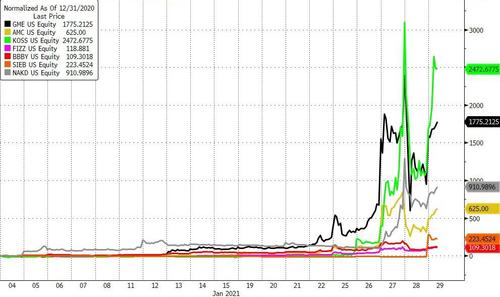

The price of GameStop’s stock has been sent soaring by rocket emojis in the Reddit forum r/wallstreetbets. The rally has captured the attention of the world, including regulators and the White House. At the market’s close on January 28, GameStop shares were worth about $198, up about 400 percent from a week ago, but down from their meteoric height of over $400. Everyone from Bernie Sanders to Jon Stewart is saying that this is evidence that Wall Street is broken or rigged. What’s really going on?

Stocks go up and down all the time. Why is the GameStop rally different?

A lot of Wall Street hedge fund money was tied up in betting that GameStop, which has suffered as consumers increasingly make purchases online, would continue to decline.

There are a number of ways to bet against a company’s success, but a popular strategy is to “short sell.” The mechanics of a short sale are a bit complicated: A trader doesn’t actually own the stock, but “borrows” it for a specified amount of time and then sells it when either the agreed-upon price is reached or the time period expires. But this is risky. A short sale executed without a hedge could expose a trader to unlimited losses.

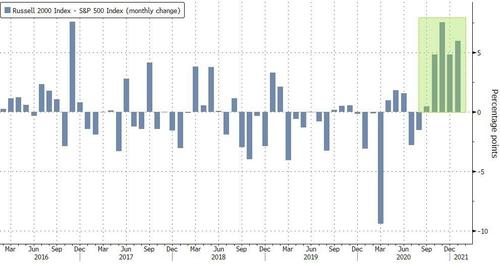

The underlying risk in short sales is what retail investors turned into an opportunity. Unlike traditional stock rallies, GameStop’s rise (and the rise of other stocks caught up in the moment, like AMC) grew from the actions of individual retail investors who have recently gained greater market access through the availability of low-cost trading apps.

Because retail traders are not a monolith, it’s often difficult to discern their exact motivation. Some hypothesize that GameStop’s rise began by identifying an undervalued stock. Others hypothesize that retail traders were exercising their muscle, seeing how much they could move the market. And others, in what is becoming the dominant narrative, hypothesize that traders identified GameStop specifically to target Wall Street’s short positions.

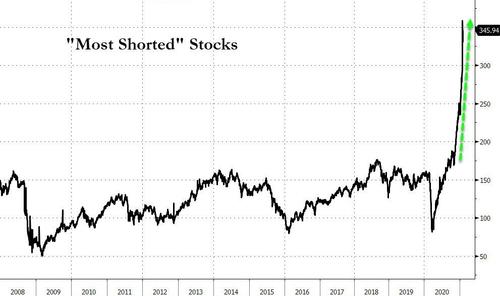

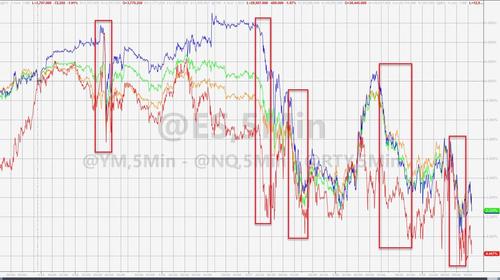

Regardless of the motivation, by executing trades in GameStop, these retail investors created what is known as a “short squeeze,” where the fast-rising price of the stock caused the holders of short positions to buy the stock in order to limit their losses––pushing the stock price even higher, creating a type of feedback loop. This left a number of hedge funds high and dry, possibly causing billions in losses.

Because a lot of the trading was in options, there was also a “gamma squeeze,” which created another feedback loop. Market makers who sell call options (bets that the stock price will rise) often buy some underlying stock to hedge their exposure, pushing the price up even further.

As more investors jumped on the bandwagon, whether retail or institutional, the price continued to soar to new heights. GameStop’s price has stabilized some on Thursday after online trading platforms limited investors’ abilities to open new trading positions.

So what’s the problem?

There may be no problem at all. Markets and bubbles go together. The Dutch tulip craze of the 1600s is just one example of the time-honored tradition of bubbles.

Retail traders riding the rally would tend to agree that there’s no problem. For Main Street, this is a success story, albeit one that may have a sad ending for those taking losses when the stock price inevitably descends. It illustrates the power of retail investors and sends a shot across the bow of Wall Street, who often calls them “dumb money.”

Wall Street, on the other hand, is shaken. Short selling is a textbook trading strategy. Indeed, despite those who argue it is morally unacceptable to bet against a company’s success, short selling generally improves market efficiency by helping to guide price discovery and capital allocation. Although it’s not unusual for short sellers to lose big, few would have predicted a short squeeze coming from retail traders.

Given the attention GameStop trading has received, regulators undoubtedly will try to ascertain whether there are any legal problems. The most common question is whether the retail traders manipulated the market. They seem to have acted with some degree of concert to change the stock’s price. But that’s not the definition of illegal market manipulation. In fact, most of us hope others will follow suit when we buy a stock, pushing the price higher. There are even legitimate investment strategies aimed at helping to push the stock in your favor.

For there to be illegal market manipulation, there generally needs to be some sort of fraud or deception. But here, little suggests that investors were being misled. The online forum was refreshingly (if vulgarly) transparent. Making a market manipulation case here may prove to be challenging.

Does this prove markets are broken?

There’s no shortage of criticism about the current situation. While Wall Street searches for solutions to protect its own bets from what it views as the unpredictable “retail horde,” retail traders decry online trading platforms’ decisions to halt trading as being in cahoots with the hedge funds. But it’s not a stretch to see GameStop as part of the normal functioning of markets. The brokerages’ decisions to limit trading reportedly stemmed requirements imposed by parts of the market infrastructure, which left brokerages scrambling to find the capital to keep trading open. When viewed through the lens of the extensive regulation of brokerages’ financial operations, a trading halt is not a surprising outcome.

The fact that GameStop is now trading far above fair estimates of the company’s value is not an incontrovertible sign that the market is broken. Stock prices move in and out of alignment all the time. It’s likely that GameStop is due for a correction, but some stocks (like Tesla) have remained overvalued, according to conventional metrics, for extended periods.

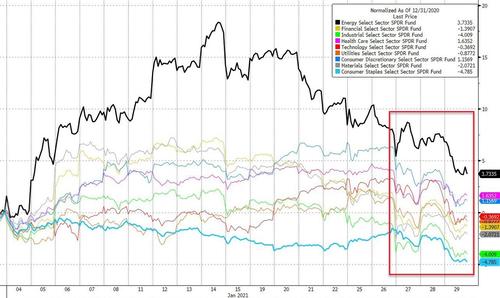

With the huge trading volume and increase in value, it’s easy to forget that GameStop remains a very small part of the market as a whole. GameStop’s trading is an extreme example, but standing alone––or even with the few other stocks that have been driven up during this time––it is not enough to show that the theories underlying market operation have failed.

Do we need new regulations?

A viral story like this may catch attention, but newsworthy headlines themselves do not justify new regulations. Easy access to the markets for retail investors is a good thing. It allows those traditionally left out, like the young or those with modest savings, to find opportunities to grow their wealth. While the GameStop trading is not what anyone would suggest as a prudent path to building long-term wealth, the expanded market access opportunities that helped fuel this rally are exactly those that we should be excited to support for retail investors.

from Latest – Reason.com https://ift.tt/36lOOXl

via IFTTT