Summary

-

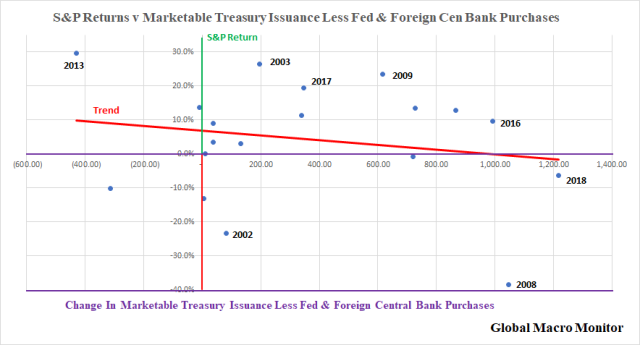

We believe the market is way off base in its analysis of what caused stocks to sell hard in 2018

-

The U.S. and world have a debt problem and yields need to mover higher in order for markets to clear

-

The breakout in long-term yields in late September broke the U.S. stock market

-

The macro factors that caused the stock market collapse, the changing dynamics in the Treasury market, have not changed and are likely to deteriorate further

-

A volatile future is highly likely

-

Timing to be determined

Is that it?

The end of the bear market?

Autopsy in the above title is a misnomer. We believe the bear is not quite dead yet.

Moreover, what was it that caused stocks, the S&P500, to sell off 20.21% in just 66 trading day?

We don’t claim to have the Truth, nor does anyone else, but what we do have, is what we believe to be a well researched, thought out alternative and provocative opinion, based on empirical data, and proud to say far from the conventional wisdom of the market. That is, that stocks sold off over worries of a potential monetary policy mistake and an imminent recession — total nonsense, in our opinion.

The Market Now Believes The Fed Has A New Dual Mandate

Furthermore, what a disgrace it was to watch the market clowns and cheerleaders try to force — and now believe they have succeeded — Jay Powell and the FOMC to change their “dual mandate” from price stability and maximum employment to supporting the S&P500 and Nasdaq. Total yuck!

Spoiler alert. We estimate the Fed will still reduce the balance sheet by $17 billion in January; $46 billion in February; $34 billion in March, and the Fed Funds target range will remain at 2.25-2.50 over the same period.

No change in policy, but some soothing words from Mr. Powell that the FOMC will remain flexible and data dependent.

Baffling. When in the hell has the Fed not been flexible and data dependent?

The Fed Put

The cheerleaders are happy, nonetheless, as they believe the Powell Fed is now the stock market’s bitch. We are not so sure.

Jay Powell appears, at least to us, to be one cunning and smooth operator. That Fed put you perceive lurking down 10 percent is no more real than the illusion of Mexican pesos flowing into the Treasury coffers to pay for that “f%#ken Wall.”

If it soothes the market’s soul to believe in such a fantasy, so be it.

The Origins Of The Bear Market

We believe the 2018 global bear market began with the massive volatility spike which started at the end of last January.

We believe there will be a stock bear market in 2018 but less confident on its depth and length, however. We will turn that page, if, and when, we get there.

Recall in our earlier posts (see here and here), there have been three other massive volatility shocks since 1950, similar to the one the S&P500 just experienced.

1) 1955: Ike’s heart attack; 2) 1962: the “Kennedy slide” or JFK bear market; and 3) 1987: the “crash” bear market, which lasted only 38 days.

We threw out Ike’s heart attack as it was not a prelude to a bear market. The S&P500 recovered shortly after the sharp Monday sell-off after President Eisenhower had a heart attack on the 8th hole at Cherry Hills Country Club the prior Saturday afternoon.

Bear Markets Do Not Happen Without Recession?

To that, we say, poppycock! Time to tune out the cheerleaders.

The data are clear. The U.S. economy thrived during the 1962 bear market, growing at more than 6 percent, on average. The economy grew at 3 ½ percent in 1987. No recession, not even close, in those two bears. – GMM, Feb 21, 2018

Yes, the S&P500 did make a nominal new high in September, which turned out to be a very ugly bull trap. Not so for most other markets.

The 2018 Sell-Off Was Different

We also noted last year how the big spike in volatility and massive selling was different than past corrections.

Here’s an excerpt from our post, Why This Correction Is Different,

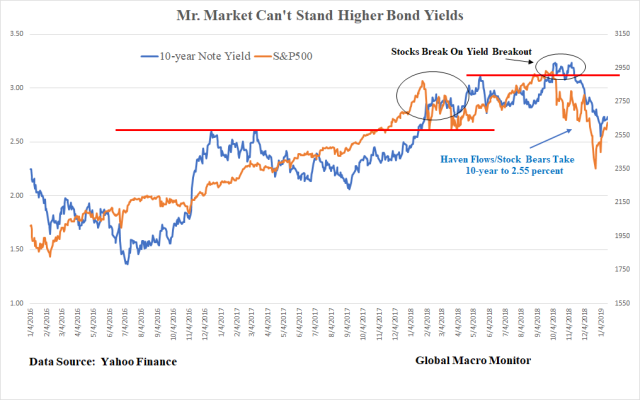

The sell-off that began on January 29th spanned ten trading days and took the S&P500 down 10.2 percent (11.8 percent from intraday high to low), and was the first correction this century that corresponded with a rise in the 10-year Treasury yield. That is a positive correlation between stocks and bonds to the downside during an official correction.

Moreover, the table below shows there has been only one other correction or bear market in almost 30 years that has seen the 10-year Treasury yield rise. The correction in 1999 and 41 bps move higher in bond yields was the result of the Fed and market yields rebounding from the sharp drop and overshoot in interest rates during the Russian debt default and LTCM crisis in 1998. – GMM, March 18, 2018

Thus began our laser focus on bond yields and the changing dynamics of the Treasury market.

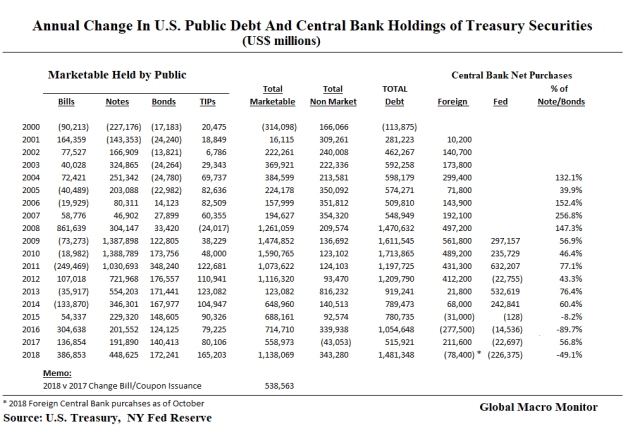

The Gathering Storm In The Treasury Market

On September 24th, we posted our 5,000 plus word tome, The Gathering Storm In The Treasury Market, the very day the S&P500 peaked at 2940.91, its all-time high.

In addition to the massive increase in the supply of Treasury securities hitting the market, we noted several structural factors on the demand side that are changing.

-

The massive borrowing by the U.S. Treasury is crowding out emerging market capital flows

-

The structural factors that have kept long-term interest rates low and term premia repressed are fading

-

The U.S. budget deficit is exploding

-

The Treasury has to increase its market borrowing as the Fed rolls off its SOMA Treasury portfolio

-

Social security has moved into deficit and borrowing from its trust funds to finance on-budget deficits is over

-

Globalization is under threat, and foreign capital flows into the U.S., particularly the Treasury market, are declining – GMM, September 24, 2018

The yield on the 10-year Treasury soon broke out to 3.25 percent, a level not seen since 2011, which, as the chart below illustrates, broke the stock market.

Mr. Market Can Stand Many Things, But Can’t Stand Higher 10-Year Yields

Given the unprecedented increase in Treasury supply during an economic expansion, coupled with the changing structural demand factors we cited, we concluded a move to over 4 percent and quickly was a done deal. Unless however,

All bets off given a geopolitical shock — we are concerned how quickly U.S.-China relations are moving south; a collapse in stock prices, or a sharp slowdown in economic activity. Haven flows will likely swamp the structural factors pressuring yields higher. – GMM, September 24, 2018

Upshot

There you have, folks.

The stock market broke as long-term yields broke out to 8-year highs. All while the cheerleaders were claptrapping, “interest rates are moving higher for all the right reasons. Stocks are cheap, buy ’em.” What horseshit as I used to say during my baseball days.

No monetary policy mistake. No global recession.

Furthermore, it’s totally absurd, in our opinion, to think a move from a negative 2 percent real Fed funds rate to zero or barely positive in an economy with sub-4 percent unemployment can lop 20 percent off the U.S. stock market. We will concede, however, markets often ignore levels and obsess more over first and second derivatives.

Haven Flows And Bond Bears Pile Into Treasuries

As stocks collapsed, haven flows did swamp the negative structural factors, as we expected. In addition, the global macro stock bears piled into bonds as their instrument of choice to get short stocks, driving the 10-year yield down to 2.55 percent on the second trading day of the year.

Conclusion

We are beginning to suspect the global markets are experiencing an evolving epiphany that the world has a debt problem and real yields need to go higher for the Treasury market to clear. However, because of the extremely elevated level of asset prices, including stocks and housing, fundamental valuation (discounted cash flows) dictates that prices must move lower with higher interest rates.

In our “new economy” which is so dependent on asset prices — go no further than the beating Jay Powell just took — we are not so sure the bond market can clear at a much higher equilibrium real yield.

If that’s the case, then as, or if, markets grow more confident, stock bears sell their bonds, and the haven flows continue to move out of Treasuries and back into risk assets, yields should move much higher and faster than expected. Up to a tipping point level where asset markets sell-off hard again.

Too much debt has become the asset markets’ governor.

The Treasury may only be able to fully finance the shortfall in demand from natural buyers with haven flows. Ergo softer risk markets.

We could be wrong, reserve the right to be, and will change as the facts change.

Keep our alternative perspective on your radar.

* * *

Help keep the lights on at the Global Macro Monitor. Contribute any amount based on your perception of our value added by clicking here. Thank you!

via RSS http://bit.ly/2QVZRMr Tyler Durden