Authored by Sven Henrich via NorthmanTrader.com,

You’d think that the drop in yields and a Fed about to cut rates would’ve brought about some relief to credit card bills. No Sir.

And you might think that the highest interest rates on credit cards ever would deter consumers from loading up on additional credit card debt. Oh no.

Pedal to the metal and the cumulative picture spells trouble.

Look at the data.

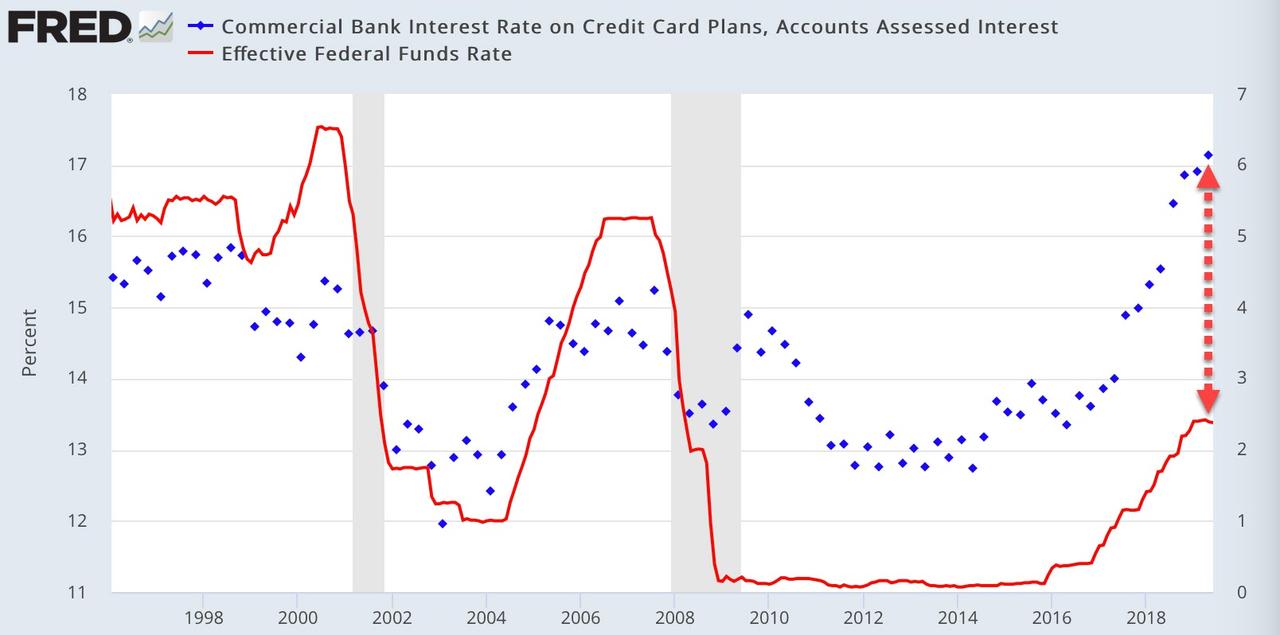

Here are credit card interest rates versus the Fed Funds rate:

Credit card companies are charging interest rates on credit cards with the widest spread above the Fed funds rate ever. Not only that, these are the highest credit card interest rates ever. But there is no inflation. Right.

Looks like consumers are getting screwed.

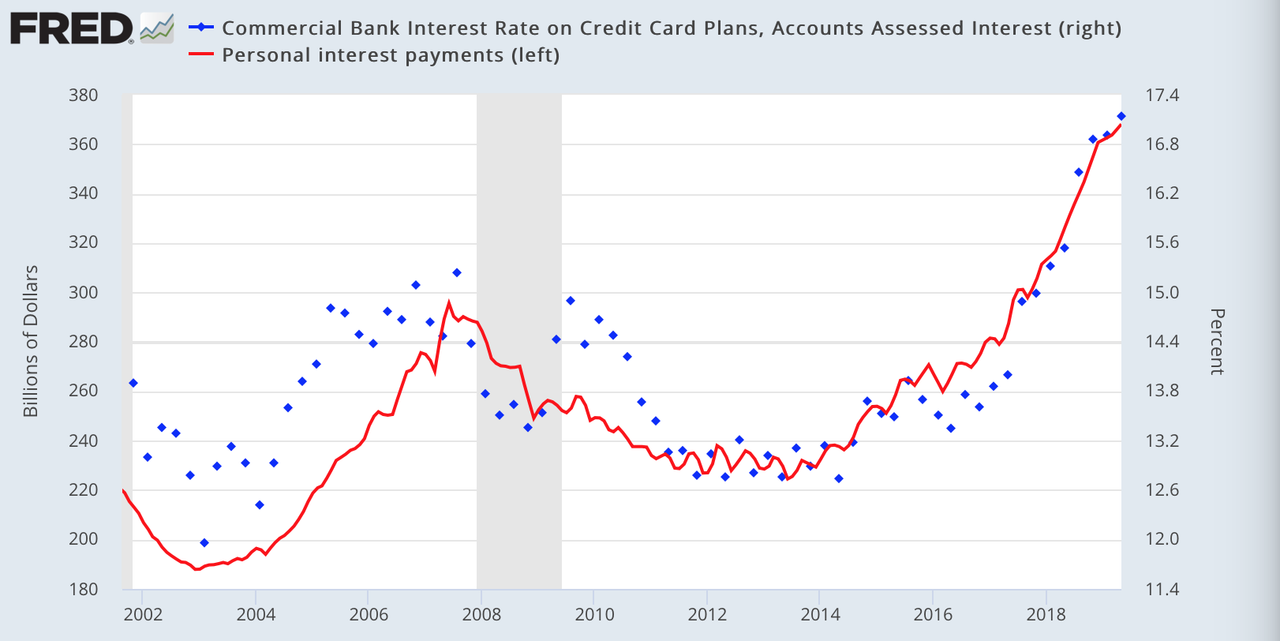

As a natural consequence personal interest payments are racing higher:

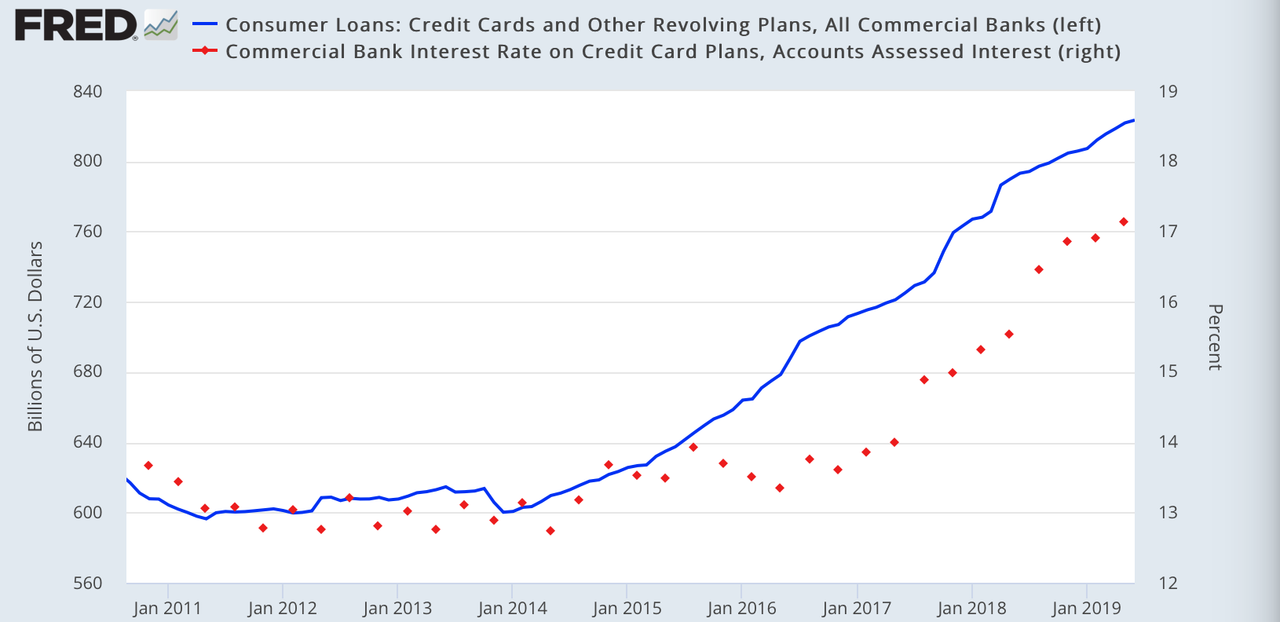

Does this stop consumers from adding to credit card debt? Nope, they keep piling in:

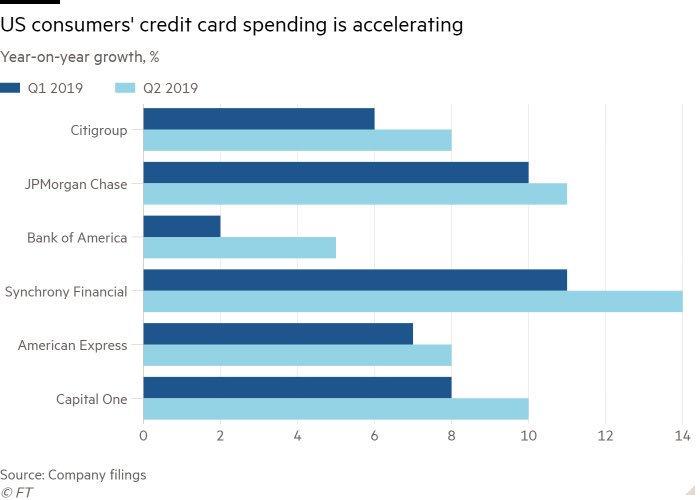

And in Q2 consumers really went for it:

Revolving debt went up by 8% in April/May (vs. up 1.5% in Q1). 8% on top of the existing record credit card debt already.

Best hope they can all pay it off quickly otherwise those high interest rates will demand a reckoning.

Why the credit splurge as opposed to paying with cash? Either it’s pure confidence in their jobs and income or a larger trend perhaps, that of consumer stress.

Any signs that would suggest stress? Look no further to mortgages, the cash buyer has dried up:

So it’s not just credit cards that suggest a drying up of disposable cash.

But hey, maybe recent stock market gains have made everybody overly confident. After all stocks don’t go down anymore.

Best hope it’s not dumb confidence.

Oh.

Unless you consider carrying record credit card debt and paying record interest rates and adding 8% of credit card debt on top of that in just one quarter to be smart.

Fact is 58% of Americans have less than $1,000 in savings. Large swaths of the American population are at the edge of trouble:

“27% of adults would need to borrow or sell something to pay for an unexpected expense of $400. One quarter of adults have no retirement savings, and skipped necessary medical care in 2018 because they were unable to afford the cost”.

While we all live in a non sustainable fantasy of 3.8% unemployment reality is 50 year lows in unemployment don’t last. And yet the figures above are exacerbated by one very inconvenient fact: 78% of US workers live paycheck to paycheck.

That’s called living on the edge. And what better way to prepare for the next downturn than having little to no savings, but record credit card balances, paying record interest rates and piling on more credit card as we speak?

Best economy ever. Not if you look at the details. The credit card splurge is warning of a coming storm.

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2K7DLp7 Tyler Durden