ECB Preview

Submitted by Newsquawk

PREVIEW: ECB Policy Announcement, 21st January 2021

- ECB policy announcement due Thursday 21st January; rate decision at 12:45GMT/07:45EST, press conference 13:30GMT/08:30EST

- No adjustments are expected to current policy settings

- The meeting will offer policymakers an opportunity to take stock of existing measures and comment on the economic outlook

OVERVIEW: After unveiling a raft of additional easing measures at the December meeting, no further tweaks are on the cards for Thursday. With a further tightening of lockdown restrictions across the region, market participants will be eyeing how this has influenced thinking at the Bank and what it could mean for the Eurozone’s recovery prospects. Lines of enquiry for the accompanying press conference will also likely focus on the ECB’s assessment on the EUR exchange rate and any hints on what to expect from the upcoming strategic review.

PRIOR MEETING: After telegraphing that stimulus was coming at the October meeting, policymakers opted to expand the pandemic emergency purchase programme (PEPP) by EUR 500bln for a total envelope of EUR 1.85trl, and extended the horizon for net purchases to at least the end of March 2022 (prev. end-June 2021). Reinvestments from the programme will now run until at least the end of 2023 (it was previously configured to end-2022). On targeted longer-term refinancing operations (TLTROs), the central bank announced it will conduct three additional operations between June and December 2021, while extending the period over which the considerably more favorable terms will apply (by 12-months, to June 2022), and it raised the total amount that counterparties will be entitled to borrow in TLTRO III operations, from 50% to 55% of their stock of eligible loans. Elsewhere, policymakers refrained from lowering the deposit rate further into negative territory, as expected, and maintained the asset purchase programme (APP) at a clip of EUR 20bln per month on an open-ended basis despite some external calls for an increase to the monthly purchase amount alongside a PEPP extension. Also as expected, no adjustment was made to the ECB’s current tiering multiplier of six. Note, the Governing Council also decided to offer four additional pandemic emergency longer-term refinancing operations (PELTROs) in 2021. Elsewhere, in what was a particularly disjointed press conference at times, Lagarde was questioned on the ECB’s view on the EUR, to which she stuck to the script by noting that the Bank will “carefully monitor” the exchange rate.

RECENT DATA: Flash CPI Y/Y for December remained at -0.3% with the core (ex-food and energy) holding at just 0.4%. Note, inflation is set to pick up in the coming months as German VAT reductions end, the early 2020 price drop in oil fades out and the service sector picks up later in the year. Note, no GDP data has been released since the prior meeting. However, the timelier survey data from IHS Markit revealed an EZ-wide services print of 46.4 whilst the manufacturing sector continues to fare better (due to fewer lockdown restrictions on activity) in expansionary territory of 55.2, leaving the composite at 49.1. That said the survey period was 4th-18th December and lockdown restrictions on the whole have become more stringent across the Eurozone. On the jobs front, the Unemployment rate for November fell to 8.3% from 8.4% with the extent of the damage to the labour market continuing to be masked by various job retention schemes.

RECENT COMMUNICATIONS: Since the prior meeting, due to the festive period and action taken last month, rhetoric from the Bank has been relatively light. In the aftermath of the meeting, Austria’s Holzmann (hawk) was quick to caution that the PEPP volume is a limit that can be used but his expectation is that it will not be fully used. This view was later echoed by Finland’s Rehn, whilst Germany’s Weidmann stated that the ECB must be wary of having a dominant market influence. Elsewhere, Germany’s Schnabel recently remarked that short-term inflation increases will not have a material effect on monetary policy decisions. Last week, president Lagarde presented a more sanguine view of the economy than some might have expected with Lagarde stating that the start to the year has been on a more positive base than some have argued and the projections released in December are still plausible. Note, at the December meeting, it was judged that “overall, the risks surrounding the euro area growth outlook remain tilted to the downside, but have become less pronounced”.

RATES: From a rates perspective, consensus looks for the Bank to stand pat on the deposit, main refi and marginal lending rates of -0.5%, 0.0% and 0.25% respectively. A prior research piece from the Bank noted that the reversal rate for the deposit rate stands around -1%, suggesting there is around 50bps of space until further rate reductions could become counterproductive. That said, whilst all options are said to be on the table, commentary from central bank officials has done little to suggest that rate tweaks are on the cards. Additionally, when faced with the option of lowering the deposit rate in March as the crisis was unfolding, policymakers refrained from doing so. As a guide: markets currently assign a ~4.5% chance of a 10bps cut to the deposit rate at the upcoming meeting and around a 47.4% probability by the end of 2021.

BALANCE SHEET: Given the adjustments to the PEPP at the prior meeting, the programme is set to be held at its current envelope; as is the case for the APP. The only question surrounding PEPP is whether or not the full envelope will be utilised. However, this will not be a pressing issue for the upcoming meeting.

TLTROs: After announcing additional operations and tweaking the conditions of these operations at the previous meeting, no action is expected on this front. That said, SocGen suggests that the need for further action cannot be excluded with the French bank concerned that the “weak” incentive structure of the operations announced last month will fail to generate much in the way of fresh demand from banks.

TIERING: Another policy option for the ECB could be an adjustment to the existing tiering multiplier of six (exempt from negative interest rates) amid rising levels of excess liquidity. However, no recent remarks from policymakers have suggested that a move on this front could take place at the upcoming meeting.

EUR: The account of the December meeting noted “it was pointed out that the nominal effective exchange rate currently stood at an all-time high and that the recent appreciation could contribute significantly to the subdued inflation outlook”. As such, market participants will be cognizant of any remarks on the EUR by President Lagarde and what it could mean for the policy outlook. Analysts at Danske Bank expect “Lagarde to repeat the awareness of the FX developments and repeat that it feeds into the inflation outlook, without further commenting on this. She will signal readiness to act, while repeating that FX is ‘not part of the mandate’.”

STRATEGIC REVIEW: Another potential line of enquiry for journalists will be any further indications on the progress of the Bank’s strategic review (due to be released H2 2021). The key focus of which will be “what precisely we mean by ‘price stability’, that is, what rate of inflation we should aim for” (ECB). As it stands, the ECB’s target is for “inflation rates of below, but close to, 2% over the medium term”. Last week, President Lagarde remarked that housing costs need to be better accounted for. However, beyond this details remain light as policymakers look to avoid front-running the conclusions of the review. SocGen suggests that the focus by the Bank in 2020 on financing conditions rather than inflation targeting “suggests that it will take more to change markets’ inflation expectations than resetting the inflation target to a slightly higher and symmetric target (around 2%)”.

* * *

A far more concise preview comes from Amplify Trading’s Anthony Cheung who writes that while he does not expect any policy adjustments from the ECB, it will be interesting what Lagarde says on:

- Extension of lockdowns (emphasis on Germany)

- Pace of vaccination rollout (new variant)

- Thoughts on Biden impact (inflation)

- Recent political instability in Italy (spread control)

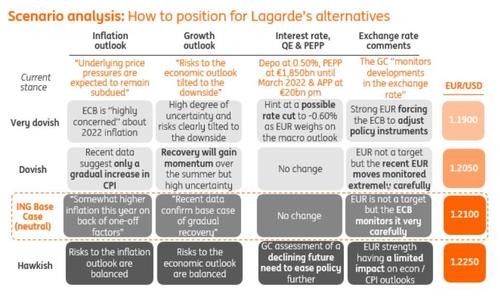

Finally, here is the always informative and succinct scenario analysis from ING

Tyler Durden

Thu, 01/21/2021 – 04:15

via ZeroHedge News https://ift.tt/3sN5jpk Tyler Durden