It may be days before we know who won yesterday’s presidential election, but by the end of the evening, it was clear that drug warriors had suffered a resounding loss. Across the country, in red and blue states, on both coasts and in between, in the Midwest and the Deep South, voters passed ballot initiatives that not only continued to reverse marijuana prohibition but also broke new ground in making drug laws less punitive and more tolerant.

New Jersey’s approval of marijuana legalization was expected. Preelection surveys consistently put public support above 60 percent, although the actual margin of victory was a few points bigger than the polls suggested.

Arizona, where voters rejected legalization in 2016, was iffier. Public support averaged 56 percent in five polls conducted from mid-May to mid-October, and voters have been known to have second thoughts about legalization as Election Day approaches. In the end, legalization won by nearly 20 points. Survey averages likewise underestimated public support in Montana, where voters approved legalization by a 13-point margin, and Mississippi, where voters favored a relatively liberal medical marijuana initiative by a margin of nearly 3 to 1.

And who would have predicted that South Dakotans, who are overwhelmingly Republican and conservative, would make their state the first jurisdiction in the country to simultaneously legalize medical and recreational marijuana? Not me. Voters favored the former measure by more than 2 to 1, while the latter won by seven points.

“These results once again illustrate that support for legalization extends across geographic and demographic lines,” says Eric Altieri, director of the National Organization for the Reform of Marijuana Laws. “The success of these initiatives proves definitively that marijuana legalization is not exclusively a ‘blue’ state issue, but an issue that is supported by a majority of all Americans—regardless of party politics.”

The South Dakota results were not the only first yesterday. By a margin of more than 3 to 1, voters in Washington, D.C., approved quasi-decriminalization of “entheogenic plants and fungi.” That initiative, which says suppressing the use of such substances should be “among the lowest law enforcement priorities for the District of Columbia,” goes further than similar measures enacted recently in Denver, Ann Arbor, Oakland, and Santa Cruz, since it applies to noncommercial production and distribution as well as possession and covers ibogaine, dimethyltryptamine, and mescaline in addition to psilocybin and psilocin (although it does not include a prohibition on the use of public funds to pursue such cases).

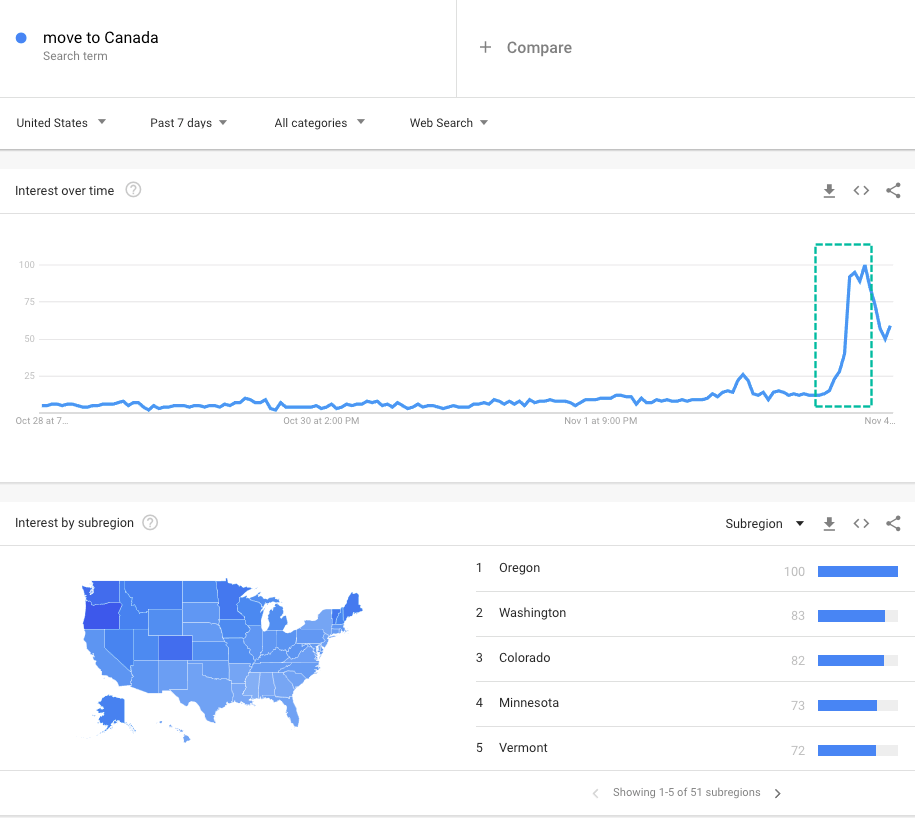

Oregon, meanwhile, became the first jurisdiction in the United States to legalize psilocybin and the first to decriminalize possession of all drugs. The first initiative, which won by a margin of more than 11 points, allows adults 21 or older, regardless of whether they have a medical or psychiatric diagnosis, to consume psilocybin at state-licensed centers. The second measure, which was supported by nearly three-fifths of voters, makes low-level, noncommercial possession of controlled substances, which was previously a misdemeanor punishable by up to a year in jail, a citable offense punishable by a $100 fine.

Yesterday’s returns confirm that marijuana prohibition, which is opposed by two-thirds of Americans, is on its way out. Fifteen states have now approved legalization, up from 11 the day before yesterday. As of next year, about one in three Americans will live in states where recreational use is legal.

The results also point the way toward less oppressive treatment of other psychoactive substances. Last year, when Denver became the first jurisdiction in the country to make psilocybin use a low law enforcement priority, it might have seemed like a symbolic victory with minimal practical consequences. But a similar Denver initiative dealing with marijuana, passed in 2007, helped pave the way for the 2012 legalization of cannabis in Colorado, the first state to allow recreational use. Less than two years after Denver’s psilocybin vote, Oregon already has taken the next step.

When Denver’s initiative passed, I worried that drug policy reform would stall, limited to substances that Americans are prepared to recognize as relatively benign and beneficial. But Oregon’s decriminalization initiative, which covers notorious substances such as heroin, fentanyl, cocaine, and methamphetamine as well as psychedelics such as LSD, shows voters can be persuaded that it is wrong to treat drug users as criminals. They will instead be treated less severely than speeders or illegal parkers, which certainly counts as an improvement. The initiative’s backers estimate that it will reduce possession arrests by more than 90 percent.

Crucially, while drug users can avoid the $100 fine by undergoing a “health assessment” at an “addiction recovery center,” they are not required to do so, and assessments are supposed to “prioritize the self-identified needs of the client.” In fact, opponents of the initiative, including self-identified critics of the drug war, complained that the reform makes it impossible to force drug users into treatment by threatening them with criminal penalties. That is a feature, not a bug.

Americans may not be ready to eliminate all penalties for drug use, let alone recognize the moral dubiousness of continuing to arrest and imprison people who merely aid and abet what is no longer a crime and never should have been. But if the history of marijuana reform teaches us anything, it is the importance of incremental changes that eventually lead to a fundamental reconsideration of the way the government treats psychoactive substances that politicians do not like. First marijuana use was changed from a felony to a misdemeanor, then it was decriminalized, then it was allowed for medical purposes, and now it is increasingly treated as a legal intoxicant sold by legitimate businesses.

Although that process took decades, the last breakthrough happened sooner than I expected. We may yet be surprised by how quickly the rest of the drug prohibition regime crumbles.

from Latest – Reason.com https://ift.tt/2I2U2OQ

via IFTTT