Pulitzer-prize winning investigative reporter David Fahrenthold has published his latest bombshell about President Trump’s business empire (which is presently being run – at least nominally – by his sons, Eric and Don Jr.). And let’s just say that, if WaPo was trying to cast more aspersions on Trump the businessman, the paper didn’t do a very good job.

The Washington Post reported on Wednesday that a an area strip club had booked the Doral golf course for a tournament where participants can pay for a stripper to work as a caddy and accompany them around the course. Afterwards, a party for participants will be held back on the strip club’s premises, and it will feature bottle service for the high rollers and a “tasteful” burlesque show that will feature nudity.

But unfortunately for Fahrenthold, who is among a cabal of journalists desperately trying to expose Trump for profiting from his office, he was forced to admit (toward the bottom of the story, of course), that Trump’s Doral resort has actually been struggling thanks to the Trump presidency, since it has lost some of its biggest accounts, including its status as a stop on the PGA Tour.

Shadow Cabaret, the strip club organizing the tournament, has used the Trump name and family insignia in its marketing materials.

The “Shadow All Star Tournament” is organized by the Shadow Cabaret, a strip club in Hialeah, Fla. Emanuele Mancuso, Shadow Cabaret’s marketing director, said in a telephone interview that this was the first time the club had held a tournament at Trump Doral.

The Trump name and family crest are displayed prominently in the strip club’s advertising materials, which offer golfers the “caddy girl of your choice.”

The club’s owner said he didn’t pick the club for political reasons, but because a lot of the tournament’s participants are “VIPs” who demand luxury treatment. He added that the stripper caddies will be clothed “the whole time.”

Mancuso said the strip club did not intend to send a political statement by choosing Trump’s resort. Rather, he said, the choice was for luxury. These golfers are VIPs, Mancuso said. “They deserve a VIP environment.”

Mancuso said there would be no nudity at the resort. On the course, he said, the caddies would wear pink miniskirts and what he called “a sexy white polo.” Afterward, however, the golfers and the dancers would return to another venue – the cabaret itself – for what he described as a “very tasteful” burlesque show, which could involve nudity.

“They’re going to be clothed the whole time” at the golf course, Mancuso said. “At the venue is different.”

When Farenthold contacted the Trump Organization, it not only confirmed that the event would indeed take place at Doral, but also that a Miami children’s charity would receive a share of the proceeds. Farenthold managed to confirm this with the charity, a basketball themed charity called the Miami All Stars.

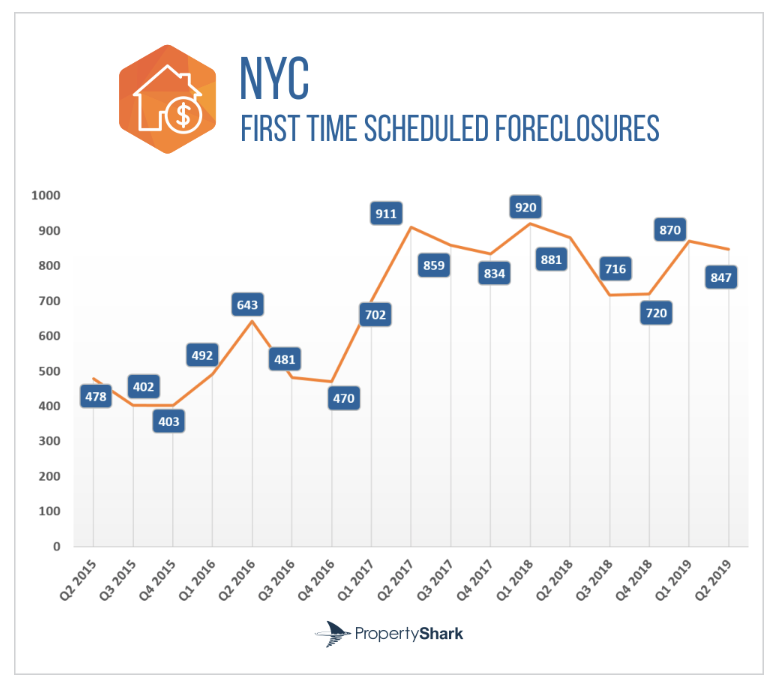

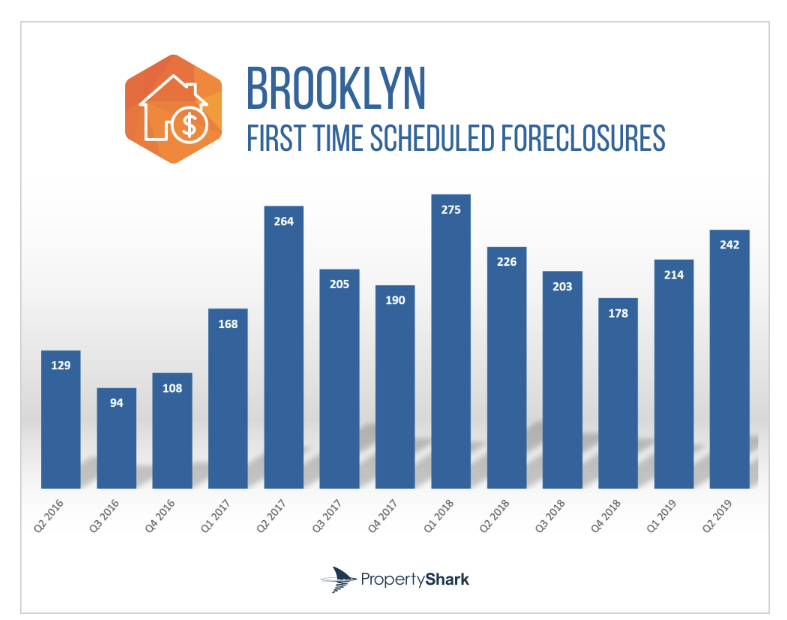

Contrary to a fiction propagated by the NYT and WaPo that the Trump “brand” had benefited from Trump’s involvement in politics, Doral has seen its revenue fall precipitously, shrinking 70% in two years.

After Trump entered politics, however, the club lost the famous tournament, and its revenue began to decline, according to documents that Trump’s company provided to Miami-Dade County in a tax dispute.

Those documents showed that the club’s net operating income fell 69 percent between 2015 and 2017. The club’s revenue rebounded slightly in 2018, according to Trump’s financial disclosure forms.

“They are severely underperforming” other resorts in the area, said a tax consultant for Trump’s company, arguing in a public hearing that the county should lower the resort’s tax assessment. She blamed the Trump name: “There is some negative connotation that is associated with the brand.”

If you’re looking for more information on the tournament, you can find it here. And we imagine the WaPo will continue writing stories about the more colorful clientele of Trump’s businesses as if they reflect poorly on the president, who has recused himself from involvement with his businesses.

via ZeroHedge News https://ift.tt/30x2ABp Tyler Durden