When Sarah Wells, the founder and CEO of a designer breast-pump bag company in Alexandria, Virginia, heard that the Supreme Court had struck down President Donald Trump’s reciprocal tariffs on Friday, she felt a “huge relief.” The decision “doesn’t fix things overnight, but it finally gives me the ability to plan a way out of survival mode,” Wells tells Reason.

For Wells and thousands of small business owners like her, Trump’s trade war has brought unprecedented levels of chaos and confusion to daily operations. Instead of reshoring jobs, Wells says she was “forced to make layoffs and operational changes because of sustained tariff costs.”

The tariffs, imposed on “Liberation Day” last April, invoked the International Emergency Economic Powers Act (IEEPA) to set a minimum universal 10 percent tariff on imports. The so-called “reciprocal tariffs” were modified and postponed until they finally went into effect on August 7. Since then, these rates have continued to fluctuate as countries brokered deals with the Trump administration.

The unpredictability of these tariffs, coupled with the high costs they imposed on intermediate goods, made “rational business planning impossible,” according to an amicus brief submitted by Crutchfield Corporation, a family-owned electronics retailer based in Charlottesville, Virginia. We Pay the Tariffs, a coalition of over 700 small businesses, also filed a brief opposing Trump’s IEEPA tariffs. The group reports that American businesses and consumers paid $223 billion in tariffs from March to December 2025.

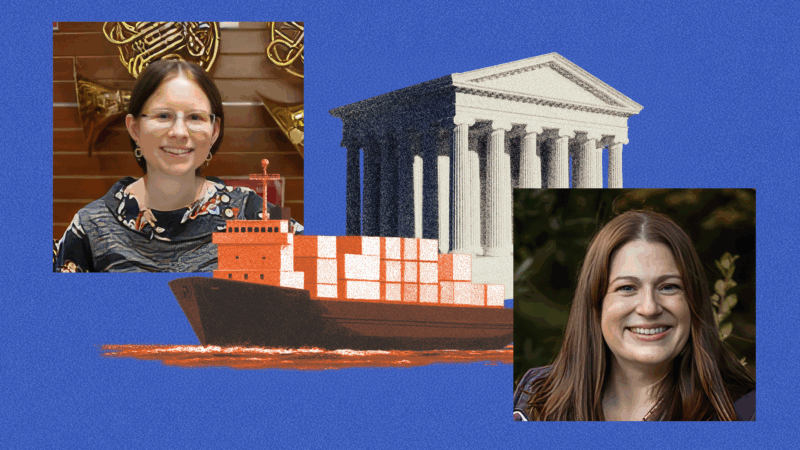

This includes Kacie Wright, one of the owners of Houghton Horns, a musical instrument retailer based in Keller, Texas.* Wright says that roughly 60 percent of her products are imported, primarily from China, the European Union, the United Kingdom, and Brazil. With the double-digit tariffs imposed on these imports, Houghton Horns has had to increase retail prices on most of these products in order to maintain its 2024 profit margins. Still, “having to pay thousands out-of-pocket in advance to receive inventory…has hit our cash flow very hard,” Wright says.

Now that these duties have been struck down, Wright is optimistic about what lies ahead: “We are happy that we can save our business tens of thousands of dollars, and that we can offer our customers, who are mostly students and career musicians, more affordable pricing.” (Wright plans on “reconfiguring and lowering most of the prices on our website 10-30%.”)

But even for those who don’t own businesses, Friday’s decision is a cause for celebration.

Americans are in for a windfall of effective tax relief following the Court’s ruling. The Tax Foundation estimates that the average household would have paid $1,300 more in taxes. Now that the IEEPA tariffs have been enjoined, the Tax Foundation estimates an average tax increase of only $400.

Ilya Somin, who won a unanimous decision from the Court of International Trade alongside Liberty Justice Center in V.O.S. Selections v. U.S. (one of the two consolidated IEEPA cases which the Supreme Court ruled on on Friday), tells Reason that the Court’s decision is “a major victory for the constitutional separation of powers, for free trade, and for the millions of American consumers and businesses enduring the higher taxes and higher prices as a result of these tariffs.”

Neal Katyal, co-counsel at Liberty Justice Center and one of the attorneys who argued the consolidated IEEPA cases before the Supreme Court, said that the “Supreme Court stood up for the rule of law and Americans everywhere” by affirming that “only Congress can impose taxes on the American people.”

While there is great cause for celebration, business owners are still concerned about non-IEEPA tariffs.

Wright says she is “worried about tariffs on incoming shipments” because there’s “no good way to know what [is owed] until [U.S. Customs and Border Protection] sends us the invoice.” She’s also concerned Trump might invoke Section 301 of the Trade Act of 1974 or Section 232 of the Trade Expansion Act of 1962, which allow the president to impose tariffs under the pretense of responding to unfair trade practices or national security risks presented by foreign imports, respectively. Wright’s fears were realized on Friday afternoon when Trump said he would impose a 10 percent global tariff for 150 days via Section 122 of the Trade Act of 1974.

Wells tells Reason that “whether small businesses can truly recover will depend on what happens next, and issuing refunds will be critical to getting businesses like mine back on track.” While the IEEPA tariffs are unambiguously defeated, further legal fights over tariff refunds between businesses and the administration are anticipated. Tom Wetzel, owner of Red Raven Games, a board game retailer based in Draper, Utah, echoed Wells’ sentiment, saying, “Getting some or all the tariff money back would be great.” However, not all of the damage done can be refunded: “Our market has taken significant losses due to our customers’ job loss and inflation.”

In the wake of the Court’s decision, Trump may turn to other statutes that actually do grant him the authority to modify the tariff schedule. Jessica Riedl, a budget and tax fellow at the Brookings Institution, predicts that Trump “will just illegally reimpose most of those tariffs under one of the other tariff sections and then wait a year for the court to litigate it.”

If he does, the avenue by which he imposes tariffs will change, but the impact they have on businesses and consumers will not.

*CORRECTION: This article originally misstated Wright’s role at Houghton Horns.

The post Small Business Owners Celebrate Supreme Court Striking Down Trump's Tariffs appeared first on Reason.com.

from Latest – Reason.com https://ift.tt/CduTSXj

via IFTTT