Authored by Mark Jeftovic via Bombthrower.com,

“they worshiped the dragon because he gave his authority to the beast; and they worshiped the beast, saying ‘Who is like the Beast, and able to wage war against it?'”

If ‘The Beast’ is CCP-style social credit, the answer is Bitcoin

Something I’ve been thinking about more often lately is the almost otherworldly timing of the appearance of Bitcoin on the world stage.

Right at the crescendo of the Global Financial Crisis, as world leaders and central banks were showing that they would never willingly allow consequences to unfold, even worse, they would reward moral hazard and bail out the banks, a mysterious white paper dropped on a cypherpunks mailing list:

Subject: Bitcoin P2P e-cash paper

Satoshi Nakamoto satoshi at vistomail.com Fri Oct 31 14:10:00 EDT 2008

I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.

The paper is available at: http://www.bitcoin.org/bitcoin.pdf

The main properties:

-

Double-spending is prevented with a peer-to-peer network.

-

No mint or other trusted parties.

-

Participants can be anonymous.

-

New coins are made from Hashcash style proof-of-work.

-

The proof-of-work for new coin generation also powers the network to prevent double-spending.

Bitcoin: A Peer-to-Peer Electronic Cash System

Abstract. A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without the burdens of going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work. The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power. As long as honest nodes control the most CPU power on the network, they can generate the longest chain and outpace any attackers. The network itself requires minimal structure. Messages are broadcasted on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

Full paper at: http://www.bitcoin.org/bitcoin.pdf

Satoshi Nakamoto

…and the world changed.

When an idea whose time has come arrives, nothing can stop it. It may take generations to play out and the transition may be tumultuous, but no human agency can resist it. Fire, self-awareness, language, human rights, increasingly higher levels of mental abstraction, energy density and systems of organization. Something is impelling this relentless progression, and since everything born of human activity had to start as an idea, that something has to be thought.

Yet, we live in a world of radical material reductionism. Conventional canon holds that thought is simply a by-product of brain activity. At its most reductive level, thought, and consciousness itself are just accidents of innumerable material processes randomly iterating over billions of years until one day, some apes suddenly became aware of themselves. “The rest is history”, goes the logic.

Contrary to this, we have multiple streams of philosophy, mythology, certain currents of depth psychology and over the last hundred years even science, namely quantum mechanics, that takes a completely different position. The material world is a consequence of non-material reality, not the precursor to it, and that non-material reality is self-aware and conscious:

“I regard consciousness as fundamental. I regard matter as as derivative from consciousness. We cannot get behind consciousness. Everything that we talk about, everything that we talk about as existing, postulates consciousness.”

– Max Planck, emphasis added.

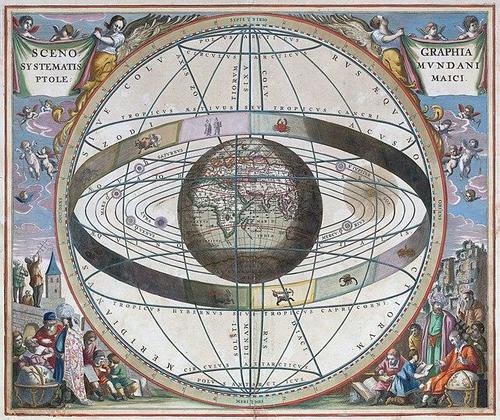

Which is preeminent, consciousness or matter, is the modern day analog of the battle between the Ptolemaic and the heliocentric cosmologies.

I think in the fullness of time, after enough people have been burned at the stake for saying it, we’ll accept that everything occurring in the material world has its origin in a non-material realm. One whose dynamics shape the events of this one. It has a directionality to it that is taking events in a certain direction. Also, to one degree or another, there may be some oppositional forces aligned against it.

On my latest appearance on Steve Bannon’s Warroom I made the point that “Bitcoin is resistance to financial repression”. Bannon had declared previously that “the government is forcing you into crypto and gold”, and before my segment, Congressman Gaetz, speaking on the new IRS regulations to surveil the populace, said that the government was “weaponizing” its bureaucratic apparatus against its own citizenry.

Where I might politely differ from Bannon and Congressman Gaetz is in the idea that this war against the middle class, against the people, isn’t peculiar to the Biden administration. This has been going on for generations, across both parties. It’s the architecture of the modern welfare state. However contrary to what many think, the welfare state isn’t all powerful, it’s fighting for its own survival.

One of the core battlegrounds in this struggle, perhaps the most important one, is around the nature and mechanics of money. The reason why is because the advent of honest money enabled the exchange of value. It meant people could come together and peacefully trade in a way that resulted in mutual benefit. It was a kind of alchemy. Without honest money we are left with force and coercion. Either subtly or overtly.

The book that probably went the furthest in initially “red-pilling” me about the nature of money, how sound money fostered peace and prosperity, while fiat money (“false” money) enabled division, corruption and war, was Ferdinand Lips’ “Gold Wars”. Lips posited that “The Gold War is nothing else than a Third World War. The demise of the classic gold standard would pit the central bankers and political class against the people, ushering in a “monetary dark age”.

What may be unique to the Biden administration, and incumbent politicians across liberal democracies is the quickening. How in the wake of this (likely lab originated) pandemic it all seems to be headed for a blow off top in tyranny, the world over.

Gold has had near mystical connotations for millennia.

Lips, citing the legendary Harry Shultz unpacks the societal detriment that is caused by unsound money:

Money sets a standard that spreads into every area of human activity. No paper money backing, no morality….Layer by layer we are corrupted when money loses certainty… Big Brother was made possible through the absence of automatic controls and loss of individual freedom via non-convertible currency. So, pass the word. Fight for gold. Not for profits, though they are helpful and help us fight for individual freedom, but for a future that returns to sanity in various standards. If we have a gold standard we get golden human standard! The two are intertwined. They are the ultimate cause and effect. Gold blesses.

One wonders what the late Ferdinand Lips would have thought of the situation today. Shultz wrote the last edition of his newsletter in 2011, warning us then that:

“Roughly speaking, the mess we are in is the worst since 17th century financial collapse. Comparisons with the 1930’s are ludicrous. We’ve gone far beyond that. And, alas, the courage & political will to recognize the mess & act wisely to reverse gears, is absent in U.S. leadership, where the problems were hatched & where the rot is by far the deepest.”

But despite the recorded experience over the entire course of monetary history, how fiat currencies always go to zero, every time, no exceptions, the established elites will not return to a sound money standard of their own free will. Doing so would relinquish their own hold on power, and politics today attracts (almost exclusively) disordered, sociopathic personalties.

Enter, digital currencies

In the early 00’s, there was an abortive attempt to fuse sound money with emerging digital payments in systems like e-gold, Pecunix, and Goldmoney (which is still going today). They were centralized and corporate entities, which meant they had definable attack surfaces that prevented them from posing any serious threat to the status quo.

Recently Peter Thiel mused that the mysterious Satoshi Nakamoto, be it a person or a group, probably cut their teeth in that first attempt at a new era sound money in these digital gold currencies.

Today, people just look at “digital money”, whether it’s crypto-currencies like Bitcoin, digital stablecoins like Facebook’s Diem, or the impending Fedcoin and they put it all into the same bucket. This is mistake.

Digital money is just a medium. Just as the internet is a medium. And where the internet can be used to promote repressive, anti-human ideologies like collectivism, woke-ism and transhumanism, and can be the facilitator for surveillance capitalism, it is also an enabler and empowering mechanism for the underdogs.

For alternative press, independent journalism and open discourse, the internet is the great equalizer. It provides the tools for small, medium and home businesses to compete against the 800lb gorillas in their space (the topic of yet another one of my still-in-progress books that got pushed to the back burner). The advent of the internet was a Promethean event. Cooked up in the bowels of the military-industrial complex it was loosed into the world, perhaps with the intent of further enslaving the masses, but it was designed almost too well.

The internet opened the door to emancipation of information.

So to are digital currencies the new medium for value exchange in an emerging networked world. I never tire of citing the late Stephen Zarlenga and his exhaustive study of history showing how control over the monetary system amounts to control over society.

In a networked world, the battle for monetary morality will be played out in cyberspace. Gold will always be an immutable, ageless anchor for value, but on this battlefield, sound money needed ally. This is guerrilla warfare and something truly asymmetric was required.

What the world needed, was Bitcoin. Digital gold.

Where Central Bank Digital Currencies (CBDCs) are the emerging digital cash platforms of indebtedness and servitude, Bitcoin and (real) cryptos are the liberators. They are not the same, they are antipodes, playing out a timeless struggle in a new terrain. (How can you tell the difference between an oppressive and a liberating digital currency? If you hold your own private keys, it’s an emancipatory crypto, if you can’t self-custody, opt-out, or fork-off, it’s EvilCoin).

This battle is ultimately, a spiritual one

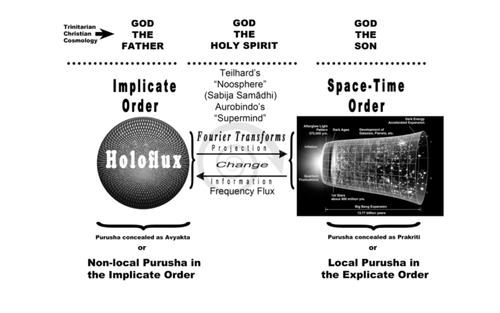

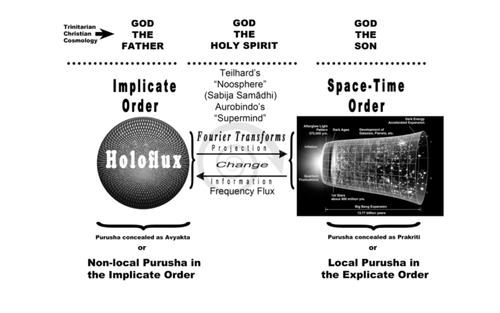

Over the years, as much as I tried to ignore it, I finally had to acknowledge my belief that the ultimate impetus to create emancipatory monetary technologies originate from another plane. By that I don’t mean ethnocentrically modelled deities plotting earthly intrigue from Mount Olympus. I mean more along the lines of impulses and dynamics that we can barely understand from our limited vantage point, ultimately originate from a non-material realm from where they project a kind of morphogenic field into the material world, where these tensions play out.

There are various models for this, David Bohm’s Implicate / Explicate Orders, Karl Pribam’s Holoflux Theory – these models are synthesized coherently in the work of Dr. Shelli Renee Joye..

Why believe any of this New Age woo-woo when the material reductionists would tell me that my belief is simply a side effect of an electro-chemical storm in my brain? Mere “qualia”?

After my Bannon appearance I ended up speaking with Joe Allen, who covers transhumanism for the Warroom. He also writes the Singularity Weekly Substack. We talked for over an hour and we discussed atheism vs radical material reductionism. We discussed the difference between the scientific method and Scientism. We talked about Rudolf Steiner, who posited a coming Age of Ahriman, a period in which humanity would become enamoured with materialism and forget its own soul, an era wherein Ahriman himself would incarnate physically in the West. Steiner, who died in 1925, put it as occurring sometime in the late 20th century, someplace in the US or Canada (if I had to bet, my money would be on Mark Zuckerberg).

Left: Rudolf Steiner’s sculpture of Ahriman, circa 1914. Right: Mark Zuckerberg, b. 1984

For anybody who’s ever attempted to read Steiner, it’s mostly impenetrable. My personal theory is that Steiner spent abnormally large swaths of his life in a hypnogogic state. Perhaps without fully realizing it himself. Nonetheless, he pretty much invented bio-organic farming and Waldorf Schools, among other things.

I ended up telling Joe a true story, one that happened to me nearly 30 years ago, but I remember it like it was yesterday. When the material reductionists tell you that everything you think, feel and decide are simply the outcomes of a billiard ball universe: atoms and molecules colliding while neurons and synapses are firing in your brain, they have to admit when pressed; they can’t actually tell you what consciousness really is. Nor how life emerged from inert matter, or how a brain somehow secretes sentience.

And they cannot explain how something like this happens:

The time: 1992-ish, I’m a bohemian, long haired dude going to college in London, Ontario, playing in a metal band, studying computer programming at Fanshawe College, living in a rooming house / hovel: a mattress on a pair of skids on the floor of a small room in a basement (because the basement flooded every time it rained).

Me, with hair. Circa 1992, covering then Ontario Premier Bob Rae’s song “Same Boat Now”

I had just finished an essay for school, about smart card technology and I closed the assignment with some speculation that eventually smart cards could morph into bar codes and implants. I went on to describe how some religious types (I wasn’t one) thought this would play out along biblical lines, as per the Book of Revelations. On a lark, I close out the essay with Revelations 13:17:

“And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name on his hand or his forehead”

At this point, one of my roommates in the hovel, he was a drug dealer who scared the hell out of me, and some of his even scarier friends show up and they were cooking something up that I didn’t want to be a witness to. So I got the hell out of there.

Very agitated and restless at this point I’m trying to figure out where to go, I decide on the University of Western Ontario’s D. B. Weldon Library, a short bus ride up road. “Nobody will know me there, and I can just disappear in there with a book” I think to myself.

On my way I hit the ATM to get my last $5 out of my bank account. I remember thinking about my essay and giving my bank card some extra scrutiny as I pondered those last paragraphs. Number of the Beast, implants, all that stuff.

I’m still nervous and pumped full of anxiety (my living situation wasn’t the greatest in those days). But I remember what happened distinctly:

Once the bus let out on campus, I felt almost trance-like. “In the zone”. I walked into the library cognizant that I had not brought anything with me to read, but the plan was to simply walk in there and pick a ‘random’ book off the shelves, then flop into a chair and read it for the next few hours.

I jump into the elevator. Get off on the 3rd or 4th floor (D. B. Weldon is 5 stories high), and then, again, trancelike – turn walk, turn, walk, turn walk – stop. Reach out to one side and pluck a book off the shelf then flip it open….

“And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name on his hand or his forehead.”

The book was Swedenborg’s “Revelations Explained”.

Suffice it to say, if it were in a movie this would be the scene where the violins are doing those short, sharp Psycho-style stabbing notes in the background. I’d experienced synchronicities before, but this one was off the charts.

Until now, I haven’t told too many people about that event. My wife thinks that it wasn’t a synchronicity as much as a demonstration of the power of mind, that on a subconscious level I had memorized the titles and order of everything in the library on previous visits and that somehow I had managed to retrieve that needle from the haystack because of the mental priming of the morning’s events (I guess my wife is somewhat of a “Scully” to my “Mulder”). But that doesn’t explain picking out a book I had never read by an author I had never heard of and flipping it open to the exact page that happened to also quote Revelations 13:17.

When the Internet hit and there were these head fakes toward micropayments and digital cash I would think about this event. Then crypto-currencies came along I started thinking about it more often. My intuition was telling me that Bitcoin wasn’t a “Mark of the Beast” style technology as foretold in prophecy. If anything, Bitcoin, being a liberating and empowering technology would be the opposite of that. An antidote.

Once the pandemic hit, and vax passports went from conspiracy theory to reality in about 18 months I became quite alarmed about the means, motive and opportunity to fuse the impending CBDCs with health passports and China-style social credit systems. Suddenly implants and chips didn’t seem so far-fetched anymore.

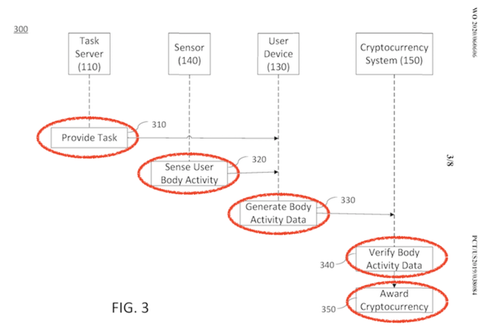

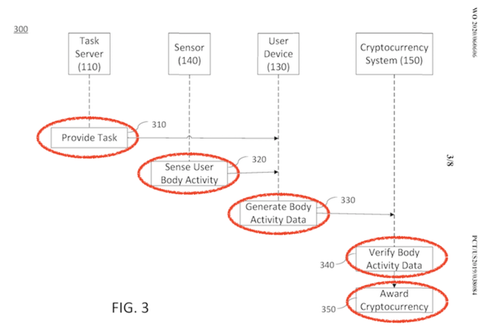

When I told Joe Allen this story, he said it reminded him of the wildly memetic Microsoft 2020-06/06/06 patent. It purportedly described a system for human implants that would turn people into crypto-currency miners and reward them with tokens for completing assigned tasks. Best Matrix flick ever.

When I first heard about this one, it was on Facebook and I nearly ripped into the original poster because it was so obviously an unhinged conspiracy theory that could easily be debunked by simply looking up the damn patent number in the bloody database. I mean people …get a grip.

The only problem is that the 2020/060606 patent turns out to be real, it is listed in the WIPO database (not USPTO), and it describes (get this), “A Crypto-Currency System Using Body Activity Data”.

Human body activity associated with a task provided to a user may be used in a mining process of a cryptocurrency system. A server may provide a task to a device of a user which is communicatively coupled to the server. A sensor communicatively coupled to or comprised in the device of the user may sense body activity of the user. Body activity data may be generated based on the sensed body activity of the user. The cryptocurrency system communicatively coupled to the device of the user may verify if the body activity data satisfies one or more conditions set by the cryptocurrency system, and award cryptocurrency to the user whose body activity data is verified.

Jesus Christ. Make it stop.

The WIPO assigned patent filing numbers, as far as I can tell, are simply assigned serially by year. 2019/060606 is Hydrated Caruon Material Powder and Use of it for Preparation of an Electrode for an Electrical Storage Device. 2021/060606 is Nuclear Fuel Uranium Dioxide Pellets Having Improved Fission Gas Capturing Capability.

What were the odds that Microsoft, a global quasi-monopoly, co-founded by Epstein bro and elite-level globalist Bill Gates, would file a patent on a human implantable task/reward system and wind up with this number in it?

Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred and sixty-six.”

I’m not saying that we are dealing with actual, literal Biblical prophecy playing out in our time. Because frankly, there are people who think that at every point throughout history.

The timing of the arrival of Bitcoin, the Promethean dynamic behind both it and the Internet, the “signs and wonders” of the quickening, and the rhyming of ultra-long historical cycles, not to mention the unsustainability of the current status quo; this is all building toward some kind of self-organizing criticality. A global Minsky Moment. What I do think is that whatever is driving it all is not originating from a linear, material universe that just so happened to belch out consciousness along the way.

It could be as explainable as our own collective subconsciousness willing or fearing certain dynamics into material reality. It could be larger, extra-dimensional forces that super-sensibly atuned people like Steiner or Swedenborg glimpsed over a century ago and could barely unpack what they experienced into linear terms.

Whatever is happening, it has been unfolding for a long, long time…

It was not precisely a memory. You have already had proof that time is more complex than your science ever imagined. For that memory was not of the past, but of the future -of those years when your race knew that everything was finished. We did what we could, but it was not an easy end. And because we were there, we became identified with your race’s death.

Yes, even while it was still ten thousand years in the future!

It was as if a distorted echo had reverberated round the closed circle of time, from the future to the past. Call it not a memory, but a premonition.

The idea was hard to grasp, and for a moment Jan wrestled with it in silence.

Yet he should have been prepared; he had already received proof enough that cause and event could reverse their normal sequence. There must be such a thing as racial memory, and that memory was somehow independent of time.

To it, the future and the past were one. That was why, thousands of years ago, men had already glimpsed a distorted image of the Overlords, through a mist of fear and terror.

“Now I understand,” said the last man.

– Arthur C Clarke, Childhood’s End

When I confront the spectre of widespread social credit systems, technocratic collectivism or transhumanist ideations of digital immortality, I get a palpable anti-human vibe from them. When I meditate on empowering technologies like cryptography, on structures of decentralization and on the ideals of self-sovereignty it feels just so much more life affirming.

Alas, the zeitgeist today is dominated with the mindset of the former, but fortunately, Prometheus has already made his rounds. If you value freedom, autonomy, universal human rights and believe we are all ‘the offspring of a deathless soul’, then Bitcoin isn’t your enemy, it’s your ally.

“For we wrestle not against flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against spiritual wickedness in high places.”

* * *

I cover macro tensions between the globalists and sovereign-individual extensively in The Crypto Capitalist Letter, along with a tactical focus on publicly traded crypto stocks. Get the overall investment / macro thesis free when you subscribe to the Bombthrower mailing list, or try the premium service for a month with our fully refundable trial offer.