Rabobank: The Problem Is No Central Bank Can Bail Out The Physical Economy From Shortages

By Michael Every of Rabobank

Back in the days before infinite liquidity and markets being in love with the idea of being big just for the sake of it, there used to be discussion about the difference between extensive and intensive growth. Put simply, extensive growth is achieved by adding more inputs to get more output; intensive growth is achieved by getting more output from existing inputs – what we call ‘productivity’. Back in the old days, we used to have that too.

Extensive vs. intensive comes to mind on the back of yet another stronger-than-expected US inflation print (0.4% m/m, 5.4% y/y; 0.2% m/m core, 4.0% y/y). This was followed by the White House announcing early results of its supply chain task force. The longshoreman and the short is: the Port of LA is expanding to 24/7 operation; the union has announced they are willing to work extra shifts; and large US companies are announcing they will use expanded hours to move more cargo off the docks, so ships can come to shore faster. So, crisis over?

Not at all, in the view of supply-chain experts. Well before this announcement they had pointed out –as did we, in ‘In Deep Ship’— that simply getting containers out of the terminal at LA achieves very little if you don’t the solve chassis crisis; if the containers sit there waiting for trucks; or for truckers; or for rail. All you do is move the logjam from sea to shore – and that can potentially make matters worse. The Transportation Secretary running this task force is a vocal opponent of the ‘so build a bigger road’ mentality that ends up with bigger roads and the same traffic logjam. This is the same policy idea without even spending on the cement and asphalt.

Some are also asking why the White House bafflingly still hasn’t appointed a US Maritime Administrator yet. Others are asking how trying to facilitate more imports into the US, rather than banging the drum for localization and ‘just in case’, is compatible with Build Back Better and resiliency. But there is bipartisanship in failing to understand what is going wrong, and how to solve it. Florida Governor De Santis is offering his state’s ports as an alternative to LA when it isn’t practical; and a Californian Republican just introduced the SHIP Act to Congress to “ban cargo ships from idling or anchoring in the coastal waters of Southern California for the next 180 days”, so forcing dozens of vessels to hang around in the ocean for months rather than safely offshore.

In short, we are seeing a lot of moving faster, and very little moving smarter. The Grinch will easily steal Xmas, and far more, at this rate.

Sailing on regardless, the FOMC minutes from the September 21-22 meeting said that an illustrative path of QE tapering designed to be simple to communicate and entailing a gradual, fixed reduction in net asset purchases of $10bn Treasuries and $5bn agency MBS, ending around the middle of next year, is seen as providing a straightforward and appropriate template that policymakers might follow. Of course, the Fed also noted that it could adjust the pace of tapering if economic developments were to differ substantially from what they expected – like both inflation and employment has so far, to no effect. In short, the Fed announced tapering in just a few weeks (November 3), and then actually start to taper from either mid-November or mid-December. Isn’t that fitting in a way? After all, there will almost certainly be far less *stuff* circulating in the US economy, so shouldn’t we match that with far less liquidity? Before you say yes, if you believe the Fed actually think like that, I have a port in New Mexico to sell you. They clearly have stock portfolios to worry about instead.

Meanwhile, it wouldn’t be a day ending in a y without a new global supply-chain disruption. This time China is to stop exporting refined fuel. This is just as the rest of Asia is set to consume more, as it begins to open up again. As Bloomberg puts it, quoting Oilchem: “State-owned refiners are earning more from local sales”. Which is where arguments about localization and resiliency begin to re-emerge, for some.

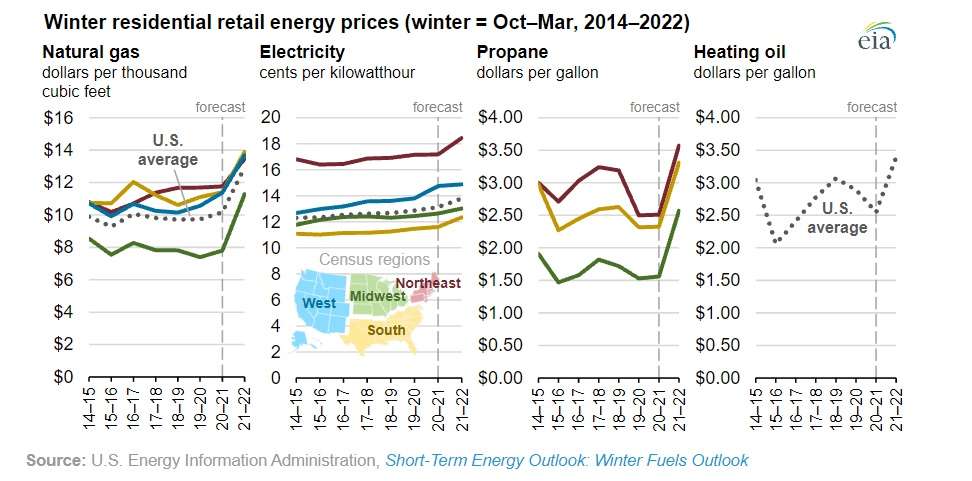

Staying with energy, Chinese coal prices are hitting new highs again, with this now set to be passed on to industry; by contrast, the EU are talking about tax cuts to help industry and consumers cope with rising electricity prices! Isn’t this strategy, albeit via wage increases, what we tried and failed with in the 1970s? It’s not that this is necessarily the wrong thing to do to avoid recession risks and social unrest – but it will only push prices even higher, and strain supply chains even more. Indeed, while all the headlines about the IEA’s annual energy report yesterday are naturally that we need to more than redouble our efforts to shift towards renewables, if you read the nastier details, there is also a need for massive investment in fossil fuels through to 2030. If that doesn’t arrive, high energy prices are here to stay, seems to be the message: like Xmas gifts, is it on the way though? And to some places, or everywhere?

After slowing loan growth yesterday in China, and another far-higher-than-expected trade surplus, today saw Chinese inflation data. CPI came in at 0.7% y/y vs. 0.8% last month and the same expected for this. More importantly, PPI came in at 10.7% y/y vs. 9.5% last month and 10.5% expected. Recall that coal prices alone will push this series much, much higher ahead in theory.

Staying with China, Bloomberg says “At this point, it’s no longer about salvaging the troubled China Evergrande Group or its billionaire chairman Hui Yan Ka from the debt crisis. It’s jobs, growth and, ultimately, social stability that are at stake. In other words, a bailout of the indebted developer may not be enough to underpin one of the world’s second-largest economy as payment defaults become contagious, a sales slump spreads to the whole sector, and more players see their ratings cut.” The argument is naturally parroted by Wall Street: sure, *pretend* to deal with asset bubbles, but you cannot really deal with them “because markets!” Yet Bloomberg also notes loosening policy slightly won’t change consumer psychology, and Beijing has made clear house prices are no longer going to be allowed to keep going up – so why buy a 2nd, 3rd, 4th home, etc., which accounted for 85% of recent home sales?

So, we are looking at both deflation and inflation in China, vs. just inflation everywhere else. Moreover, we are back to extensive vs. intensive growth, which Wall Street no longer understands; just as it now fails to grasp Schumpeter; just as it utterly fails to read Marx. Don’t let that all stop the Street, or Chinese markets, perpetually pricing in bailouts and hockey sticks and “transitory” and Xmas every day, however. It’s all a generation of traders have known both East and West, so who can blame them? The problem is no central bank can bail out the physical economy from shortages.

To wrap up, Aussie jobs data showed a -138K print, yet where unemployment went down to 4.6%, and only part-time jobs were apparently lost, not full-time. Extensive or intensive takes on such partial data are not really worth too much of anyone’s time. They certainly won’t be moving the RBA from not moving.

Tyler Durden

Thu, 10/14/2021 – 10:10

via ZeroHedge News https://ift.tt/3j1XcSd Tyler Durden