Here’s what we were told: An August motorcycle rally in Sturgis, South Dakota, helped spread COVID-19 to more than a quarter-million Americans, making it the root of about 20 percent of all new coronavirus cases in the U.S. last month. So said a new white paper from the IZA Institute of Labor Economics, at least. And national news outlets ran with it.

“Sturgis Motorcycle Rally was ‘superspreading event’ that cost public health $12.2 billion,” tweeted The Hill.

“The Sturgis Motorcycle Rally held in South Dakota last month may have caused 250,000 new coronavirus cases,” said NBC News.

“The Sturgis Motorcycle Rally represents a situation where many of the ‘worst-case scenarios’ for superspreading occurred simultaneously,” the researchers write in the new paper, titled “The Contagion Externality of a Superspreading Event: The Sturgis Motorcycle Rally and COVID-19.”

Not so fast. Let’s take a look at what they actually tracked and what’s mere speculation.

According to South Dakota health officials, 124 new cases in the state—including one fatal case—were directly linked to the rally. Overall, COVID-19 cases linked to the Sturgis rally were reported in 11 states as of September 2, to a tune of at least 260 new cases, according to The Washington Post.

There very well may be more cases that have been linked to the early August event, but so far, that’s only 260 confirmed cases—about 0.1 percent of the number the IZA paper offers.

To get to the astronomical number of cases allegedly spread because of the Sturgis Motorcycle Rally, the researchers analyzed “anonymized cellphone data to track the smartphone pings from non-residents and movement of those before and after the event,” notes Newsweek. “The study then linked those who attended and traveled back to their home states, and compared changes in coronavirus trends after the rally’s conclusion.”

Essentially, the researchers assumed that new cases in areas where people went post-rally must have been spread by those rally attendees, despite there being no particular evidence that this was the case. The paper, which has not been peer-reviewed, also failed to account for simultaneous happenings—like schools in South Dakota reopening, among other things—that could have contributed to coronavirus spread in some of the studied areas.

The researchers also assumed a $46,000 treatment price for each person infected to calculate the $12.2 billion public health cost of the event—but this figure would only make sense if every person had a severe case requiring hospitalization.

The results of the IZA paper “do not align with what we know,” South Dakota epidemiologist Joshua Clayton said at a Tuesday news briefing.

The IZA paper “isn’t science; it’s fiction,” Gov. Kristi Noem (R) said.

It’s also good election-time propaganda, apparently. Despite the dubious nature of the IZA study, a range of Democratic consultants and cheerleaders have been using it to condemn President Donald Trump.

BREAKING: That Sturgis motorcycle event that should’ve never happened is now linked to an estimated 250,000 cases and it could cost us all up to $12 billion. Vote out Trump and every anti-mask, virus-loving lap dog Republican. This election, and the next. And the next. And so on.

— Scott Dworkin (@funder) September 8, 2020

FREE MINDS

Yet another piece of GOP stunt legislation takes aim at social media and Section 230.

Today, Senate Republicans offered another stupid, stupid, politically backwards, and stupid bill, that would amend #Section230 to change how platforms moderate content. The “Online Freedom and Viewpoint Diversity Act” — nice title. Let’s see…. 1/11 https://t.co/2pLj4hXcql

— Tarleton Gillespie (@TarletonG) September 9, 2020

FREE MARKETS

Regulation alert:

It's striking that's there's almost no national media coverage of how tomorrow's FDA deadline is going to change vaping in the US. One gets the impression that not many reporters ostensibly covering the topic actually talk much to producers and consumers. https://t.co/GcHcOny4Cd

— Jacob Grier (@jacobgrier) September 8, 2020

See also: How the FDA Is Saving the Cigarette.

QUICK HITS

- The Trump administration is reportedly planning to announce more troop withdrawals from Iraq and Afghanistan:

NEWS: White House will tomorrow announce further troop reductions from Iraq, per a Trump administration official. And further Afghanistan troop reductions coming in a few days.

— Jennifer Jacobs (@JenniferJJacobs) September 9, 2020

- No, the government didn’t rescue dozens of sex-trafficked children from a double-wide trailer in Georgia.

- Juneau paves the way for marijuana bars:

BREAKING: The City of Juneau just passed the first in the nation permit for onsite consumption of cannabis.

— Jess Mears (@jess4liberty) September 9, 2020

- The Academy Awards is revising its Oscar eligibility criteria for Best Picture:

Change starts now. We've announced new representation and inclusion standards for Best Picture eligibility, beginning with the 96th #Oscars. Read more here: https://t.co/qdxtlZIVKb pic.twitter.com/hR6c2jb5LM

— The Academy (@TheAcademy) September 9, 2020

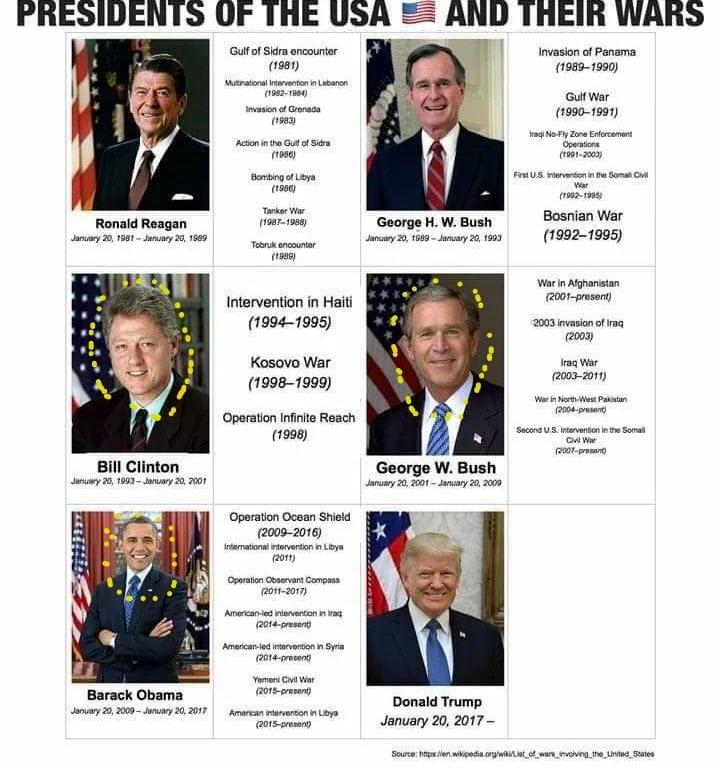

- Department of “War Is Peace”:

Well, they gave it to President Obama and he left office as the first two-term president in U.S. history to have been at war every single day of his presidency. https://t.co/ZHxcNtjrdD

— Kat Murti (@KatMurti) September 9, 2020

from Latest – Reason.com https://ift.tt/3k1wx6h

via IFTTT