feudalism, land wasn’t owned by the working class, but provided to them by landed barons, hence the term “Land Lord”. If you disrespected your Lord, or broke his rules, or he perceived another peasant/farm animal/crop would be a better use of the land, he could take it back.

Essentially, the behaviour of serfs was kept in check by their reliance on the nobility for a place to live. That’s very much the dynamic they’re going for here.

Rental agreements can be full of any terms and conditions the landlord wants, and the more desperate people get the more of their consumer rights they will sign over.

Maybe you’ll agree to smart meters which monitor your internet or power-usage habits, and then sell the data to behavioural modellers and viral marketers.

Maybe you’ll have to agree to certain power limitations or water shortages in order to “fight climate change”.

Maybe it will get worse than that.

Maybe they’ll go full Black Mirror style corporate dystopia. Maybe, through affiliation programs, the mega-equity firm which owns your rental house has ties to McDonald’s, and as such will require you to not eat at any competing fast-food franchises, or demand you observe at least ninety seconds of Disney advertisements per day.

Maybe it will be as simple as including vaccine status in the tenancy agreement, making it impossible for the unvaxxed to find a home.

Maybe they just want to make poor people miserable.

After all, the super-wealthy have got all the money they could ever need, and all the luxury they could ever use. Their living standards are as high as physically possible. So maybe the only way they can keep “winning”, is to start driving the living standards of us proles down.

No air travel. No vacations. No going out at all. Live in a tiny house, or a pod. Eat bugs. Get rid of your car. Rent your clothes. Or your furniture. Pay taxes on sugar. And alcohol. And red meat.

They’ve been very clear about this. They’ve told you about the Great Reset and the Internet of Things. That’s the plan.

You won’t own a house. And you’ll be happy…or else the mega-corporation you’re forced to rent from will kick you out.