By Jan Nieuwenhuijs of The Gold Observer

The more debt is being accumulated on the balance sheets of European central banks, the more likely they will revalue gold to write off this debt. When I asked the German central bank if they consider this option they replied: “at this stage, we prefer not to speculate about any potential decisions … that might or might not be taken in the future.”

“There is no limit on gold’s price.”

Kenneth Rogoff (2016)

Government debt to GDP levels in many countries are at all-time records and I’m not aware of any politician or economist that has outlined a clear strategy to lower the debt burden. Technically, there are six ways to lower government debt to GDP:

- Economic growth

- Default

- Higher taxes

- Austerity

- Debt relief

- Inflation

I don’t think option one, two, three and four are viable, which leaves debt relief and inflation. Inflation is currently elevated and shifting wealth from savers to debtors. But can inflation stay elevated and solve the debt problem without destabilizing societies? When people on lower incomes can’t make ends meet, they tend to revolt. Social instability leads to political instability, which leads to monetary instability, which leads to more social instability. In many countries, like the United States, we can already observe this doom loop.

Revaluing Gold to Write off Bad Debt

One possible solution is that central banks use unrealized gains of the gold on their balance sheet to write off sovereign bonds, providing debt relief to their governments. And when the unrealized gains aren’t sufficient (spoiler: for many countries the unrealized gains aren’t sufficient) central banks can revalue gold. Let’s have a look at how this works from an accounting perspective.

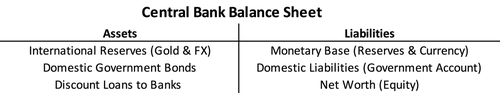

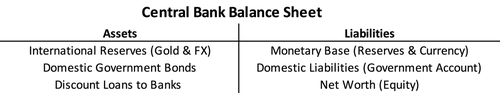

On the asset side of a central bank’s balance sheet the most important line items are international reserves (consisting of gold, foreign exchange and Special Drawing Rights), domestic government bonds and loans to banks. On the liability side the main items are the monetary base, domestic liabilities (such as an account for the government) and the central banks’ equity.

In double-entry bookkeeping something has to be written off on the liability side if on the asset side governments bonds are written off. What can it be? Of course, a central bank can use its capital (equity), but that’s far too little to cater any relief of substance. (Operating under negative equity could jeopardize a central bank’s credibility.)

Which brings us to gold. Because gold is the only international currency that isn’t issued by a central bank and thus can’t be printed, there is no limit to its price denominated in fiat currencies, which can and are printed. To illustrate, European central banks accumulated most of their gold during Bretton Woods when gold was valued at $35 dollars per troy ounce. At a current gold price of roughly $1800 dollars these central banks have unrealized gains worth hundreds of billions of dollars (denominated in euros on their balance sheet). How can these unrealized gains be used?

When the gold price rises the value of the gold on the asset side of a central bank’s balance sheet increases. At the same time, on the liability side of the balance sheet an equal increase will be recorded in what is referred to as a “revaluation account.” A gold revaluation account, which effectively has no limit, registers the unrealized gains on gold.

An example: the German central bank owns 3,359 tonnes of gold, which was purchased for €8 billion euros. Currently the gold is worth €173 billion euros, creating a gold revaluation account of €165 billion euros (173 – 8).*

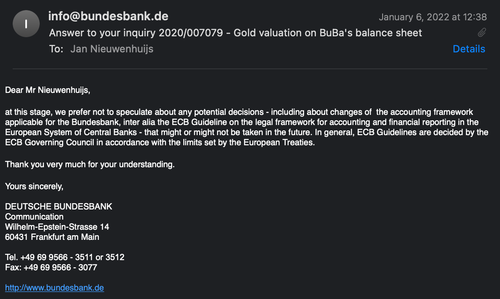

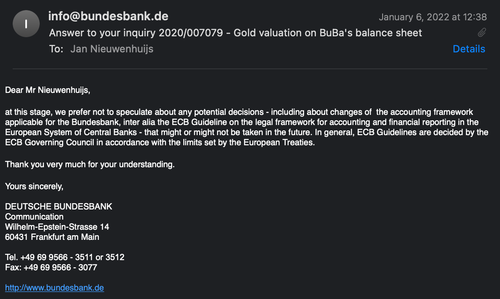

While researching this subject I asked the German central bank (the Bundesbank, or “BuBa” in short) if it’s possible to use gold’s revaluation account to write off bad debt. I tend to aim such questions at the Bundesbank because they always respond very quickly. I’m aware that Italy’s government debt is the elephant in the room, but these countries are part of the same monetary union and Germany is the main guarantor of the E.U. Recovery Fund (Next Generation EU). BuBa replied that according to the prevailing accounting rules any unrealized gains in gold can only be used for unrealized losses in gold, not for losses in assets such as U.S. dollars or European bonds. BuBa wrote me:

Gold’s revaluation account – on the balance sheets of European central banks – cannot be used to write off bad assets. According to Art. 15 e) on income recognition of the ECB Guideline on the legal framework for accounting and financial reporting in the ESCB “there shall be no netting of unrealized losses in any one security, or in any currency or in gold holdings against unrealized gains in other securities or currencies or gold”. Please have a look at CL2016O0034EN0010010.0001.3bi_cp 1..1 (europa.eu) for further information.

Case closed? No, because central banks can change the rules at will. Using gold’s revaluation account, for literally anything, has been done before and there is no reason why it can’t be done again. In the 1930s gold was revalued by central banks the world over—countries went off the gold standard and devalued against gold. In 1940 the Dutch government set the new official gold price at ƒ2,009 guilders per Kg. This made the Dutch central bank’s gold revaluation account equal ƒ221 million guilders, of which ƒ30 million guilders were used to cover losses on sterling assets. The rest was used for other purposes. Bear in mind, the Dutch did this because they knew the gold price couldn’t decline below the official price.

So, I asked BuBa why not use gold’s revaluation account and if needed revalue gold? After an unusual long silence, suggesting they carefully thought about what to reply, I received an email. For the sake of accuracy, below is a screenshot of the email with my questions and a screenshot of the email with their response.

They could have just said no, but they didn’t. They replied that, “at this stage, we prefer not to speculate” about changing the accounting rules and revalue gold to write off bad debt. Meaning, they don’t rule out this possibility. Also note, BuBa writes that “in general” the accounting rules are set “by the ECB Governing council in accordance with the limits set by the European Treaties.” Implying that there are exceptions.

Why did BuBa write this to me? Possibly, this was a signal for the market to revalue gold, saving BuBa the hassle of doing it themselves (printing money to buy gold). As a reminder, former Bundesbank President Jens Weidmann wrote in 2018 that gold is “the bedrock of stability for the international monetary system.” A comment that is anything but discouraging investors from buying gold and driving up its price. Weidmann added that gold is a “major anchor underpinning confidence in the intrinsic value of the Bundesbank’s balance sheet.” If gold is underpinning confidence in BuBa’s balance sheet, why wouldn’t it underpin confidence in investors’ balance sheets?

It’s impossible to furnish the Italian government substantial debt relief without revaluing gold. Italy’s government debt is €2.7 trillion euros, of which is €600 billion euros is held by the Italian central bank (Banca D’Italia, or BDI). BDI’s gold revaluation account is currently over €100 billion euros, so the gold price has to be multiplied by approximately five for BDI to be able to write off its domestic government bonds. Though, BDI can also continue to absorb debt, say, an additional €500 billion euros, and then revalue gold times ten.

A New Global Gold Standard

Revaluing gold to write off bad debt would require central banks to set a floor price for gold. If a central bank uses its revaluation account fully, the gold price ideally doesn’t fall back or this central bank will incur unrealized losses. As such, the central bank would need to stabilize the gold price, which is a form of a gold standard.

When it comes to revaluing gold Europe is most likely to take the initiative, as opposed to the United States, because revaluing gold will damage the dollar’s status as world reserve currency: not something the U.S. aspires. Thereby, the euro is the second most liquid currency in the world, enabling the eurozone to revalue gold—by printing euros and buy gold—without devaluing much against other currencies and commodities.

Still, European central banks would face risks in revaluing gold as they can’t know how much gold they must buy, and thus print euros for, at what new price. Although, I think the moment they will start buying, countries outside of Europe will join purchasing gold as they too have a debt problem.

Last but not least, Europe has been preparing a new global gold standard since the 1970s (as I have written about extensively here). Revaluing gold would be a logical step towards a new international monetary system based on gold. It might not be the classic gold standard, but perhaps a system of gold price targeting, allowing countries more easily to devalue their currency if needed. After all, currency devaluations are a fact of life.

By revaluing gold bad debt can be written off and the new price will cause the currency in circulation to be sufficiently backed by gold. A reset offering a new international monetary system.

H/t Sander Boon

*For the exact data on BuBa’s gold revaluation account see their annual report.