Unlike the chaotic, disorderly Q4 market selloff which saw the worst performance by professional investors since the financial crisis, there was an almost resigned acceptance to the sharp drop in stocks in the days after Trump reignited the trade war a little over a week ago. There may be a simple reason for that: while it has been duly noted that for much of 2019 investors had refused to rush into risk assets, over the weekend JPM estimated that both institutional and retail investors were as long stocks as they were ahead of the Q4 bear market crash. However, there is one difference – unlike six months ago, this time investors were hedged.

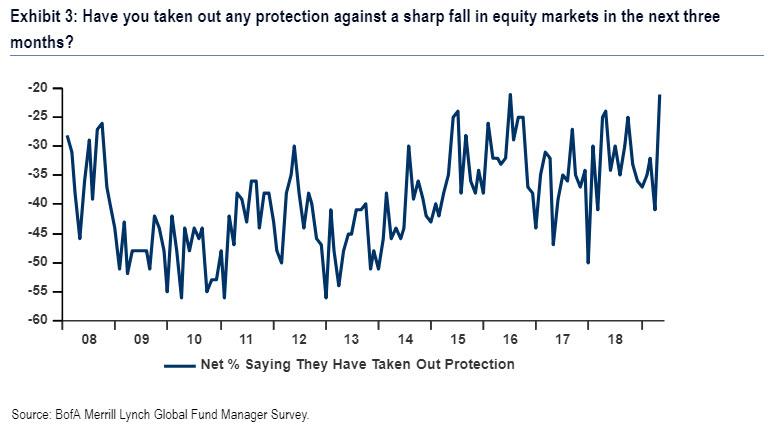

According to the latest Bank of America Fund Manager Survey which took place in the May 3-9 period, and which polled 250 panelists who manage $687BN in AUM, a record 34% of investors said they have taken out protection against a sharp fall in equity markets over the next three months, the highest level ever on an absolute and net basis (net -21% say they have taken out protection).

Yet while skeptical investors are only dipping their toe in a rally they don’t trust, only thanks to record downside hedges, BofA’s CIO Michael Hartnett notes that while investors are well-hedged, they are not positioned for a trade deal breakdown, and the full “risk-off.” Meanwhile, the BofA strategist sees rising recession risks, Fed cuts, GT10 <2%, SPX <2600, CNY >7 among the possible market and policy responses.

Furthermore, as predicted two days ago when we noted that while trade war was the #1 “tail risk” over past year, said “fear” peaked in July’18, and we said we “expect this to quickly change when the latest Fund Manager Survey is released”, and sure enough, in the latest FMS, the #1 tail risk is once again “trade war”, only with far more enthusiasm: +29 points. According to BofA, this was the “biggest MoM jump in Trade War (+17ppt) as top “tail risk” since June to July 2018 (+29ppt); now topped the charts for 11 of past 12 survey” but still concerns about trade war risks remain well below the peak of 60% in Jul’18. Give it a few more months.

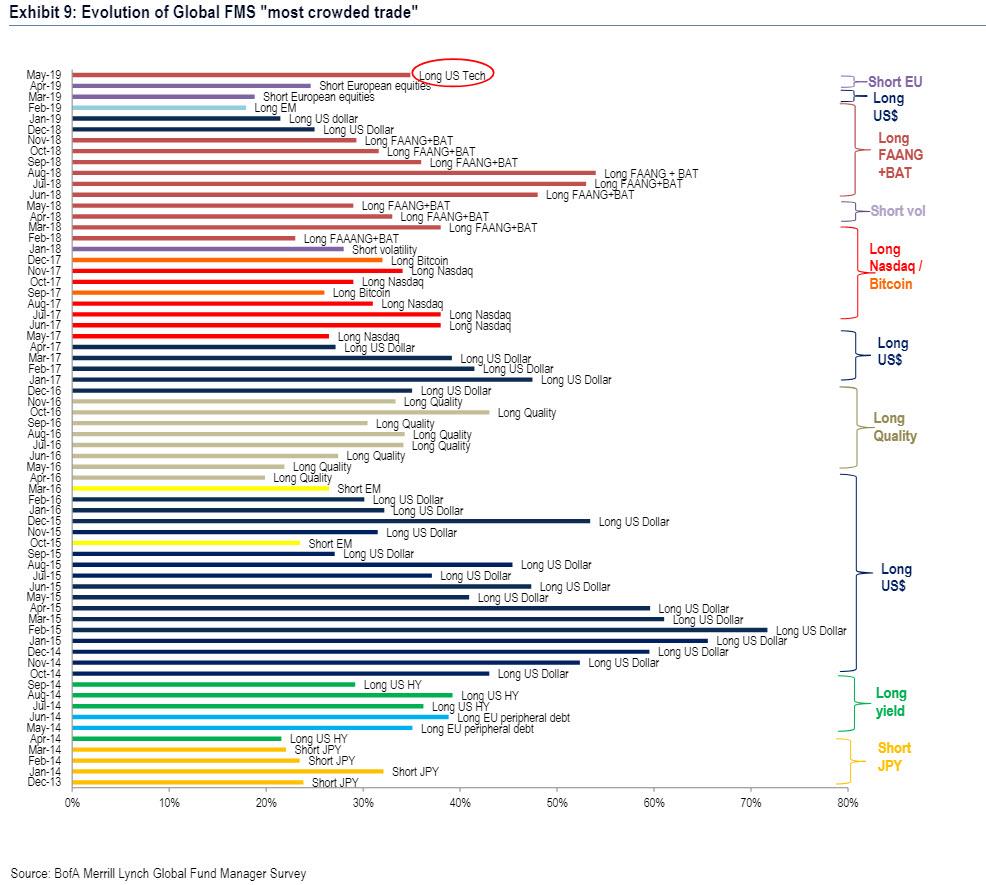

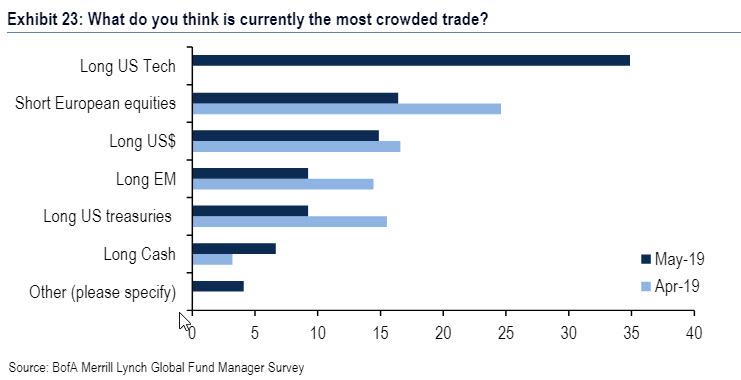

Looking at that other, just as notable indicator from the monthly survey, namely what investors thinks are the “most crowded trades”…

… the response in May was #1 “long US tech”, #2 “short EU stocks”, #3 “long US$”…

… and sure enough, SOX -12%, FAANG -10%, EUR unch, Bitcoin $5k to $8k past 2 weeks.

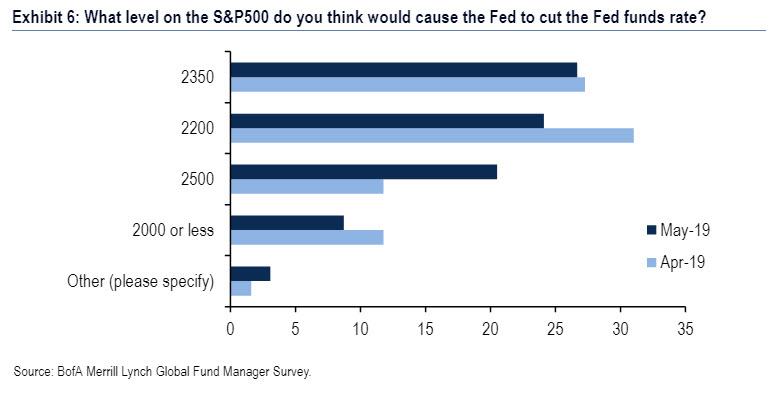

Another interesting question was where do most professional investors expect the Fed to cut rates: the answer 2305 on the S&P 500 according to the average response.

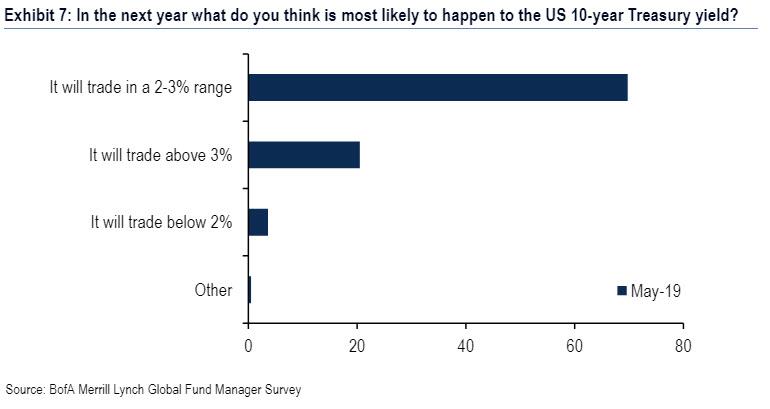

And yet, only 4% of investors believe US 10-year Treasury yield drops <2% over the next 12 months (vs. 70% say 2-3% range, 21% say >3%); meaning that very few investors are positioned for even lower rates.

When asked what they would rather see corporations do with funding, investor interest in corporate deleveraging was near a record high of 46% vs. just 12% who want buybacks and 34% desire capex; Of course, in a market where buybacks are the only source of margin stock demand, the risk is that corporate deleveraging becomes self-fulfilling…. Or as Hartnett notes, credit spreads remain the best recession “tell”.

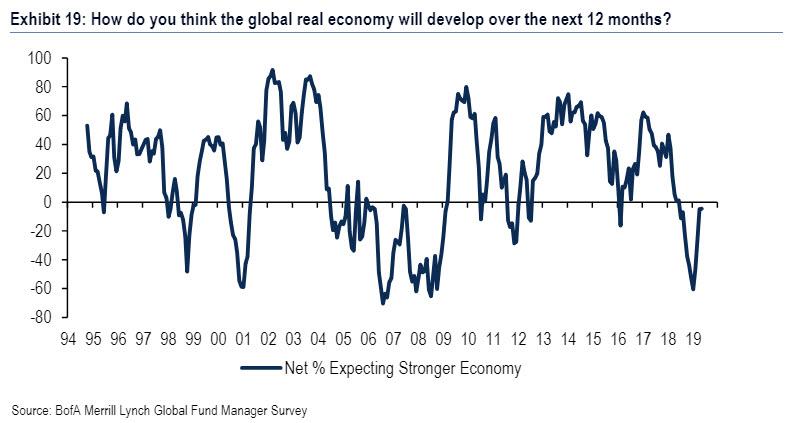

Looking at the broader economy, global growth expectations hold flat with 5% of FMS investors expecting growth to weaken over the next 12 months, well above recent low of 60% in Jan’19 (consistent with 2000/01 & 2008/09 recession levels).

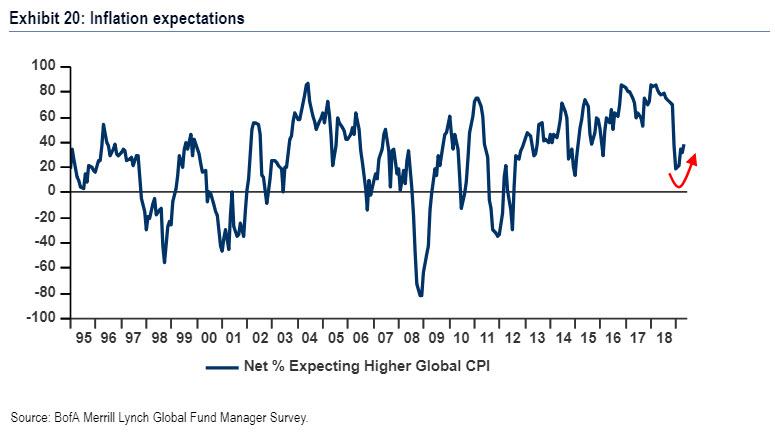

With fewer investors expecting growth contraction, it was perhaps to be expected that inflation expectations continued to rise, up 6% MoM to 38% expecting higher global CPI next 12 months… but still well below 70% in Nov’18.

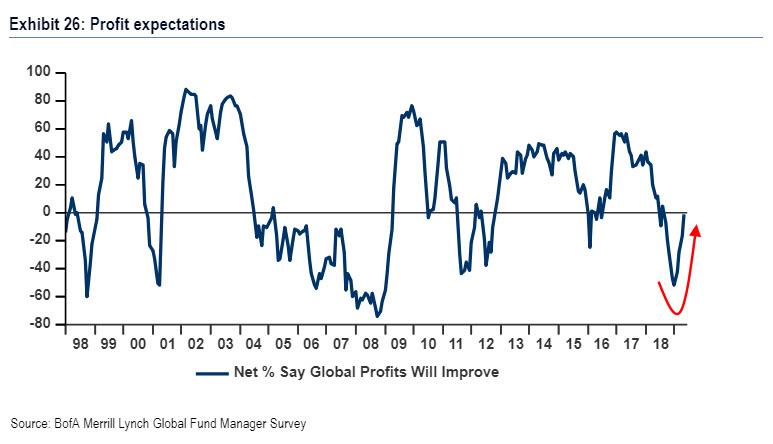

At the same time, global profit expectations continue to rebound, rising 15ppt to just 1% saying they will deteriorate in the next 12 months, a 9-month high; note Jan’19 low of 52% expecting deteriorating profits as worst outlook since Dec’08.

What does this mean for stocks? According to Hartnett, investors are currently longs US stocks, EM, discretionary, tech, banks, and all are threatened if key technical levels cannot hold this week (e.g. SPX 2775 & IG CDX 70); As BofA also notes, EPFR flow data shows Friday largest day of EM equity redemptions since Jun’18.

Finally, putting it all together, Hartnett writes that “no trade deal means post-FMS investor mood has soured significantly (incoming all on HK peg breaking, bank CDS, retest Dec lows…);” Yet with the BofAML Bull & Bear Indicator at 5.1 means that “Investors see little reason to ‘buy in May’ unless the 3Cs – credit, the consumer, and China – quickly surprise to the upside.”

via ZeroHedge News http://bit.ly/2EbyDOp Tyler Durden