Bill Dudley Pretends To Care About Savers, Says Only Congress Can Fix Mess Fed Has Created

Tyler Durden

Wed, 10/28/2020 – 12:57

While not nearly as provocative as his mid-2019 op-ed, in which former NY Fed president and Goldman partner Bill Dudley urged the Fed to crash the market to prevent a Trump re-election, which had the dramatic effect of a loud fart in a crowded room as countless “serious” pundits did everything they could to avoid discussing the fact that a former Fed official admitted that the central bank is i) more powerful than the president and ii) can arbitrarily manipulate markets at will, earlier today Bill Dudley took to his favorite media outlet this morning, and in a Bloomberg op-ed (which apparently nobody has read judging by the 3 comments after it), was forced to “explain” that the Fed is not bluffing when it begs Congress to inject trillions into the economy because – you see – after a decade of the Fed doing just that and enabling the terminal political dysfunction and polarity observed in US politics, the Fed no longer can do it.

As Dudley puts it, while no “central bank wants to admit that it’s out of firepower… unfortunately, the U.S. Federal Reserve is very near that point. This means America’s future prosperity depends more than ever on the government’s spending plans — something the president and Congress must recognize.”

He’s right: yet one wonders why it took the Fed 11 years to realize it. After all, every time the US economy needed a quick sugar high, it was not Congress but the Fed that stepped in to inject trillions in liquidity, or cut rates, or both, and since this calmed markets, it remove all political incentive and desire to take the difficult and in most cases, unpopular political decisions that would have created a Congressional tradition of passing fiscal stimulus when the need arose, in the process helping the economy not the markets. But since this never happened, one can make an argument that it was the Fed that set the stage for the kind of political chaos and lack of consensus that has led to not only Trump but the most polarized political and social environment in US history.

While Dudley will never admit any of this, he at least concedes something else we have said for the past 11 years: by pulling demand from the future by cutting rates and injecting liquidity, the Fed has merely doomed the economy to even more pain in the future. Note – not the market, which is at all time highs – but the economy, as even Dudley admits. This is how Dudley hopes to convince Congress that after doing everything to push stocks up, even if it meant zero impact for the economy, it no longer can do even that:

There’s always something more that the Fed can do. It can push down longer-term interest rates by buying more Treasury and mortgage-backed securities, or by committing to keep buying for a longer period of time. It can promise to keep short-term interest rates lower for longer, or until inflation and the unemployment rate reach their targets. It can put a specified ceiling on long-term interest rates (a maneuver that economists call yield-curve control). It can even take interest rates negative (a move that Fed officials have so far rejected).

But this misses a crucial point. Even if the Fed did more — much more — it would not provide much additional support to the economy.

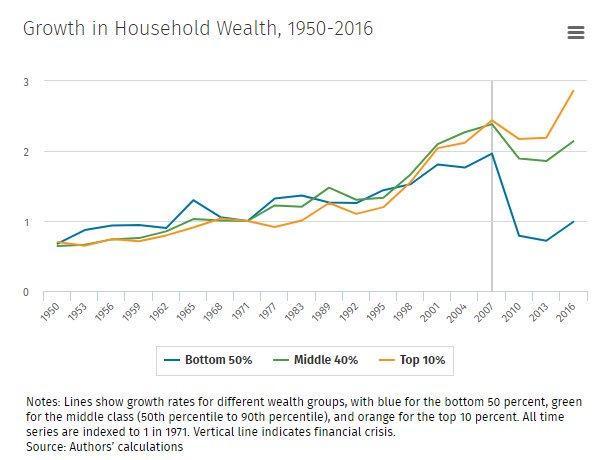

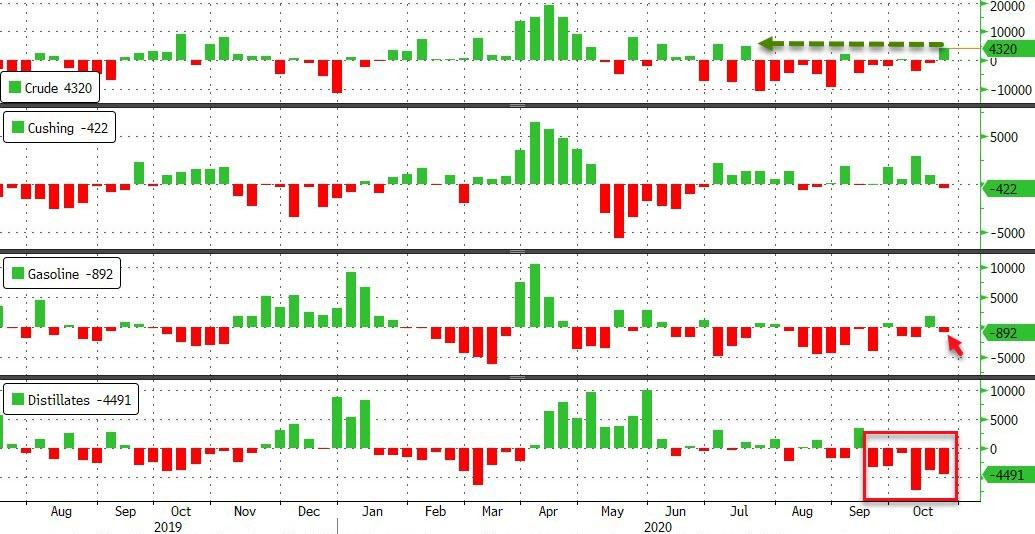

And there it is: “the economy”, not the market, because unlike fiscal stimulus which at least makes it way to the lower wealth tiers, monetary stimulus only helps markets and the 1%, something we have discussed so extensively in the past we even dubbed the US a banana republic thanks to the Fed’s “tools.”

Dudley then tries to convince his readers that everything that the Fed has done is now toothless and anything else it could do, may well be worthless:

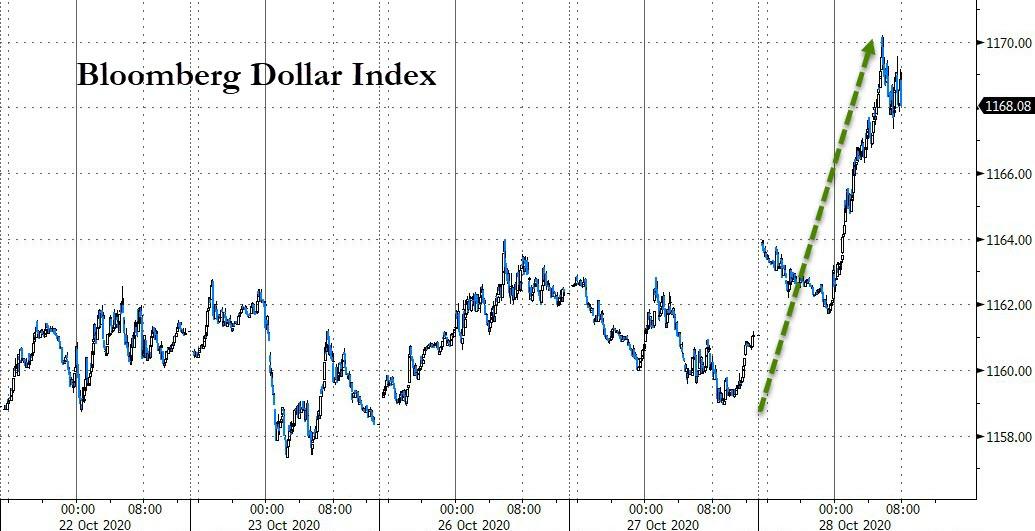

Interest rates are already about as low as they can go, and financial conditions are extremely accommodative. Stock prices are high, investors are demanding very little added yield to take on credit risk, and a weak dollar is supporting U.S. exports. The rate on a 30-year mortgage stands at about 3%. If the Fed managed to push that down by another 0.5 percentage point, what difference would it make? Hardly any. The housing market is already doing very well.

Well, yes, but someone has to push the S&P500 to 5,000, 10,000 or more: after all the banks that are the owners of the Federal Reserve desire nothing more than higher asset prices. Oddly enough, they got their wish for the past 11 years, and it is only now that the Fed suddenly has this brilliant “eureka” moment that whatever it did never really made its way to the economy, especially when looked over a longer time interval as Dudley admits next:

… the stimulus provided by lower interest rates inevitably wears off. Cutting interest rates boosts the economy by bringing future activity into the present: Easy money encourages people to buy houses and appliances now rather than later. But when the future arrives, that activity is missing. The only way to keep things going is to lower interest rates further — until, that is, they hit their lower bound, which in the U.S. is zero.

It was his next observation that was especially ominous: according to Dudley the Fed (i.e., monetary stimulus) has “already pushed bond and stock prices to such high levels that future returns will necessarily be lower.” In other words, in a world in which stocks must rise every year to boost the net worth of the average (if not median) American, the Fed has set the seeds for the next market crash. To wit:

When interest rates stay low for long enough, the policy can even become counterproductive. In the U.S., monetary stimulus has already pushed bond and stock prices to such high levels that future returns will necessarily be lower. Assuming stable valuations, expected equity returns over the next decade are probably no greater than 5% or 6%. The 0.7% yield on the 10-year Treasury note doesn’t even cover expected inflation.

Which brings us to the peak “bloodboiling” moment in Dudley’s idiotic screed, the one where the millionaire ex-Goldmanite hits peak hypocrisy when he suddenly pretends to give a shit about savers being unable to live on zero interest rates:

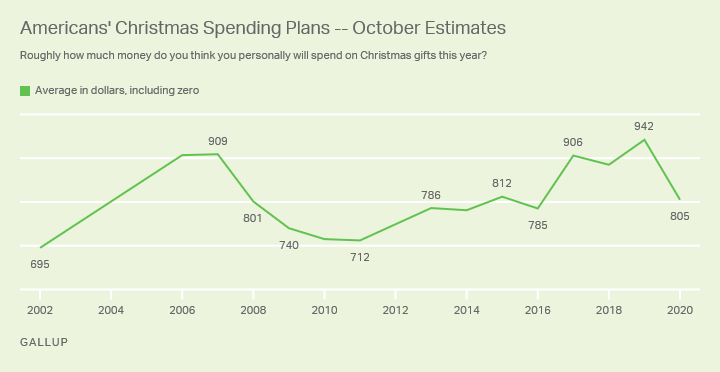

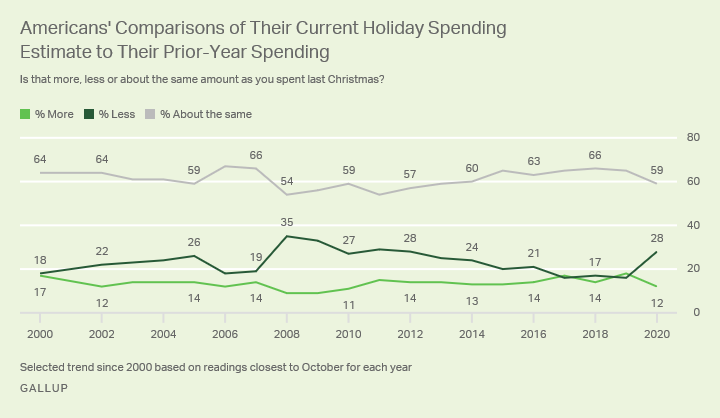

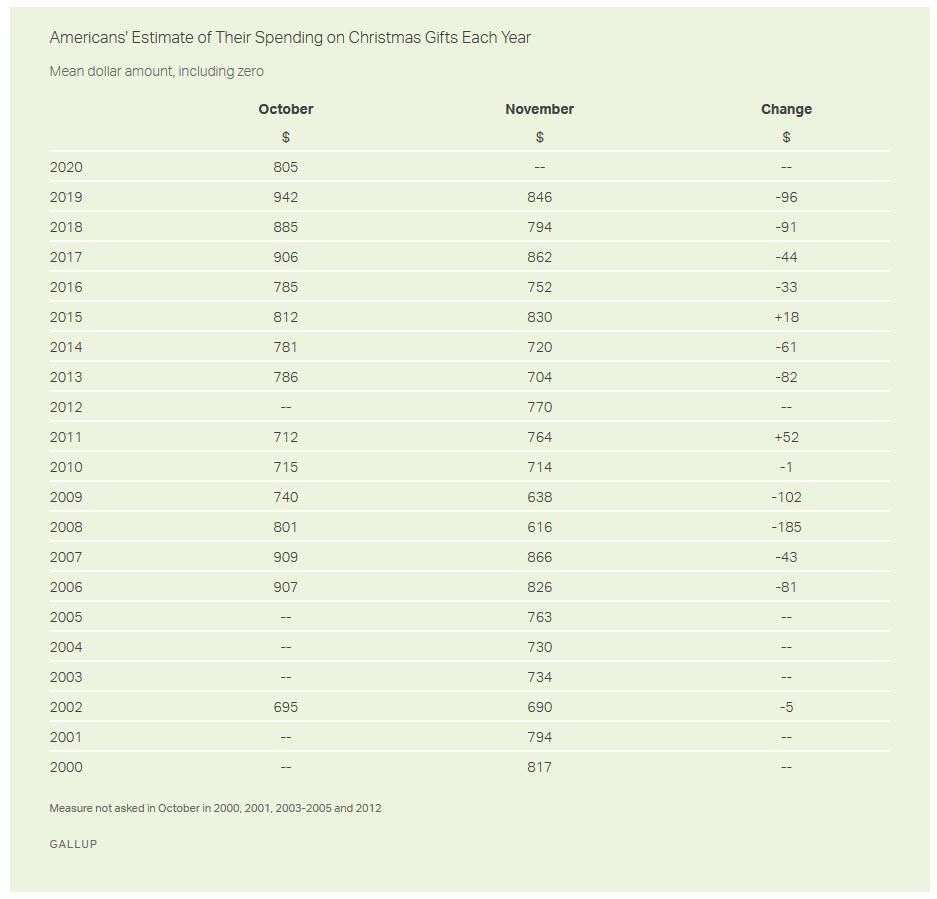

As a result, people will have to save more to reach their objectives, be they a secure retirement or sending their kids to college. That leaves less money to spend.

If only there was some entity that sets interest rates.

But wait, it gets better, because more than 10 years after first cutting rates to zero the Fed, in all its academic brilliance, discovers that this action has consequences:

Even if people don’t save now, low returns will eventually take a toll. State and local pension funds, for example, will fall even shorter of what’s need to cover their obligations. To make up the difference, officials will either have to raise taxes or cut benefits for pensioners. Either action will leave people poorer, depressing consumer spending and economic growth.

So having gotten the US into this epic mess, where for years and years not a single Fed official had the brilliant moment of insight that just hit Dudley, the former NY Fed president has a solution: punt the epic shitstorm it has created to Congress.

What to do? No doubt, Fed officials should still commit to using all their tools to the fullest. But they should also make it abundantly clear that monetary policy can provide only limited additional support to the economy. It’s up to legislators and the White House to give the economy what it needs — and right now, that means considerably greater fiscal stimulus.

Are to conclude then that what the Fed did for the past 11 years was not giving the economy what it needs? And if so, who benefited from the Fed’s $7 trillion balance sheet?

Don’t answer that’s rhetorical.

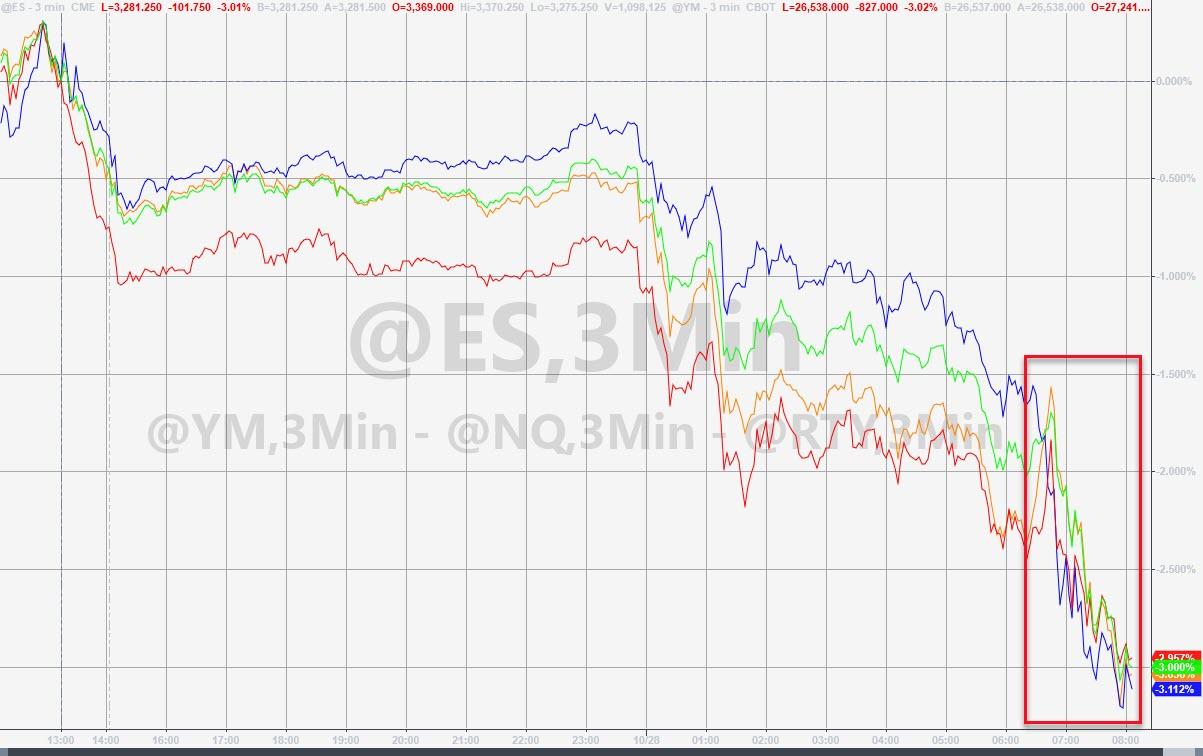

And here is another rhetorical question: could the market selloff have anything to do with ensuring Trump is not re-elected? We will give the podium again to Dudley and the conclusion to his August 2019 op-ed:

I understand and support Fed officials’ desire to remain apolitical. But Trump’s ongoing attacks on Powell and on the institution have made that untenable. Central bank officials face a choice: enable the Trump administration to continue down a disastrous path of trade war escalation, or send a clear signal that if the administration does so, the president, not the Fed, will bear the risks — including the risk of losing the next election.

There’s even an argument that the election itself falls within the Fed’s purview. After all, Trump’s reelection arguably presents a threat to the U.S. and global economy, to the Fed’s independence and its ability to achieve its employment and inflation objectives. If the goal of monetary policy is to achieve the best long-term economic outcome, then Fed officials should consider how their decisions will affect the political outcome in 2020.

And now you know.

via ZeroHedge News https://ift.tt/37M5f0Q Tyler Durden