Minnesota is poised to join the panic-driven crusade against vaping, a move that’s guaranteed to drive even more business through well-established smuggling channels.

In Minnesota, as elsewhere, cigarette smuggling is well established. In a 2012 article, Tax Foundation economist Patrick Fleenor traced the black market import of smokes right back to the imposition of a tax in 1947.

“By the mid-1950s, official figures show, the sale of legal, tax-paid cigarettes had plunged 20 percent below the national level,” Fleenor wrote. “Frustrated by the inability to collect the taxes due, the state’s chief cigarette tax administrator quipped that ‘even the attorneys who come into my office are smoking untaxed cigarettes.'”

Decades later, the Minnesota Department of Revenue touts new law enforcement efforts intended to recover “hundreds of thousands of dollars” in lost tobacco taxes because of cigarettes smuggled from elsewhere. The sources include Indiana, where the 99.5 cent per pack tax offers real savings to Minnesota consumers who balk at paying their state’s $3.59 per pack take.

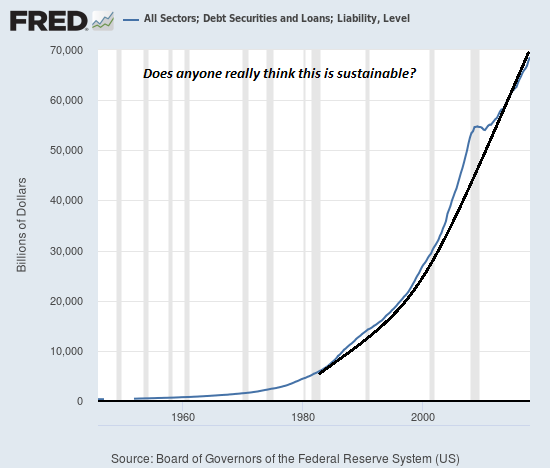

Well, good luck with that. As Fleenor pointed out in 2012, officials have been trying to collect all of the revenue they believe they’re due since the middle of the last century. And as they’ve pushed the tax rate ever-further, the gap has widened between what they want to collect and what they actually take in.

The Mackinac Center for Public Policy, which tracks tobacco smuggling nationally, estimates that illegally imported smokes now account for 34.62 percent of all cigarettes sold in Minnesota. That takes about a $300 million dollar bite out of revenue.

“Lawmakers often think that raising cigarette taxes are a ‘win-win’—generating more revenue for state government and improving public health by making it harder to legally purchase cigarettes,” note Mackinac’s Michael D. LaFaive and Todd Nesbit. “Studies suggest, however, that states with high excise taxes are more likely to have high cigarette smuggling rates.”

Minnesota has fueled a highly lucrative black market in tobacco products simply by raising taxes high enough to make it extremely profitable for small entrepreneurs and big criminal networks alike to smuggle in smokes from places where tobacco can be purchased more cheaply. That means Indiana, of course. But with enough money at stake, there’s now a booming trade in counterfeit cigarettes from overseas.

If high taxes on readily available goods create illegal markets, just imagine what happens under restrictions and outright bans that make products available only from illegal sources. As we’ve seen during Prohibition and with the War on Drugs, it drives willing consumers to underground dealers.

And it’s about to happen around the country again, with Massachusetts and Michigan already imposing tough restrictions on e-cigarettes, and Minnesota’s Governor Tim Walz favoring a ban on all flavored vaping products.

The legal changes are largely a perverse panic-driven response to health dangers posed by black-market vaping products containing THC as well as a witches’ brew of other, potentially dangerous, ingredients. By banning legal vaping products, officials seem set on driving people back to the already-smuggled tobacco that they abandoned for safer e-cigarettes, and to create a new black market for underground vaping products.

“Smuggling of vaping products would likely become a new profit source for today’s large-scale cigarette smugglers,” warned Mackinac’s LaFaive when the anti-vaping panic set in among politicians last month. “They’ve already established networks in the state; adding supplies of small, flavored vaping cartridges or liquids to their supply chain would be all too easy.”

Evidence of increased demand for smuggled vaping products didn’t take long to surface.

“Smoke shops in New Hampshire say they’ve seen a surge in business after Massachusetts implemented a four-month ban on the sale of vaping products,” WBUR reported this week.

“I think it’s stupid that they banned it, and I’m going to keep vaping anyways,” one cross-border customer told reporters.

That’s the sort of motivated consumer who has already driven a quarter of the Bay State’s highly taxed cigarette market into the hands of criminal networks. Now politicians seem destined to hand a whole new product line to smugglers, while strengthening demand for their usual goods.

Actually, when we remember that the driving force behind vaping restrictions are health dangers associated with black market products containing THC, smuggled e-cigarettes and associated products aren’t a new line at all. They’re just an extension of an existing one.

“It seems there’s too much conflating these tragic lung injuries with store bought brands of regulated, legal e-cigs like Juul and NJOY; and far too little blaming THC, CBD, and bootleg nicotine vapes,” said former FDA commissioner, Scott Gottlieb.

Yup. And by conflating legal vaping products with black market ones, and e-cigarettes with tobacco, for the purposes of restrictions and bans, officials are delivering a large and lucrative market to underground operators who have a proven track record of defying laws and frustrating enforcers. Building that black market will very likely increase the dangers associated with goods produced and distributed by criminals rather than by legitimate businesses.

Whatever officials in Minnesota and elsewhere think they’re doing through endless press releases about the latest doomed effort to crack down on smuggled cigarettes—now joined by vaping products—they’re really just demonstrating their impotence. They long ago demonstrated that they’re not up to the task of fighting the black markets that their excessive taxes and restrictions create.

from Latest – Reason.com https://ift.tt/2MvMmD1

via IFTTT