Manager Of $139BN Fidelity Fund Blames Robinhood For Exodus Of Client Money

Tyler Durden

Mon, 09/21/2020 – 05:30

At this point, few serious market historians would deny that Robinhood has changed the market game in a major way. As we explained a few weeks ago when it was revealed that the SEC would be investigating Robinhood for allegedly misleading customers about how it makes money, the discount brokerage is now making a tidy sum selling its users’ order flow to HFT firms like Citadel.

Some might call this “market making”, others might call it “frontrunning”. It depends on the context. As far as RobinHood’s business goes, the company, and its discount brokerage rivals, bristle at the notion that RH is helping HFT firms front-run mom-and-pop traders.

Whatever the impact on market conditions, it’s clear this trend has accelerated dramatically since the start of the year. It’s one reason Barstool Sports’ founder Dave Portnoy has achieved almost as much notoriety for his market commentary as he earned from his pizza reviews.

Thanks to the allure of “gameification”, young people actively trading via discount electronic brokerages has become so popular, that managers of large mutual funds are starting to feel threatened.

Fidelity portfolio manager Will Danoff, the longtime manager of the $139 billion Contrafund, which is up more than 20% year to date, significantly outperforming the S&P 500 recently told Bloomberg that he’s “worried” about Robinhood luring away more of his investors, particularly younger investors.

Will Danoff has been wondering why billions of dollars keep flowing out of the Contrafund, the giant mutual fund he manages at Fidelity Investments. Performance isn’t the problem. He’s up 21% this year, trouncing the S&P 500’s 6.2% return. His conclusion: Today’s kids want something sexier.

“There’s a demographic issue,” Danoff, who has beaten the benchmark by an average of more than 3 percentage points annually over three decades, said in a Bloomberg Front Row interview. “We need to appeal to the Gen Z-ers and the younger generation as well, and luckily I think our app is quite good. But you know, a typical Gen Z-er may not be as interested in owning a mutual fund.”

To be sure, mutual funds have been on the decline for years, losing more and more market share to lower-cost ETFs. Now, the younger generation’s demands for user-friendly and trendy apps, and their taste for the rush of “day trading”, represents a new challenge for people like Danoff.

As Bloomberg points out, compared with Portnoy, Danoff’s buy-and-hold methodology looks “antiquated”.

Next to the social media antics of celebrity speculator Dave Portnoy, Danoff’s world of buy-and-hold discipline seems antique by comparison.

“When I started in 1990, there were 261 equity funds, and now there are thousands,” said Danoff, who manages $230 billion. “There are thousands of hedge funds. There are thousands or millions of Robinhood investors. There’s sovereign wealth funds, etc. So there’s no question that it’s become much, much more competitive.”

Danoff’s concerns are certainly justified, but he’s missed out on some important trends himself. Danoff told BBG he dumped his Tesla position back in 2018, missing out on $10 billion in gains.

Will Danoff

Buying back in to such a capital-intensive business at such a lofty valuation makes him too apprehensive to even contemplate, so he feels like he’s stuck in limbo, he says. At the same time, Danoff has stuck with Berkshire Hathaway shares, despite Berkshire’s struggles over the past decade.

But even Buffett, at the age of 89, is finding ways to innovate that are throwing Wall Street for a loop. This year he has dumped stocks, airlines and other US stocks in favor of buying stakes in Japanese trading houses, and Barrick Gold.

Fidelity also owns and operates its own discount electronic brokerage, and has sought to lure younger investors with offerings like crypto trading, and allowing customers to integrate Coinbase. So, should Danoff start working on his cover letter for a job at DDTG? Probably not. However, if the goal is to make mutual funds more “fun” or “exciting” in the hopes of attracting more young investors, the firm will have its work cut out for it: any fund or asset that prices just once per day probably isn’t exciting enough to hold the attention of younger investors.

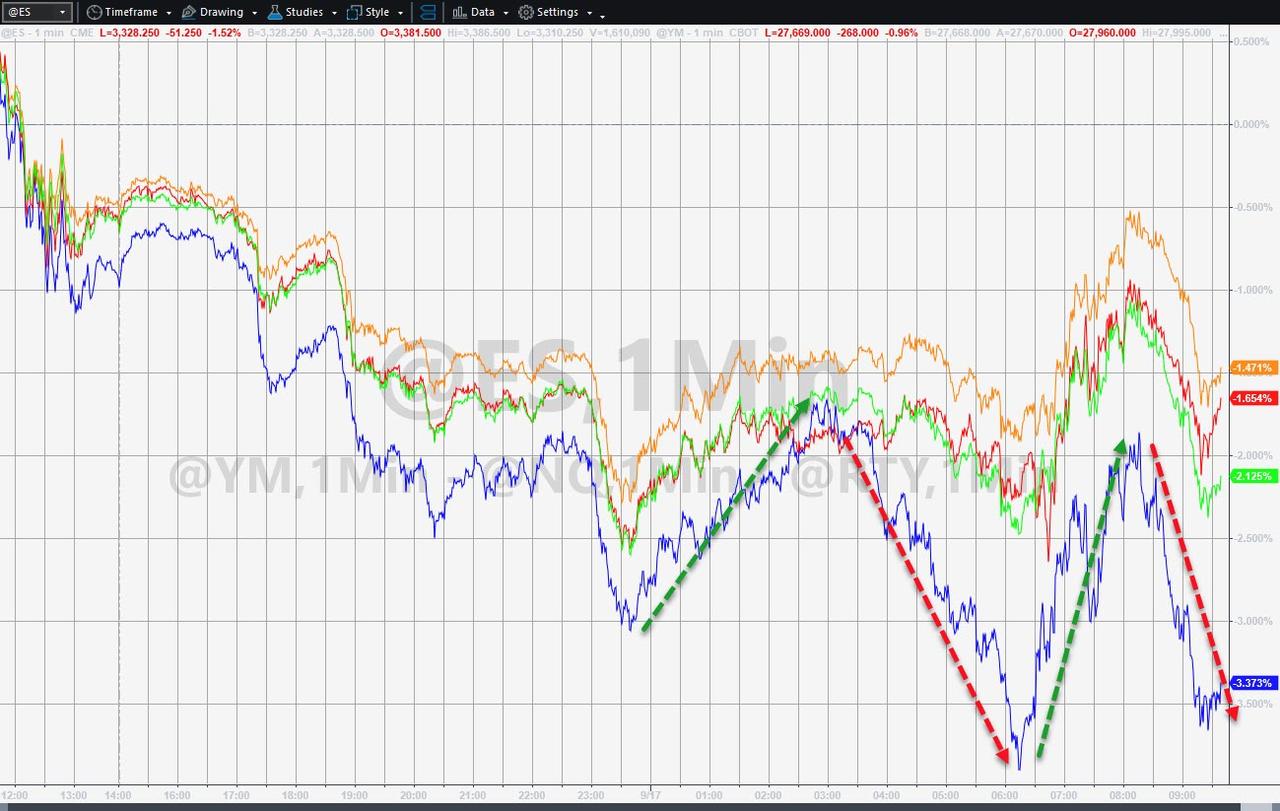

But how might this trend impact market dynamics? Well, some argue we’re already seeing it play out in real time. Just look at the Nasdaq Thursday: It has already swung 2% in both directions.

At the end of the day, Fidelity has reason to complain: It’s attempts at being ‘hip’ aside, the exchanges and HFT firms are the ones who are really going to make a killing off the “Robinhood-ification” of markets.

via ZeroHedge News https://ift.tt/3kBUkdq Tyler Durden