If the Federal Bureau of Investigation (FBI) wants to scrutinize a person or organization, it must meet certain legal standards demonstrating evidence to support suspicion of criminal activity before opening an investigation.

Well, sort of. It turns out that if the feds can’t meet the bar to justify an investigation, they can move ahead by calling their surveillance efforts “assessments.” Then, they can use the assessments to justify full investigations—assuming FBI agents care to follow the rules to begin with, which is not always the case. That’s led to the feds snooping on roughly 1,100 religious figures, journalists, activists, and public officials in recent years.

Assisted by the Cato Institute, about four years ago, Reps. Jamie Raskin (D–Md.) and Nancy Mace (R–S.C.) asked the Government Accountability Office (GAO) to look into the use and abuse of FBI assessments as end-runs around restrictions on investigative authority. Cato then sued for more information about assessments. The lawsuit proceeds, but the GAO did produce a “for official use only” report intended to be read and destroyed by recipients. Fortunately, Racket News‘s Ryan Lovelace got hold of a copy and wrote it up—and the Cato Institute posted the report to the internet.

Snooping ‘Without a Particular Factual Predication’

According to the GAO, “the Federal Bureau of Investigation (FBI) can open assessments with an authorized purpose and clearly defined objective and without a particular factual predication.” That’s a pretty low bar for delving into people’s lives. By contrast, “initiating an investigation requires predication, such as allegations, reports, facts, or circumstances indicative of possible criminal or national security threatening activity.” According to the Attorney General’s Guidelines for Domestic FBI Operations, published in 2008, “assessments may be carried out to detect, obtain information about, or prevent or protect against federal crimes or threats to the national security or to collect foreign intelligence.” But they can also be used as a gateway to higher threshold investigations.

Assessments come in several forms. Per the GAO report, Type I/II are targeted at individuals and organizations “relating to activities…constituting violations of federal criminal law or threats to the national security.” Type III look at “actual or potential threats within a field office’s area of responsibility,” Type IV at “internal FBI information gaps,” Type V assess targeted individuals’ suitability and credibility as sources, and Type VI seek information regarding foreign intelligence. Type I/II and III are considered the most concerning categories and “the FBI opened approximately 127,000 Type I/II and Type III assessments, comprising about 124,000 Type I/II and 2,800 Type III assessments from calendar year 2018 to 2024.”

Assessments Become Investigations for Half of Cases Targeting Religious and Political Figures

According to the GAO, “about 14 percent of Type I/II assessments were converted into an investigation, which has different requirements to open.” But that conversion rate can go higher when it involves domestic political concerns: “Assessments concerning categories of individuals or organizations specified in the Domestic Investigations and Operations Guide (e.g., domestic political candidate or religious organization) are designated as sensitive investigative matters (SIM.)” Also included in the SIM category are public officials, political organizations, and journalists. “Among the approximate 1,100 Type I/II assessments with SIM designation, the FBI converted 48 percent into investigations in contrast to 14 percent of all the approximate 124,000 Type I/II assessments into investigations.” In short, “sensitive” assessments are much more likely than others to become full investigations.

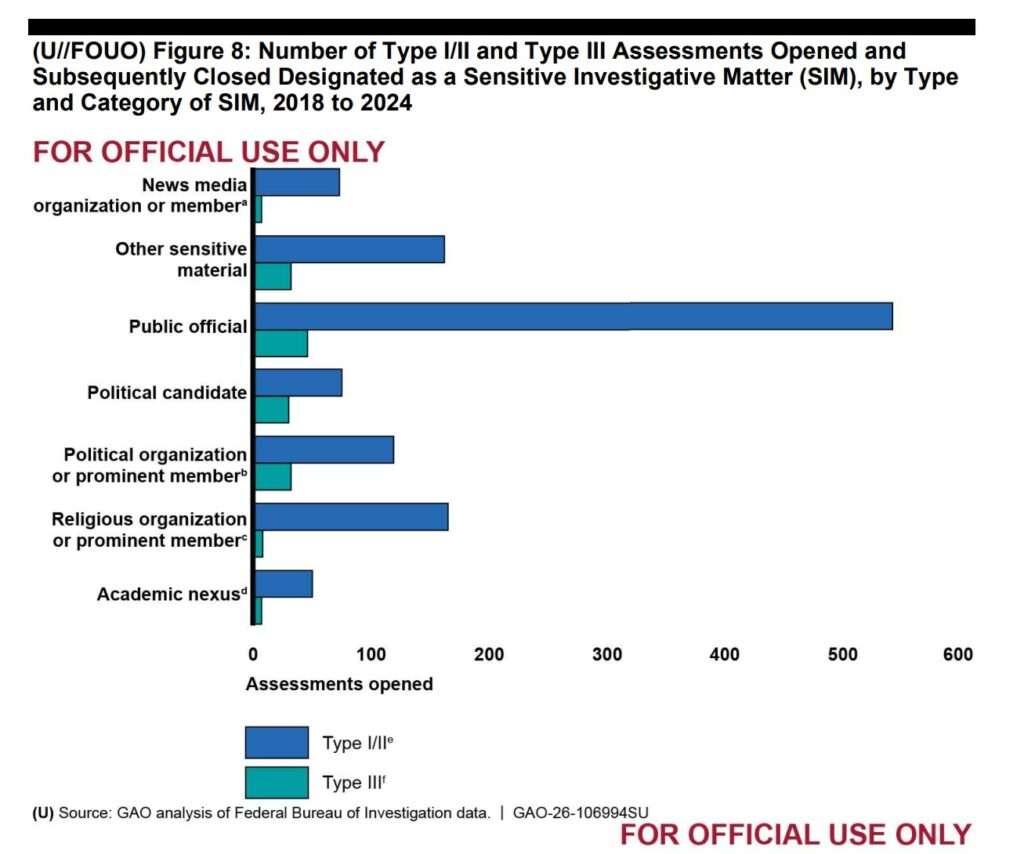

Between 2018 and 2024, according to the GAO report, “the FBI designated approximately 1,100 Type I/ll and 100 Type III assessments as SIMs.” Those numbers included members of the news media, political candidates, political organizations and prominent members thereof, religious figures, academics, and (the largest category) public officials.

‘The FBI Can Gather a Dossier on Anyone They Choose’

“Today, the FBI can gather a dossier on anyone they choose. And the amount of information available is so much broader than anything J. Edgar Hoover could have imagined,” Mike German, a former FBI special agent, told Racket News’s Lovelace.

The FBI occasionally reviews its internal performance and its agents’ adherence to guidelines. It’s not surprising to learn that a government agency that found the rules for initiating formal investigations too restrictive sometimes has difficulty coloring within the lines when it comes to the looser standards for assessments. “Of the 988 Type I/II assessments and ‘information only’ incidents reviewed from 2018 through 2024, approximately 5 percent included instances of insufficient authorized purposes and approximately 7 percent included instances of unauthorized investigative methods,” according to the GAO report. Abuses weren’t confined to a few agents or rogue offices. Twenty-four of the 56 FBI field offices reviewed from 2021 to 2024 had at least occasionally used unauthorized investigative methods for “information only” purposes used to decide whether to open assessments.

When reviews found evidence of such abuses, the results weren’t shared with other offices to discourage similar transgressions. That’s a problem because “of the 15 FBI field offices that received a National Security Reviews in 2023, eight received an identical recommendation pertaining to noncompliance with the requirements for an authorized purpose.” FBI agents far and wide aren’t just violating restrictions on assessments, they’re breaking the same rules in the same ways.

Worse, observes the GAO report, “The FBI relies on staff to self-report noncompliance with assessment policy requirements. The FBI noted that self-reporting likely undercounts actual noncompliance, but has not assessed if other tools could identify it.”

Assessments are ‘a Bill of Rights-Related Crisis’

So, we know the FBI created a looser set of rules for scrutinizing the public and it admits that its agents are abusing even those eased restrictions. But that’s probably only the tip of the iceberg.

“What should be obvious now is that the FBI’s misuse of Assessments represents a Bill of Rights-related crisis of far greater proportions than the equally objectionable Foreign Intelligence Surveillance Act (FISA) Section 702 electronic surveillance power, which is set to expire on April 20, 2026,” warns Patrick G. Eddington, a senior fellow at the Cato Institute and former CIA analyst. “Now would be an excellent time for Congress to initiate a Church Committee-style review of every single existing surveillance program being employed by executive branch elements.”

The FBI has frequently been caught spying on Americans. It’s obvious the feds are dedicated to continued domestic snooping, even if that requires working around restrictions on their activities.

The post Report: The FBI Bent Its Own Rules To Spy on 1,100 'Sensitive' Targets appeared first on Reason.com.

from Latest – Reason.com https://ift.tt/eMZDyKP

via IFTTT