Chinese, European, and US Small caps all lost ground on the week… could be worse though, you could be a bond or bund-holder…

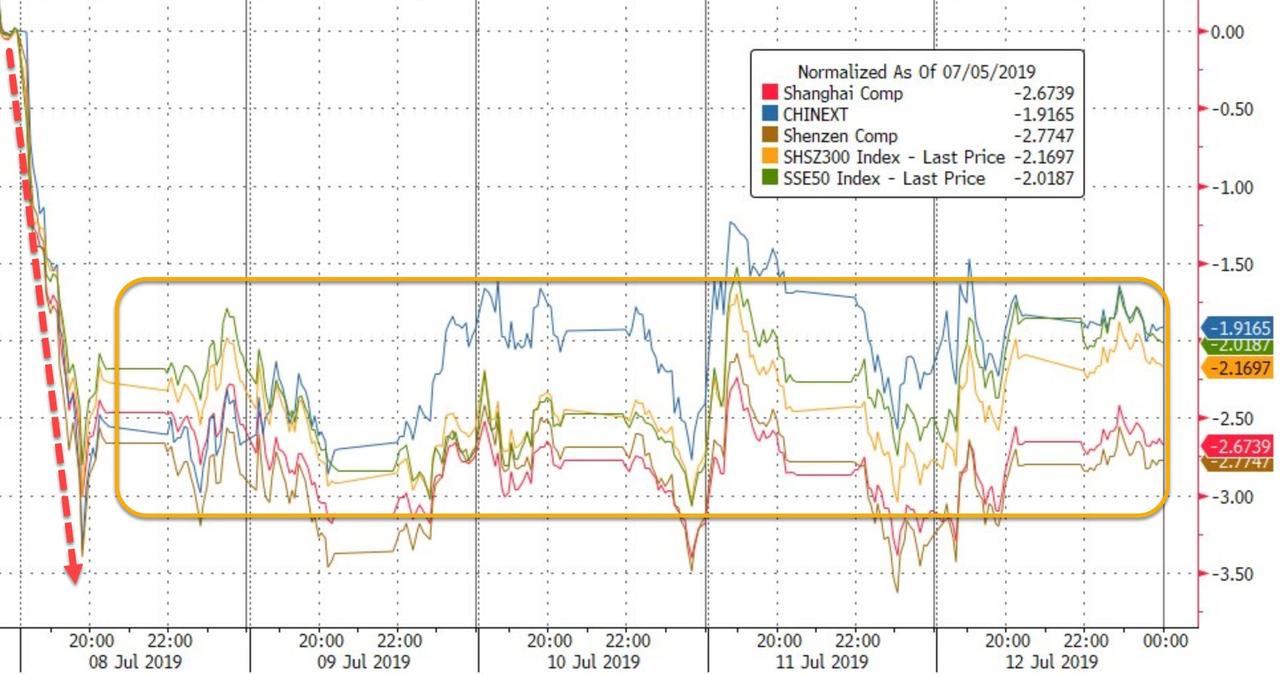

Chinese stocks ended the week lower but the losses were all on Monday…

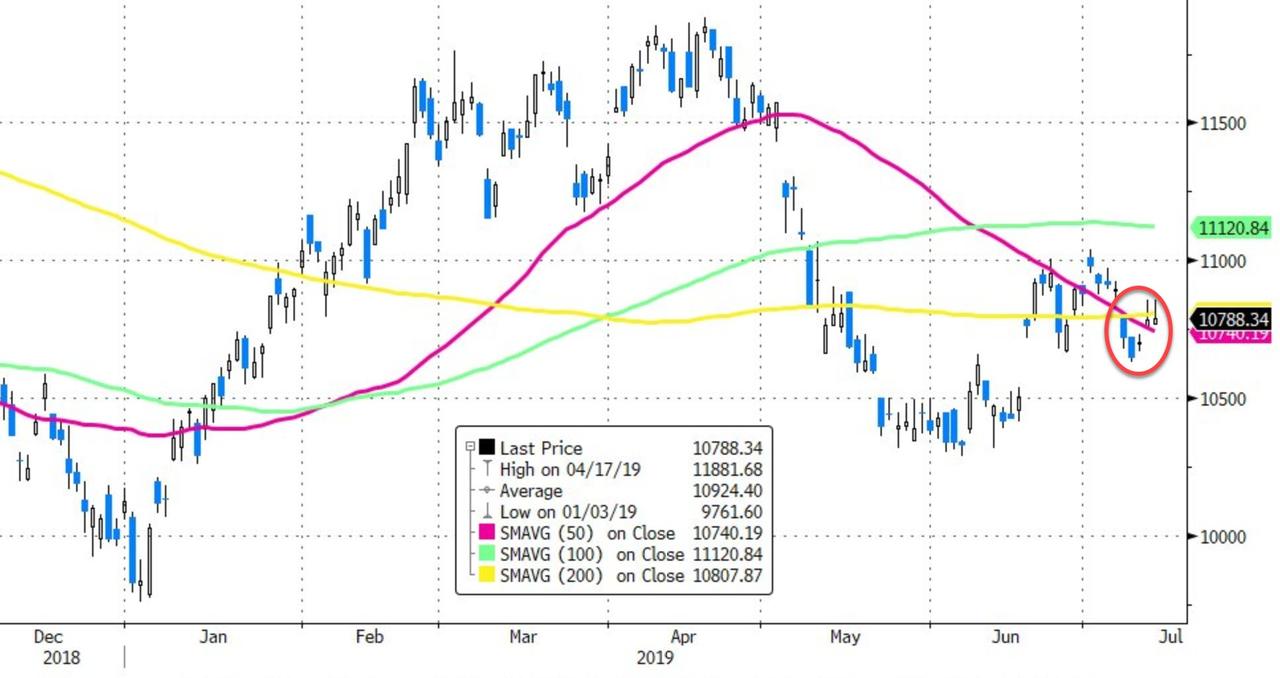

Hang Seng’s China index tumbled into a death-cross…

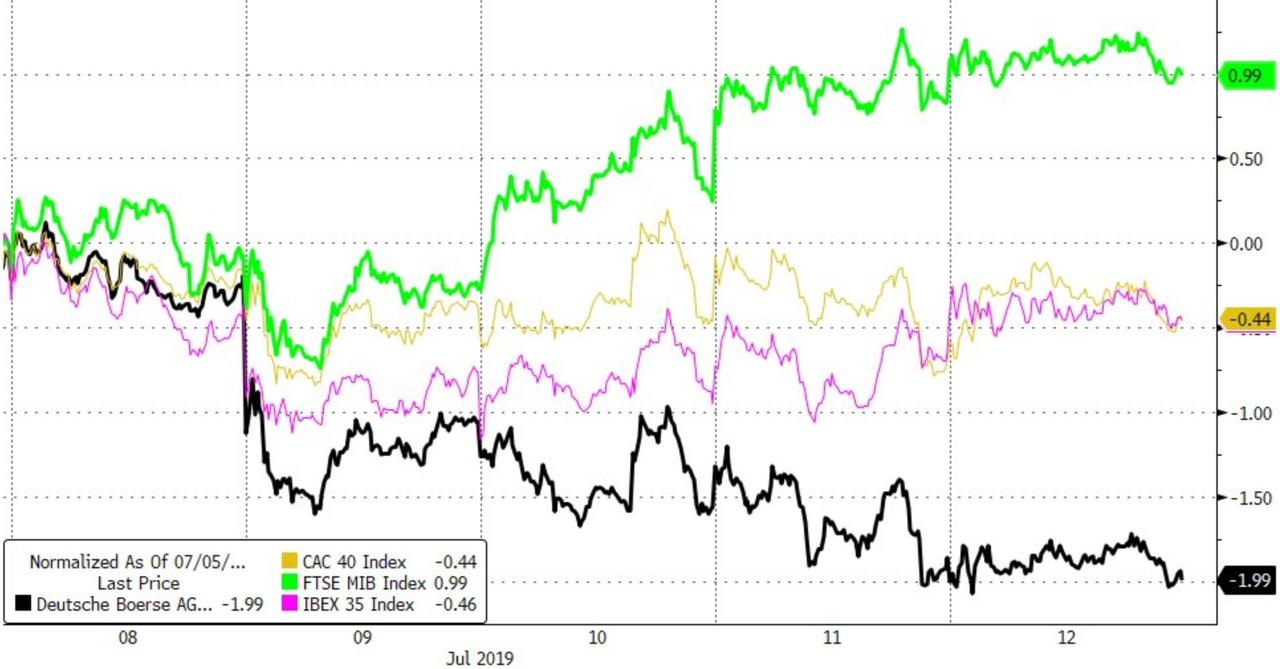

Only Italy managed gains on the week in Europe with Germany’s DAX tumbling…

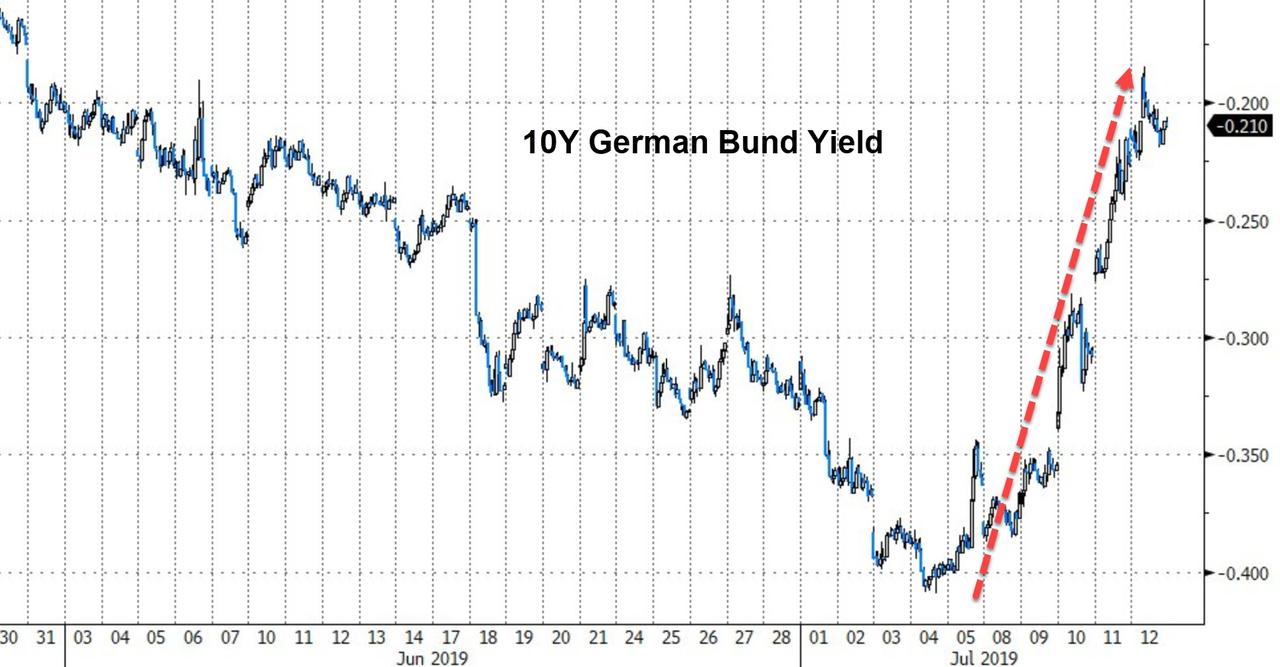

And while German stocks tumbled, German bunds collapsed (worst yielding spike since June 2017)…

Even Small Caps ramped into the green for the week today, but ended red. The Dow and Nasdaq led the week though…

The Dow, Nasdaq, and S&P all closing at the high of the day and at record highs…

Not a meltup…

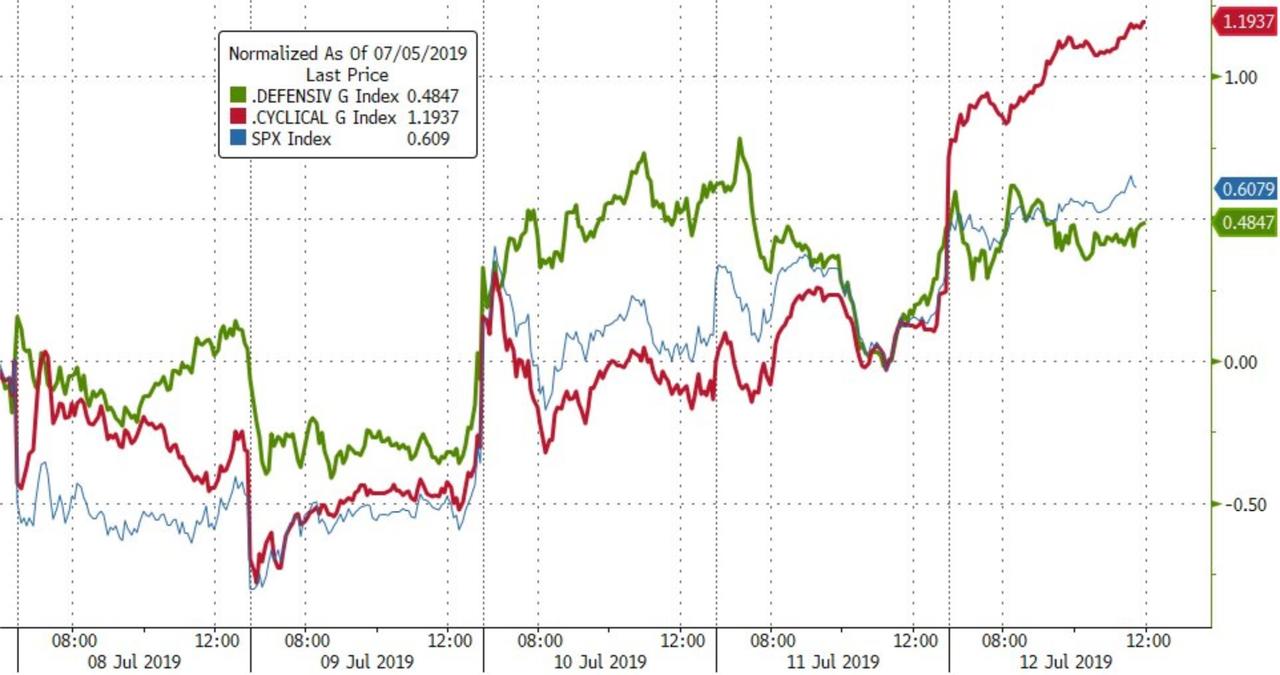

Cyclical stocks melted up today, outperforming defensives that had dominated the week until then…

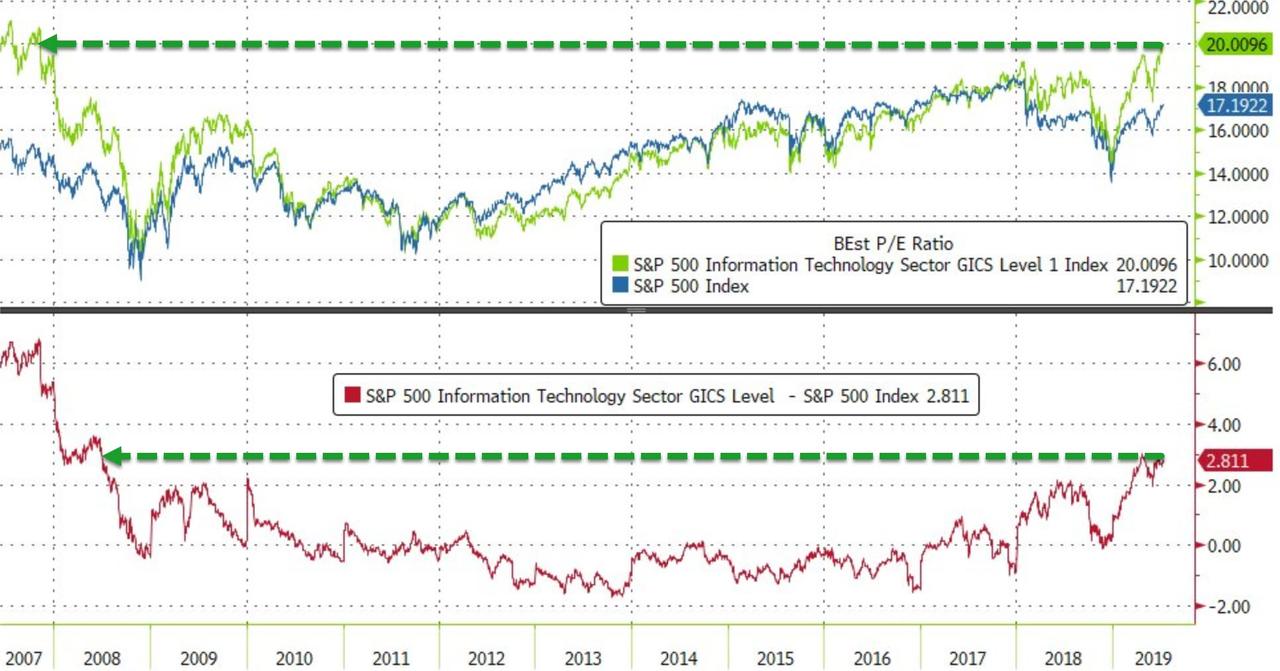

S&P Tech Sector topped 20x Fwd P/E today – its highest since Nov 2007…

JNJ tumbled on DoJ criminal probe headlines..

For the first time in 7 weeks, the aggregate return from holding the long-bond and the S&P was negative…

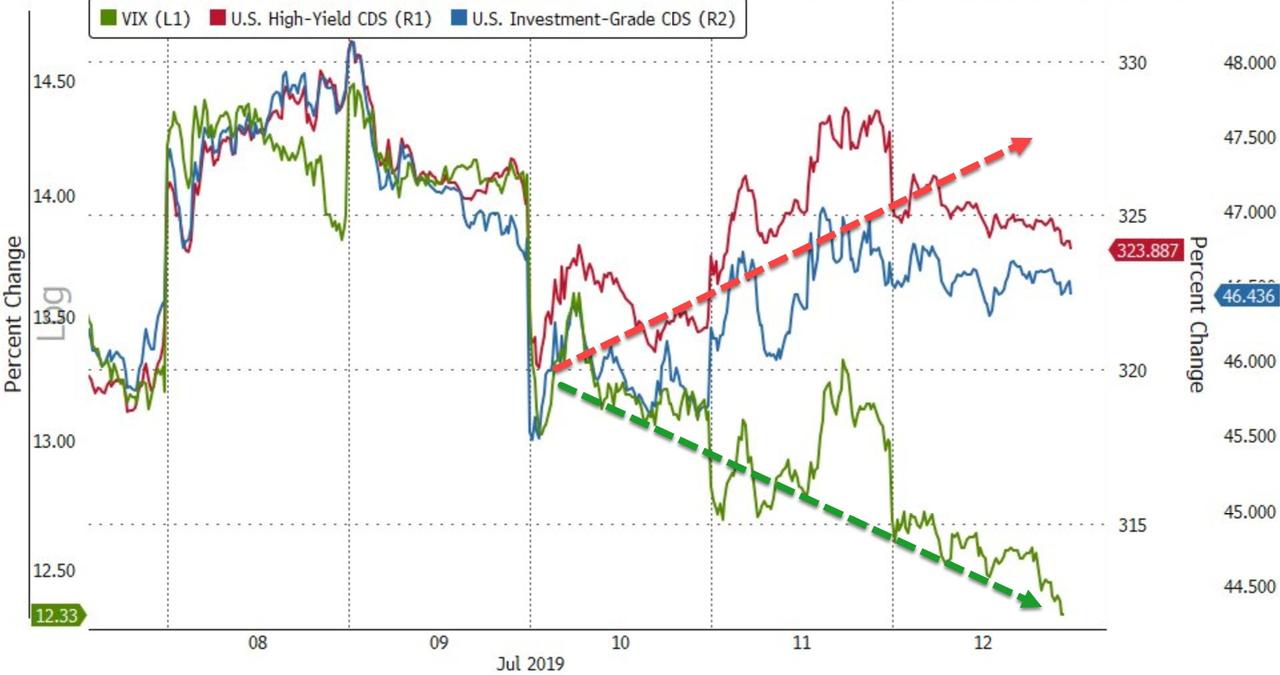

Credit and equity protection costs diverged notably the last few days as VIX collapsed to a 12 handle and credit spreads widened…

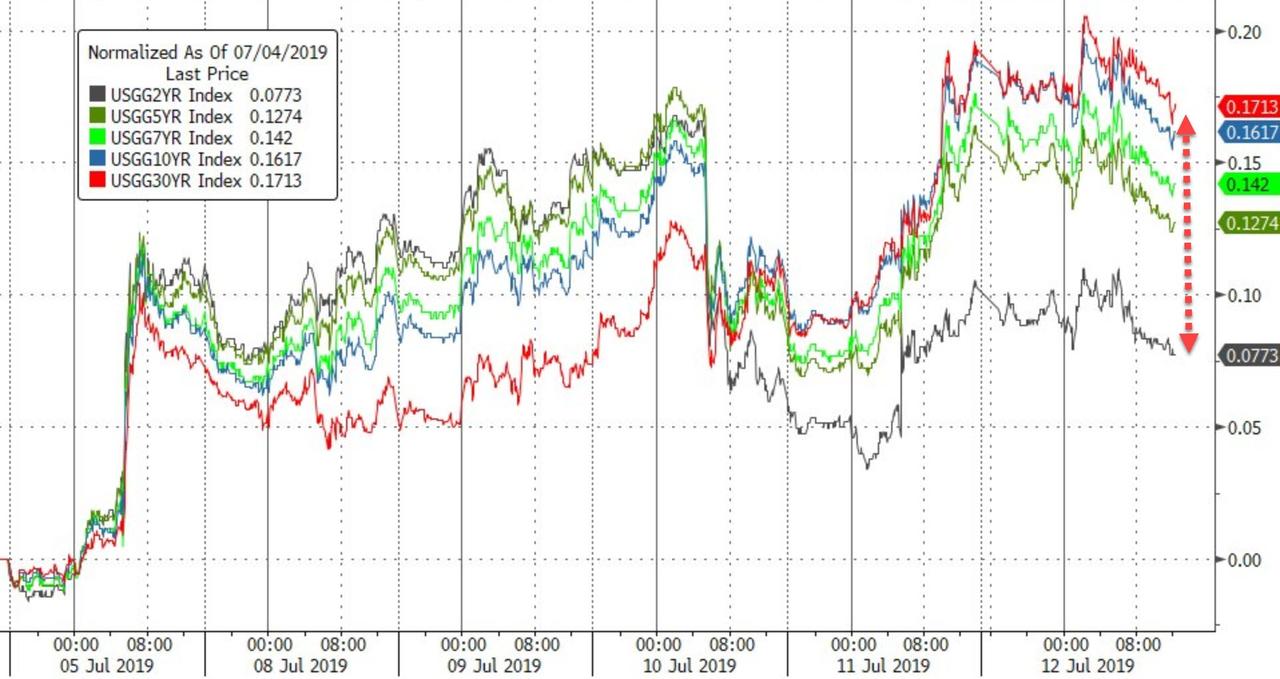

Treasury yields exploded higher this week (except 2Y) and including the Friday spike from payrolls, 30Y is up almost 18bps…

With 30Y spiking up to 7-week highs…

The yield curve steepened dramatically this week…

But we note that each time the 3m10Y curve tried to get back above zero (un-invert), it failed…

The dollar is down 3 days in a row to end the week (post-Powell) after surging post-Payrolls…

Meanwhile, FX vols have collapsed. USDJPY im;lied vol is at a record low…

So much for surging economic policy uncertainty

Cryptos were mixed this week with Bitcoin gaining over 5% and the rest of the larger alt-coins losing ground… (but rallying on the day after Trump’s comments)

Big gains for commodities this week with oil prices up large and silver very modestly outperforming gold…

WTI ended the week back above $60 but hit a wall of resistance at the longer term downtrend…

Gold held above $1400 on the week but has gone nowhere for almost a month…

Finally, we offer the following from BofA:

“…we anticipate an “overshoot” in credit & equity prices in coming months, followed by an overshoot in gold (US$ devaluation) before big H2 top in asset prices (as bond bubble pops & policy impotence visible).”

And then?

via ZeroHedge News https://ift.tt/2XN6uEa Tyler Durden