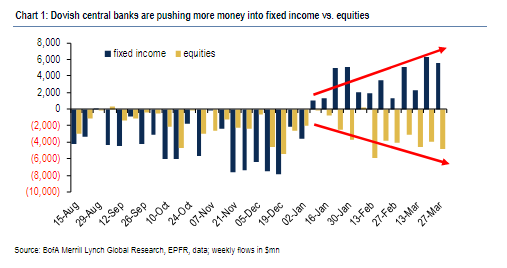

There have been two conflicting themes in the market so far in 2019: the first one has been the relentless selling by equity investors since the start of the new year despite the market’s remarkable surge in 2019, offset by buying of fixed income securities in a scramble to lock up yield ahead of potential rate cuts and/or QE by the Fed later in 2019 or in 2020 (most recently discussed here).

The second theme, which is closely tied to the first, has been the market’s so-called “jaws”, where stocks have moved sharply higher while yields have tumbled to multi-year lows, sparking investor confusion: is the bond market right in anticipating a period of acute deflation and/or recession, or is it wrong and stocks, which are less than 5% below their all-time highs, correct in their optimistic outlook.

As Goldman’s David Kostin writes, it is this decoupling that is dominating client discussions:

Ten-year US Treasury yields have plunged to 2.4%. From an investor perspective, stable equity prices coupled with falling interest rates means a wider earnings yield gap and implies a more attractive relative value for stocks assuming the economy does not fall into recession.

As Kostin recounts, one client told the chief Goldman equity strategist, that it all really “depends from which direction the jaws close – through higher rates or via lower equity prices.”

That’s the question that the bank tries to answer in its latest US Weekly Kickstart report.

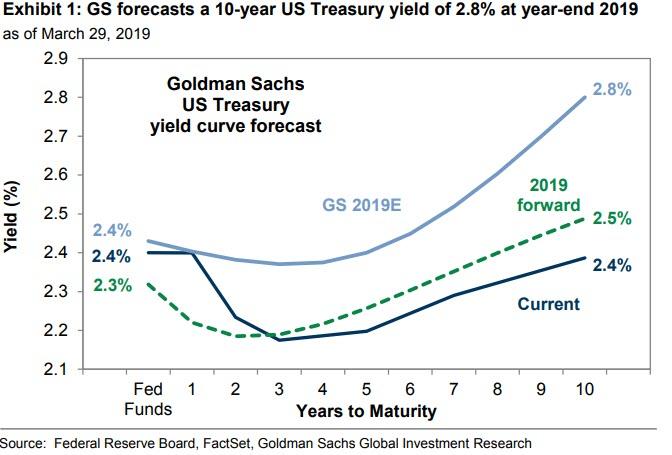

For its part, Goldman remains as usual cautiously optimistic: The bank which last December incorrectly predicted no less than 4 rate hikes in 2019, now forecasts the 10-year US Treasury yield will rise to 2.8% at year-end 2019 (down from the previous forecast of 3.0%).

As Kostin adds, the lower rate would be conducive to equity valuations remaining at or above the current elevated level of 16.8x, which is in the 79th percentile in absolute terms versus the past 30 years but at just the 29th percentile relative to interest rates.

The 90 bp plunge in the 10-year Treasury yield since last September (3.2%) and 30 bp drop since year-end (2.7%) has caused the yield gap to widen to 350 bp, which is considerably above the 40-year average (230 bp).

Kostin then falls back on the bank’s Treasury forecast as one supporting risk assets, noting that “the reduced pace of rising yields to less than 5 bp per month is encouraging for equity investors” and explaining that “historically, the S&P 500 has posted positive returns when the 10-year Treasury yield has increased by less than one standard deviation relative to the prior 36 months.”

That’s the good news – inasmuch as Goldman is correct that the drop in yields is now over and won’t accelerate further, which in turn would strongly hint that at least the bond market is confident of an imminent recession; the bad news is the ongoing deterioration in everything from the economy at the macro level, to corporate margins and earnings at the micro.

Starting with the first, Goldman notes that “economic data have been sending mixed signals” and notes that “this week, below-consensus housing starts contributed to the continued negative reading of our US MAP index of economic data surprises. Consumer Confidence disappointed at 124 vs. consensus 132.”

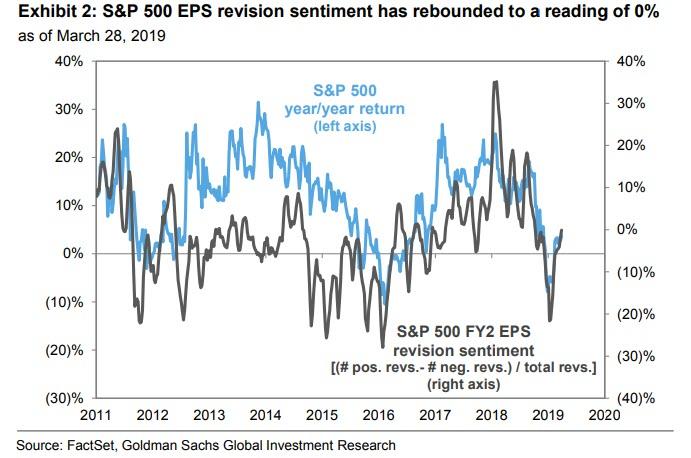

Next up is the deteriorating corporate earnings picture, with Q1 looking especially grim with the risk of a mini earnings recession on the horizon. To be sure, starting with Apple in early January, management teams have been tempering earnings expectations. In fact, more than 140 firms have reduced 2019 EPS guidance since the start of the year and 67 firms have cut guidance by more than 2%. As Goldman notes, earnings revisions have been more negative than usual. During the past three months, analysts have cut expectations for full-year 2019 S&P 500 EPS by 4%, nearly four times the usual rate of roughly 1% per quarter. On the other hand, 1-month revision sentiment has rebounded to a reading of 0%.

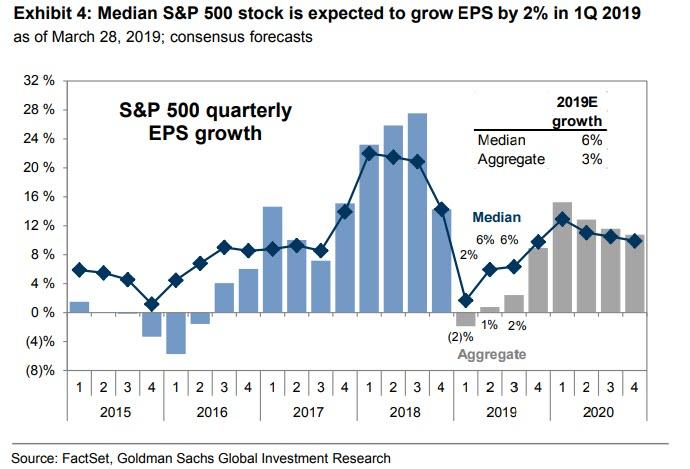

And while sellside earnings sentiment may have finally troughed, consensus now expects aggregate S&P 500 EPS to fall by 2% in 1Q, which would be the first year/year decline since 2Q 2016 even as consensus still expects strong 5% sales growth. One thing to note: while the average print will be negative, the median S&P 500 stock is expected to grow EPS by 2%, indicating that a few outsized firms (AAPL, MU, WDC, CVX, XOM, NVDA) are weighing on the aggregate measure according to Goldman. This dichotomy is also present for full-year 2019 EPS growth, with the median firm projected to grow EPS by 6% while the aggregate index grows by just 3%.

The weakness in Q2 earnings has two main causes: a sharp drop in international sales, arguably a consequence of the US-China trade war, and sliding profit margins, the result of rising labor costs and the highest wage growth since the financial crisis.

Regarding the first, Goldman observes that negative S&P 500 EPS growth in 1Q will be driven by sectors with the highest international revenue exposure: Materials (-18%), Energy (-18%), and Info Tech (-8%).

With at least 40% of revenues derived from outside the US, these sectors have been most exposed to the slowdown in global growth as our Global CAI slowed to an average of 3.2% in 1Q 2019 from 4.6% in 1Q 2018. Adding to the headwinds, the 13% year/year decline in the price of oil will weigh on Energy EPS. Previously, we highlighted the reduced price of oil as a potential risk to our 2019E S&P 500 EPS forecast of $173 (+6% vs. 2018), with potential downside of $5 to $168 (+3%).

As for shrinking margins, Goldman cautions that EBIT margins are expected to compress by 112 bp in 1Q 2019, the largest quarterly contraction since 4Q 2014, and adds that margin pressure will be felt in every sector except Consumer Staples, which is benefiting from the reclassification of lower-margin CVS into Health Care. Excluding this reclassification, Consumer Staples EBIT

margin would be flat (-2 bp) and Health Care would experience an even further reduction (-217 bp).

This is a major problem because in addition to a modest increase in the effective tax rate in 2019 to 21% from 19% in 2018, this decline in EBIT margins would contribute to the largest expected decline in S&P 500 net margins since the Financial Crisis. To be sure, executives have cautioned investors on margins as they reported 4Q 2018 earnings, citing both trade tensions with China and the continued tightening of the labor market as factors contributing to margin uncertainty in 2019.

And while despite the adversity of sliding margins and profits amid a global economic slowdown is not enough to dent Goldman’s optimis, with the bank issuing its reco du jour, and pointing out that as margin pressures mount, “investors should focus on companies that have demonstrated the ability to maintain margins through pricing power” one other bank is not so sure.

In his latest take on how much market complacency is now built into the market, JPMorgan’s Nikolaos Panigirtzoglou goes back to the question of the market “jaws” and comes out with a far less sanguine conclusion. Noting that the strong rally in equity, credit and commodity markets over the past quarter “has significantly reduced their cushion against growth downside risks”, the JPM strategist concludes that “there appears to be a disconnect between rate and risky markets at the moment with rate markets signaling more elevated growth and recessions risks, and equity, credit and commodity markets pricing in more optimistic scenarios.”

Finally, here is why the question of which was the market’s “alligator jaws” close that is keeping Goldman clients up at night, is so critical – according to JPMorgan calculations…

- US equity markets appear to be currently pricing in only 15% chance of a typical US recession and discount only 3% decline in earnings.

- In contrast, the 85bp fall in 5-year US Treasury yields from their early November peak points to 80% chance of a US recession.

In other words, stocks are pricing in smooth sailing while bonds are now certain a recession is coming. And while historically bonds have always been right in the end, this time equities have the explicit backstop of the Fed. So will 23-year-old momo traders and Jerome Powell be smarter than the “smartest traders in the room”, and will yields jump in the next few weeks? The answer may reveal itself as soon as mid to late April when the bulk of companies will report Q1 earnings and share their outlook for the rest of the year, which if it is anything like the start of 2019, would quickly cripple the growing stock market optimism.

via ZeroHedge News https://ift.tt/2FF9Ke4 Tyler Durden