Authored by Jessica Rabe via DataTrekResearch.com,

“I want to buy…”

If you type those four words into Google’s search engine, it will auto populate the rest of the sentence with frequently associated completions to that query. The first two that come up: “a house” and “a timeshare”. Those have been popular searches during the current US economic recovery, showing robust interest in home ownership. To give you a comparison of this kind of attention, bitcoin topped the list back in Q1 2018 after its dramatic increase in price. Now, it’s not even included. “A car” and “stock” round out the top four currently.

Given recent concerns of potentially fewer new home sales this year after yesterday’s weak housing starts data, we also turned to Google Trends to gauge demand at this late point in the cycle. If you missed it, housing starts dropped 11.2% y/y in December, the slowest rate of construction in over two years; they are also down 10.2% y/y. For those unfamiliar, Google Trends measures search volumes for any term or phrase back to 2004. We looked at queries related to Americans’ interest in buying houses and updating their homes as those searches are reliable leading indicators of future demand.

Here’s what we found:

US Google searches for “buy a house”: reached a record in January 2019, although it is only a smidge higher than January 2017/2018. The most popular times for searches of this phrase are in the beginning of the year and over the summer.

“New bathroom” searches:record hit in April 2016, but interest right now is up 10% year-over-year. Searches here usually pop at the turn of the calendar to a new year as well.

“New kitchen” searches:peaked in December 2017 and are roughly unchanged y/y. This is also a New-Year’s favorite.

“New pool” searches: this term spikes each June. The record was in June 2016, but 2017 and 2018 got close in the same month.

“Buy refrigerator” searches:peaked in November 2017, but almost reached that level last November. Year-over-year, interest is currently down slightly by 3%.

“Buy paint” searches: peaked in July 2015. People look this up most often over the summer, but it’s down 6% y/y as of this month.

“Home Depot/Lowes” searches: peaked in May and July of 2018 and are up slightly over the last year.

“Renovation” searches:peaked in April 2016 and got close the summer of 2017. The high for interest last year in August was down 5% y/y. Searches are up 7% y/y as of this month.

Our take on these searches:

- Americans’ interest in buying houses is still at record levels, at least by Google’s measure.Millennials are driving this trend as those aged 37 and younger have accounted for the largest share of home buyers for the past several years according to the National Association of Realtors. This cohort was a drag on household formation following the Great Recession due to a weak labor market, tepid wage growth, and outsized student loan debt. More recently they’ve benefitted from years of strong economic growth and started reaching the age when they want to settle down, albeit later in life than their parents.

- The top of the current cycle for homeowner renovations and updates was likely in 2016/2017.That makes sense as it gave consumers plenty of time to save up and increase their earnings power before spending money on improvements following the Great Recession. It’s now slowed since homeowners don’t make changes too often in terms of buying durable goods or renovating rooms, but interest remains at healthy levels. That’s a positive sign given the importance of strong consumer spending for economic growth and the home improvement sector’s corporate earnings this year.

* * *

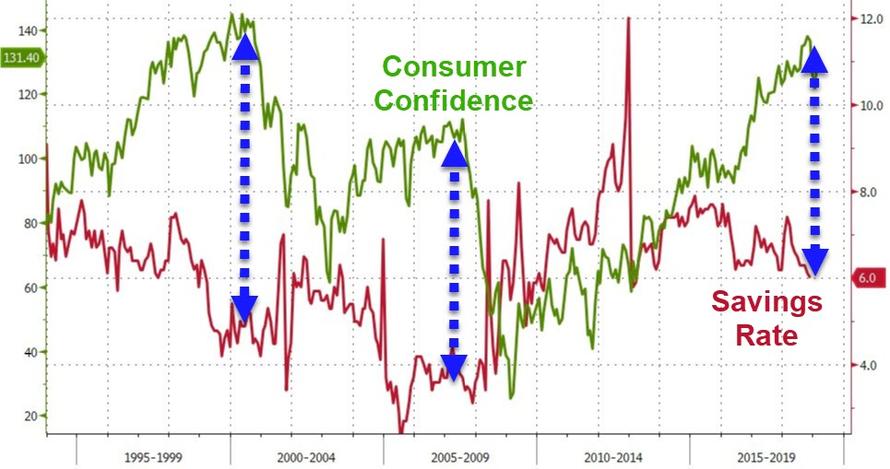

ZH: All of these still exuberant buying attitudes brought to mind a cyclical factor that appears to be peaking out just as it did in 2000 and 2007…

The yawning gap between the savings rate (low and getting lower) and consumer confidence (high and getting higher) reflects American consumers’ aptitude to borrow and spend at just the wrong time.

via ZeroHedge News https://ift.tt/2BYH6Dz Tyler Durden