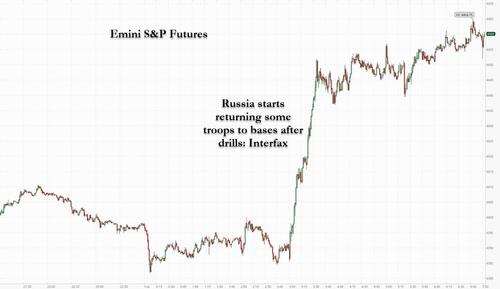

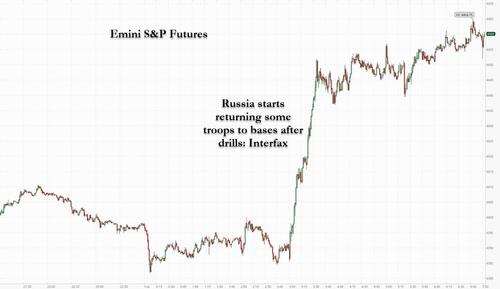

With less than 24 hours to go until the Feb 16 CNN and CIA-leaked Putin “invasion day” – because if you are Russia you always leak to the US intel agencies when you are going to invade a sovereign nation – this morning markets got a welcome surprise when just after 3am ET, Interfax reported and Russia’s Defense Ministry later confirmed that some troops are starting to return to their regular bases after completing drills. Markets welcomed the positive signals from Moscow, which included Russia’s top diplomat saying that diplomacy with the West could succeed, as US equity futures surged, bond yields were lifted and and oil, gold and other safe havens were slammed amid continued optimism that geopolitical tensions in Ukraine may be easing.

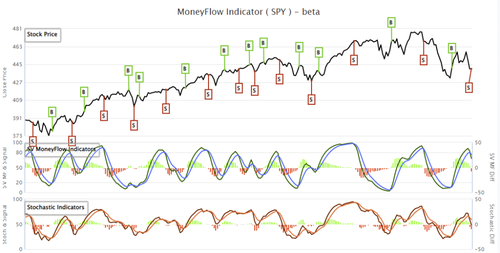

As of 715am, emini S&P futures were 1.6%, or 72 points higher, and trading at 4,464 while Nasdaq futures rose 2.2% and Dow futures were 1.2% higher. 10Y Treasury yields bounced above 2.02% after dropping as low as 1.90% yesterday after the US deep state sparked fresh groundless panic about an imminent invasion. The dollar, oil and gold tumbled while cryptos jumped. Meanwhile, iron ore tumbled as China ramped up a campaign to stop prices from overheating.

In premarket trading, Intel rose after agreeing to buy Israel’s Tower Semiconductor Ltd. for $5.4 billion. Big U.S. technology companies including Apple Inc., Tesla Inc. and Microsoft Corp. also rose, along with cryptocurrency-exposed stocks as Bitcoin extended its recent rebound back above the $44,000 level. Bigtech stocks also gained in premarket trading. Here are some other notable premarket movers:

- Intel (INTC US) adds 1.4% in early trading after it agreed to acquire Tower Semiconductor for about $5.4 billion. Tower Semiconductor jumps 45%.

- Resonant Inc. (RESN US) shares soar257% following its announced sale to Murata Electronics North America for $4.50 per share.

- Advanced Micro Devices (AMD US) shares rise 3.5% in U.S. premarket; focus is shifting to solid long-term and multiple growth factors now that the semiconductor company completed Xilinx acquisition, writes Cowen (outperform).

- Larimar Therapeutics (LRMR US) shares sink 58% in premarket trading after the company said the FDA is maintaining its clinical hold on Larimar’s CTI-1601 program.

- Arista Networks (ANET US) shares jump 10% in premarket trading after the cloud-networking company gave a quarterly revenue forecast that exceeded analysts’ expectations.

- Amkor Technology (AMKR US) shares gain 9% in early trading, after the semiconductor manufacturing company reported its fourth-quarter results and gave a forecast.

- Car rental company Avis Budget (CAR US) reported fourth-quarter profit and revenue that beat the average analyst estimate. Shares fell 1.2% in postmarket trading Monday, with Morgan Stanley pointing out a weakness in pricing.

Also in knee jerk reaction, the Russian ruble strengthened the most in more than two weeks against the dollar, leading gains among emerging-market currencies after the Interfax news service reported some troops were returning to bases after drills in the Western and Southern military districts, fueling speculation tensions over Ukraine are abating. The yield on Russia’s ruble debt tumbled a quarter percentage point.

Still, significant uncertainty remains over the extent of Russia’s pullback, with NATO saying it has yet to see evidence of a pullback. And nerves are still raw after Monday, when stocks were spooked by President Volodymyr Zelenskiy’s sarcastic comment about the rest of the world predicting a date for an attack by Russia. The U.S. has said its intelligence indicates Russia may attack imminently, although officials in Moscow have repeatedly denied an invasion is planned and it now looks like they were correct again. Meanwhile, diplomatic efforts are continuing, with German Chancellor Olaf Scholz meeting Russian President Vladimir Putin.

Markets have been whipsawed this week as the Ukraine crisis added to existing concerns over high inflation and the withdrawal of stimulus by the Federal Reserve. Investor focus will turn to producer price inflation figures for cues on how aggressive the Fed is likely to be with reining in its monetary policy.

“What we are seeing is a Fed that is reacting to inflationary prints even though many of the pressures on inflation are factors that the Fed really can’t solve,” Kristina Hooper, chief global market strategist at Invesco, said on Bloomberg Television. “So that certainly increases the risks and reduces the clarity.”

In Europe, the Euro Stoxx 50 rose 1%, with FTSE MIB outperforms adding 1.1%, FTSE 100 lags adding 0.3%. Autos, industrials and chemicals are the strongest performing sectors. Energy shares underperformed in Europe as oil retreated from the highest since 2014 and natural gas prices dropped on a possible cooling in the crisis. Delivery Hero SE led gains in Europe, while Glencore Plc jumped to a 10-year high.

Asian stocks, most of which closed before the Russian news hit the tape, extended losses for a third day, checked by the prospect of higher U.S. interest rates and concern Russia’s fallout with Ukraine will lead to conflict. The MSCI Asia Pacific Index fell as much as 0.8%. Financial and industrial sectors were the biggest drags while consumer staples and healthcare names provided support. Equities in mainland China bucked the trend, climbing after the central bank stepped up support for the slowing economy. The CSI 300 rose more than 1% after the People’s Bank of China injected a net 100 billion yuan ($15.7 billion) into the banking system with its medium-term lending facility, while leaving the borrowing rate unchanged. The key China stock gauge is still down nearly 7% this year, hurt by concerns over the economy. Investors will closely examine the Federal Reserve’s meeting minutes due this week for the next clues on monetary-policy tightening, said Mamoru Shimode, the chief strategist at Resona Asset Management. The market also remains on edge over geopolitical tensions, after Ukrainian President Volodymyr Zelenskiy spooked investors with confusing comments. “We’re in a very delicate situation for markets,” Shimode said. “The worst-case scenario is for this to drag on, leading to higher and higher oil and energy prices, which will leave no choice for the U.S. to tighten policy further and in turn, deteriorate economic growth.”

Japanese equities fell for a second day as the latest data on the local economy failed to cheer investors amid ongoing worry over Russia-Ukraine tensions and upcoming U.S. interest-rate hikes. Service providers and banks were the biggest drags on the Topix, which fell 0.8%. Recruit was the largest contributors to a 0.8% loss in the Nikkei 225, dropping 12% as analysts pointed to concerns about the post-pandemic outlook for HR-related business. The yen strengthened 0.2% against the dollar. Japan’s gross domestic product expanded at a slightly slower-than-expected annualized pace of 5.4% in the three months through December compared with the previous quarter, the Cabinet Office reported Tuesday. Economists had estimated growth of 6%. “Real GDP remained 0.2% below pre-pandemic 4Q 2019, highlighting Japan’s lagging recovery compared to the U.S. and Europe,” Shuji Tonouchi, an economist at Mitsubishi UFJ Morgan Stanley wrote in a note. “High import prices continue to spread to the investment deflator, which has weighed on housing and other investment.”

In FX, the Bloomberg Dollar Spot Index fell as much as 0.3% as risk assets rallied; Sweden’s krona was the top performer among G-10 peers while the yen and the Swiss franc were at the bottom, after giving up earlier gains. The euro erased yesterday’s loss versus the dollar to briefly top $1.1350. The pound advanced against the dollar but fell against the euro. U.K., real average wages fell at the fastest pace since 2014 in December, prompting concerns about a cost of living crisis. The Aussie recovered even as iron ore plummeted after Beijing ramped up a campaign to stop prices overheating. The ruble soared as much as 2.1% and currencies in the EU’s east extended gains against the dollar

In rates, Treasuries slid as haven-buying is unwound leading to modest bear steepening with 2s10s widening ~3bps, while bunds hovered, underperforming European peripheral bonds. Treasury losses were led by long-end of the curve, as stocks rally globally on signs that the Russia-Ukraine crisis may be easing. Yields are cheaper by 4bp-5bp across long-end of the curve, steepening 5s30s by ~2bp; front-end outperforms slightly with 2- year yields cheaper by less than 1bp and 2s10s steeper by nearly 4bp. In the 10-year sector bunds outperform U.S. by 2.7bp, gilts by 6.3bp. Peripheral spreads tighten to Germany with 10y BTP/Bund narrowing ~1bp. Italian 10-year yield briefly touches 2%, now back to 1.965%.

In commodities, crude futures decline. WTI trades within Monday’s range, falling 2.7% to trade near $92.85. Spot gold falls roughly $15 to trade near $1,856/oz, while other precious metals follow suit. Most base metals trade in the green; LME lead rises 1%, outperforming peers. LME aluminum lags.

Bitcoin continues to pick up and back away from a potential test of the USD 40k mark to the downside following pressure emerging at the tail-end of last week/over the weekend

Looking at the day ahead, data releases from the US include January’s PPI and the February Empire State manufacturing survey. Meanwhile in Europe, there’s UK unemployment for December, the German ZEW survey for February, and the second estimate of the Euro Area’s Q4 GDP. Otherwise, central bank speakers include the ECB’s Villeroy, and earnings releases include Airbnb.

Market Snapshot

- S&P 500 futures up 1.3% to 4,450.25

- STOXX Europe 600 up 1.1% to 465.91

- MXAP down 0.2% to 187.14

- MXAPJ little changed at 616.00

- Nikkei down 0.8% to 26,865.19

- Topix down 0.8% to 1,914.70

- Hang Seng Index down 0.8% to 24,355.71

- Shanghai Composite up 0.5% to 3,446.09

- Sensex up 3.0% to 58,096.29

- Australia S&P/ASX 200 down 0.5% to 7,206.93

- Kospi down 1.0% to 2,676.54

- Brent Futures down 2.5% to $94.02/bbl

- Gold spot down 0.9% to $1,854.13

- U.S. Dollar Index down 0.31% to 96.07

- German 10Y yield little changed at 0.29%

- Euro up 0.3% to $1.1340

- Brent Futures down 2.5% to $94.02/bbl

Top Overnight News from Bloomberg

- Investor confidence in Germany’s economic recovery improved further as the country edges closer to loosening its coronavirus restrictions. The ZEW institute’s gauge of expectations rose to 54.3 in February from 51.7 the previous month. An index of current conditions also increased

- Employment in the euro area exceeded its pre-pandemic level, shrugging off surging Covid-19 infections to highlight the economy’s increasing resilience to virus disruptions. The number of employed people rose 2.1% from a year ago in the final quarter of 2021, reaching 161.8 million, data released Tuesday showed

- China’s central bank stepped up support for its slowing economy by pumping in cash via policy loans for a second straight month. The benchmark stock index advanced, outperforming regional equities.

- Riksbank Deputy Governor Martin Floden says the recent krona weakening is partly related to the market perceiving the Riksbank’s latest decision as dovish, but even more to the tensions linked to Russia and Ukraine

A more detailed look at global markets courtesy of Newsquawk:

Asia-Pac stocks traded mostly lower following a similar handover from Wall Street. ASX 200 was subdued as the energy and mining names gave back some of yesterday’s gains, whilst the RBA minutes offered no fresh information. Nikkei 225 was pressured by its industrial sector and with a resilient Yen providing further headwinds. Hang Seng continued to be overpowered by the COVID situation in Hong Kong which prompted Chief Executive Lam to announce new measures to curb the spread. Shanghai Comp. bucked the trend and posted mild gains after the PBoC decided to inject CNY 300bln via 1yr MLF, albeit at a maintained rate of 2.85%

Top Asian News

- China Warns Iron Ore Trading Cos Against Speculation, Hoarding

- Hong Kong ‘Overwhelmed’ But Doesn’t Plan Lockdown: Virus Update

- PBOC Offers 300b Yuan of MLF With Rate Unchanged at 2.85%

- Japan Preliminary 4Q GDP Annualized Rises 5.4% Q/q; Est. +6%

European bourses are firmer in a pick-up from a relatively contained open amid developments on the geopolitical front. Updates that some Russia troops are returning to base lifted above Monday’s best levels.US futures In Europe, sectors are all in the green though is the relative underperformer amid additionalBasic Resources monitoring from China re. iron ore.

Top European News

- U.K. Incomes See Biggest Squeeze Since 2014 as Inflation Bites

- HSBC Said to Face ‘Disruptive’ Review of Credit Risk Reporting

- Glencore Sets Aside $1.5 Billion as Graft Probes Near End

- Engie Hikes Dividend 60% as Energy Price Surge Lifts Profits

In FX, the greenback slips as markets draw encouragement from Russia recalling troops after completing drills. Euro especially relieved by less perceived risk of imminent invasion of Ukraine. Pound perky as risk sentiment picks up and UK earnings exceed expectations. Kiwi and firm as NZ and China improve FTA terms.Yuan Rouble up as Russia’s Lavrov says dialogue with West to continue and results are achievable.

In commodities, crude benchmarks were hit on the reported withdrawal of some Russian troops, in an unwinding of geopolitical premia after a relatively uneventful APAC session. Pressure that sent below the USD 94.00/bbl mark, for instance. Brent Spot gold/silver also deteriorated on the above update, as havens across the board waned; albeit, the yellow metal retains USD 1850/oz. China’s NDRC and SAMR will reportedly be holding a meeting on iron ore in Qingdao on Feb 17th; Glencore (GLEN LN) and Trafigura are among those required to submit recent transaction data and port stockpiles, according to Chinese press. Iraq Federal Court deems Kurdish oil and gas law as unconstitutional, State News reports. Barclays raised its WTI and Brent price forecasts, both by USD 7/bbl, to USD 89/bbl and USD 92/bbl respectively, according to Reuters.

In fixed income, core bonds back off in tandem with some Russian forces returning from drills. Gilts hold up better after well received 2032 DMO issuance in contrast to a so-so German Bobl sale. US Treasuries bear-steepen awaiting Wednesday’s 20 year note supply.

In crypto, bitcoin continues to pick up and back away from a potential test of the USD 40k mark to the downside following pressure emerging at the tail-end of last week/over the weekend.

In geopolitics:

- Kremlin spokesperson Peskov said Russian President Putin is “willing to negotiate”, has always demanded negotiations and diplomacy; adding the Ukraine crisis was only one part of Russia’s larger security concerns, via CNN.

- US State Department advises US citizens to immediately depart Belarus, according to Bloomberg.

- US is reportedly closing its embassy in Kyiv and relocating diplomatic operations to Western Ukraine. US State Department ordered destruction of computer equipment amid warnings of Russian invasion, according to WSJ.

- Russia military says it is continuing set of drills involving almost all districts and navies, Interfax reports; some Western and Southern units are set to return to bases.

- Russian Kremlin says that warnings from the US that Russia is going to launch a fresh attack on Ukraine on Wednesday is “baseless hysteria”, via Reuters.

- Russian lawmakers vote in favour of sending a resolution on the recognition of two breakaway regions in Eastern Ukraine to President Putin, via Reuters.

- EU’s Borrell says if there is a war between Ukraine and Russia, Nordstream 2 will not become operational, via Reuters.

- Biden admin officials are reportedly running out of patience regarding talks on China’s shortfalls under the Phase One deal, but the White House plans to let the talks play out before considering the next steps, according to Bloomberg sources. This is in-fitting with reports from last Monday.

- There are reports of Houthi militias firing a ballistic missile at Marib, Yemen, according to Al Arabiya

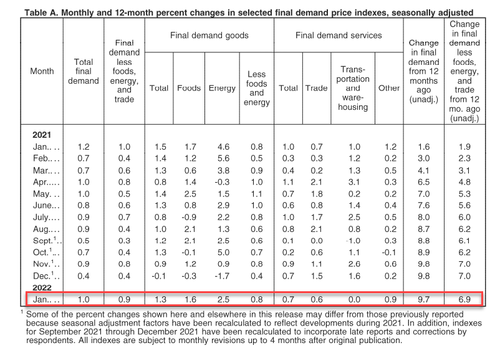

US Event Calendar

- 8:30am: Jan. PPI Final Demand MoM, est. 0.5%, prior 0.2%, revised 0.3%; YoY, est. 9.1%, prior 9.7%

- 8:30am: Jan. PPI Ex Food and Energy MoM, est. 0.5%, prior 0.5%; YoY, est. 7.8%, prior 8.3%

- 8:30am: Feb. Empire Manufacturing, est. 12.0, prior -0.7

- 4pm: Dec. Net Foreign Security Purchases, prior $137.4b

DB’s Jim Reid concludes the overnight wrap

Yesterday was a wild ride back and forth across what were relatively restrained ranges given all the newsflow. Headlines bounced about all over the place so it was hard to keep up. However in something I’ve never seen before, late quotes from the Ukrainian President that Russia would attack tomorrow, were soon rowed back by his office as “sarcasm”. I’m not sure if I’ve ever known a better use of the phrase “lost in translation”.

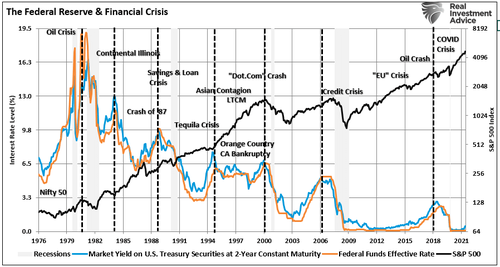

Starting in Europe, markets began the week catching up to the negative headlines that broke late on Friday. Optimistically, by the middle of the day, comments from Russian Foreign Minister Lavrov to President Putin that diplomacy should continue and there was still a chance of a deal helped to stabilise various assets. Focus then turned back to global monetary policy tightening, where comments from officials echoed what they said last week. St. Louis Fed President Bullard, much like last week, preferred a more aggressive path of policy, reiterating in a CNBC interview that he wanted 100bps of rate increases by July 1, saying that “our credibility is on the line here and we do have to react to data.”

This led to a big reversal in fixed income which peaked around the European close. Initially European sovereign yields sold off nearly 10bps in the morning but closed only marginally lower with 10yr bunds (-1.3bps) and OATs (-0.4bps) making a sharp about turn. Gilt yields actually rose across the curve, with the 10yr yield up +4.5bps to a 3-year high of 1.59% as overnight index swaps priced in a more aggressive series of rate moves this year. In keeping with the pattern of recent days, there was yet another widening in peripheral spreads, with the gap between Spanish and German 10yr yields moving above 100bps for the first time since June 2020, whilst the gap between Italian and German yields hit 169bps, the highest since July 2020.

The day was awash with headlines. Earlier U.S. officials reportedly had satellite images of Russian troops moving to attack positions which caused a wobble, but the big one was the headline from Ukraine’s President that was later put down to sarcasm.

Before the clarification, the headlines drove a discrete risk-off cross-asset price response, with 10yr yields falling around -7bps from their intraday highs, the S&P 500 dipping to session lows, and safe-haven currencies appreciating. Most assets stabilised for the remainder of the afternoon, however, as markets digested the misunderstanding. Next stop is German Chancellor Scholz’s planned trip to Moscow today. Expect plenty of headlines.

Treasury yields still wound up increasing across the curve after all was said and done, albeit below intraday highs, with 2yr yields (+7.5bps) outpacing 10yr yields (+5.0bps) on the continued hawkish tone from Fed officials combined with deteriorating risk sentiment. This drove the 2s10s curve to 41.0bps, the flattest level since August 2020. Fed funds futures are pricing 6.6 rate hikes by the end of 2022, the highest closing reading so far, and around +164bps of tightening, just below our US econ team’s updated call for +175bps of tightening this year.

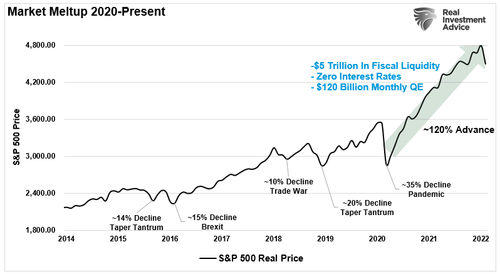

For equities, the continued geopolitical tensions and the move to price in additional rate hikes led to further declines and the S&P 500 shed another -0.39%, well off the intra-day lows (-1.22%) but bringing its losses since January’s all-time high to -8.23% (-7.65% YTD). Growing volatility saw the VIX index rise a further +1.27pts, hitting 28.6pts, and Bloomberg’s index of US financial conditions fell to its least accommodative level in 3 weeks. US tech stocks outperformed, with the NASDAQ flat and the FANG+ up +0.57%. Over in Europe, where markets had been closed on Friday when the Ukraine headlines came through, the STOXX 600 lost a larger -1.83% (-2.99% at the day’s lows).

Looking at some of the most affected assets, oil prices took another leg higher after the geopolitical headlines, echoing Friday’s surge, with Brent Crude up +2.16%, whilst WTI saw a somewhat bigger gain of +2.53%. That marked the highest closing level for both since 2014. Furthermore, European gas prices remained elevated with a further +4.32% gain, but at €80.77/MWh it was still roughly in line with where they’d spent most of January. Growing appetite for haven assets was very good news for gold however, which advanced +0.6% in its 6th gain in the last 7 sessions, and 9 of the last 11, eclipsing its recent closing peak back in November.

Overnight in Asia, equity markets are mostly trading lower. In Japan, the Nikkei (-0.74%) has reversed its early morning gains after Japan’s economy expanded at an annualized rate of +5.4% q/q, less than the consensus estimate of +6.0%. For 2021, the nation’s economy grew +1.7%, recording its first expansion in three years after contracting -4.5% in 2020 and -0.2% in 2019. Meanwhile, the Kospi (-1.06%) and the Hang Seng (-1.14%) are both also trading lower. Elsewhere, the Shanghai Composite (+0.40%) and the CSI (+0.93%) are trading up after the People’s Bank of China (PBOC) injected cash via policy loans for a second consecutive month to counter the economic slowdown. The PBOC pumped in a net amount of 100 billion yuan ($15.7 billion) in the banking system via its medium-term lending facility (MLF). The MLF rate was kept unchanged at 2.85% after being cut from 2.95% last month.

Separately, oil prices are touch lower with Brent crude futures down -0.69% to $95.81/bbl while US crude futures -0.76% to $94.73/bbl. US treasury yields are 1-2bps across the curve.

Looking ahead, equity futures in the DM are relatively flat with contracts on the S&P 500 (+0.08%), Nasdaq (+0.20%) and DAX (+0.02%) waiting for fresh newsflow.

There wasn’t much on the data front yesterday, though we did get the New York Fed’s Survey of Consumer Expectations for January, which interestingly saw a decline in short and medium-term inflation expectations. In fact, short-term inflation expectations at the one-year horizon fell to 5.8%, the first decline since October 2020, whilst 3-year ahead expectations fell to 3.5% from 4.0% which was a bit surprising given all that we’ve seen and heard of late.

To the day ahead now, and data releases from the US include January’s PPI and the February Empire State manufacturing survey. Meanwhile in Europe, there’s UK unemployment for December, the German ZEW survey for February, and the second estimate of the Euro Area’s Q4 GDP. Otherwise, central bank speakers include the ECB’s Villeroy, and earnings releases include Airbnb.