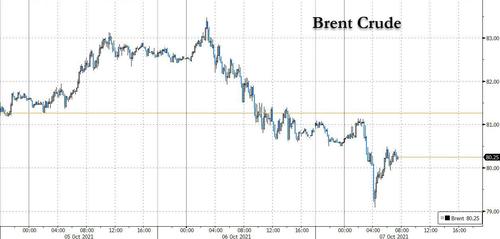

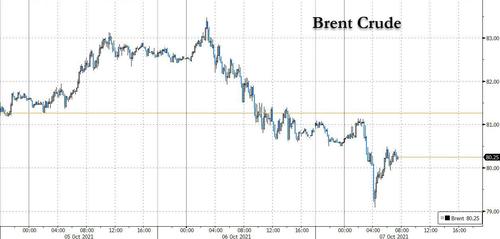

The nausea-inducing rollercoaster in the stock market continued on Thursday, when US index futures continued their violent Wednesday reversal – the biggest since March – and surged with Nasdaq futures up more than 1%, hitting a session high, as Chinese technology stocks rebounded from a record low, investors embraced progress on the debt-ceiling impasse in Washington, a dip in oil prices eased worries of higher inflation and concerns eased about the European energy crisis fueled a risk-on mood. At 7:30am ET, S&P futures were up 44 points or 1.00% and Dow futures were up 267 points or 0.78%. Oil tumbled as much as $2, dragging breakevens and nominal yields lower, while the dollar dipped and bitcoin traded around $54,000.

Wednesday’s reversal started after Mitch McConnell on Wednesday floated a plan to support an extension of the federal debt ceiling into December, potentially heading off a historic default, a proposal which Democrats have reportedly agreed to after Senate Majority Leader Chuck Schumer suggested an agreement would be in place by this morning. While the deal is good news for markets worried about an imminent default, it only kicks the can to December when the drama and brinksmanship may run again.

Markets have been rocked in the past month by worries about the global energy crisis, elevated inflation, reduced stimulus and slower growth. Meanwhile, the prospect of a deal to boost the U.S. debt limit into December is easing concern over political bickering, while Friday’s payrolls report may shed light on the the Federal Reserve’s timeline to cut bond purchases.

“We have several things that we are watching right now — certainly the debt ceiling is one of them and that’s been contributing to the recent volatility,” Tracie McMillion, head of global asset allocation strategy at Wells Fargo Investment Institute, said on Bloomberg Television. “But we look for these 5% corrections to add money to the equity markets.”

Tech and FAAMG stocks including Apple (AAPL US +1%), Nvidia (NVDA +2%), Microsoft (MSFT US +0.9%), Tesla (TSLA US 0.8%) led the charge in premarket trading amid a dip in 10-year Treasury yields on Thursday, helped by a slide in energy prices on the back of Putin’s Wednesday announcement that Russia could ramp up nat gas deliveries to Europe, something it still has clearly not done.

Perhaps sensing that not all is at Putin said, after plunging on Wednesday UK nat gas futures (NBP) from 407p/therm to a low of 209, prices have ominously started to rise again.

As oil fell, energy stocks including Chevron, Exxon Mobil and APA led declines with falls between 0.6% and 2.1%. Here are some of the other big movers today:

- Twitter (TWTR US) shares rise 2% in U.S. premarket trading after it agreed to sell MoPub to AppLovin for $1.05 billion in cash

- Levi Strauss (LEVI US) rises 4% in U.S. premarket trading after it boosted its adjusted earnings per share forecast for the full year; the guidance beat the average analyst estimate

- NRX Pharmaceuticals (NRXP US) drops in U.S. premarket trading after Relief Therapeutics sued the company, alleging breach of a collaboration pact

- Osmotica Pharmaceuticals (OSMT US) declined 28% in premarket trading after launching an offering of shares

- Rocket Lab USA (RKLB US) shares rose in Wednesday postmarket trading after the company announced it has been selected to launch NASA’s Advanced Composite Solar Sail System, or ACS3, on the Electron launch vehicle

- U.S. Silica Holdings (SLCA US) rose 7% Wednesday postmarket after it started a review of strategic alternatives for its Industrial & Specialty Products segment, including a potential sale or separation

- Global Blood Therapeutics (GBT US) climbed 2.6% in Wednesday after hours trading while Sage Therapeutics (SAGE US) dropped 3.9% after Jefferies analyst Akash Tewari kicked off his biotech sector coverage

On the geopolitical front, a senior U.S. official said President Joe Biden’s plans to meet virtually with his Chinese counterpart before the end of the year. Tensions are escalating between the two countries, with U.S. Secretary of State Antony Blinken criticizing China’s recent military maneuvers around Taiwan.

European equities rebounded, with the Stoxx 600 index surging as much as 1.3% boosted by news that the European Central Bank was said to be studying a new bond-buying program as emergency programs are phased out. Also boosting sentiment on Thursday, ECB Governing Council member Yannis Stournaras said that investors shouldn’t expect premature interest-rate increases from the central bank. Here are some of the biggest European movers today:

- Iberdrola shares rise as much as 6.8% after an upgrade at BofA, and as Spanish utilities climbed following a report that the Ministry for Ecological Transition may suspend or modify the mechanism that reduces the income received by hydroelectric, nuclear and some renewables in relation to gas prices.

- Hermes shares climb as much as 3.8%, the most since February, after HSBC says “there isn’t much to worry about” from a possible slowdown in mainland China or questions over trend sustainability in the U.S.

- Edenred shares gain as much as 5.2%, their best day since Nov. 9, after HSBC upgrades the voucher company to buy from hold, saying that Edenred, along with Experian, offers faster recurring revenue growth than the rest of the business services sector.

- Valeo shares gain as much as 4.9% and is Thursday’s best performer in the Stoxx 600 Automobiles & Parts index; Citi raised to neutral from sell as broker updated its model ahead of 3Q results.

- Sika shares rise as much as 4.2% after company confirms 2021 guidance, which Baader said was helpful amid market concerns of sequentially declining margins due to rising raw material prices.

- Centrica shares rise as much as 3.6% as Morgan Stanley upgrades Centrica to overweight from equalweight, saying the utility provider will add market share as smaller U.K. companies fail due to the spike in wholesale energy prices.

Earlier in the session, Asian stocks rallied, boosted by a rebound in Hong Kong-listed technology shares and optimism over the progress made toward a U.S. debt-ceiling accord. The MSCI Asia Pacific Index climbed as much as 1.3%, on track for its biggest jump since Aug. 24. Alibaba, Tencent and Meituan were among the biggest contributors to the benchmark’s advance. Equity gauges in Hong Kong and Taiwan led a broad regional gain, while Japan’s Nikkei 225 also rebounded from its longest losing run since 2009. Thursday’s rally in Asia came after U.S. stocks closed higher overnight on a possible deal to boost the debt ceiling into December. Focus now shifts to the reopening of mainland China markets on Friday following the Golden Week holiday, and also the U.S. nonfarm payrolls report due that day. READ: China Tech Gauge Posts Best Day Since August After Touching Lows “Risk off sentiment has persisted due to a number of negative factors, but worry over some of these issues has been alleviated for the near term,” said Shogo Maekawa, a strategist at JPMorgan Asset Management in Tokyo. “One is that concern over stagflation has abated, with oil prices pulling back.” Sentiment toward risks assets was also supported as a senior U.S. official said President Joe Biden plans to meet virtually with Chinese President Xi Jinping before the end of the year.

Of note, holders of Evergrande-guaranteed Jumbo Fortune bonds have yet to receive payment; the holders next step would be to request payment from Evergrande. The maturity of the bond in question was Sunday October 3rd, with a Monday October 4th effective due data, though the bond does have a five-day grace period only in the event that payment failure is due to an administrative/technical error.

Australia’s S&P/ASX 200 index rose 0.7% to close at 7,256.70. All subgauges finished the day higher, with the exception of energy stocks as Asian peers tumbled with a retreat in crude oil prices. Collins Foods was among the top performers after the company signed an agreement to become KFC’s corporate franchisee in the Netherlands. Whitehaven tumbled, dropping the most for a session since June 17. In New Zealand, the S&P/NZX 50 index fell 0.5% to 13,104.61.

Oil extended its decline from a seven-year high as U.S. stockpiles grew more than expected, and European natural gas prices tumbled on signals from Russia it may increase supplies to the continent.

The yield on the U.S. 10-year Treasury was 1.526%, little changed on the day after erasing a 2.4bp increase; bunds outperformed by ~1.5bp, gilts by less than 1bp; long-end outperformance flattened 2s10s, 5s30s by ~0.5bp each. Treasuries pared losses during European morning as fuel prices ebbed and stocks gained. Bunds and gilts outperform while Treasuries curve flattens with long-end yields slightly richer on the day. WTI oil futures are lower after Russia’s offer to ease Europe’s energy crunch. Negotiations on a short-term increase to U.S. debt-ceiling continue.

In FX, the Bloomberg Dollar Spot Index was little changed and the greenback was weaker against most Group-of-10 peers, though moves were confined to relatively tight ranges. The U.S. jobs report Friday is the key risk for markets this week as a strong print could boost the dollar. Options traders see a strong chance that the euro manages to stay above a key technical support, at least on a closing basis. Risk sensitive currencies such as the Australian and New Zealand dollars as well as Sweden’s krona led G-10 gains, while Norway’s currency was the worst performer as European natural gas and power prices tumbled early Thursday after signals from Russia it may increase supplies to the continent. The pound gained against a broadly weaker dollar as concerns over the U.K. petrol crisis eased and focus turned to Bank of England policy. A warning shot buried deep in the BoE’s policy documents two weeks ago indicating that interest rates could rise as early as this year suddenly is becoming a more distinct possibility. Australia’s 10-year bonds rose for the first time in two weeks as sentiment was bolstered by a short-term deal involving the U.S. debt ceiling. The yen steadied amid a recovery in risk sentiment as stocks edged higher. Bond futures rose as a debt auction encouraged players to cautiously buy the dip.

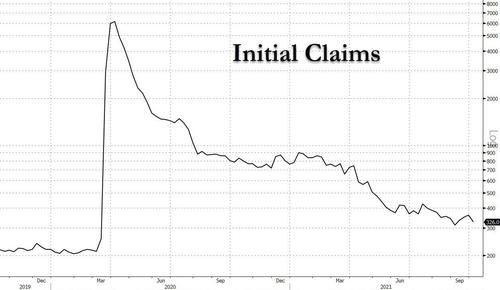

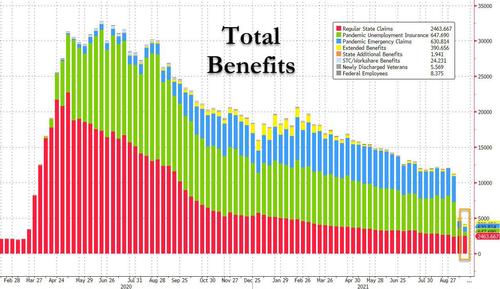

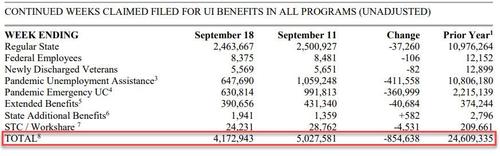

Looking ahead, investors will be looked forward to the release of weekly jobless claims data, likely showing 348,000 Americans filed claims for state unemployment benefits last week compared with 362,000 in the prior week. The ADP National Employment Report on Wednesday showed private payrolls increased by 568,000 jobs last month. Economists polled by Reuters had forecast a rise of 428,000 jobs. This comes ahead of the more comprehensive non-farm payrolls data due on Friday. It is expected to cement the case for the Fed’s slowing of asset purchases. We’ll also get the latest August consumer credit print. From central banks, we’ll be getting the minutes from the ECB’s September meeting, and also hear from a range of speakers including the ECB’s President Lagarde, Lane, Elderson, Holzmann, Schnabel, Knot and Villeroy, along with the Fed’s Mester, BoC Governor Macklem and PBoC Governor Yi Gang.

Market Snapshot

- S&P 500 futures up 1% to 4,395.5

- STOXX Europe 600 up 1.03% to 455.96

- MXAP up 1.2% to 193.71

- MXAPJ up 1.8% to 633.78

- Nikkei up 0.5% to 27,678.21

- Topix down 0.1% to 1,939.62

- Hang Seng Index up 3.1% to 24,701.73

- Shanghai Composite up 0.9% to 3,568.17

- Sensex up 1.2% to 59,872.01

- Australia S&P/ASX 200 up 0.7% to 7,256.66

- Kospi up 1.8% to 2,959.46

- Brent Futures down 1.8% to $79.64/bbl

- Gold spot up 0.0% to $1,762.96

- U.S. Dollar Index little changed at 94.19

- German 10Y yield fell 0.6 bps to -0.188%

- Euro little changed at $1.1563

Top Overnight News from Bloomberg

- Democrats signaled they would take up Senate Republican leader Mitch McConnell’s offer to raise the U.S. debt ceiling into December, alleviating the immediate risk of a default but raising the prospect of another bruising political fight near the end of the year

- The European Central Bank is studying a new bond-buying program to prevent any market turmoil when emergency purchases get phased out next year, according to officials familiar with the matter

- Market expectations for interest-rate hikes “are not in accordance with our new forward guidance,” ECB Governing Council member Yannis Stournaras said in an interview with Bloomberg Television

- Creditors have yet to receive repayment of a dollar bond they say is guaranteed by China Evergrande Group and one of its units, in what could be the firm’s first major miss on maturing notes since regulators urged the developer to avoid a near-term default

- Boris Johnson’s plan to overhaul the U.K. economy is a 10-year project he wants to see out as prime minister, according to a senior official. The time frame, which has not been disclosed publicly, illustrates the scale of Johnson’s gamble that British voters will accept a long period of what he regards as shock therapy to redefine Britain

- The U.K.’s surge in inflation has boosted the cost of investment-grade borrowing in sterling to the most since June 2020. The average yield on the corporate notes climbed just past 2%, according to a Bloomberg index

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded positively as the region took impetus from the mostly positive close in the US where the major indices spent the prior session clawing back opening losses, with sentiment supported amid a potential Biden-Xi virtual meeting this year, and hopes of a compromise on the debt ceiling after Senate Republican Leader McConnell offered a short-term debt limit extension to December. The ASX 200 (+0.7%) was led higher by strength in the tech sector and with risk appetite also helped by the announcement to begin easing restrictions in New South Wales from next Monday. The Nikkei 225 (+0.5%) attempted to reclaim the 28k level with advances spearheaded by tech and amid reports Tokyo is to lower its virus warning from the current top level. The Hang Seng (+3.1%) was the biggest gainer owing to strength in tech and property stocks, with Evergrande shareholder Chinese Estates surging in Hong Kong after a proposal from Solar Bright to take it private. Reports also noted that the US and China reportedly reached an agreement in principle for a Biden-Xi virtual meeting before year-end and with yesterday’s talks in Zurich between senior officials said to be more meaningful and constructive than other recent exchanges. Finally, 10yr JGBs retraced some of the prior day’s after-hours rebound with haven demand hampered by the upside in stocks and after the recent choppy mood in T-notes, while the latest enhanced liquidity auction for longer-dated JGBs resulted in a weaker bid-to-cover.

Top Asian News

- Vietnam Faces Worker Exodus From Factory Hub for Gap, Nike, Puma

- Japan’s New Finance Minister Stresses FX Stability Is Vital

- Korea Lures Haven Seekers With Bonds Sold at Lowest Spread

- Africa’s Free-Trade Area to Get $7 Billion in Support From AfDB

Bourses in Europe hold onto the gains seen at the cash open (Euro Stoxx 50 +1.5%; Stoxx 600 +1.1%) following on from an upbeat APAC handover, albeit the upside momentum took a pause shortly after the cash open. US equity futures are also firmer across the board but to a slightly lesser extent, with the tech-laden NQ (+1.0%) getting a boost from a pullback in yields and outperforming its ES (+0.7%), RTY (+0.6%) and YM (+0.6%). The constructive tone comes amid some positive vibes out of the States, and on a geopolitical note, with US Senate Minority Leader McConnell offered a short-term debt ceiling extension to December whilst US and China reached an agreement in principle for a Biden-Xi virtual meeting before the end of the year. Euro-bourses portray broad-based gains whilst the UK’s FTSE 100 (+1.0%) narrowly lags the Euro Stoxx benchmarks, weighed on by its heavyweight energy and healthcare sectors, which currently reside at the foot of the bunch. Further, BoE’s Chief Economist Pill also hit the wires today and suggested that the balance of risks is currently shifting towards great concerns about the inflation outlook, as the current strength of inflation looks set to prove more long-lasting than originally anticipated. Broader sectors initially opened with an anti-defensive bias (ex-energy), although the configuration since then has turned into more of a mixed picture, although Basic Resource and Autos still reside towards the top. Individual movers are somewhat scarce in what is seemingly a macro-driven day thus far. Miners top the charts on the last day of the Chinese Golden Week Holiday, with base metal prices also on the front foot in anticipation of demand from the nation – with Antofagasta (+5.1%), Anglo American (+4.2%) among the top gainers, whist Teamviewer (-8.2%) is again at the foot of the Stoxx 600 in a continuation of the losses seen after its guidance cut yesterday. Ubisoft (-5.1%) are also softer, potentially on a bad reception for its latest Ghost Recon game announcement.

Top European News

- ECB’s Stournaras Reckons Investor Rate-Hike Bets Are Unwarranted

- Shell Flags Financial Impact of Gas Market Swings, Hurricane

- Johnson’s Plans for Economy Signal Ambitions for Decade in Power

- U.K. Grid Bids to Calm Market Saying Winter Gas Supply Is Enough

In FX, the latest upturn in broad risk sentiment as the pendulum continues to swing one way then the other on alternate days, has given the Aussie a fillip along with news that COVID-19 restrictions in NSW remain on track for being eased by October 11, according to the state’s new Premier. Aud/Usd is eyeing 0.7300 in response to the above and a softer Greenback, while the Aud/Nzd cross is securing a firmer footing above 1.0500 in wake of a slender rise in AIG’s services index and ahead of the latest RBA FSR. Conversely, the Pound is relatively contained vs the Buck having probed 1.3600 when the DXY backed off further from Wednesday’s w-t-d peak to a 94.102 low and has retreated through 0.8500 against the Euro amidst unsubstantiated reports about less hawkish leaning remarks from a member of the BoE’s MPC. In short, the word is that Broadbent has downplayed the prospects of any fireworks in November via a rate hike, but on the flip-side new chief economist Pill delivered a hawkish assessment of the inflation situation in the UK when responding to a TSC questionnaire (see 10.18BST post on the Headline Feed for bullets and a link to his answers in full). Back to the Dollar index, challenger lay-offs are due and will provide another NFP guide before claims and commentary from Fed’s Mester, while from a technical perspective there is near term support just below 94.000 and resistance a fraction shy of 94.500, at 93.983 (yesterday’s low) and the aforementioned midweek session best (94.448 vs the 94.283 intraday high, so far).

- NZD – Notwithstanding the negative cross flows noted above, the Kiwi is also taking advantage of more constructive external and general factors to secure a firmer grip of the 0.6900 handle vs its US counterpart, but remains rather deflated post-RBNZ on cautious guidance in terms of further tightening.

- EUR/CHF/CAD/JPY – All narrowly mixed against their US peer and mostly well within recent ranges as the Euro reclaims 1.1500+ status in the run up to ECB minutes, the Franc consolidates off sub-0.9300 lows following dips in Swiss jobless rates, the Loonie weighs up WTI crude’s further loss of momentum against the Greenback’s retreat between 1.2600-1.2563 parameters awaiting Canada’s Ivey PMIs and a speech from BoC Governor Macklem, and the Yen retains an underlying recovery bid within 111.53-23 confines before a raft of Japanese data. Note, little reaction to comments from Japanese Finance Minister, when asked about recent Jpy weakening, as he simply said that currency stability is important, so is closely watching FX developments, but did not comment on current levels.

In commodities, WTI and Brent front month futures are on the backfoot, in part amid the post-Putin losses across the Nat Gas space, with the UK ICE future dropping some 20% in early trade. This has also provided further headwinds to the crude complex, which itself tackles its own bearish omens. WTI underperforms Brent amid reports that the US was mulling a Strategic Petroleum Reserve (SPR) release and did not rule out an export ban. Desks have offered their thoughts on the development. Goldman Sachs says a US SPR release would likely be of up to 60mln barrels, only representing a USD 3/bbl downside to the year-end USD 90/bbl Brent forecast and stated that relief would only be transitory given structural deficits the market will face from 2023 onwards. GS notes that any larger price impact that further hampers US shale activity would lead to elevated US nat gas prices in 2022, and an export ban would lead to significant disruption within the US oil market, likely bullish retail fuel price impact. RBC, meanwhile, believes that these comments were to incentivise OPEC+ to further open the taps after the producers opted to maintain a plan to hike output 400k BPD/m. On that note, sources noted that the OPEC+ decision against a larger supply hike at Monday’s meeting was partly driven by concern that demand and prices could weaken – this would be in-fitting with sources back in July, which suggested that demand could weaken early 2022. The downside for crude prices was exacerbated as Brent Dec fell under USD 80/bbl to a low of near 79.00/bbl (vs 81.14/bbl), whilst WTI Nov briefly lost USD 75/bbl (vs high 77.23/bbl). Prices have trimmed some losses since. Metals in comparison have been less interesting; spot gold is flat and only modestly widened its overnight range to the current 1,756-66 range, whilst spot silver remains north of USD 22.50/bbl. Elsewhere, the risk tone has aided copper prices, with LME copper still north of USD 9,000/t, whilst some also cite supply concerns as a key mining road in Peru (second-largest copper producer) was blocked, with the indigenous community planning to continue the blockade indefinitely, according to a local leader. It is also worth noting that Chinese markets will return tomorrow from their Golden Week holiday.

US Event Calendar

- 7:30am: Sept. Challenger Job Cuts YoY, prior -86.4%

- 8:30am: Oct. Initial Jobless Claims, est. 348,000, prior 362,000; Continuing Claims, est. 2.76m, prior 2.8m

- 9:45am: Oct. Langer Consumer Comfort, prior 54.7

- 11:45am: Fed’s Mester Takes Part in Panel on Inflation Dynamics

- 3pm: Aug. Consumer Credit, est. $17.5b, prior $17b

DB’s Jim Reid concludes the overnight wrap

On the survey, given how fascinating markets are at the moment I think the results of this month’s edition will be especially interesting. However the irony is that when things are busy less people tend to fill it in as they are more pressed for time. So if you can try to spare 3-4 minutes your help would be much appreciated. Many thanks.

It was a wild session for markets yesterday, with multiple asset classes swinging between gains and losses as investors sought to grapple with the extent of inflationary pressures and potential shock to growth. However US equities closed out in positive territory and at the highs as the news on the debt ceiling became more positive after Europe went home.

Before this equities had lost ground throughout the London afternoon, with the S&P 500 down nearly -1.3% at one point with Europe’s STOXX 600 closing -1.03% lower. Cyclical sectors led the European underperformance, although it was a fairly broad-based decline. However after Europe went home – or closed their laptops in many cases – the positive debt ceiling developments saw risk sentiment improve throughout the rest of New York session. The S&P rallied to finish +0.41% and is now slightly up on the week, as defensive sectors such as utilities (+1.53%) and consumer staples (+1.00%) led the index while US cyclicals fell back like their European counterparts. Small cap stocks didn’t enjoy as much of a boost as the Russell 2000 ended the day -0.60% lower, while the megacap tech NYFANG+ index gained +0.82%.

Risk sentiment improved following reports that Senate Minority Leader Mitch McConnell was willing to negotiate with Democrats to resolve the debt ceiling impasse and allow Democrats to raise the ceiling until December. This means President Biden and Congressional Democrats would be able to finish their fiscal spending package – now estimated at around $1.9-2.2 trillion – and include a further debt ceiling raise into one large reconciliation package near year-end. Senate Majority Leader Schumer has not publicly addressed the deal yet, but Democrats have signaled that they’ll accept the deal, although they’ve also indicated they’d still like to pass the longer-term debt ceiling bill under regular order in a bipartisan manner when the time came near year-end. Interestingly, if we did see the ceiling extended until December, this would put another deadline that month, since the government funding extension only went through to December 3, so we could have yet another round of multiple congressional negotiations in just a few weeks’ time.

The news of a Republican offer coincided with President Biden’s virtual meeting with industry leaders, where the President implored them to join him in pressuring legislators to raise the debt limit. Treasury Secretary Yellen also attended the meeting, and re-emphasised her estimate for the so-called “drop dead date” to be October 18. Potentially at risk Treasury bills maturing shortly thereafter rallied a few basis points, signaling investors took yesterday afternoon’s debt ceiling developments as positive and credible.

This was a far cry from where markets opened the London session as turmoil again gripped the gas market. UK and European natural gas futures both surged around +40% to reach an intraday high shortly after the open. However, energy markets went into reverse following comments from Russian President Putin that the country was set to supply more gas to Europe and help stabilise energy markets, with European futures erasing those earlier gains to actually end the day down -6.75%, with their UK counterpart similarly reversing course to close -6.96% too. The U.K. future traded in a stunning 255 to 408 price range on the day.

We shouldn’t get ahead of ourselves here though, since even with the latest reversal, prices are still up by more than five-fold since the start of the year, and this astonishing increase over recent weeks has attracted attention from policymakers across the world as governments look to step in and protect consumers and industry. In the EU, the Energy Commissioner, Kadri Simson, said that the price shock was “hurting our citizens, in particular the most vulnerable households, weakening competitiveness and adding to inflationary pressure. … There is no question that we need to take policy measures”. However, the potential response appeared to differ across the continent. French President Macron said that more energy capacity was required, of which renewables and nuclear would be key elements, while Italian PM Draghi said that joint EU gas purchases had wide support. However, Hungarian PM Orban took the opportunity to blame the European Commission, saying that the Green Deal’s regulations were “indirect taxation”, which shows how these price spikes could create greater resistance to green measures moving forward. Elsewhere, blame was also cast on carbon speculators, with Spanish environment minister Rodriguez saying that “We don’t want to be hostages of external financial investors”, and outside the EU, Serbian President Vucic said that his country could ban power exports if there were further issues, which just shows how energy has the potential to become a big geopolitical issue this winter.

Those declines in natural gas prices were echoed across the energy complex, with both Brent Crude (-1.79%) and WTI (-1.90%) oil prices subsiding from their multi-year highs the previous day, just as coal also fell -10.20%. In turn, that served to alleviate some of the concerns about building price pressures and helped measures of longer-term inflation expectations decline across the board. Indeed by the close, the 10yr breakeven in the US had come down -1.4bps, and the equivalent measures in Germany (-4.6bps), Italy (-6.1bps) and the UK (-4.2bps) had likewise seen declines of their own.

In spite of those moves for inflation expectations, this proved little consolation for European sovereign bonds as higher real rates put them under continued pressure, even if yields had pared back some of their gains from the morning. Yields on 10yr bunds (+0.6bps), OATs (+0.9bps) and BTPs (+3.2bps) were all at their highest levels in 3 months, whilst those on Polish 10yr debt were up +13.7bps after the central bank there unexpectedly became the latest to raise rates, with the 40bps hike to 0.5% marking the first increase since 2012. However, for the US it was a different story, with yields on 10yr Treasuries down -0.5bps to 1.521%, having peaked at 1.57% earlier in the London morning.

There was a late story in Europe that could bear watching in the coming weeks as Bloomberg reported that the ECB is studying a new bond-buying tool that could help ease market volatility if a “taper tantrum”-esque move were to happen when the PEPP purchases end in March. The plan would reportedly target purchases selectively if there were to be a larger selloff in more heavily indebted economies, which differs from the existing programs that buys debt in relation to the size of each member’s economy.

Asian stocks overnight have performed strongly, with the Hang Seng (+2.28%), Nikkei (+1.68%) and KOSPI (+1.61%) all advancing after the positive news on the debt-ceiling, as well on news that US President Biden was set to meeting with Chinese President Xi by the end of the year. All the indices were lifted by the IT and consumer discretionary sectors, and the Hang Seng Tech index has rebounded by +3.29% this morning. Separately, Evergrande-related news has been subsiding in recent days, but China Estates, a company controlled by a backer of Evergrande, rose 30% after the company disclosed an offer to take it private for $245mn. Otherwise, US futures are pointing to a positive start later, with those on the S&P 500 (+0.50%) and DAX (+1.19%) both advancing.

Turning to Germany, exploratory talks will be commencing today between the centre-left SPD, the Greens and the Liberal FDP, who together would make up a so-called “traffic-light” coalition. That marks a boost for the SPD, who beat the CDU/CSU bloc into first place in the September 26 election, although CDU leader Armin Laschet said that his party were “still ready to hold talks”. However, the CDU/CSU have faced internal tensions after they slumped to their worst-ever election result, whilst a Forsa poll out on Tuesday said that 53% of voters wanted a traffic-light coalition, versus just 22% who favoured the Jamaica option led by the CDU/CSU. So momentum seems clearly behind the traffic light option for now.

Looking at yesterday’s data, in the US the ADP’s report at private payrolls came in at an unexpectedly strong +568k (vs. +430k expected), which is the highest in their series for 3 months and comes ahead of tomorrow’s US jobs report. However in Germany, factory orders in August fell by -7.7% (vs. -2.2% expected) amidst various supply issues.

To the day ahead now, and data releases include German industrial production and Italian retail sales for August, whilst in the US we’ve got the weekly initial jobless claims and August’s consumer credit.From central banks, we’ll be getting the minutes from the ECB’s September meeting, and also hear from a range of speakers including the ECB’s President Lagarde, Lane, Elderson, Holzmann, Schnabel, Knot and Villeroy, along with the Fed’s Mester, BoC Governor Macklem and PBoC Governor Yi Gang.