Authored by Sven Henrich via NorthmanTrader.com,

Did the US just lose the trade war? It seems like a ludicrous question to ask at this time as the US just raised tariffs on China to increase pressure on the negotiation process. The accepted conventional wisdom is that the US has the stronger hand to play as China would suffer more from tariffs than the US. That sounds good on paper, but is that really true in a three dimensional world with moving parts and conflicting timelines?

In many a fight match up the audience can get a sense of shift in momentum during a fight and as this trade war just shifted gears I can’t help but wonder if the momentum has shifted in China’s favor.

Let’s start with the reason for the sudden tariffs. Those came about because the US side was surprised, surprised by China’s apparent withdrawal from previous commitments. At least that’s the public narrative that is spun. Unless you’re in the negotiation yourself it’s hard to know. Fact is Trump, Kudlow and team led the world believe that a trade deal was imminent. It wasn’t. This move to escalate was not planned, it happened because team Trump realized they couldn’t get the deal they wanted or expected.

Being surprised and being forced to be reactive to escalate does not indicate a position of strength, but rather a position of weakness. And by reacting with tariffs Team Trump may have actually weakened their own position. Why? Because of inflation, time, and pain.

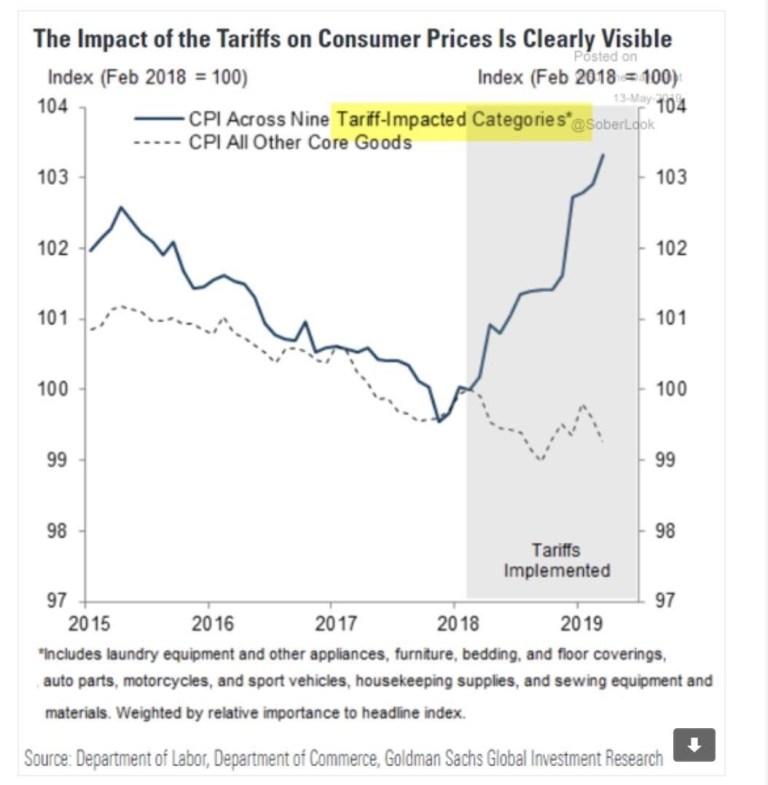

Let’s start with inflation: Despite Donald Trump’s repeated claims that China will pay the tariffs it simply is not so. US businesses and consumers are paying for tariffs which causes consumer inflation on the one hand and margin compression on the other, and perhaps a mix of both depending on what can be passed on.

But conceptually it’s literally shooting yourself in the foot.

Rhetoric:

There is no reason for the U.S. Consumer to pay the Tariffs, which take effect on China today. This has been proven recently when only 4 points were paid by the U.S., 21 points by China because China subsidizes product to such a large degree. Also, the Tariffs can be…..

— Donald J. Trump (@realDonaldTrump) May 13, 2019

Reality via Goldman Sachs:

Consumers are already paying for the tariffs and soon a lot more.

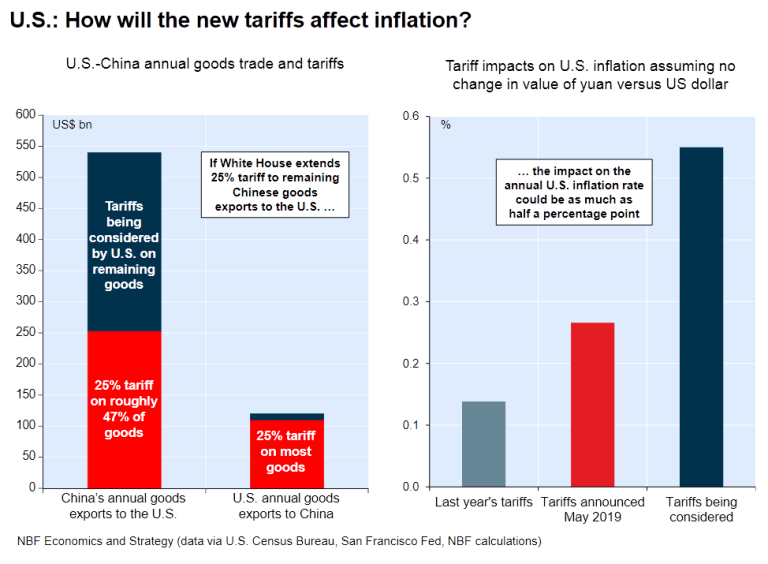

With new tariffs in effect the impact will broaden out:

The Fed’s going to cut rates (as Trump’s demands) if inflation suddenly jumps by 0.5% per the scenario above? Not going to happen.Indeed in this scenario the Fed may be forced to raise rates. Bull market over. Recession coming. What a mess.

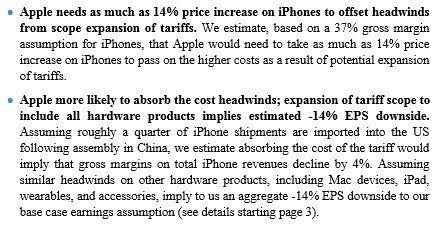

Think the numbers are outlandish? Consider the math $AAPL is now confronted with. According to JPM Apple needs as much as a 14% price increase on iPhones to offset headwinds from scope expansion of tariffs or eat it with margin compression:

No, the damage from tariffs will be measurable and real and it’s not a long term winning formula which brings me to the second consideration: Time.

Someone will blink and I suspect it will be the US side. Why? Because for Trump there’s an election to worry about. The Chinese don’t have an election to worry about and that puts the time pressure on Trump, not the Chinese. The Chinese will continue to intervene and yesterday they showed backbone and followed through on retaliation. But because the US election cycle clock is ticking Donald Trump cannot afford a trade war extending into the end of the year, especially if the consequences of such a protracted trade war would spill into the larger economy.

A protracted trade war and associated loss of confidence has not been accounted for in earnings estimates.

Which brings me to the third issue: How much pain is Donald Trump willing to take with a falling stock market that he views as his measure of success. Judging from the daily jawboning: Not very much. Overnight futures jumped as Trump started the optimism train again for a late June G20 meeting and even this morning he’s out with repetitive tweet storms regarding China desperately trying to project strength:

China will be pumping money into their system and probably reducing interest rates, as always, in order to make up for the business they are, and will be, losing. If the Federal Reserve ever did a “match,” it would be game over, we win! In any event, China wants a deal!

— Donald J. Trump (@realDonaldTrump) May 14, 2019

If only the Fed would cut rates we would win. Way to go to set the Fed to be the fall guy if things go bad. It’s the Fed’s fault if we lose the trade war with China. Of course, nothing is ever Trump’s fault. It’s the world that’s evil and Trump’s trying real hard to be the shepherd:

No, the frequency of tweets and erratic nature of the tweets as Jim Cramer called themthis morning suggest Trump finds himself under sudden pressure given the big market thumping yesterday.

Again I ask: Why would the Chinese agree to a deal they view as disadvantageous? They’re not running against the clock here, Trump is. He may still have a few months, but delays of several months will bring about economic and financial market consequences the president can ill afford politically. And the Chinese know this.

Trade wars end when one or both parties are forced to cave on positions. That’s not happening yet and won’t happen with US stock prices only 5% off of the all time highs. And now with the latest bout the parties are being forced into corners. Neither can politically afford to look to cave to pressure and that sets the stage for a protracted trade war, one that the US may now look to lose. Why? Because Trump won’t get the deal he thought he’d get just a week ago. Instead he was goaded into raising tariffs and is now hurting US business and consumers in the process.

The upshot in all this: If the US caves sooner rather than later the price may be confined to the political, and result in a major relief rally, especially if tariffs are removed. What the specifics of any trade deal then are may not matter in the immediate aftermath. I’m sure Mr. Trump will present himself to be winner even if he got knocked out in the second round. After all, it’s the Fed’s fault.

But no trade deal and ongoing tariffs into the rest of the year? I think it’s fair to say markets have not priced that scenario in. Best hope somebody caves.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/30lotnK Tyler Durden