NYC Schools Close As COVID-19 Makes “Dangerous Comeback” Across US: Live Updates

Tyler Durden

Tue, 10/06/2020 – 09:40

Summary:

-

NYC closes schools in ‘hot spots’

-

Horace Mann school also closes amid outbreak

-

US in the grip of “dangerous” COVID-19 comeback

-

Cases continue to rise across US as Midwest drives new wave

-

GSK + VIR say new antibody treatment enters Phase 3

-

Ireland’s cabinet suggests raising alert level

-

China in talks to have WHO ‘assess’ vaccines

-

India reports fewest new cases since Aug. 25

* * *

Schools in ‘hot spots’ across NYC are closing Tuesday – a day earlier than NYC Mayor Bill de Blasio had hoped – as Gov Cuomo, de Blasio’s political arch-rival, makes changes to the mayor’s proposal, which was subject to state approval. De Blasio had wanted to shutter all “non-essential” business, in the first rollback of the city’s summertime reopening efforts, but Gov. Cuomo wisely staid his hand.

Of course, NY isn’t alone, as outbreaks are worsening across the Midwest and other parts of the country, while states like NY and NJ see incipient new outbreaks of their own.

In addition to the public schools in NYC’s hot spots, Horace Mann, a private school in the Bronx, has suspended in-person classes for its middle and upper grades for two weeks after the school was alerted to a mini outbreak among its teaching staff.

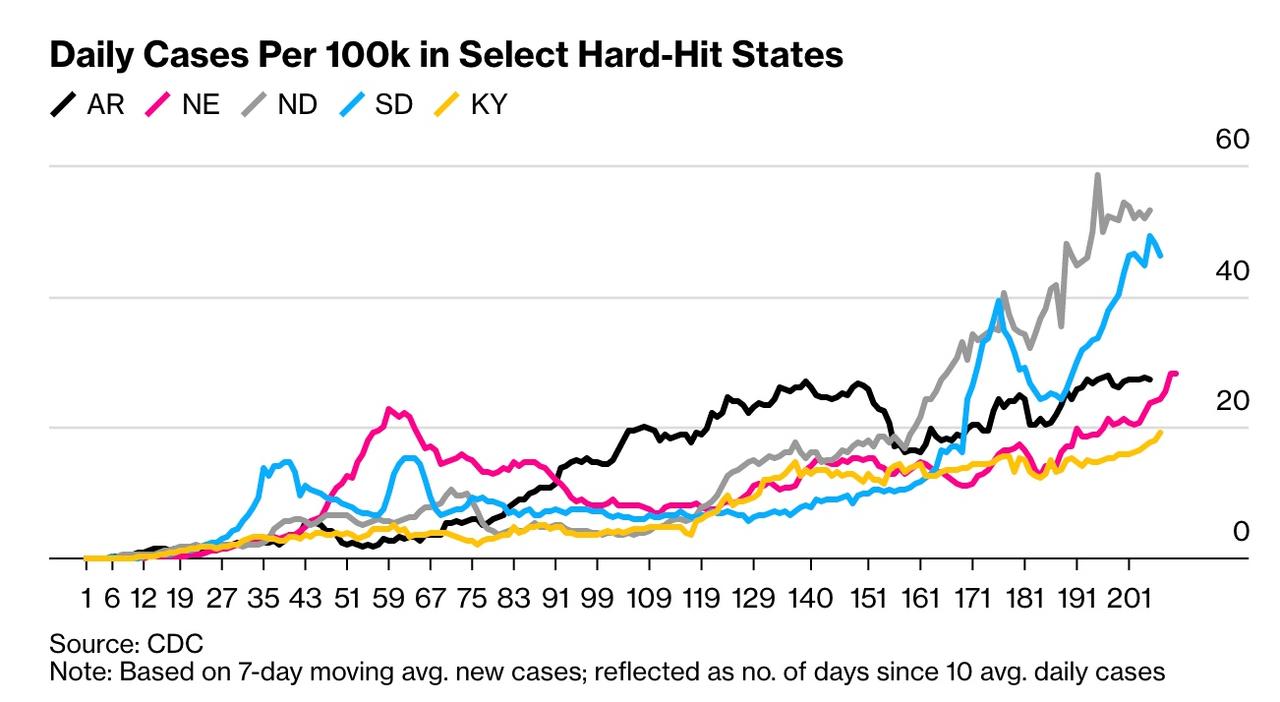

But, as Bloomberg points out, South Dakota and North Dakota are seeing some of the worst outbreaks relative to their populations.

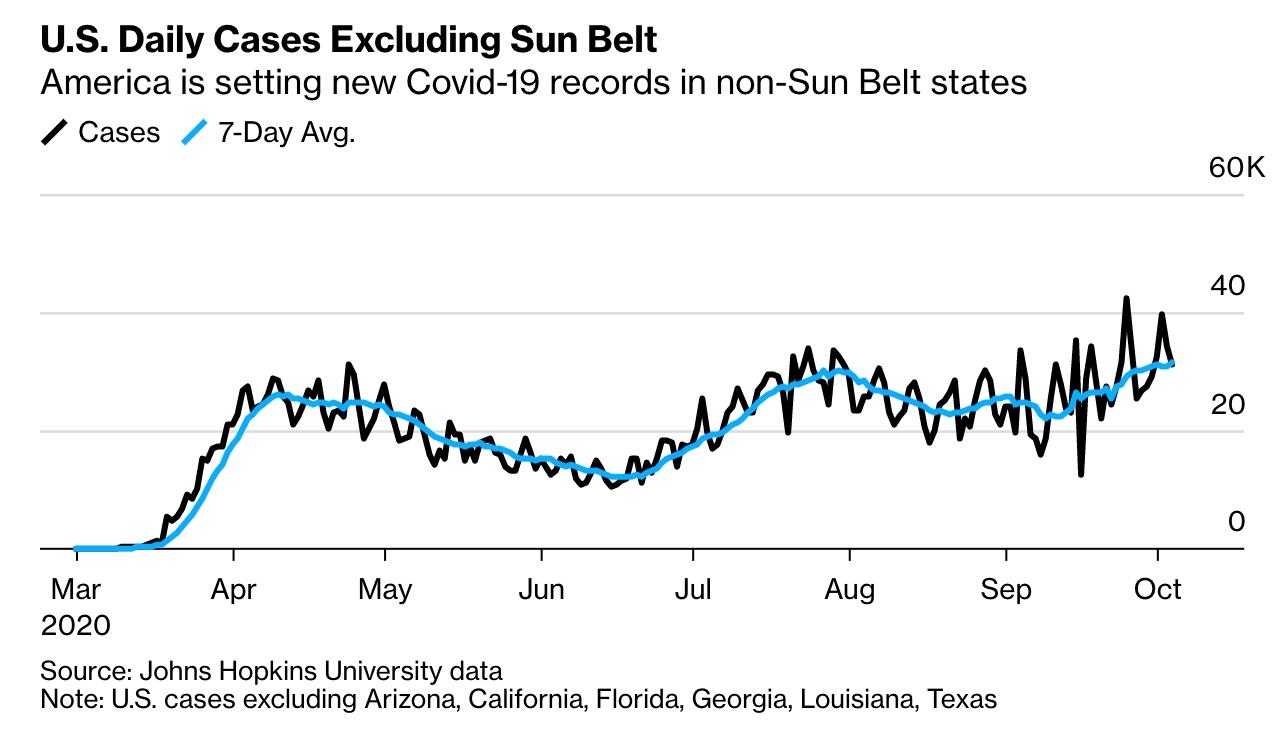

While big states like California, Florida and Texas are seeing cases continue to decline, outside of the Sun Belt, the US outbreak is growing.

Scientists in the US have long warned of a looming “Twindemic” as the coronavirus mixes with the common cold and the seasonal flu. And in the Midwest, where falling temperatures are starting to send people indoors, many states are seeing the virus arrive in towns and small communities where it has been almost totally absent. In Nebraska, the seven-day average of cases hit a record Saturday, joining Midwestern and Western states including Wisconsin, Montana and the Dakotas in confronting a virus that had eluded them until recently.

“We’re in very bad shape, never having achieved any sense of containment, never gotten below 20,000 new confirmed cases per day,” said Eric Topol, director of Scripps Research Translational Institute. “Things can only get worse on this course.”

Meanwhile, as Trump’s return to the White House captivated the country on Monday, the NYT reported – as we mentioned last night – that the administration is once again pressuring the FDA to make changes to its proposed new vaccine guidelines to strip out a section that would essentially rule out the approval of a vaccine before election day.

Despite rising case numbers, Texas Gov Greg Abbott is reportedly preparing to announce another round of rollbacks for the state’s COVID-19-related restrictions.

Finally, on the pharmaceutical side, GlaxoSmithKline and VIR have announced that their antibody therapy, which is similar to convalescent plasma and other techniques seeking a ‘cure’ for COVID-19.

Here’s more COVID-19 news from last night and this morning:

Global cases reach 35,485,738. The worldwide death toll has hit 1,044,085 (Source: JHU)

US COVID cases +39,562 (prev. +35,504) and deaths +460 (prev. +690). New York COVID cases +933 (prev. +1,222) and deaths +8 (prev. +14). (Source: Newswires).

Biontech and Pfizer have initiated a rolling submission to the European Medicines Agency for COVID-19 vaccine candidate as the EU scrambles to approve the leading vaccine projects, which also includes AstraZeneca and Oxford (which has also struck a deal for rolling submission of trial data) (Source: AFP).

France COVID cases +5,084 (prev. +12,565) and deaths +69 (prev. +32). (Source: AFP).

Ireland’s Cabinet recommended to raise the country’s alert level to 3, from, at midnight Tuesday (Source: RTE).

Iranian President Hassan Rouhani reportedly may have contracted COVID-19 (Source: FARS).

China is in talks to have its locally produced COVID-19 vaccines assessed by the World Health Organization, as a step toward making them available for international use, a WHO official says. Hundreds of thousands of essential workers and other groups considered at high risk in China have been given locally developed vaccines even though clinical trials had not been completed, raising safety concerns (Source: Nikkei).

India’s latest daily new case count was just 61,267, fewer than the 74,442 a day earlier and the lowest single-day tally since Aug. 25. India has seen a total of 6.69 million. Deaths rose by 884 to 103,569 (Source: Nikkei).

via ZeroHedge News https://ift.tt/3iAjeZr Tyler Durden