Authored by Robert Murphy via The Mises Institute,

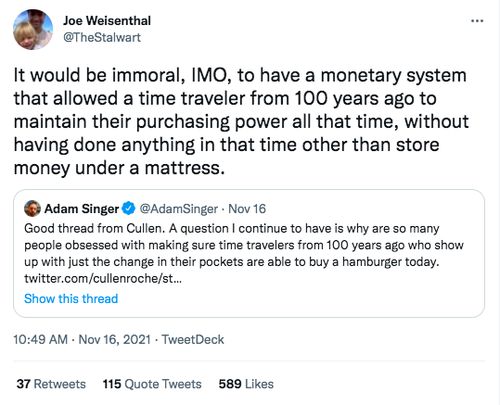

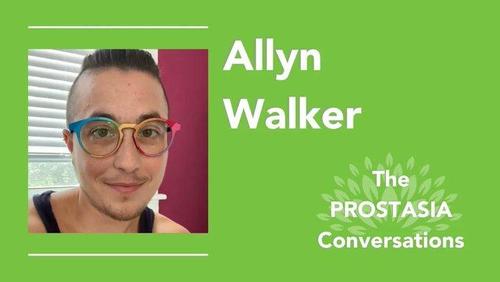

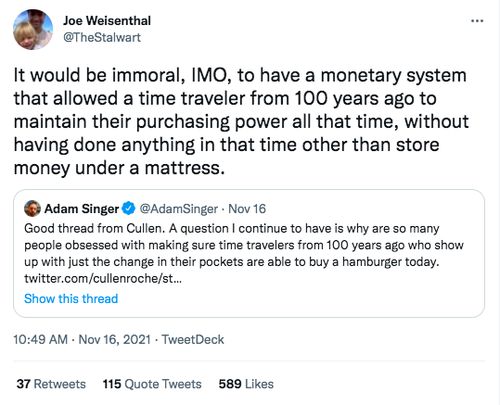

Joe Weisenthal is an editor and host at Bloomberg who has recently been using his large Twitter platform to cast stones at the inflation hawks. In one recent thread, Weisenthal mocked the people worried about the falling purchasing power of the US dollar, and claimed in fact that it would be immoral for currency to maintain its value over time.

As we’ll see, although Weisenthal’s thought experiment of a time traveler is a bit whimsical, it provides a good opportunity for us to explore the underlying economics. The whole episode underscores, once again, why the Austrian school provides the public with a beacon of light amid the confusion of our financial punditry.

Weisenthal’s Time Traveler

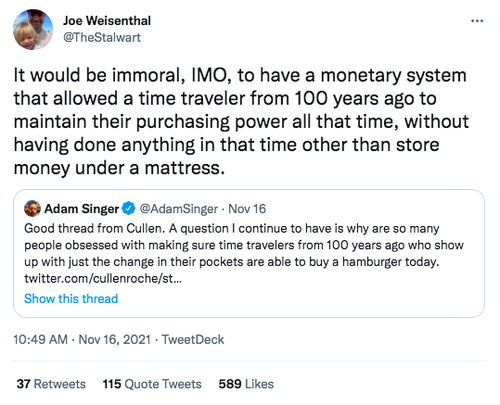

Below is the original tweet, which is largely self-explanatory, though interested readers can see me grappling with Weisenthal by clicking here.

In context, Weisenthal (and Adam Singer) are poking fun at the Ron Paul–types who are upset at the steady decline in the dollar’s purchasing power since the Fed was formed in late 1913. Weisenthal thinks it is absurd to expect that actual currency would maintain its market value over the course of a century. Why, what would such a “hoarder” have done to benefit society all that while?

Shrinking the Time Scale

To cut to the chase, Weisenthal is completely mistaken: there was nothing immoral about the classical gold standard and its maintenance of the dollar’s purchasing power over long stretches. But it will be easier to pinpoint the flaw in Weisenthal’s thinking if we first consider a simple story.

Suppose Joey is a teenager who cuts lawns for extra income and he typically makes $25 a weekend. Joey wants to buy a $300 Xbox, so he saves his weekly lawn-mowing money under his mattress. After three months, Joey takes the saved $300 in cash to the mall and buys the coveted electronics.

Does Joe Weisenthal have a problem with this scenario? Did the market economy function immorally by allowing Joey to transfer his purchasing power from the start of the summer to the end of the summer? Was Joey supposed to have done something in addition to cutting lawns to earn the ability to defer his potential consumption through time?

I trust Weisenthal would not object to Joey saving up his currency over the summer. But then, what is the principled difference between Joey’s three-month deferral and Weisenthal’s time traveler who executed a hundred-year consumption deferral?

Present Goods Trade at a Premium for Future Goods

In fact, not only should a time traveler not be penalized for deferring consumption a century, he should be actively rewarded. This is because present goods are more valuable than future goods. (Note that we are here getting into some very technical issues. The interested reader can check out my three-part podcast series—one, two, and three—to hear the intricate details of interest theory in the Austrian tradition.)

So to go back to the original tweets, if a guy in 1921 has two quarters in his pocket, and that would be enough for him to buy a delicious hamburger, then for his willingness to effectively trade away his 1921 hamburger for a burger to be delivered in 2021, the guy should at least get to trade at par. And in fact, he would (normally) be able to obtain a promise for more than one burger in the future, since the former are more valued. (This is no more mysterious than one present burger trading for more than one present hot dog.)

It’s easy to understand why, subjectively, people would need to be promised a greater number of goods in the future to give up potentially consuming their goods today. But how, mechanically, can the borrowers deliver on these promises? How is it possible, technologically speaking, to transform 100 units of present goods into (say) 150 units of future goods?

The answer is that the longer we are willing to wait, generally speaking, the greater physical output we can obtain for a given amount of today’s inputs. Eugen von Böhm-Bawerk famously referred to the superior physical productivity of wisely chosen, more roundabout processes. For example, if a man is in the woods and wants to get water from a stream into his nearby cabin, he has different techniques he could use.

A very fast and direct method is to cup his hands and run back and forth from the stream to his cabin. This delivers some water to his cabin very quickly, but the yield—measured in gallons of water per hour of his labor—is also very low.

An intermediate method would be to hollow out two coconuts to make little buckets, and then go back and forth armed with the newly created capital goods. This would take longer to get the initial water to his cabin, but once the process is underway, it would deliver far more gallons per hour of invested labor—even including the time spent constructing the buckets.

Finally, the man might take several months digging a small path from the stream to his cabin, so that the water flowed directly to him. Once completed, his renovations would be extremely productive if we measure in terms of water volume per hour of his labor time.

And so we see society would be willing and able to reward Weisenthal’s hypothetical time traveler for earning $100 in 1921 and then postponing his consumption for a century. The real resources that would have gone into satisfying him in 1921 would be freed up to be invested in longer processes, which had a higher physical yield. To put it simply, it makes perfect sense that a 1921 hamburger would trade on the forward market for several 2021 hamburgers.

Bonds versus Cash

We can really see the weakness in Weisenthal’s analysis if we suppose the time traveler took his original cash and deposited it into a savings account at the bank. Would it be immoral for a bank account to have $100 in 1921, and to grow to more than that amount by 2021?

Or for another example, what if the time traveler from 1921 initially bought a very long-term bond that would come due in 2021? The time traveler jams the bond into his pocket, activates the time machine, and shows up at Weisenthal’s doorstep. He asks Joe to help him cash his matured bond (and working at Bloomberg, Weisenthal is just the guy). The time traveler is pleased to discover that the nominal interest he earned on the hundred-year bond is just enough to have maintained his purchasing power, since goods are much more expensive than the traveler is used to seeing. Has the market economy behaved immorally by allowing such a transaction to occur?

In principle, the same type of intertemporal trade occurs if people invest their savings not in bank account balances or bonds, but instead in the accumulation of actual cash. Even here, the initial drop in consumption frees up real resources that can be channeled into the production of a greater amount of future goods. As Ludwig von Mises explains in Human Action:

If an individual employs a sum of money not for consumption but for the purchase of factors of production, saving is directly turned into capital accumulation. If the individual saver employs his additional savings for increasing his cash holding because this is in his eyes the most advantageous mode of using them, he brings about a tendency toward a fall in commodity prices and a rise in the monetary unit’s purchasing power. If we assume that the supply of money in the market system does not change, this conduct on the part of the saver will not directly influence the accumulation of capital and its employment for an expansion of production. The effect of our saver’s saving, i.e., the surplus of goods produced over goods consumed, does not disappear on account of his hoarding. The prices of capital goods do not rise to the height they would have attained in the absence of such hoarding. But the fact that more capital goods are available is not affected by the striving of a number of people to increase their cash holdings. If nobody employs the goods—the nonconsumption of which brought about the additional saving—for an expansion of his consumptive spending, they remain as an increment in the amount of capital goods available, whatever their prices may be. Those two processes—increased cash holding of some people and increased capital accumulation—take place side by side.

It is a fascinating topic to ponder the ideal money (if such a concept makes sense) and whether its purchasing power would fall, rise, or remain steady over long periods. What we can say for certain is that rapid and unpredictable changes are undesirable, because a wildly fluctuating money defeats the effectiveness of monetary calculation, which is one of the underpinnings of civilization itself. To wit, double-entry bookkeeping only works when the money units of revenues and costs are comparable.

Conclusion

Contrary to Joe Weisenthal’s musings, there is nothing immoral if a money retains its purchasing power over long stretches. In general, when people channel their savings into conventional vehicles (such as bank accounts or bonds), this frees up real resources that can be used to yield a greater physical amount of output down the road. In principle, holding currency could be merely a different financial asset for achieving the same purpose.