For the first time since March, WTI Crude is back below $60 as fears over demand (trade tensions) and supply (inventory glut) overwhelm any Mid-East geopolitical risk, and is helped by extreme positioning.

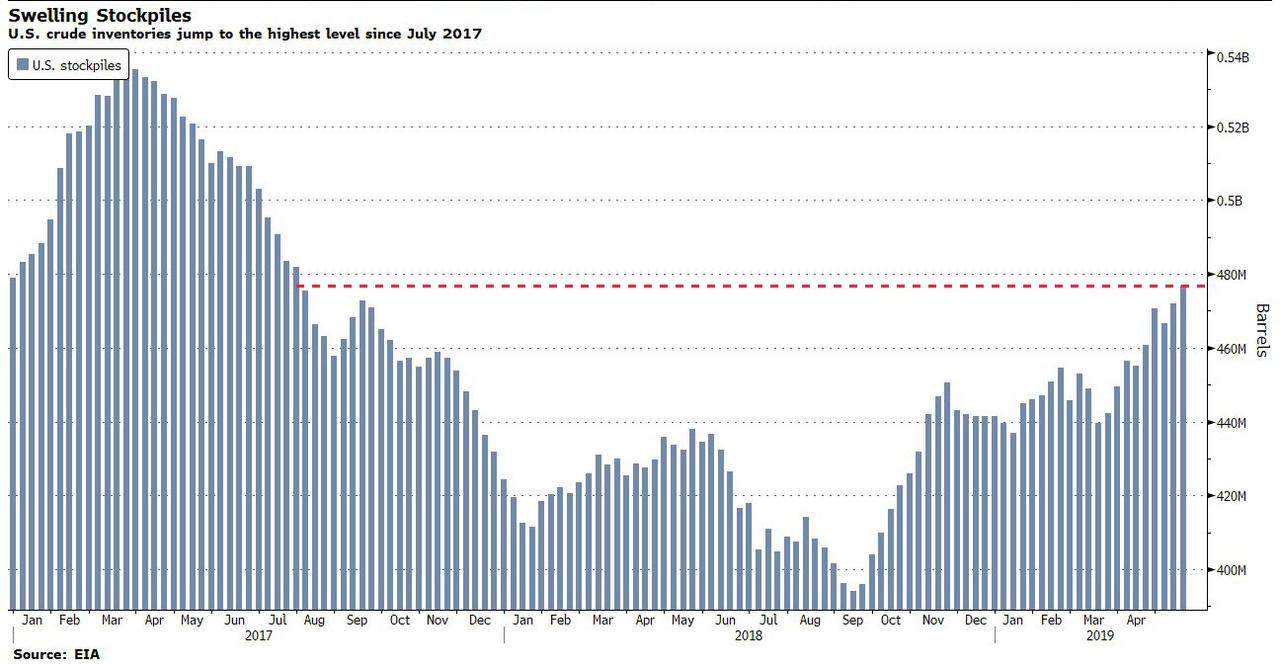

US crude stockpiles rose by 4.7 million barrels last week to the highest level since mid-2017, despite expectations for a decline, while fuel inventories also climbed.

Additionally the recent spike in US-China trade tensions have stymied hope for a renaissance in global growth (and thus oil demand) to soak up these inventories.

Add to that the fact that speculators were extremely long positioning ahead of this drop, and WTI prices are plunging…

Oil is on course for its first monthly loss this year.

“Neither renewed Middle East tensions nor the possibility of extending OPEC+ output cuts has managed to bump crude oil from its tight range,” said Ole Sloth Hansen, head of commodity strategy at Saxo Bank A/S in Copenhagen.

“Worries about the impact of the trade war on global economic growth as well as a stubbornly strong dollar” are capping prices.

via ZeroHedge News http://bit.ly/2YKBk1o Tyler Durden