Lucid Motors SPAC Continues Its Plunge After Deal Announcement

The SPAC taking Lucid Motors public plunged over 40% from its recent highs on Tuesday morning after the “shine” of its announcement of a tie-up with Lucid lost its luster to the market. The SPAC stock, Churchill Capital Corp. IV, had previously run from near $10 to at one point over $60 per share in anticipation of a deal being announced with Lucid.

The deal is consummating at a pro forma equity value of $24 billion at the PIPE offer price of $15 per share, which will provide Lucid with $4.4 billion in cash. “The total investment of approximately $4.6 billion is being funded by CCIV’s approximately $2.1b in cash (assuming no redemptions by CCIV shareholders) and a $2.5b fully committed PIPE at $15/share, a 50% premium to CCIV’s net asset value,” Bloomberg reported on Tuesday.

The PIPE is being anchored by the Saudi Public Investment Fund, as well as “accounts managed by BlackRock, Fidelity Management & Research LLC, Franklin Templeton, Neuberger Berman, Wellington Management and Winslow Capital Management, LLC,” according to the same BBG report.

There was at least one financial anchor trying to offer up some help to retail bagholders on Monday. And although it may have saved some shareholders the pain of Tuesday morning’s plunge, it was still a day late.

Hey CCIV investors: You realize the PIPE investors, who actually got to see the books of Lucid, paid $15 a share while they literally watched retail buy at $40 and $50 and $60 a share? I’ve mentioned before these structures can create misalignment. Not always. But sometimes. https://t.co/ujhsNv3iyS

— Andrew Ross Sorkin (@andrewrsorkin) February 23, 2021

As a reminder Lucid Motors is backed by the Saudi sovereign wealth fund and merged with a blank-check company started by investment banker Michael Klein.

It should come as no surprise that the Saudi-backed Lucid is working with Churchill Capital Corp IV. Klein has ties to the Saudi Public Investment Fund and has acted as an adviser for the PIF. He also advised on the Aramco initial public offering.

Lucid joins the ranks of other EV companies who have gone public via SPAC in an effort to chase the industry leader (in terms of valuation, at least) Tesla. This deal would be one of the largest SPAC deals consummated since the trend began, just slightly below United Wholesale Mortgage LLC’s $16 billion merger with Gores Holdings IV Inc.

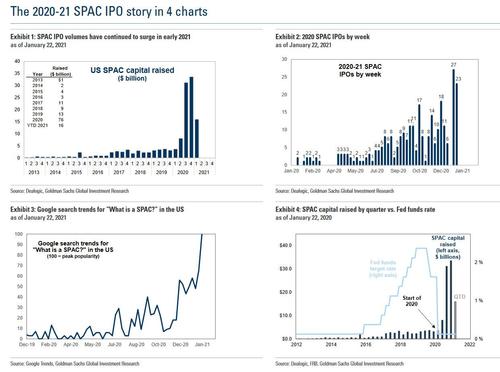

Several months into 2021, the SPAC boom doesn’t look like it’s going to let up anytime soon. Goldman Sachs told clients in a recent note about all of the SPAC excitement outlined in the four charts below.

Meanwhile, billionaire real-estate investor Sam Zell spoke with CNBC two weeks ago and warned how SPACs reminded him of the “rampant speculation again, very much like the dot-com boom.”

Tyler Durden

Tue, 02/23/2021 – 08:49

via ZeroHedge News https://ift.tt/3pJpUb7 Tyler Durden