Can Six Myths Keep The Market Going?

Authored by Patrick Hill via RealInvestmentAdvice.com,

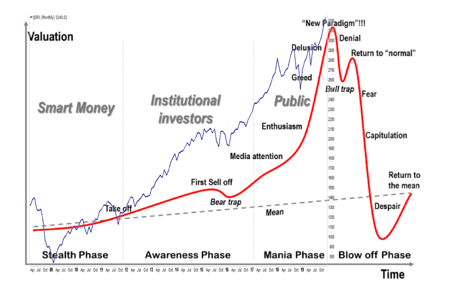

Piper Jaffray forecasts by year end 2020, the S&P 500 (SPX) will hit 3600, a 12.8 % increase. Of eighteen analysts interviewed by Marketwatch only three forecasters expect a decline for the SPX. Will the SPX reach 3600? The SPX has soared over 400 % from a low of 666 in 2009 to over 3200 at the close of 2019. Mapping the SPX ten year history onto a psychology market cycle map of growth and decline phases poses interesting questions. As the market has zoomed over 400% upwards over ten years, it is clearly in the Mania Phase. Yet, the US economy is growing at the slowest rate of any economic recovery since WWII at 2.2 % GDP per year, why the disconnect?

Source: Patrick Hill – 12-31-19

One reason for the disconnect is investment analysts and the media lead investors to believe there is no downside risk. On New Year’s Eve, Goldman Sachs released a prediction for 2020 claiming that the ‘tools of the Great Moderation’ (Fed policy shift) begun 30 years ago low-interest rates, low volatility, sustainable growth and muted inflation are still in place and were only interrupted by the 2008 financial crisis. Plus we would add the Dotcom crash. GS concluded that the economy ‘was nearly recession-proof.’

The mainstream financial media also feed the Mania Phase with stories like Goldman Sachs declaring the Great Moderation is working with our economy in a ‘new paradigm’. We are to believe there will not be a recession because our policymakers have the economy under control. Really? With over $17 trillion of negative debt worldwide to keep the world economy going, central banks have succeeded in sustaining worldwide GDP at 1 – 2 % and falling as of late! For the SPX market to not descend into the Blow Off phase, investors will need to continue to believe in six economic myths:

-

The Growth Phase of the Economic Cycle is Continuing

-

Consumers Will Bailout the Economy

-

The Fed Will Keep the Economy Humming

-

If the Fed Fails Then the Federal Government Will Provide Stimulus

-

The Trade War Won’t Hurt Global Growth

-

The Economy and Markets Are Insulated from World Politics

Let’s look at each myth that is likely to affect portfolio and market performance in the next year. This analysis is based on research data of economic, social, government, business trends and observation of markets and the economy. If markets are to continue to climb, either policymakers must solve difficult issues or investors must continue to believe these myths are true. The first myth establishes a critical framework for viewing all economic activity. We are actually at the end of the growth phase of the economic cycle; here is why.

Myth 1. The Growth Phase of the Economic Cycle is Continuing

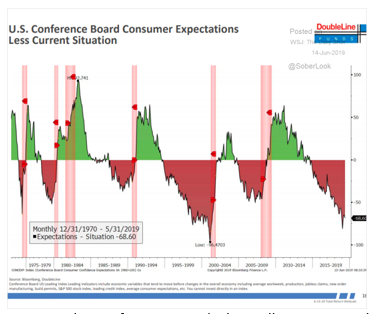

The Fed has reported that the economy is still in ‘mid-cycle’ phase. We differ with this position as several indicators show the economy is reaching the end of its growth cycle and ready to revert to the mean. As GDP is driven 70 % by consumers, let’s look at what is really happening to consumers. The ratio of current consumer conditions minus consumer expectations is at levels seen just before prior recessions not mid-stage growth economies.

Sources: The Conference Board, The Wall Street Journal, The Daily Shot – 6/14/19

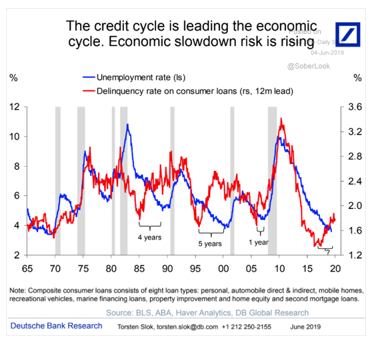

In the chart below, consumers are stretched as loan default rates are rising despite a 50-year low unemployment rate. Rising delinquencies tend to signal rising unemployment and economic decline is likely in the near future.

Sources: Deutsche Bank, Bureau of Labor Statistics, The Wall Street Journal, The Daily Shot – 6/4/19

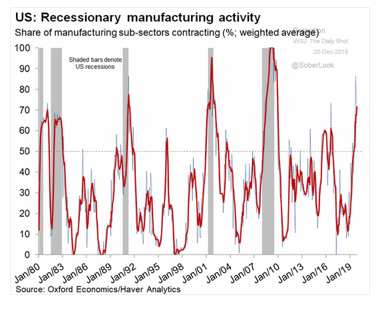

Of major concern is that the manufacturing sector is now in a recession based on five months of ISM reports below the 50 % economic expansion benchmark. The overall contraction is validated as 70 % of manufacturing sub-sectors are contracting as noted in the report below. While the US economy is primarily driven by services, the manufacturing sector has a multiplier effect on productivity, support services, and employment with high paying jobs. Note the contraction in sub-sectors is reaching levels last seen before recessions.

Sources Oxford Economics, The Wall Street Journal, The Daily Shot – 12-20-19

There are other indicators pointing to the end of the growth phase. For example, the inversion of the 2 – 10 yield curve last summer is now steepening – often seen before an economic slowdown. Another indicator is the number of firms with negative earnings launching IPOs in 2019 was at levels not seen since 2000. Finally, productivity and capital investments are at ten year lows.

Myth 2. Consumers Will Bailout the Economy

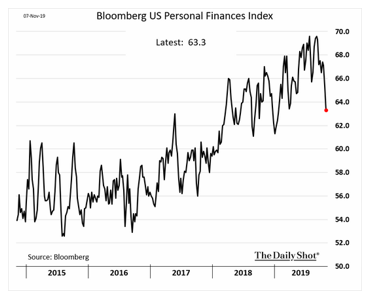

Market pundits have been quick to rely on the consumer to continue spending at growth sustaining rates. Yet, budgets for the middle class are squeezed as consumers cope with student loan debt payments, new car payments, health care bills, and credit card debt. The Bloomberg Personal Finance Index dropped significantly in October:

Source: Bloomberg, The Wall Street Journal, The Daily Shot – 11/10/19

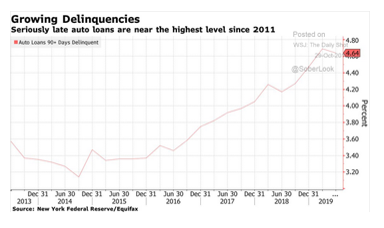

Car loans now span seven years on average versus five years a few years ago. Further, the new loans ‘roll in’ debt from previous car purchases due to negative equity in the owner’s trade-in vehicle. Vehicle price increases up to 10 % over the last year for both cars and trucks add to the debt burden. Car debt is beginning to weigh on consumers as delinquencies are climbing:

Sources: NY Federal Reserve, The Wall Street Journal, The Daily Shot – 10/29/19

Today, credit card rates are running at a ten-year peak of 17 – 22 % have seen no relief despite the Fed cutting rates. There is a record spread between the Federal Funds rate and credit card rates as banks seek new revenue sources beyond making loans. Many consumers are turning to credit cards to pay bills to sustain their lifestyle as their wages are not keeping up with rising living costs.

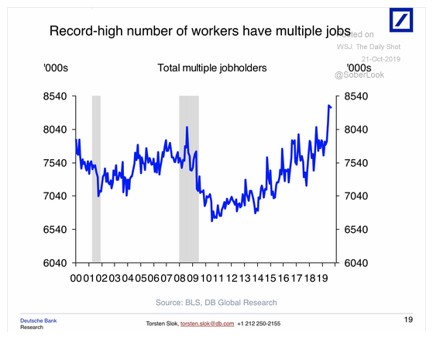

In addition, consumers are increasingly working at more than one job to be sure they can pay their bills.

Sources: Deutsche Bank, Bureau of Labor Statistics, The Wall Street Journal, The Daily Shot – 10/21/19

Workers need to take on multiple jobs in the gig economy. McKinsey & Company estimates that 52 million people are gig workers or a third of the 156 million person workforce. Contractors have no job security. Gig workers often receive hourly wages with no health, retirement or other benefits. The lack of benefits means they have limited or no financial safety net in the event of an economic slowdown.

There are other key indicators of consumer financial distress, for example, consumer spending on a quarter over quarter basis has continued to decline, Bankrate reports that 50 % of workers received no raise in the last year. Real wages (taking into account inflation) for 80 % of all workers have been stagnant for the past twenty years. Uncertain economic forces are putting consumers in a financial bind, for more details, please see our post: Will the Consumer Bailout the Economy?

Myth 3. The Fed Will Keep the Economy Humming

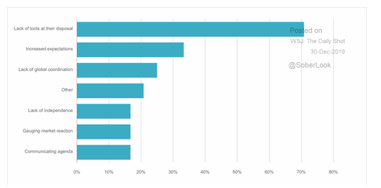

The Fed has said it will do whatever necessary to keep the economy growing by keeping interest rates low and injecting liquidity into the financial system. However, a survey on Fed actions shows that 70 % of economists interviewed believe the Fed is running out of ammo to turnaround the economy.

Sources: The Wall Street Journal, The Daily Shot – 12-30-19

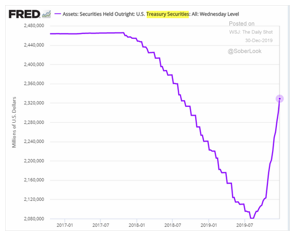

We agree with their perspective that the Fed is entering an economic space where no central bank has gone before. In the past, the Fed lowered rates when an economic downturn was evident. Just prior to earlier recession’s interest rates were at a higher starting level of at least 4 – 5 %. Plus, today the Fed has returned to pumping liquidity into the economy via its repo operation and QE as shown below.

Sources: The Federal Reserve of St. Louis, The Wall Street Journal, The Daily Shot – 12/30/19

The International Bureau of Settlements (BIS) disclosed in their analysis of recent Fed repo operations that funding supported not only banks but hedge funds. A key concern is the nature of the hedge fund bailout. How steep is the loss being mitigated? Is there a possibility of contagion? Is more than one hedge fund involved? Should the Fed be bailing out hedge funds that are overextended due to speculation? The Fed is already using its tools at the height of the current economic growth cycle. The Fed financial tools are too stretched to turnaround an economy in a recession from multiple financial bubbles bursting.

The Fed continues to declare that inflation is at 2.1 %, missing the reality of what consumers are actually paying for goods and services. We find from industry research that finds inflation is likely in the 6 – 10% range. Inflation should be defined as price increases of goods and services that consumers buy, not inflation defined by a formula to suit political needs. Using inflation lifestyle ‘cost of living’ data, which is not transparent or available for audit does not meet the foundational data needs of investors. Gordon Haskett Research Advisors conducted a study by purchasing a basket of 76 typical items consumers frequently buy at Walmart and Target. Their study showed that from June 2018 to June 2019, prices increased by about 5.5%.

Other industry research supports inflation running at a much higher level than government figures. On a city by city basis, Chapwood has developed an index for 500 items in major metropolitan areas of the US. Chapwood reports the average national inflation level to be about 10 %. Note inflation is compounded; for example, in San Jose a five year average price increase of 13% is for each year. An item costing $1.00 would cost $1.13 the next year and then $1.28 the third year and so forth. It is likely workers caught in a squeeze between stagnant wages and 10 % inflation will not be able to continue to sustain present levels of economic growth.

Real inflation at 6 – 10 % has major policy, portfolio, and social implications. For example, with the ten year Treasury Bond at 1.90% and inflation at 6 %, we are actually living in a ’de facto negative interest’ economy of – 4.10 %. Higher inflation levels fit the financial reality of what workers, portfolio managers, and retirees are facing in managing their finances. Many workers must take multiple jobs and develop a ‘side hustle’ to just keep up with inflation much less get ahead. For portfolio managers, they must grow their portfolio at much higher rates than was previously thought just to maintain portfolio value. Finally, for retirees on a fixed income portfolio it is imperative they have additional growth income sources or part-time work to keep up with inflation eating away at their portfolio. For more details on our analysis of a variety of inflation, categories see our post: Is Inflation Really Under Control?

One additional assumption about Fed intervention repeated by many analysts is the Fed liquidity injections mean that corporate sales and profits will bounce back. For some financially sensitive industries this argument may be true. For other firms with excellent credit ratings, they may be able to obtain low-interest loans to ride out falling sales. But, the reality is that corporations build and sell products based on demand. If demand falls, low-interest loans will not increase sales. Only new products, new channels, reduced pricing, marketing and other initiatives will revive sales.

Myth 4. If the Fed Fails Then the Federal Government Will Provide Stimulus

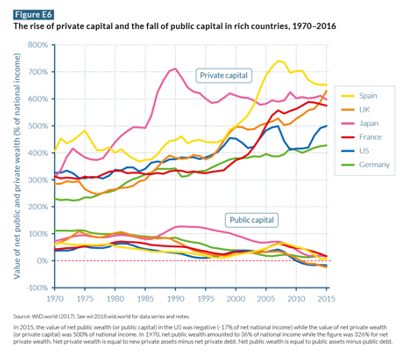

European Central Bank leaders have called on European governments to provide economic stimulus for their markets. Picking up on this idea, analysts have proposed the US government move on infrastructure and other spending programs. However, tax cuts, low-interest rates, stock buybacks, and record corporate debt offerings have shifted a huge balance of world-wide wealth to the private sector. For 40 years, there has been a significant increase in private capital worldwide while public wealth has declined. In 2015, the value of net public wealth (or public capital) in the US was negative -17% of net national income, while the value of net private wealth (or private capital) was 500% of national income. In comparison to 1970, net public wealth amounted to 36% of national income, while net private wealth was at 326 %.

Source: World Inequality Lab, Thomas Piketty, Gabriel Zucman et al. – 2018

Essentially, central banks, Wall Street, and governments have built monetary and economic systems that have increased private wealth at the expense of public wealth. The lack of public capital makes the creation of major levels of public goods and services nearly impossible. The US government is now running $1 trillion yearly deficits with public debt at record levels not seen since WWII and total debt to GDP at all-time highs. The development of public goods and services like basic research and development, education, infrastructure, and health services are necessary for an economic rebound. The economy will need a huge stimulus ‘lifting’ program and yet the capital necessary to do the job is in the private sector where private individuals make investment allocation decisions. Congress may pass an ‘infrastructure’ bill in 2020 but given the election, it is likely to be lightly funded to pass both houses of Congress and receive the president’s signature.

Myth 5. The Trade War Won’t Hurt Global Growth

By closing the Phase One trade deal, the market has been sighing with relief with observers declaring that trade will resume a growth track. Yet, the Phase One deal is not a long term fix. If anything, the actions on the part of both governments have been to dig in for the long term. The Chinese government has taken several key actions in parallel to the deal to move their agenda ahead.

China has quietly raised the exchange rate of their currency to offset some of the impact of still in place tariffs on the U.S. economy. The government made a major move to block US and foreign companies from providing key technical infrastructure. The technology ministry has told government agencies that all IT hardware and software from foreign firms are to be replaced by Chinese systems within three years. If the Chinese government decides to establish ‘China only’ network standards it may be difficult for US firms to even work with state-sponsored companies or private businesses that must meet China’s only standards. Apple and Microsoft would have to build two versions of their products. One version for the Chinese economy and one for the world. A critical change is taking place in world trade which is the establishment of a two-block trading world. China is a key growth market at a 20 % – 30 % increase in sales annually for US multinational companies. For these corporations navigating the trade war will be problematic even with the Phase One agreement. Our post characterizing this major change in world trade can be found at: Navigating a Two Block Trading World.

The U.S. has placed sanctions on Chinese sponsored network provider Huawei, effectively limiting the network vendor from US government and private networks. The Phase One agreement includes the US canceling planned tariffs for December 15th in 2019 and rolling back tariffs to 7.5 % on $120 billion of goods imposed on September 1st of last year. Yet, tariffs of 25 % remain in place on $250 billion of Chinese goods. The Chinese have canceled retaliatory tariffs planned for December 15th and plan to increase purchases of US goods and services by $200 billion over two years. In addition, China will purchase US agriculture products at a $40 billion rate per year from a baseline of $24 billion in 2017. If the Chinese follow through on their purchase commitments US companies should see increased sales. However, history on Chinese purchases shows they forecast large purchases but small purchases are made.

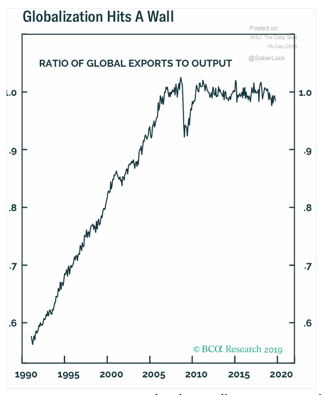

A major trade issue has been created when the US decided not to appoint any new judges to the World Trade Organization court for disputes. The court cannot hear or make decisions on any disputes any longer; meaning countries will resort to free-for-all negotiations on trade disputes. We expect as economies falter, nationalist policies on trade will gain more popularity and world trade will continue to decline after a slight blip up from the U.S.-China Phase One deal.

Sources: BCOT Research, The Wall Street Journal, The Daily Shot – 12/16/19

Finally, prior to the trade war global trade has been facing major headwinds. Since 2008, global firms have looked to open more international markets to sell their goods, but have met sales resistance causing revenue and profits to be flat or decline. We expect the flattening of global sales to output to continue and eventually decline as overall world trade falls.

CEOs in a Conference Board survey rate trade as a major concern as they look at a highly uncertain economic picture. Marc Benioff, CEO of Salesforce, described his concerns at a company all hands meeting last November:

“Because that issue (trade) is on the table, then everybody has a question mark around in some part of their business,” he said.

“I mean, we’re in this strange economic time, we all know that.”

Myth 6. The Economy and Markets Are Insulated from World Politics

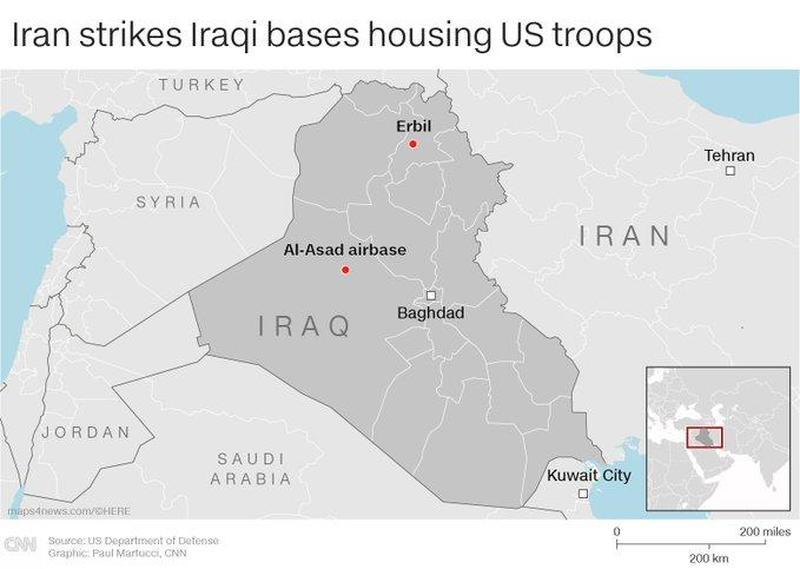

Protests have broken out in Hong Kong, Iraq, Iran, Chile, and other world cities while stock markets continue their climb. Yet, when the U.S. killed a key Iranian general the overnight S &P futures market fell 41 pts before recovering and closing 23 pts lower. The VIX soared 22 % overnight before settling back to close for a 12 % increase at 14.02. The U.S. – Iran conflict does not seem to be under control with most Middle East analysts predicting a major retaliation by the Iranian government. The price of oil spiked 4 % before settling to a 3.57 % increase on fears the Iranians may attack oil tankers in the Gulf. An escalating conflict will drive oil prices higher, disturb supply chains and likely tip the world economy into a recession.

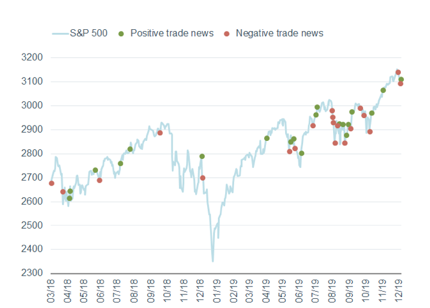

We saw during the negotiations for the Phase One trade deal how rumors both in China and the U.S. would send the S & P futures market up or down by 10 – 15 points depending upon whether the news was positive or negative. Algo traders would drop 30k contracts in a matter of seconds to make huge moves in SPX price, while the VIX was at 12.50, supposedly a calm market. The chart below shows how positive and negative news whipsawed the market.

Source: Liz Ann Sonders – Schwab – 12-7-19

Political news not only moves markets but the economy as well. When the president tweets a tariff threat, consumers and industry move swiftly to buy those goods before their prices go up. Businesses have to build the product quickly, sell it and they are left with falling sales as future purchases are pulled forward. Business to business deals are caught up in this constant flip flop on trade policies as well. CEOs must make investment decisions to build a plant in a particular country 1 – 3 years in advance. They must calculate their allocation plans based on inadequate information and in a highly uncertain policy environment. Often, rather than make an investment decision, executives will wait for the economic clouds to clear.

Summary:

The current bull market run has set record highs continuously. Yet, as the saying goes: markets go up in stair steps and down in an elevator. As a selling panic sets in the market goes into a free fall. If an economic myth is revealed by market action, corporate results, economic reports or an event the loss of belief causes the market to fall much faster than a slow stair step up.

The prudent investor will recognize the end of the business cycle is likely underway. It is time to prepare for an economic slowdown and a resulting equity market reversion to the mean. A reversion to the mean quite often requires that markets swing beyond the mean.

The wary investor will ask hard questions of their financial advisor and review corporate reports with an eye on fundamentals. Financial success is likely to result from good risk management and implementation combined with agility to make mid-course corrections. Investors should test their assumptions based on breaking trends that may impact portfolio performance. At the same time, constantly flipping investments will lead to poor performance. Allocate funds to different portfolio groups based on long, medium and short term goals to keep from being emotionally swept up in temporary market swings. The key is to be prepared for the unknown, or a black swan event. Expect the unexpected and consider the advice of market legends like Bernard Baruch:

“Some people boast of selling at the top of the market and buying at the bottom – I don’t believe this can be done. I had bought when things seemed low enough and sold when they seemed high enough. In that way, I have managed to avoid being swept along to those wild extremes of market fluctuations which prove so disastrous.”

Tyler Durden

Wed, 01/08/2020 – 12:04

via ZeroHedge News https://ift.tt/2tFEXvj Tyler Durden