Shortly after BNP Paribas closed its prop trading unit (reminding readers of the financial press that the practice of risking shareholder money for profit continued in Europe after the financial crisis, along with the sometimes enormous consequences of seemingly trivial human errors) and its US commodities derivatives trading unit, the Paris-based bank’s smaller cross-town rival SocGen is weighing whether to close its own $4.7 billion prop trading desk after four years of middling-to-abysmal returns, crowned by a 20% loss in 2018 that the bank blamed on the explosion of volatility during Q4, according to Bloomberg.

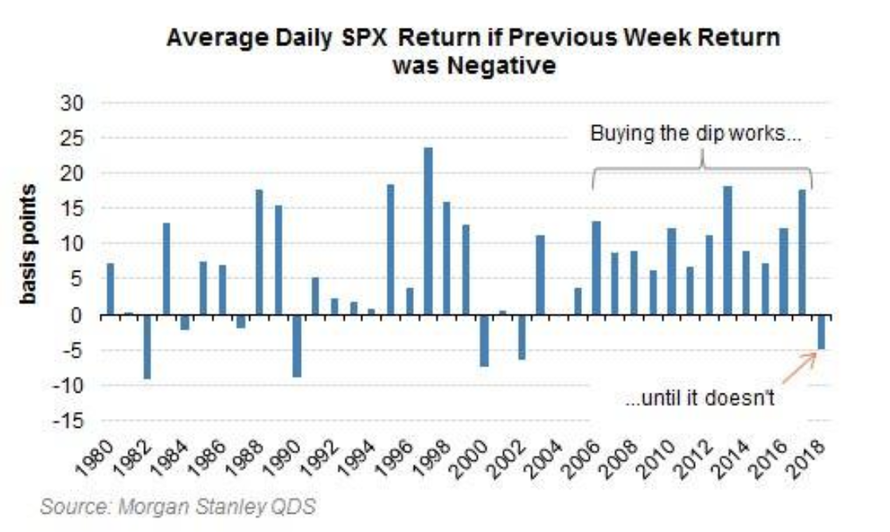

Q4 earnings season is still in its early days, but already every major bank has blamed trading-unit losses on Q4 volatility, and SocGen isn’t an exception. BBG reported that the bank shuttered its prop unit’s Hong Kong trading desk late last year as losses force it to abandon several trading strategies (BTFD?).

The bank has already revealed a 10% drop in revenue for its market unit that it attributed to activity in Q4.

French regulators allowed prop trading to continue after the crisis – while the Volcker rule effectively banned the practice in the US – but prop trading units must now follow more strict controls on capital requirements and costs, among other factors.

To be sure, this isn’t the first time the bank has placed its prop trading unit under review.

Descartes, named for the 17th-century French philosopher, had 4.1 billion euros ($4.7 billion) of assets at the end of 2017, according to filings. The unit had 377 million euros of capital, equal to about 4.5 percent of SocGen’s funds for global-markets and investor services activities, the filings show.

Executives at SocGen have reviewed the performance of Descartes several times since its creation. The unit, which has staff in Paris and London, has made less than 1 million euros in accumulated profits between 2015 and 2017, according to filings.

The losses at the Descartes unit will likely make life even more difficult for SocGen CEO Frederic Oudea after the bank paid some $2.6 billion in fines last year

The issues at Descartes compound the problems facing SocGen Chief Executive Officer Frederic Oudea, who is seeking to restore investor confidence after the bank paid about $2.6 billion in penalties last year over alleged violations of US sanctions.

As more French banks rethink whether prop trading is worth the risk, will Natixis be next?

via RSS http://bit.ly/2CqwBIH Tyler Durden