Authored by Sven Henrich via NorthmanTrader.com,

Markets are engaged in a clear battle for control: An active Fed eager to extend the business cycle using asset price inflation as its primary means to generate further debt financed growth on the one hand and deteriorating fundamentals and technicals gnawing at an artificial market construct on the other.

Let’s call a spade a spade: Markets would not be anywhere near new highs were it not for a Fed flip flopping and racing from dovish media event to dovish media event. I’ve been very vocal in my criticisms of their efforts and sense they are playing a dangerous gamehere. Hence I don’t want to belabor the point here today. But as a follow up: Friday’s desperate efforts on the side of the Fed to backtrack market expectations for a 50bp rate cut at the coming July meeting, which they themselves caused on Thursday with multiple Fed speakers, has revealed again the Fed’s singular role it has to devolved into: The market’s primary price discovery mechanism. As markets dropped below $SPX 3,000 this week dovish Fed speakers caused a renewed rally above 3,000 and as soon as they tried to walk it back with a conspicuous WSJ Journal article on Friday markets again soon rolled over.

That’s the circus atmosphere they have created and appear to be supportive of. The Fed is very aware of its role in all of this and it’s shameful. Like Alan Greenspan or not, but at least he was a cryptic speaker that left markets guessing and played his cards close to the vest. But over the years the Fed has devolved itself into this clown show we have now, a day to day manager of markets. And markets have learned to react to every single pronouncement and utterance.

Just stop:

Free advice to the @federalreserve:

Stop talking.

Just stop.— Sven Henrich (@NorthmanTrader) July 18, 2019

Seriously, just stop. It’s embarrassing and it’s not your charter to manage markets. Nobody elected you to do that. Well, then nobody elected you in the first place. You’re appointed. By politicians. And now we have politicians that overtly want to dictate policy to the Fed. A toxic mix as the Fed’s independence is risking utter bankruptcy and is already lost in the eyes of many.

But as with cheap money, once you go down that road of daily massaging markets it’s hard to extract yourself from that mess. Now markets expect daily soothing and when they don’t get it they react, as did futures Friday following close when Rosengren uttered slightly less dovish words. “I think we should wait”.

Yes, this is what our markets have devolved into. A giant Fed gaming operation and it’s safe to say that the entire month price action will be greatly influenced by what the Fed does on July 31, the last day of the month.

But by setting expectations they have cornered themselves into a position where they constantly need to feed the appetite of the beast they themselves have created: A Fed dependent market that needs and wants more stimulus.

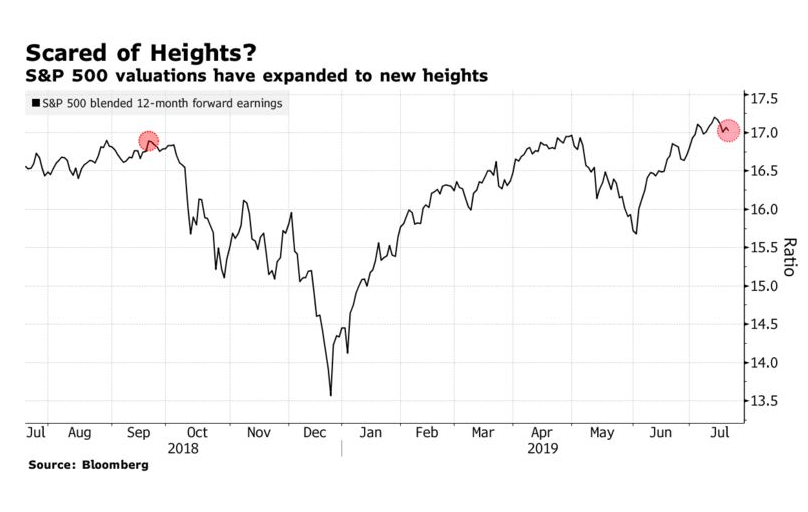

And now here we are, at some of the highest valuations:

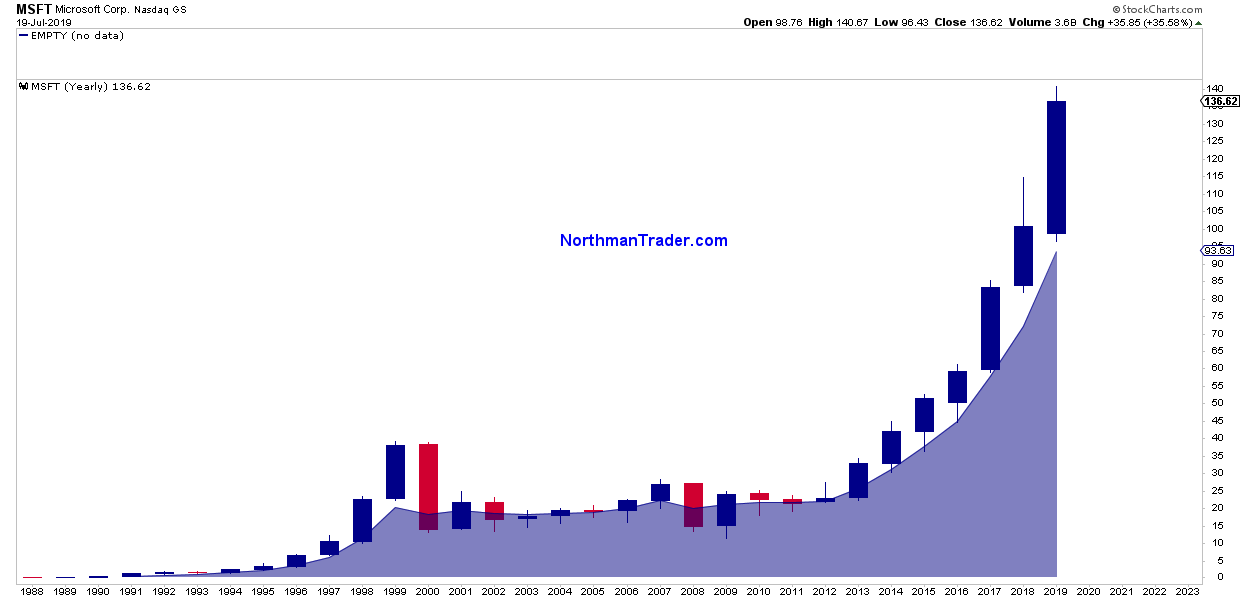

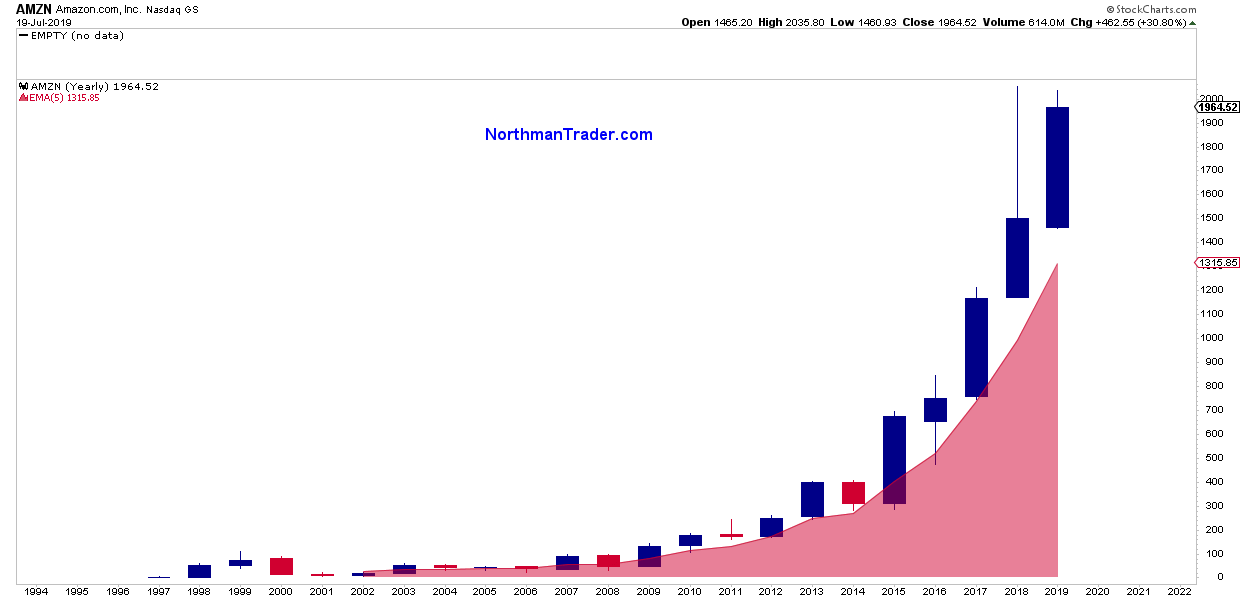

With come key stocks massively technically extended (see also: To the stars):

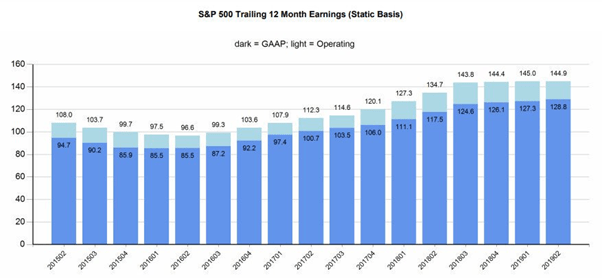

Yet earnings growth having ground to a halt:

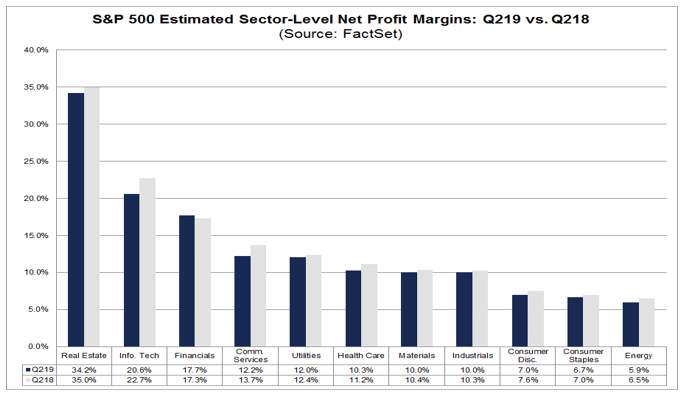

While profit margins have started shrinking:

Not the recipe for multiple expansion. But nevertheless here we are near all time highs once again, thanks to the Fed’s, so far, successful efforts.

But this is where the technicals come in and they put a at least temporary red line in the bull sand.

I am probably one of the few out there that has outlined the potential for a larger sell case on equities at this stage. The vast majority of analysts are looking for a massive expansion in prices primarily due to the Fed. From what I’ve seen earnings growth is really no longer part of the calculus. Easy money is. Fine. It may happen, I can’t deny that possibility and I’ve outlined in my weekly briefs when the sell case would be void.

And let’s be clear: Putting out technical setups in public is not an easy task. Especially on the sell side. Technical setups are about risk/reward and they are not guaranteed, they can be invalidated and if they don’t work out one gets hammered with ridicule and hate. And I’ve been wrong before. But I’ve also been right plenty of time.

Last year it was Lying Highs, a sell call which culminated in a 20% sell-off. But the call came out in September and markets didn’t top until early October. Sells are processes, bottoms are events. Like the one in December. I talked about Imbalance on December 23rd and called for a major technical rally into MA reconnects, worked nicely. Did I expect new highs on deteriorating fundamentals? No, but then this is where the Fed comes in, jawboning things higher. Yet again Lying Highs II informed us of another sell set-up coming and indeed we saw a larger sell-off into May before the Fed once again came to the rescue at the beginning of June.

No, sell calls are much harder than buy calls. After all you have an entire market machine designed to levitate asset prices higher and most people are bullish all the time, so a sell call is what the majority doesn’t want to hear. Indeed you can even make a great technical sell call, be right and still get hate, as I saw with Boeing when I called for a sell at $441. It dropped 6% in the week after the call, but then the plane crash happened and I got accused of taking joy in people dying. What nonsense, but still there it is. The stock was massively technically extended and the fundamentals took over (for the worst reason) and the stock plummeted 25% from the sell call. But it wasn’t the crash that was the problem, it was the underpinning design flaws that were the trigger and the technicals said that the long side was dangerous. And it was.

In some cases technicals are cleaner, like Gold when we called for a big rally when Gold was trading at 1270 in May, it hit 1450 on Friday a 14% rally from that bullish call.

I’m pointing all these things out to highlight how complex sell calls are, yet technicals matter and they mattered again big time this week.

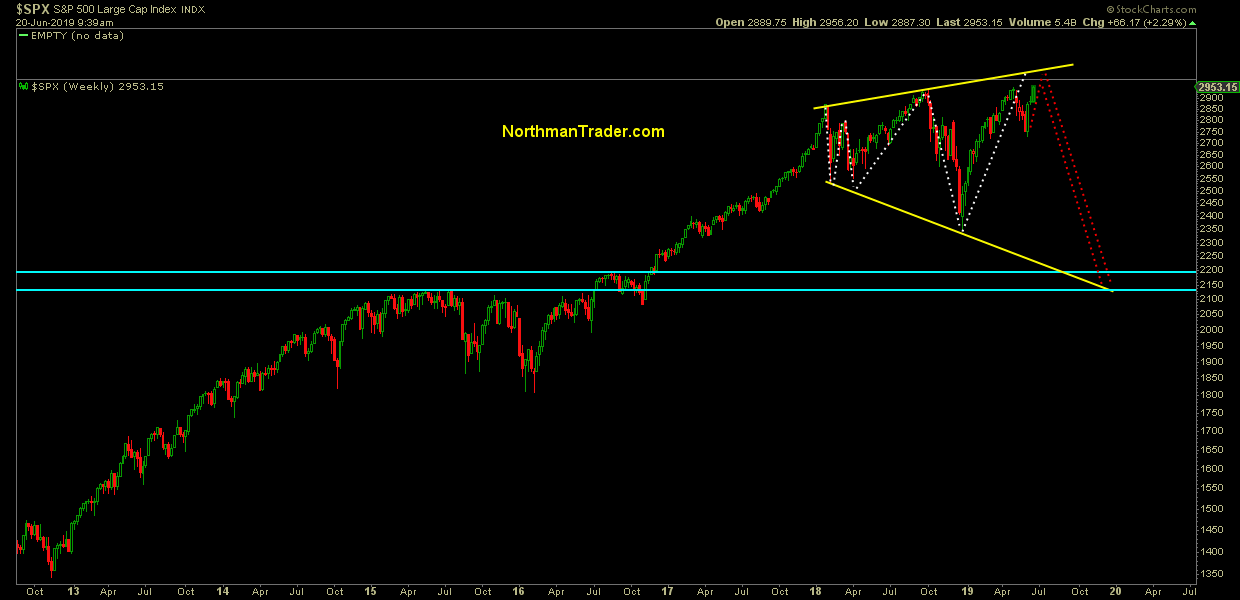

Since June and into early July I presented a potential major sell case on $SPX. In June (It’s different this time, Sell Zone, Distortion) and again last week in The ChoiceI’ve pointed to the chart below allowing for the possibility of an upper trend line tag on a megaphone pattern that could lead to a major sell-off. This is the chart shown in June:

Indeed we saw this tag on Monday this last week which then reversed:

In fact I pointed to it first thing on Monday morning:

early, but hey…. pic.twitter.com/FF58GkK5DC

— Sven Henrich (@NorthmanTrader) July 15, 2019

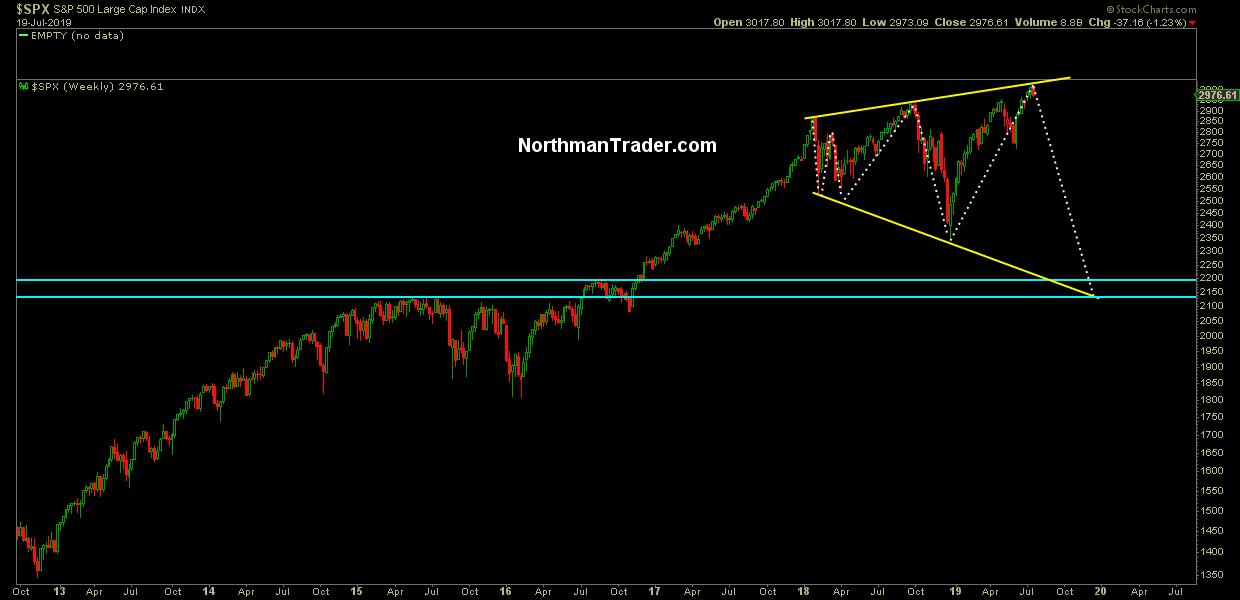

Here’s the updated chart:

This does not mean the larger sell case is validated yet, it’s not, but the 2990-3050 sell zone case I had outlined in my writings and on CNBC has so far produced a result.

But as it is a battle for control between the Fed and a still needed technical confirmation the jury is still out.

For a run down of the technicals please see the video below:

* * *

To get notified of future videos feel free to subscribe to our YouTube Channel. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2XYmJ6z Tyler Durden