Republicans keep trying to turn everything into a fight over Section 230. With President Donald Trump threatening to veto both a defense spending measure and an omnibus bill to fund government programs, Sen. Lindsey Graham (R–S.C.) is suggesting this could change if Democrats throw an anti-Section 230 clause into the mix.

Section 230—a federal communications law that helps protect free speech and free enterprise online—has become a scapegoat for bipartisan ire at big tech companies and all sorts of conservative gripes about social media.

After failed attempts to diminish Section 230 by executive order, Trump said last week he wouldn’t sign a bill to fund the military unless it randomly contained a section targeting Section 230. Now, Trump could be conditioning support for any government funding bill on that same deal.

The omnibus bill—which includes a COVID-19 relief package—passed the House and Senate on Monday. But Trump says he won’t sign, calling it “a disgrace” and “wasteful,” while also demanding that payments to individuals be raised from $600 to $2,000.

The latter amount was what Democrats originally pushed for, and Democratic leaders in Congress have leapt on Trump’s mandate to make individual stimulus checks bigger.

Trump’s concern for upping individual stimulus checks seems to be tied up in his ambitions of overturning the 2020 election results.

In his Tuesday video, Trump said he’s “asking Congress to immediately get rid of the wasteful and unnecessary items from this legislation, and to send me a suitable bill, or else the next administration will have to deliver a covid relief package, and maybe that administration will be me.”

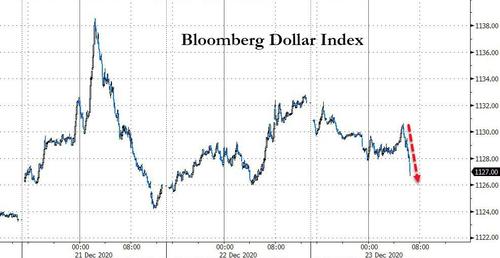

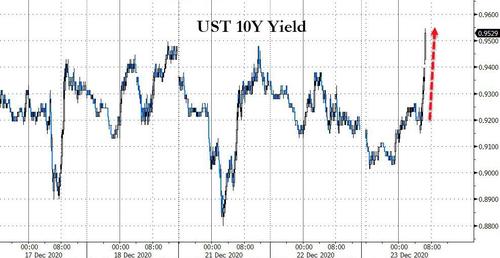

The video “landed like a sonic boom in Washington. His own aides were stunned,” says The Washington Post. “Congressional aides were stunned. Stock market futures quickly slumped on the prospect that the economic aid could be in doubt. And the implications for what happens next could be severe. If he refuses to sign the bill, the government will shut down on Dec. 29. The $900 billion in emergency economic aid will be frozen, and the race for the two Senate seats in Georgia could also be upended.”

Trump’s issue seems to be with the whole omnibus spending bill, though he keeps erroneously referring to that as the COVID-19 relief package. The latter is part of the former—a $900 billion chunk of $2.3 trillion in spending.

It’s the larger bill—which covers everything needed to keep the government running through the next year and more—that contains items like $1 billion for the creation of two new Smithsonian museums and $10 million for “gender programs” in Pakistan.

“To be sure, the president’s broadsides against a spending deal that includes lots of money for ‘lobbyists, foreign countries, and special interests’ is certainly welcome, and, frankly, on target,” writes Reason‘s Christian Britschgi. “The trouble is that the conditions Trump outlined for supporting relief legislation would make the bill much worse.”

Adding a Section 230 overhaul to those conditions would only compound the damage more. Abolishing or weakening it would be bad for internet users and companies at any time, and especially during the pandemic when tech platforms and tools have become even more vital. There’s no way legislators should be tucking such a monumental measure into an omnibus spending bill plus COVID-19 relief package as some sort of presidential extortion plan.

FREE MINDS

For the second time this month, a Columbus, Ohio, police officer has fatally shot an unarmed black man. The man’s name has not been released. Officers were wearing body cameras but did not have them turned on.

“If you’re not going to turn on your body-worn camera, you cannot serve and protect the people of Columbus,” Mayor Andrew Ginther said at a press conference. “I have asked Chief [Thomas] Quinlan to remove the officer involved of duty and turn in his badge and gun.”

Earlier this month, “law enforcement fatally shot 23-year-old Black man Casey Goodson as he entered his grandmother’s home,” notes NBC News. “The investigation into his death, which drew national headlines, is ongoing.

FREE MARKETS

Even big chain stores in New York City are taking a pandemic hit, with one in seven shutting down this past year. From the New York Post:

Some 1,132 chain stores — including 70 Duane Reades, 54 Starbucks and 22 Papyruses — have waved the white flag over the past 12 months, according to the Center for an Urban Future’s annual “State of the Chains” report, set to be released Wednesday.

The 14.2 percent decline shatters all previous records reported by the nonprofit agency since it began tracking the data 13 years ago. Last year, just 3.7 percent of all chain outlets closed, up from 0.3 percent in 2018.

QUICK HITS

• The pandemic has brought out a new sexual puritanism, suggests New York Times op-ed writer Megan Nolan.

• Mike Solana offers some unconventional wisdom on why tech companies are leaving Silicon Valley.

• Ma Rainey’s Black Bottom “has plenty of speechifying, but no sermonizing; it’s more interested in exploring different worldviews, the way they clash and conflict sometimes come together, than in asserting its own,” writes Reason‘s Peter Suderman.

• “People should be able to engage with the counselor who can best meet their needs wherever they live and continue seeing that counselor if they move across the country,” suggests Elizabeth Brokamp, a therapist challenging D.C. occupational licensing laws. “I hope my case can start removing senseless boundaries to teletherapy.”

• The spending bill is decriminalizing dressing up like Smokey the Bear.

• “About 40 migrant women who were held at a Georgia detention center have filed a class-action lawsuit alleging they were subjected to medical abuse through nonconsensual or unnecessary procedures while in the facility,” reports NBC News. “The complaint, filed late Monday in the U.S. District Court for the Middle District of Georgia, also claims women at the Irwin County Detention Center were retaliated against for speaking out against Dr. Mahendra Amin, of Ocilla, Georgia, who has been accused of the medical abuse.”

from Latest – Reason.com https://ift.tt/3mJeMJX

via IFTTT